A Closer Look at the Best Robo Advisors

Here's an in-depth analysis of the world's most popular robo advisor platforms...

Best Overall and for Tax-Efficient Investing

Wealthfront

| Account Minimum: $500 | Management Fees: 0.25% |

Wealthfront is one of the best robo advisor services, offering comprehensive financial planning, goal-setting, banking, and automated investing services. Wealthfront has continued to deliver on its goal of Self-Driving MoneyTM, automating almost every aspect of a client’s financial life.

Clients can deposit their paychecks into a Wealthfront Cash account, have their money split up automatically between spending, savings goals, and investing, as well as have all investing and retirement accounts automatically managed by its advanced robo-advisory service.

Wealthfront also offers a free financial planning app, Path, which allows users to set financial goals, such as paying for college, buying a home, or even taking time off to travel. It also shows how each of these financial goals ultimately impacts your retirement, which is unique in the robo-advisor space.

Wealthfront also offers a wide range of portfolio options, retirement and education accounts, and tax-efficient investing all for a reasonable price of 0.25% of assets under management (AUM).

Pros

-

Full financial automation available

-

ETFs available across 11 sectors

-

Daily tax-loss harvesting

-

Free financial planning app

-

Portfolio line-of-credit available

-

Competitive fees

Cons

-

No access to human advisors

-

Limited portfolio customization for clients under $100,000

Wealthfront offers top-notch investment management and plenty of easy-to-use investing tools. Check out our full Wealthfront review to learn why so many investors choose Wealthfront. If you're ready to get started, click the green button below.

Best for Beginners

Betterment

| Account Minimum: $10 | Management Fees: 0.25% - 0.40% |

Betterment is a super-simple robo-advisory platform that makes it easy for beginners to start investing. Betterment's onboarding includes filling out a few personal details, setting a goal (or multiple), and opening an investing account, such as an IRA. With an account deposit as low as $10, users can start investing for retirement or other goals.

Betterment offers five portfolio options, as well as three socially-responsible investing (SRI) portfolios to choose from. Betterment also offers tax-loss harvesting and automatic account rebalancing to keep clients on track, as well as minimizing taxes over time. All of these options are available on a user-friendly mobile app, and are covered under Betterment’s 0.25% annual fee.

Betterment also offers access to certified financial planners (CFPs) for a slightly higher fee of 0.40% per year. Users can set up a video call, or simply contact them via email for unlimited support.

Pros

-

Simple onboarding process

-

Multiple portfolio options

-

Human advisors available (for an additional fee)

-

Well-designed mobile app

Cons

-

No access to alternative assets (such as REITs)

-

No borrowing options (such as a line-of-credit)

It's hard for beginners to go wrong with Betterment, but there's something for everybody at this robo-advisor. Check out all the pros and cons in our in-depth Betterment review. If you're ready to get started, click the green button below.

Best for Work Retirement Accounts

Blooom

| Account Minimum: None | Management Fees: $45 - $250 per year |

Blooom is an advisory service that analyzes your 401(k) account, helping you build a proper asset allocation, and showing you where your work plan may be charging you too much in fees.

It offers a free analysis tool that allows you to connect your work 401(k) plan directly to Blooom. Once connected they will analyze the funds and investment options within the account and give you suggested adjustments to your portfolio.

Beyond the free analysis, Blooom offers three account tiers for additional support, each providing more advice and personalized recommendations. The entry-level service (“Blooom Essentials”) offers a personalized portfolio recommendation for $45 per year. The next level (“Blooom Standard”), offers transaction activity alerts and access to a financial advisor for $120 per year. The “Unlimited” level allows users to connect as many investing accounts as they want, as well as priority access to financial advisors for $250 per year.

While the fees may be small for larger retirement accounts, clients who are just starting would be paying a fairly high percentage of their portfolio, even at $45 per year. For example, a $2,000 account paying $45 per year is the equivalent of 2.25% annual fee. Blooom is recommended for clients with $25,000 invested (or more) to get the most value out of the service.

