What Is the Definition of Amortization?

In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. It is comparable to the depreciation of tangible assets.

In lending, amortization refers to paying off a debt through periodic payments, where each payment pays the periodic interest on the remaining balance and a portion of the loan principal. Most consumer loans (e.g. car loans, mortgages) are amortizing loans, as are many business loans.

Why Is Amortization Used for Assets?

Amortization is practiced in order to match the expense of using an asset over its useful life, rather than expensing its entire cost when purchased. This allows a business to report a portion of the asset's cost in each period that it is used, then match that cost against the revenue generated by the asset.

Consider a toy company which licenses a trademarked cartoon character to be manufactured in a line of plush toys. The trademark license can be amortized over the time period in which the toys are manufactured, matching the cost against the revenues generated by the trademarked character.

Amortization vs. Depreciation

Amortization is used for intangible assets (e.g. patents, intellectual property rights) while depreciation is used for tangible assets (e.g. computers, furniture, vehicles).

There are several ways companies can choose to calculate depreciation and/or amortization. Companies choose the best method of depreciation based on generally accepted accounting principles (GAAP).

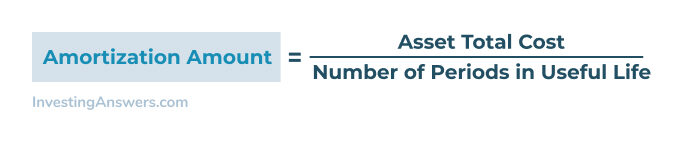

How Can You Calculate Amortization of Assets?

Just like depreciation, amortization may be calculated in different ways. It is most often calculated using straight-line amortization. This means that the value of the intangible asset is evenly divided among the anticipated periods of its useful life. The math would look like this:

For example, if a patent costs $10,000 and is expected to be useful for 10 years, the company would use straight-line amortization to list $1,000 in amortization expenses each year.

Why Is Amortization Used for Loans?

An amortizing loan payment includes the interest due for the period plus a portion of the principal. The loan principal is paid off with each payment and the lender does not have to wait until maturity to get any of its money back. Amortizing loans are typically less risky for the lender and often more manageable for the borrower.

A major advantage for borrowers is that the payment due is the same for each period, making it easier to budget for the payments. The loan is also paid off at maturity. The borrower does not have to come up with an additional (large) principal payment when the loan matures.

Are All Loans Amortizing Loans?

Not all loans are amortizing loans but most consumer loans are. Businesses often use term loans, paying interest only on the loan and paying the entire amount of the principal when the loan matures.

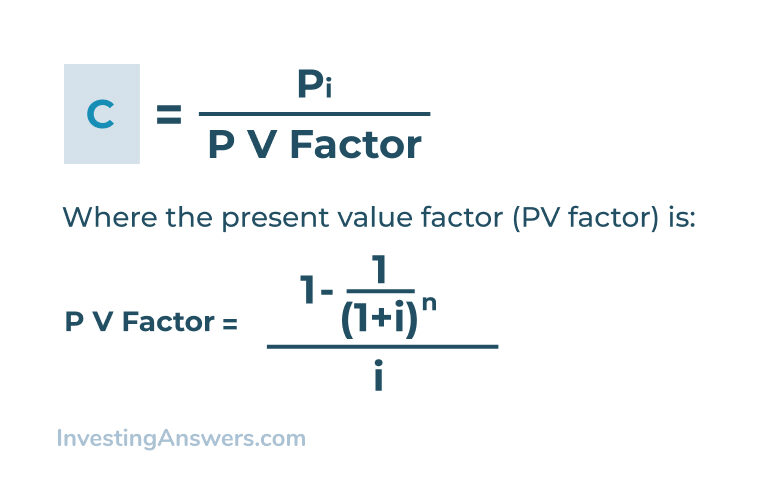

How to Calculate Loan Amortization

The formula to calculate amortization is:

Where

P is the amount of the loan

i = interest rate per period (r/m or r = annual interest rate on the loan divided by the number of payments per year)

n = m x t where m is the number of compounding payments per year and t is the number of years

Since the formula is complex, most people use an online amortization schedule calculator or a spreadsheet to calculate their mortgage payments. Lenders also provide an amortization schedule to demonstrate the monthly payments on a mortgage or personal loans. This schedule breaks down the amount of the monthly payment that goes towards repaying the principal and the amount paid on interest.

