What Is an Income Statement?

An income statement is a financial statement detailing a company’s revenue, expenses, gains, and losses for a specific period of time that is submitted to the Securities and Exchange Commission (SEC). At the most basic level, it shows profit and loss. The statement lists all revenue and gains together, then the expenses and losses to show the net income.

Business owners and senior-level management also use income statements for insights in making business decisions about operations, efficiency, performance relative to competitors, and future opportunities. In addition, public companies must submit their financial reports, including an income statement, to the SEC.

Income Statement vs. Balance Sheet

While an income statement and balance sheet are both key financial statements for companies, they are very different. income statements are used to evaluate the overall performance of a company during a period such as a fiscal year. So, the income statement shows total revenue and expenses for a specified period of time (such as a fiscal year).

Income Statement

Balance sheets are useful to assess the company’s assets and its financial obligations (liabilities) at a moment in time. A balance sheet shows the company’s assets, liabilities, and owner’s equity (such as one specific day).

Balance Sheet

If Company ABC is trying to get a loan, a bank will use a balance sheet to determine if extending credit is a sound decision. It will use an income statement, however, to see if the business is earning enough money to fulfill its obligations and to repay the loan. Even though those represent different financial indicators, together they create an overall picture.

What Does an Income Statement Show?

An income statement can seem complex when you first look at it. However, once you know what to look for, you’ll be able to use it to make decisions for your business. All of these insights will help you to understand how the company is managing all business activities.

Expenses

Every company has costs of doing business, and these expenses are included in the income statement. If certain expenses meet IRS guidelines, a company may be able to deduct them from taxable income.

Here are a few examples of expenses:

Cost of goods sold (COGS)

Selling, general and administrative expenses (SG&A)

Research and development expenses (R&D)

Depreciation

Employee wages

Sales commissions

Utilities and rent

Interest paid

Losses

However, an analysis may indicate that expenses are not being used efficiently to ensure a profit. For instance, SG&A could be too high because the company invested in new computers. Rent could also be higher than average if the company has a bigger space than it needs. Also, interest paid could be elevated and show that the company is overleveraged.

Income/Revenue

Every company strives to make money, and there are a variety of ways to do so. Whether it’s active or passive income, all sources of revenue must be shown on the income statement.

Some examples of income are:

Revenue or fees earned from selling a product or service

Interest income

Rental income

Royalty payments

Advertising income

Gains

Gains refer to money made as a result of a sale of long-term assets, company vehicles, unused land, or subsidiary companies. For instance, if a company purchased land ten years ago for $150,000 and sold it today for $200,000, it would have a net gain of $50,000. This would be included in the income statement, just like any other form of income or revenue.

Losses

Losses are a loss of value from non-operating activities. These may include a loss on a sale of long-term assets, one-time (or unusual) costs, or awards paid toward lawsuits. For example, if Company ABC has a vehicle valued at $20,000 and sells it for $5,000, it would have a loss of $15,000. This would be included in the income statement.

What Isn’t Reported on an Income Statement?

On an income statement, items that cannot be reliably measured are not reported. Additionally, income statements do not accurately reflect the inflow and outflow of cash since they operate on the accrual accounting method.

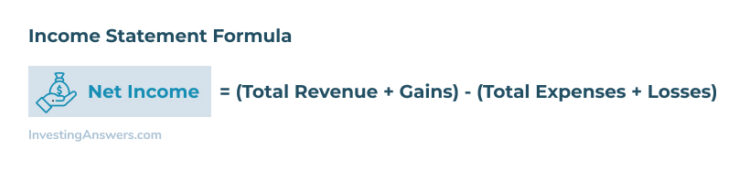

Income Statement Formula

To come up with the net income, the income statement equation calculates the difference between increases and decreases.

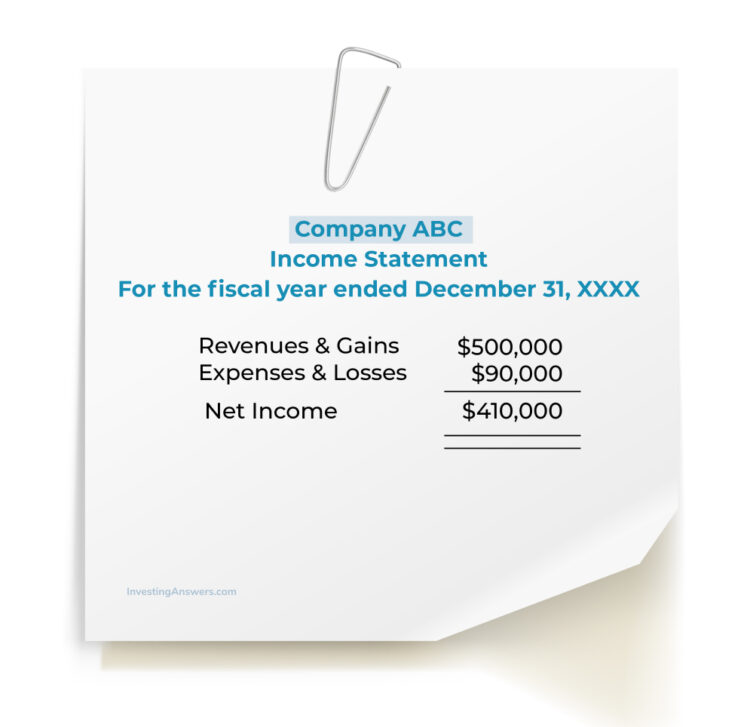

Single-Step Income Statement Example

The simplified income statement is known as the “single-step.” To utilize this method of determining net income, you must show the sum of your revenues, gains, and expenses, and losses separately.

For example, on December 31, 2020, Company ABC decided to create its income statement. It had revenue and gains of $500,000 and expenses and losses of $90,000 for the entire year. Here is the single-step income statement:

Multiple-Step Income Statement Example

The multiple-step income statement example is more complex. However, it provides greater details on what occurred during the stated time period, especially regarding specific income types and expense transactions.

_0.jpg)