Pros

-

Free 401(k) analysis

-

Personalized portfolio recommendations based on 401(k) funds available

-

Access to financial advisors

-

Expense ratio analysis for 401(k) funds

Cons

-

No phone access to financial advisors (email and chat only)

-

Fees may be high for lower account balances

If you'd like to learn more about how Blooom works, as well as the free tools and resources it offers, then check out our comprehensive Blooom review. If you're ready to see how Blooom can help you better manage your 401(k) assets, then visit Blooom.com to sign up and give it a try.

Best for Index Funds

Vanguard Digital Advisor

| Account Minimum: $3,000 | Management Fees: 0.15% |

Vanguard is one of the top financial firms in the U.S., and its digital advisor service offers access to its world-class index funds for a lower fee than most robo-advisors. Based on John Bogle’s passive investing strategy, Vanguard offers automated investment management, as well as automatic portfolio rebalancing, asset allocation, and personalized investing advice.

Vanguard Digital Advisor is a simple robo-advisory service that helps clients save for retirement and other goals using globally diversified funds with very low expense ratios. Currently, the service offers four broad-based index funds to achieve the optimal asset allocation for your investing goals. Vanguard’s simple investing philosophy gives investors instant diversification, as well as access to index funds with expensive ratios that average 0.05%, well below market averages.

Vanguard’s robo-advisory service is much lower than most, charging a 0.15% AUM fee. Vanguard is best for clients who want a simple, well-diversified portfolio, without any extra bells or whistles.

Note: For clients who want access to a human advisor, check out Vanguard’s Personal Advisor service below.

Pros

-

Low-fee index funds

-

Very low fees

-

Simple-to-use client dashboard

Cons

-

No tax-loss harvesting

-

No fractional shares

Vanguard Digital Advisor is a solid robo-advisory choice from one of the most recognizable names in the industry. It's also one of the lowest-cost options. We cover everything you need to know in our full Vanguard Digital Advisor review. If you're ready to get started, click the green button below.

Best for Access to Certified Financial Planners

Vanguard Personal Advisor Services

| Account Minimum: $50,000 | Management Fees: 0.30% |

In addition to its standard robo-advisory service, Vanguard offers a hybrid service that combines the automated digital advisor with access to human financial planners. The Vanguard Personal Advisor Services gives clients unlimited access to a licensed financial advisor, meeting over the phone, via video chat, or email. This allows you to get all your questions answered, and get a personalized portfolio from a financial professional.

Clients of this service will have access to a client dashboard, where you can create financial goals, track your progress, and adjust your plan as needed. Financial advisors are also available to review your plan, and help you adjust as your goals and needs change over time.

Vanguard Personal Advisor Services require a minimum of $50,000 invested, so beginners are better off starting with the digital robo-advisor service. But those with $50,000 or more looking for access to high-quality investments as personalized advice will be hard-pressed to find a lower fee for advisory services.

The 0.30% advisory fee is one of the lowest fees available for access to a human financial planner.

Pros

-

Low annual fees

-

Unlimited access to financial advisors

-

Client dashboard to track progress and financial goals

-

Access to high-quality Vanguard funds

Cons

-

No tax-loss harvesting

-

High account minimum

The combination of low-fee funds and access to financial advisors makes Vanguard Personal Advisor Services an interesting hybrid service for those able to meet the minimum investment requirement. Check out our full Vanguard Personal Advisor Services review for the complete details. If you're ready to get started, click the green button below.

Best for Free Financial Advisors

Sofi Automated Investing

| Account Minimum: $1 | Management Fees: None |

SoFi Automated Investing now offers a simple automation service that allows you to invest toward retirement (or other financial goals) automatically. As a hybrid robo-advisory service, SoFi Automated Investing also offers access to a team of financial advisors, as well as career coaches, at no additional cost.

As a newcomer to the robo-advisory space, SoFi is making waves by offering its service at no additional cost, and even giving users access to human advisors. Clients can quickly sign up, choose their risk tolerance, and have a simple portfolio of low-cost ETFs built for them to start investing in. While SoFi keeps fees low, it is important to note that many of the portfolios include SoFi’s own proprietary funds, which do not have the same track records as some of the larger ETFs available (such as Vanguard or Fidelity).

