What Is EBITDA?

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a measure of corporate profitability. Analysts and investors use EBITDA to evaluate a company's underlying profits without factoring in financing/accounting decisions or tax environments. Although EBITDA reporting is not required under Generally Accepted Accounting Principles (GAAP), many companies include a breakdown of their EBITDA along with their quarterly and annual financial reports.

Let's break down EBITDA into its components:

E = Earnings

B = Before

I = Interest

T = Taxes

D = Depreciation (read definition of depreciation)

A = Amortization (read definition of amortization)

There are many different ways to measure corporate profits, including net income, operating income, and a host of other metrics (keep reading for further details). The benefit of EBITDA is that it measures the profits generated by a firm's day-to-day operations. At the same time, it excludes the impact of non-cash charges like depreciation and amortization. It also strips out expenses that depend on a company's overall debt load (interest expenses), as well as its geographic location (taxes).

The end result is that EBITDA provides investors and analysts with a way to compare a firm's core profitability to other companies in the same industry.

EBITDA Formula

The EBITDA formula is easy to calculate. Just start with a company's net income, then add back interest, taxes, depreciation, and amortization.

Here's a closer look at the EBITDA formula:

Example: How to Calculate EBITDA

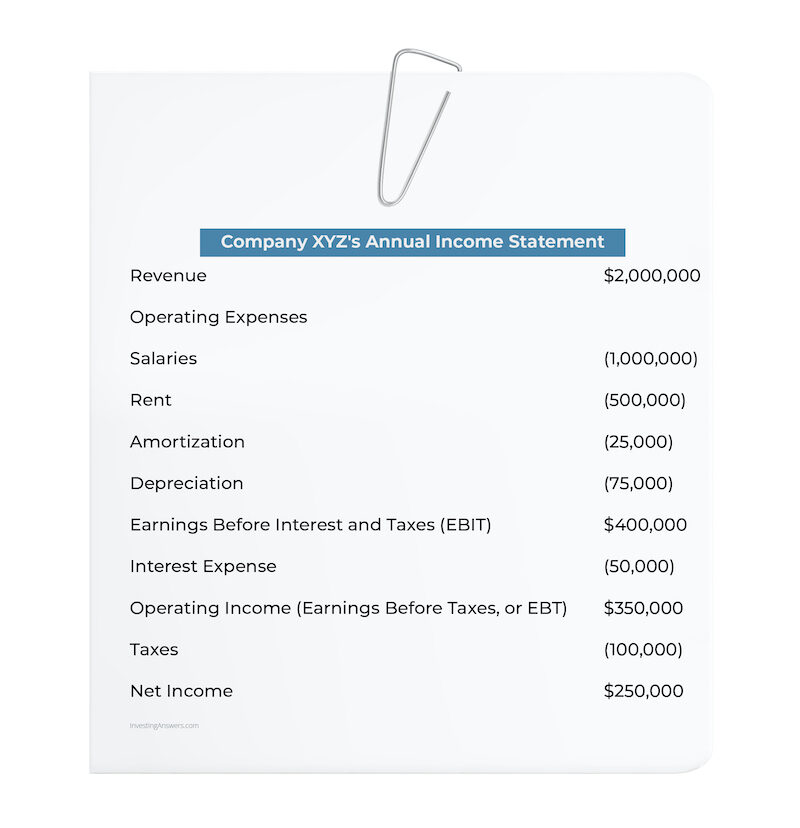

Let’s calculate EBITDA using Company XYZ’s income statement below.

To calculate EBITDA, find the line items for:

Net Income ($250,000)

Interest Expense ($50,000)

Taxes ($100,000)

Depreciation ($75,000) and

Amortization ($25,000)

Then, plug those numbers into the EBITDA formula...

EBITDA = $250,000 + $50,000 + $100,000 + $75,000

In this example, the firm's EBITDA comes out to $500,000.

Alternate EBITDA Formula

Another way to calculate EBITDA is to add back the non-cash expenses of depreciation and amortization to a company's earnings before interest and taxes (EBIT).

Here's how this alternate EBITDA formula looks:

To find EBITDA using this formula – and the income statement above – find the line items for:

Net Income ($250,000)

Interest ($50,000)

Taxes ($100,000)

Depreciation ($75,000), and

Amortization ($25,000)

Here's what the formula would look like:

Where Is EBITDA on the Income Statement?