Amortization Calculator

An amortization calculator makes it much easier to calculate the amount of principle and interest due on a loan. To use an amortization calculator, find the total amount of the loan, the interest rate, and the loan period. Enter these figures into the amortization calculator to produce an amortization schedule that breaks down the interest and principal amounts, the total monthly payment, and the balance left on the loan.

Amortization Calculation Example

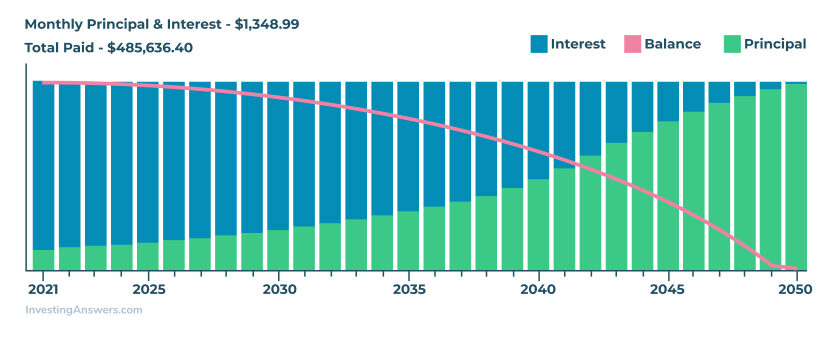

Let's assume you purchase a home and borrow $225,000 with a 30-year mortgage at 6% interest. The loan amortization schedule would look similar to this one.

| Month | Total Payment | Principal Payment | Interest Payment | New Balance |

| January | $1,349.99 | $223.99 | $1,125.00 | $224,776.01 |

| February | 1,349.99 | 225.11 | 1,123.88 | 224,550.90 |

| March | 1,349.99 | 226.23 | 1,122.75 | 224,324.67 |

| April | 1,349.99 | 227.37 | 1,121.62 | 224,097.30 |

| May | 1,349.99 | 228.50 | 1,120.49 | 223,868.80 |

| June | 1,349.99 | 229.64 | 1,119.34 | 223,639.16 |

| July | 1,349.99 | 230.79 | 1,118.20 | 223,408.36 |

| August | 1,349.99 | 231.95 | 1,117.04 | 223,176.42 |

| September | 1,349.99 | 233.11 | 1,115.88 | 222,943.31 |

| October | 1,349.99 | 234.27 | 1,114.72 | 222,709.04 |

| November | 1,349.99 | 235.44 | 1,113.55 | 222,473.59 |

| December | 1,349.99 | 236.62 | 1,112.37 | 222,236.97 |

...and so on

As you can see, the total monthly payment remains the same over the 30-year lifetime of the mortgage.

The amount of the monthly payment that goes towards repaying the principal, however, increases over time. Meanwhile, as the principal balance decreases, the amount of interest paid with each payment also decreases.

What Is a Loan Amortization Schedule?

A loan amortization schedule is the payment schedule in which both the principal and the interest are applied to the balance of the loan over a specific time period. Amortized loans pay off the interest first, then apply payments to the principal. Interest is calculated based on the ending balance of the loan from the previous period.

Using Mortgage Calculators to Determine Amortization

Since a mortgage is an amortizing loan, a mortgage calculator can be a useful tool for homebuyers to assess and compare borrowing rates, as well as their impact on repayment (loan amortization). A mortgage calculator can also be used to help understand how much of a loan you can afford.

The InvestingAnswers mortgage calculator provides a free tool to help you assess your monthly payments