Overall, Sofi Automated Investing is a compelling service to help beginners get started with no management fees. Add in the access to financial advisors and career coaching, SoFi Automated Investing is a great starting place to invest.

Pros

-

No management fees

-

Access to low-cost ETFs

-

Access to financial advisors and career coaches (Free)

-

Automatic portfolio rebalancing and tax-loss harvesting

Cons

-

SoFi-sponsored ETFs present a conflict of interest

We like SoFi Automated Investing a lot and find its one of the best values in the robo-advisory industry. It doesn't charge a management fee, but still offers investors plenty of features. Check out its investment choices and more in our full SoFi Automated Investing review. If you're ready to get started, click the green button below.

Best for Socially Responsible Investing

Marcus Invest by Goldman Sachs

| Account Minimum: $1,000 | Management Fees: 0.35% |

Goldman Sachs recently launched its robo-advisory service, based on its popular banking product Marcus. Marcus Invest offers access to a wide range of portfolio options, including socially responsible investing (SRI) options. This allows clients to avoid investing in companies that profit from mining coal, selling tobacco products, or firearms.

Marcus Invest also offers its own Smart Beta portfolio, which aims to outperform the overall market. This portfolio has Goldman Sachs ETFs included and will refund any Goldman Sachs fund fees to clients who are investing using this portfolio. Marcus Invest is on the higher end of management fees, charging 0.35% of AUM, and does not give clients access to human financial advisors.

Pros

-

SRI portfolio options

-

Automatic rebalancing

-

Low-cost ETFs

-

Fund fee credits for Goldman Sachs ETFs (Smart Beta portfolio only)

Cons

-

No tax-loss harvesting

-

Higher fee than other robo-advisors

-

No access to financial advisors

If you'd like to learn more about how Marcus Invest works and if it's right for you, check out our full Marcus Invest review. If you're ready to get started, click the green button below.

Best for Investing Education

E*Trade Core Portfolios

| Account Minimum: $500 | Management Fees: 0.30% |

E*Trade is one of our favorite online brokers and now offers its own robo-advisory service. E*Trade Core Portfolios is simple-to-use, offers a thorough onboarding process, and access to life financial advisors if you ever need help with your investments.

E*Trade Core Portfolios offer customizable portfolios using low-cost ETFs, as well as automatic rebalancing, and tax-sensitive investing (to minimize taxes). E*Trade also offers 24/7 customer service, and a robust library of user education materials, including financial planning tools.

The E*Trade Core Portfolios service has an industry-average 0.30% management fee, but with the included access to licensed financial advisors, this fee is very reasonable.

Pros

-

Extensive risk tolerance onboarding for accurate investing

-

Access to many low-cost ETFs

-

Portfolios are customizable, with SRI investing options

-

24/7 customer service

-

Access to human advisors at no additional cost

Cons

-

No tax-loss harvesting

-

No exposure to international bonds

E*Trade is no stranger to the investment industry, and now its robo-advisory services offers automated investing and more at a reasonable fee. Check out our full E*Trade Core Portfolios review for the complete list of pros and cons. If you're ready to get started, click the green button below.

Best Free Robo-Advisory Service

Schwab Intelligent Portfolio

| Account Minimum: $100 | Management Fees: None |

Charles Schwab is a long-standing investment broker that now offers its robo-advisory services with no management fees. The only fees users pay are the annual fees of the underlying funds they are invested in. The Schwab Intelligent Portfolio builds a portfolio of low-cost ETFs based on a user's risk tolerance, with over 50 ETFs to choose from, in 20 asset classes.

Schwab Intelligent Portfolios offer automatic rebalancing, portfolio customization, and 24/7 customer service. Users with a minimum balance of $50,000 can also enroll in tax-loss harvesting as an additional feature.

The Schwab mobile app is a very user-friendly way to see your portfolio dashboard, as well as take advantage of Schwab’s user education library.

While Schwab does not charge a fee, the ETFs within the portfolio are Schwab-managed (how Schwab makes money), and the portfolio holds a decent portion in cash (up to 10%), which may be too conservative for some investors.

