What is EBITDAR?

EBITDAR, which stands for earnings before interest, tax, depreciation, and either restructuring or rent costs (depending on what you're measuring) measures a company's profitability without taking into account its capital structure, tax rate, or primary non-cash items such as depreciation or amortization. It also backs out restructuring or rent costs, so that a company or analyst can approximate the cash available before either of these costs are paid for.

EBITDAR Formula - How to Calculate EBITDAR

EBITDAR is calculated using a company's income statement. It does not appear as a line item, but it can easily be calculated using other line items that do appear on the income statement.

The formula for EBITDAR is:

EBITDAR = EBIT + Depreciation + Amortization + Restructuring Costs (or Rent, depending on what version of EBITDAR you're calculating)

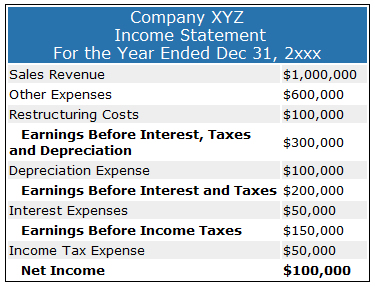

Let's take a look at a hypothetical income statement for Company XYZ:

In this example, we calculate EBITDAR by finding the line item for EBIT ($200,000), depreciation ($100,000), amortization (N/A) and restructuring costs ($100,000), and then we use the formula:

EBITDAR = $200,000 + $100,000 + 0 + $100,000 = $400,000

EBITDAR is $400,000 vs. net income of $100,000.

Why the Meaning of EBITDAR is Important

EBITDAR provides investment analysts with information for evaluating a company’s operating performance without regard to other factors unrelated to operations such as interest expenses, tax rates, major non-cash items, or nonrecurring items such as restructuring costs.

EBITDAR helps minimize variables that are unique from company to company, in order to focus the analysis on operating profitability as a singular measure of performance. Such analysis is particularly important when comparing similar companies across a single industry.

EBITDAR is similar to other measures of profitability such as EBIT and EBITDA, but is used for certain types of companies such as casinos and restaurants that have unique rent costs, or for any company that has incurred non-recurring restructuring costs over the past fiscal year. Removing these costs allow analysts to compare these companies to others in their industry that do not share the same costs.