What Is a Cash Flow Statement?

A cash flow statement (also referred to as the statement of cash flows) is a document that reports the inflows and outflows of cash within a business. It is one of three main financial statements that businesses use alongside the balance sheet and income statement.

The simplest definition of a cash flow statement is that it’s a financial statement which measures the cash generated and used by a company within a given period.

What Is Included on a Cash Flow Statement?

Cash flow statements typically break down a company's cash sources and uses into three categories:

- cash flow from operating activities

- cash flow from investing activities, and

- cash flow from financing activities.

What Does Cash Flow from Operating Activities Mean?

Operating activities include the business activities related to revenue such as payroll, buying and selling merchandise, purchasing supplies or inventory, and making rent payments.

Because working capital is a component of cash flow from operations, investors should be aware that companies can influence cash flow by lengthening the time they take to pay the bills. By postponing paying bills – and putting off buying inventory – companies can preserve cash.

What Does Cash Flow from Investing Activities Mean?

Investing activities include anything related to investment gains and losses. This includes buying and selling property, purchasing a plant, and buying/ selling equipment (also referred to as PP&E) and loans made or received by vendors. When cash is used for PP&E, it is considered capital expenditure (or CapEx).

What Does Cash Flow from Financial Activities Mean?

Financing activities include cash that is passed from investor or creditor to business owner and back. This includes borrowing or repaying loans, dividend or share buyback payments, and capital raised during fundraising.

How Cash Flow Statements Are Helpful with Decision Making

Cash flow statements reflect how companies manage cash and demonstrate their liquidity. These statements show a company how much cash is on hand and whether they can pay their expenses.

A cash flow statement can also help companies plan for the future by providing predicted future cash flow. In addition, by viewing how much cash a company has on hand – and how much is flowing in and out – these statements help investors gain a better understanding of a company’s strength.

No matter how it’s measured, cash flow helps companies expand, develop new products, buy back stock, pay dividends, or even reduce their debt. Higher revenues, lower overhead, and greater efficiency are big drivers of cash flow. This is also why many people value cash flow statements more than any other financial statement or measure.

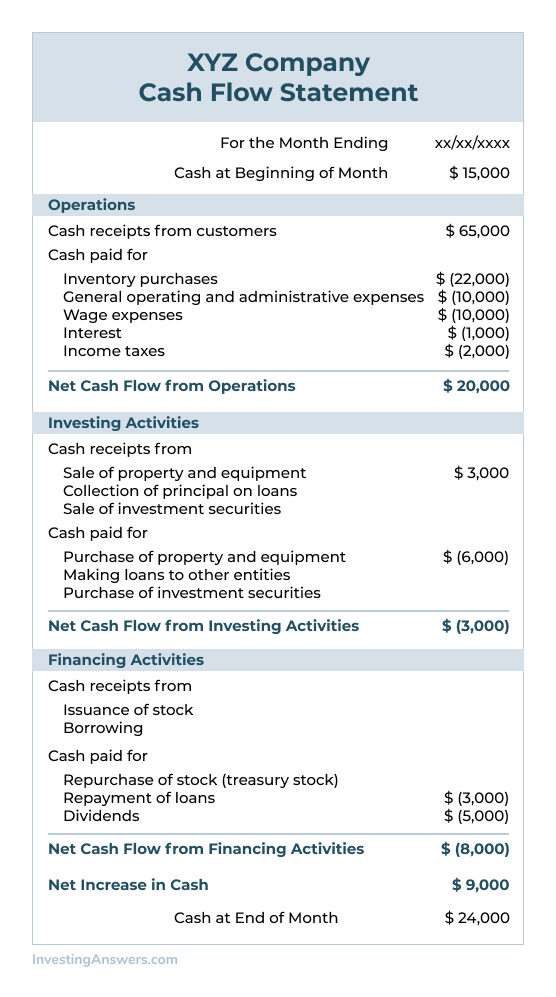

Cash Flow Statement Example

A cash flow statement starts with the net earnings for a given month (or given period) at the top of the spreadsheet. From there, it has rows for adding in and subtracting cash provided by operating activities, investing activities, and financing activities. This provides the net cash flow.

Finally, there is a line for any cash that is being added to arrive at the final balance of cash at period end.

The Difference Between the Cash Flow Statement and Balance Sheet

Although a cash flow statement and balance sheet are separate documents, they work off of one another. To complete the cash flow statement, information from the balance sheet is required.

For example, let’s say you have a balance sheet from July 2020 and one from August 2020. The difference in cash balance between these two consecutive sheets is $31,500. This amount should then be the exact same as the net cash flow in the cash flow statement covering that period.

The Difference Between the Cash Flow Statement and Income Statement

Just like the cash flow statement and balance sheet go together, so do the cash flow statement and income statement. When a sale is completed but paid for by credit, the transaction is recorded as profit on the income statement, but the cash may be more or less than the income figure. Net earnings from the income statement are used to compute figures on the cash flow statement.

Who Prepares Cash Flow Statements?

Typically the chief financial officer (CFO) of a company is in charge of cash management strategies, including preparing financial statements such as the cash flow statement. Business managers and corporate treasurers may also prepare financial statements.

Is a Cash Flow Statement Mandatory?

Yes. Both the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IAS) require that cash flow statements are provided.