Pros

-

No management fees

-

Wide variety of ETFs to choose from

-

24/7 customer service

Cons

- No tax-loss harvesting under $50k balance

Schwab Intelligent Portfolios comes from a trustworthy name and offers a lot of value to investors. For more details, check out our full Schwab Intelligent Portfolios review. If you're ready to get started, click the green button below.

Best for Wealth Management and Free Online Tools

Personal Capital

| Account Minimum: $100,000 | Management Fees: 0.49% - 0.89% |

Personal Capital was first marketed as a free investing app that helps users review and manage their investments all in one place. Personal Capital still offers this high-quality free app, but also is a financial advisor firm that offers digital asset management and access to human advisors for those with $100,000 invested (or more).

As a more “hands-on” robo-advisory service, Personal Capital offers wealth management with a personal touch. Clients that have over $100,000 in investments to manage are onboarded through a direct call with a financial advisor, putting together a customized portfolio of stocks, bonds, ETFs, and cash.

For private wealth management clients with $1,000,000 or more invested, Personal Capital also offers alternative investment options for qualified investors, such as private equity options.

Tax-loss harvesting, automatic rebalancing, and goal-setting are standard offerings, plus a tax-efficient investing strategy to put more tax-heavy assets into tax-advantaged accounts. All of Personal Capital’s portfolio management relies on modern portfolio theory, but clients can adjust most any aspect of their investments by consulting directly with a financial advisor on the team.

Management fees are more than typically robo-advisory services, at 0.89% of assets under management. But this is more of a full-service financial planning firm than an automated investing tool, so a sub-1% annual fee is reasonable. Fees reduce with more invested, going as low as 0.49% for clients with assets over $10 million.

Pros

-

High-touch financial planning

-

Fully-customized portfolio construction

-

Unlimited access to financial advisors

-

Top-rated free mobile app for investment tracking

Cons

-

High minimum ($100,000)

-

Higher fees than standard robo-advisors

Personal Capital is no longer just a free investing app to help manage your investments. Check out everything it has to offer in our full Personal Capital review. If you're ready to get started, click the green button below.

Best for Low Minimums

Fidelity Go

| Account Minimum: None | Management Fees: 0% - 0.35% |

Fidelity is one of the largest and most trusted investment brokers in the U.S., offering high-quality mutual funds, no-fee index funds, and fantastic customer service.

They now offer a robo-advisory service aimed at beginner investors, and will even manage your first $10,000 for free. In addition, the portfolio is constructed of no-fee ETFs, so investors can truly invest for no additional fees whatsoever. Add in the fact that there are no minimum balance requirements and only $10 to start investing, and Fidelity Go is a great starter option for investors.

Fidelity Go is a simple robo-advisor, building portfolios based on some basic risk tolerance questions answered by users. The portfolio is made up of fee-free Fidelity Flex mutual funds in seven asset classes. This is an easy way for beginners to get broad exposure to the market without losing anything to annual fees.

For clients with $10,000 - $50,000 invested, the annual fee is $36 per year, which ranges from 0.08% - 0.36% annual fee, depending on your balance. For clients with $50,000 or more invested, this fee is a flat 0.35%, which is higher than competitors at this level. Overall, Fidelity Go is perfect for beginners to start investing with no fees, with as little as $10 to start investing.

Pros

-

No account minimum

-

No fees below a $10,000 balance

-

Fee-free funds

Cons

-

No tax-loss harvesting

-

No access to human advisors

If you'd like to learn more about how Fidelity Go works and if it's right for you, check out our in-depth Fidelity Go review. If you're ready to get started, click the green button below.

Best for Investing Spare Change

Acorns

| Account Minimum: None | Management Fees: $1 - $5 per month |

Acorns is a spare-change saving and investing app that offers simple robo-advisory services for those who want to start investing small amounts. Originally created as a neat way to round up your purchases and save the difference, Acorns has expanded its offerings to automatically invest that spare change for you.