EBITDA is not included as a line item on the income statement, but you can calculate it by using other items reported on every income statement.

The History of EBITDA

EBITDA gained popularity in the 1980s when leveraged buyout investors were looking at restructuring companies that were going under. EBITDA was used to determine whether companies could pay their liabilities and take on new debts for company restructuring.

While EBITDA was popular at the start for a quick look at a company's ability to handle restructuring, EBITDA is still used by analysts to focus on the outcome of operating decisions, while excluding the impacts of non-operating decisions like:

interest expenses (a financing decision)

tax rates (a governmental decision), or

large non-cash items like depreciation and amortization (an accounting decision)

By minimizing the non-operating effects that are unique to each company, EBITDA allows investors to focus on operating profitability. This singular measure of performance is particularly important when comparing similar companies across a single industry – or companies operating in different tax brackets.

EBITDA Limitations

EBITDA is a primary tool for analyzing a company’s ability to make a profit from sales. This figure can then be compared across companies and industries. EBITDA should not be used as the sole metric for examining a company’s financial health and should be used in conjunction with other metrics (e.g. net income, debt payments).

There are limitations to EBITDA though:

EBITDA Can Skew Investor’s Perspective

EBITDA can be used by companies with low net income to try and 'window-dress' their profitability. EBITDA will almost always be higher than reported net income, making it a figure that can skew an investor’s perspective (if they are not also looking at the bottom line).

EBITDA May Be Deceptive

EBITDA can be deceptive when applied to certain types of companies. Any firms that are saddled with high debt loads (or those that must frequently upgrade costly equipment) should not use EBITDA as a metric. For companies in these situations, interest payments and depreciation represent a recurring drag on annual cash flows. This deserves to be counted as 'real' expenses.

EBITDA Doesn’t Adhere to GAAP

EBITDA calculations don’t adhere to generally accepted accounting principles (GAAP). Investors are at the discretion of the company to decide what is – and is not – included in the EBITDA calculation. There's also the possibility that a company may choose to include different items in their calculation from one reporting period to the next.

What Is EBITDA Margin?

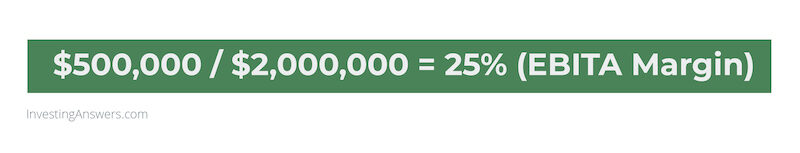

EBITDA is a measure of operating profit. EBITDA margin measures a company's earnings before interest, taxes, depreciation, and amortization as a percentage of its total revenue. More simply, EBITDA margin measures how much cash profit a company made in a year, relative to its total sales.

EBITDA Margin Formula

Using figures from Company XYZ's income statement above, the EBITDA margin would be:

The margin tells you that Company XYZ was able to turn 25% of its revenue into cash profit during the year.

What Is the EBITDA Coverage Ratio?

The EBITDA coverage ratio measures a company's ability to pay off liabilities such as debts and lease payments. It is a solvency ratio, meaning that it compares EBITDA and lease payments to the total debt payments and lease payments.

EBITDA Coverage Ratio Formula

The higher the EBITDA coverage ratio, the better able a company is to repay its liabilities. In general, if a company's EBITDA coverage ratio is at least equal to 1, it means that a company is in a good position to pay off its debts. The lower the EBITDA coverage ratio, the harder it will be for a company to repay its obligations.

What is EBITDA Multiple and How Do You Calculate It?

EBITDA multiple (also referred to as enterprise multiple) is a ratio that compares a company’s total market value (enterprise value) to EBITDA. This metric is used to determine whether a company is over or undervalued.

1. Find Enterprise Value

To determine the EBITDA multiple, you must first find the company's enterprise value.

The enterprise value is calculated thusly:

2. Use EV and EBITDA to Derive Enterprise Multiple

Once you know the company's enterprise value, simply divide by the company's EBITDA.

A company with a low enterprise multiple is considered to be an attractive investment because it reflects a low price for the value of the company. This simply means more company for your dollar.

What Other Financial Measures Are Similar to EBITDA?

The following are all financial measures similar to EBITDA: