Compared with the income statement or the balance sheet, the cash flow statement gets perhaps the least amount of attention from everyday investors. Ironically, the cash flow statement can be the most telling of the three financial statements; in fact, it's the only financial statement that matters to many investors. Here are ten things you need to remember about this important report.

1. The Cash Flow Statement's Three Sections

The cash flow statement is broken into three sections covering the fundamental components of every business: cash from operations, cash from investing activities, and cash from financing activities.

The cash from operations section deals with the cash inflows and outflows directly related to the company's primary activity: selling a good or service.

The cash from investing activities section shows how much the company spent (or made) on buying (or selling) assets such as property, equipment, or even other companies.

The cash from financing activities shows the inflows and outflows of capital the company uses to fund its operations; this is where one sees the proceeds from equity offerings, for example, or payments on bonds or bank debt.

2. The Cash Flow Statement Shows Whether the Company Generates or Uses Cash

The cash flow statement answers this question by showing the reader what aspects of the business are generating the cash and what aspects are burning the cash.

In many analytical situations, there is nothing as important as knowing its sources and uses of cash. For example, the income statement may show an increase in sales, but if a company is burning through the cash instead of retaining it, this could potentially be a sign of trouble.

3. The Cash Flow Statement Shows Only Cash Expenses

Income statements and balance sheets include non-cash expenses, depreciation often being the largest of those. But guess what? Nobody's actually writing a check to 'Depreciation.' It's a non-cash expense, so the cash flow statement gets rid of it. This is a big reason companies might never show a dime of net income but could actually be earning millions.

4. The Cash Flow Statement Showcases True Cash Movement

The cash flow statement doesn’t showcase whether transactions are associated with next month or next year: It simply tracks the movement of cash within a company. This statement isn’t very influenced by accrual accounting methods (which record expenses during the period which they're incurred).

Let’s say the accounting department cuts a $6,000 check to Insurance Company ABC for the next six months of insurance premiums. For the next six months, the current month's income statement will reflect one-sixth (or $1,000) of that check.

This month's cash flow statement will show the full amount of the check as a cash outflow. It doesn’t matter that the bill will cover the next six months of insurance: the cash flow statement only focuses on the cash left in the account.

5. The Cash Flow Statement Discloses Total Cash Used for Asset Purchases

The cash flow statement discloses the total amount of cash used to purchase assets or make other capital expenditures.

The cash from the investing activities section discloses the amount of cash involved in purchasing/divesting capital assets during a certain period. This is helpful for determining how far along a particular project may be, how much a particular acquisition 'really' costs (when intangible costs are considered), or how much the company got for the sale of certain assets.

6. The Cash Flow Statement Shows Company Debt Payments

Like a mortgage, corporate payments on debt are usually made up of interest and principal.

The income statement typically only shows the interest payment portion and the balance sheet typically only shows the principal payment portion. The cash flow statement, however, will reveal the actual size of the debt payment.

The purpose of the cash flow statement is to track the cash inflows and outflows of a company for each period it is created. It shows the amount of money left in a company’s account after all expenses are paid. The cash flow statement is useful in decision-making by helping companies and investors analyze and understand the strength and profitability of a company.

7. The Cash Flow Statement Determines what was Wired into Cash Accounts

A company might say they are involved in a $10 million equity offering, but that offering could be spread over several years or involve major fees/expenses. In this case, the cash flow statement is the only primary financial statement that will show exactly how much went into the company's cash account – and when.

The cash flow statement can give a real-time snapshot of cash that has been wired into different accounts within the company.

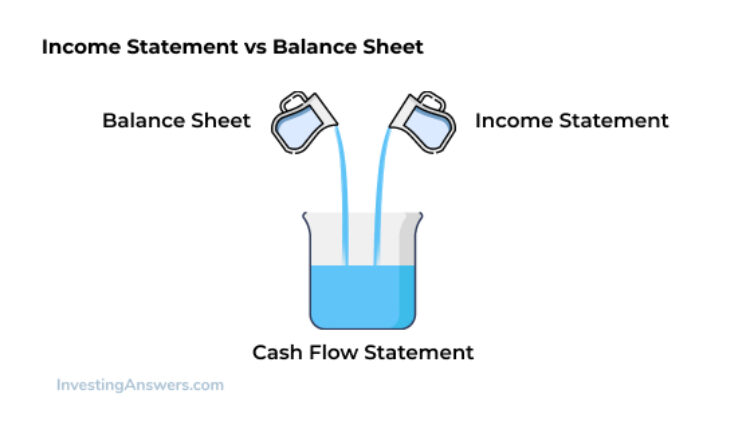

8. The Cash Flow Statement is Affected by Income Statement and Balance Sheet Changes

Cash flow shows the cash a company has on hand. This is different than what the income statement shows since the income statement takes into account money that has been earned but not necessarily paid to the company. The cash flow statement is a true indicator of the cash that’s available and will help the company make essential financial decisions.

This makes it different from both the income statement and the balance sheet (which shows a snapshot of the company’s financial position at any given time). However, these three statements are integrated.

If there is a change in revenue/expenses which affects net income, the net income on the first line of the cash flow statement will also be impacted. If the working capital, financing, or the purchase/sale of PP&E (Property, Plant and Equipment) on a balance sheet changes, the cash flow statement will also reflect these changes.

9. The Cash Flow Statement Shows Changes in Working Capital

Accounts payable and accounts receivable are major components of working capital and are the source of a company's short-term liquidity. When customers pay the company for products or services received, working capital increases. Likewise, the opposite is true: When a company has to pay its own bills, accounts payable increases, thus reducing the company’s working capital.

10. The Cash Flow Statement will Equal the Balance Sheet Cash Flow for That Period

The cash balance between two consecutive balance sheets should be equal to the new cash flow in a cash flow statement covering that same period.

Say you have a balance sheet from January 2021 and one from February 2021. The difference in cash balance between them is $40,000. Thus, the net cash flow in the cash flow statement covering that period should also equal $40,000.

Why Cash Flow Statement Analysis is Helpful

Analysis of a cash flow statement is helpful for both companies and investors as it provides insight into a business’ inflows and outflows of money.

A company will use these statements to determine how it’s doing from a standpoint of strength and liquidity. It also helps determine whether a company has enough cash on hand to pay its bills. Investors use these statements to determine whether a company is a sound investment and how efficiently the company uses its shareholders’ investments. A cash flow statement will illustrate how a company pays its bills, invests in itself, and pays dividends.