Acorns offers three levels of service:

Lite: For $1 a month, you can invest in a taxable brokerage account

Personal: For $3 a month, you can also invest in retirement accounts, such as an IRA

Family: For $5 a month, you can also open an investment account for kids

Portfolios consist of broad-based, low-cost index funds from iShares and Vanguard, offering a solid mix of well-diversified funds. There are only five portfolio options, based on a user’s risk tolerance, and it cannot be customized. The flat monthly rate may seem low, but for smaller balances (under $2,500), it may represent a 0.48% or higher fee.

Pros

-

Get started investing with as little as $5

-

Rounding up spare change to invest

-

Fractional share purchases

-

Low-fee funds available

-

SRI investing at no additional cost

Cons

-

Fee may be high for smaller balances

-

No portfolio customization

-

No tax-loss harvesting

Acorns is our favorite robo advisor for beginner investors who want a platform with low minimums and low monthly fees. With more than 10 million users and $3B in assets under management, it's also one of the most popular robo advisors on the market. For more details, please read our Acorns review here. If you're ready to open an account, then we recommend taking advantage of Acorns' $10 sign-up bonus.

Best for New Investors

Stash

| Account Minimum: None | Management Fees: $1 - $9 per month |

Stash is a simple investing app aimed at helping new investors get started. Stash does not invest your money like a traditional robo-advisor, but rather is a registered broker that gives specific investing advice, and helps you build an investing portfolio.

Stash offers access to thousands of low-fee ETFs and individual stocks, allowing for nearly unlimited portfolio customization.

There are three levels of service:

Stash Beginner: For $1 a month, you get personalized investing advice and a taxable brokerage account

Stash Growth: For $3 a month, you also get access to retirement accounts, such as an IRA

Stash+: For $9 a month, you can also open an investment account for kids, have access to a rewards checking account, and $10k in life insurance

Stash is not a robo-advisor in the traditional sense, and does not invest for you, offer tax-loss harvesting, or access to human advisors. It does, however, offer automatic and quarterly rebalancing of your selected portfolio. It is designed for do-it-yourself investors that want some hand-holding while building an investment portfolio.

Pros

-

Access to thousands of funds and stocks

-

No account minimums

-

Fantastic investing education tools

-

Rewards debit card & checking account available

Cons

-

Fee may be high for smaller balances

-

Does not invest funds for you

-

No tax-loss harvesting

Stash is one of the best robo advisors for beginners. If you'd like to learn more about how Stash works and if it's right for you, check out our in-depth Stash review. If you're ready to get started, click the green button below.

Best for Commission-Free Trades

M1 Finance

| Account Minimum: $100 | Management Fees: $0 for basic accounts, $125/year for M1 Plus |

M1 Finance is a free investing app that offers commission-free trading of more than 6,000 stocks and ETFs. M1 Finance also offers handpicked expert portfolios (“pies”) or the ability to create a customized portfolio. There are no account management fees for basic accounts, and it only takes $100 to open an investment account.

Users can invest in standard brokerage accounts, or open an individual retirement account (IRA). Users can also set up recurring investments, allowing them to transfer funds to M1 Finance on a regular schedule. Those funds are automatically invested based on a user’s selected investment portfolio.

M1 Finance also offers other financial services, including:

- M1 Borrow. Investors can borrow against their taxable investment accounts at low interest rates.

- M1 Spend. A checking account with a debit card and no annual fees.

- M1 Credit Card. A rewards credit card offers cash back that can be invested directly into your M1 Finance account (available to M1 Plus members only).

M1 Finance also offers a premium service called M1 Plus. This service unlocks even more features, including kids’ investing accounts, lower interest rates on portfolio loans, and a 1% interest rate on funds held in the M1 Spend account.

Pros

-

Access to 6,000+ stocks and ETFs

-

80+ expert portfolios (“Pies”) to choose from

-

No trading commissions or annual fees (for basic accounts)

-

Automated investing and dynamic rebalancing

Cons

-

Annual cost to add custodial accounts (M1 Plus Required)

-

Customer service is email only

-

Requires choosing portfolio and manually setting up investments

M1 Finance does a lot of things right. To find out if M1 Finance is right for you, check out our full M1 Finance review. If you're ready to get started, click the green button below.

Robo Advisor Comparison: How Should You Choose a Robo Advisor?

Following are the top factors to consider when choosing a robo-advisor to manage your portfolio.

