What Are Consolidated Financial Statements?

A consolidated financial statement is the combined financial statements of a parent company and all of its subsidiaries, divisions, and/or sub-organizations. Consolidated financial statements provide a comprehensive overview of a company's financial operations for the entire group of entities.

Why Are Consolidated Financial Statements Important?

If the financial results of each entity were individually reviewed, the investor would have a limited idea of how well the company was doing. A consolidated income statement quickly helps the investor see how the entire company is doing financially.

Consolidated Financial Statements Example

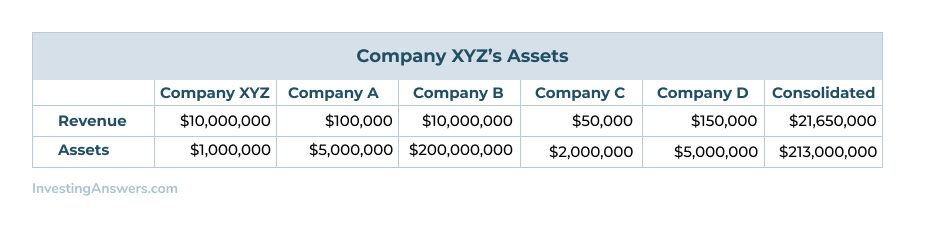

Let’s assume that Company XYZ is a holding company that owns four other companies: Company A, Company B, Company C, and Company D. Each of these pays royalties and other fees to Company XYZ.

At the end of the year, Company XYZ's income statement reflects a large number of royalties and fees with very few expenses (which are recorded on the subsidiary income statements). An investor looking solely at Company XYZ's holding company financial statements could easily get a misleading view of the entity's performance.

However, Company XYZ could consolidate its financial statements by 'adding' the income statements, balance sheets, and cash flow statements of XYZ and its three subsidiaries together. These results might provide a more complete picture of the whole Company XYZ enterprise.

Company XYZ's assets are only $1 million, but the consolidated number shows that the entity as a whole controls $213 million in assets.

Required Reporting for Consolidated Financial Statements

There are few consolidated financial statement reporting requirements for private companies, but public companies must follow generally accepted accounting principles (GAAP). GAAP governs when to consolidate financial statements and whether certain entities need to be consolidated.

Companies with a minority interest in an entity don’t usually need to consolidate them on their statements. For example, if Company XYZ owned 5% of Company A, it wouldn’t have to consolidate Company A's financial statements with its own.

However, as soon as a company owns 50% of a subsidiary, it’s required to prepare consolidated financial statements.

Companies commonly break down their consolidated statements by division or subsidiary so investors can see the relative performance of each. In many cases, this isn’t required, especially if the company owns 100% of the division or subsidiary.

GAAP Requirements for Consolidated Financial Reporting

GAAP requires companies to eliminate intercompany transactions from their consolidated statements. In order to avoid “double counting” them, they must exclude movements of cash, revenue, assets, or liabilities from one entity to another.

Intercompany transaction examples might include:

Interest one subsidiary earns from a loan paid to another subsidiary

'Management fees' that a subsidiary pays the parent company

Sales and purchases among subsidiaries

Is Consolidated Financial Reporting Right for My Company?

If you own at least 50% of a subsidiary, you should consider consolidating your financial reporting. This will give you a comprehensive overview of your company and the subsidiaries you own, and quickly helps you see how your entire company is doing financially.

From balance sheets to financial ratios, discover how consolidated financial statements fit into your business accounting with our Financial Statement Analysis for Beginners tutorial.