Determine the Best Type of Account for You

Most robo-advisors offer several options for account types. Review the options to choose the best type for you and your financial needs, including retirement and taxable accounts, IRAs, individual and joint accounts, trusts, and more.

Review the Minimum Investment Requirements

The minimum investment requirements for robo-advisors can range anywhere from $0 to $5,000. You’ll find that many fall on the low-end of this range.

Understand Your Risk Tolerance

Robo-advisors will provide you with an online survey to better understand your risk tolerance and asset allocation. For example, it may help determine whether you want to be more conservative or aggressive with your investment choices.

The service’s algorithm will provide portfolio options based on your answers and will automatically invest your assets once a portfolio is chosen. It is important to understand the difference between a conservative and aggressive approach, then determine which best aligns with your financial goals before choosing any financial plan.

Know Your Investment Options

Robo-advisors usually build investment portfolios using low-cost, exchange-traded funds and index funds. These portfolios are baskets of investments pooled together to mirror the behavior of an index, like the Dow Jones Industrial Average or the S&P 500. When using an online financial planning service, you’ll pay the robo-advisor management fee along with the expense ratio (which is charged by the funds).

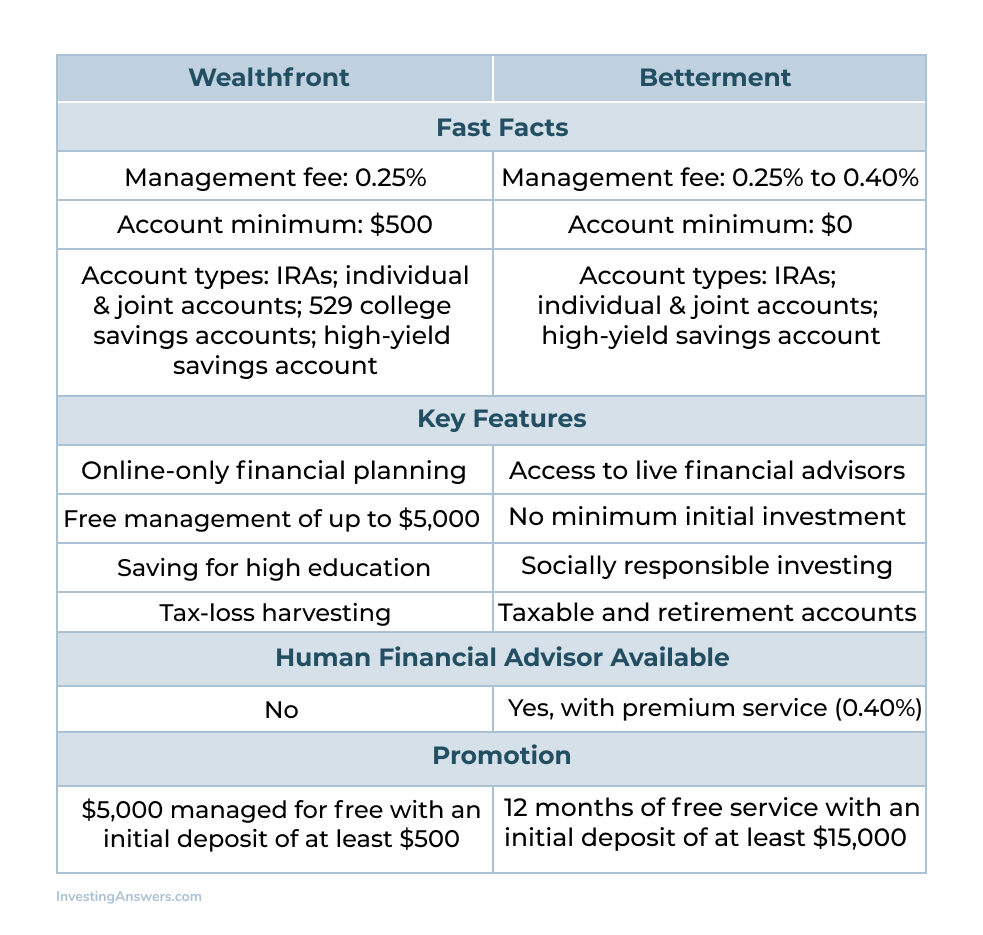

Robo Advisor Comparison Example: Wealthfront vs. Betterment

Below is a comparison table that lists the facts, features, and fees of the robo-advisors Wealthfront and Betterment. This framework can be used to compare many other robo-advisor companies. We also have a full comparison of Betterment and Personal Capital here.

Robo Advisor Basics: What Are Robo Advisors?

Robo-advisors are financial planning services offered by brokerage firms to provide investment advice to investors at lower costs. They use a computerized algorithm to create and manage a customer’s portfolio based on several factors, including: financial goals, time horizon, and risk tolerance.

The services provided by robo-advisors can range from automatically investing assets and rebalancing to tax optimization. Many people have begun choosing robo-advisors due to their low fees and initial investment requirements, as well as the peace of mind that comes with the automated service.

How Do Robo Advisors Work?

Robo-advisors use computer algorithms to provide financial advice based on the information gathered from customers via online surveys. Financial goals, time horizon, and risk tolerance preferences are examples of data that is collected on each survey.

They typically include the following services:

-

Automatic or interval rebalancing of your portfolio so it never strays from your desired allocation

-

Financial planning tools like calculators and knowledge center articles

-

Tax strategies for taxable accounts (e.g. tax-loss harvesting)

Are Robo Advisors Safe?

Robo-advisors are as safe as any other portfolio manager. They are required to follow strict financial guidelines that are regulated by the Financial Industry Regulatory Authority (FINRA) which oversees all financial institutions in the United States.

There are no guarantees that the robo-advisor will perform as well as you hope or that the company will be around forever. There are, however, certain safeguards in place through a custodian bank which will protect your assets should the company go out of business.

Robo Advisors vs Financial Advisors: What's the Difference?

Robo-advisors are online investment platforms. They create and maintain a financial plan using computerized algorithms. While some companies do provide assistance from a financial planning team, robo-advisors generally require little-to-no human supervision.

Financial advisors and financial planners are licensed professionals who work in-person and one-on-one with investors to help manage finances in several areas (e.g. college, estate planning). Some people are willing to pay the higher cost for a financial advisor because of the personal attention they receive.

Many companies now offer a hybrid option, meaning clients can have the personal attention of a designated financial advisor (though they would either meet over the phone or via video chat). There are lower fees associated with working with an online financial advisor – and possibly even lower fees associated with working with a robo-advisor.

Are Robo Advisors Worth It?

Determining whether a robo-advisor is worth using depends upon your financial goals and need for personalized financial advice. When it comes to low fees and convenience, automated services based on your financial goals, robo-advisors are the way to go.

If your situation is more complex, you can hire a professional financial advisor to personally comb through your situation for areas of opportunity.

What Are Robo Advisor Returns?

Many robo-advisors haven’t been around long enough to provide a complete picture of performance. To get a clearer idea of overall investment performance, it’s best to look at returns going back five or more years. Anything fewer than five years tells very little regarding how it will withstand market volatility.

What Are Robo Advisor Costs?

To use a robo-advisor service, the funds will charge you management fees and expense ratios. Expense ratios can be as low as 0% – with the annual fee being a percentage of the investor’s portfolio. Some services will also charge for trade and transactions. To avoid hidden fees, be sure to look at the fine print for each company. If the benefit of low fees is important to you, be vigilant when selecting your robo-advisor.

How Do Robo Advisors Make Money?

Robo-advisors make money from the following fees passed on to the investors at their firm:

-

Account fees

-

Transaction fees

-

Management fees

-

Expense ratios

-

Cash deposits

-

Arbitrage

Here's a final recap...

Our Favorite Robo Advisors for 2023

-

Best for free online tools: Personal Capital

-

Best for access to certified financial planners: Vanguard Personal Advisor Services

-

Best for index funds: Vanguard Digital Advisor

-

Best overall and for tax-efficient investing: Wealthfront

-

Best for beginners: Betterment

-

Best for investing spare change: Acorns

-

Best for work retirement accounts: Blooom