No matter where you are on your financial journey, you probably know that investing your money is the key to building a comfortable retirement and achieving financial freedom. But with dozens of investment accounts, thousands of stocks, bonds, and funds available, and seemingly unlimited ways to invest your hard-earned money, how do you know if you're doing it right?

Personal Capital is one of our favorite tools because it takes the complicated mess of your financial life and automatically organizes it in a goal-oriented, simple-to-understand way. While it's not a perfect tool, there are some great features and education tools built into its platform that can steer you in the right direction (and possibly save your thousands in the long run).

What is Personal Capital

Personal Capital is a free financial app and wealth management company that offers a suite of tools to help users gain insight into their investments. It's one of the simplest and most powerful apps on the market that can help users invest smarter and plan for retirement.

With features such as the retirement fee analyzer, retirement planner, saving planner, and multiple investment performance tools, users can gain detailed insights into ways to improve their portfolio while working toward their financial goals.

Personal Capital is also a financial management firm that offers access to a team of licensed financial advisors for .89% of assets under management. They are similar to a robo-advisor in that they follow a specified investing plan based on your risk tolerance (and other factors), but they offer the personal touch of being able to call an advisor to talk through your investments at any time.

How Personal Capital Works

Users can sign up for a free Personal Capital account online with an email address and some basic personal information. Once your account is set up, you can connect your financial accounts to import all of your financial details.

It is recommended you connect bank accounts, investment accounts, as well as debt accounts (such as a car loan or mortgage). The more information Personal Capital has to work with, the more accurate its planning tools are to show you what is possible.

With your financial accounts connected, Personal Capital will display an overview of all your accounts, including cash holdings, investment holdings, debt balances, and your overall net worth.

There are multiple tools within your Personal Capital account to dive deeper into your finances (which we'll cover below), but the goal of each section is to give you a snapshot of your current financial picture and allow you to set financial goals and track your progress.

For those interested in the wealth management services provided by Personal Capital, there is a minimum requirement of $100,000 in invested assets to get started.

Once you connect your investment accounts to the platform, Personal Capital may contact you to set up a free consultation with a financial advisor to talk through your investing and financial goals, and offer its advisory services to help you achieve them.

Personal Capital Features

Personal Capital has become famous due to its suite of powerful (free) financial tools and trackers to help you take control of your finances.

While its investing tools are comprehensive, it also offers a simple budgeting and tracking tool, as well as its own banking product (Personal Capital Cash) to help users with day-to-day financial management.

Here's a breakdown of Personal Capital's features and services:

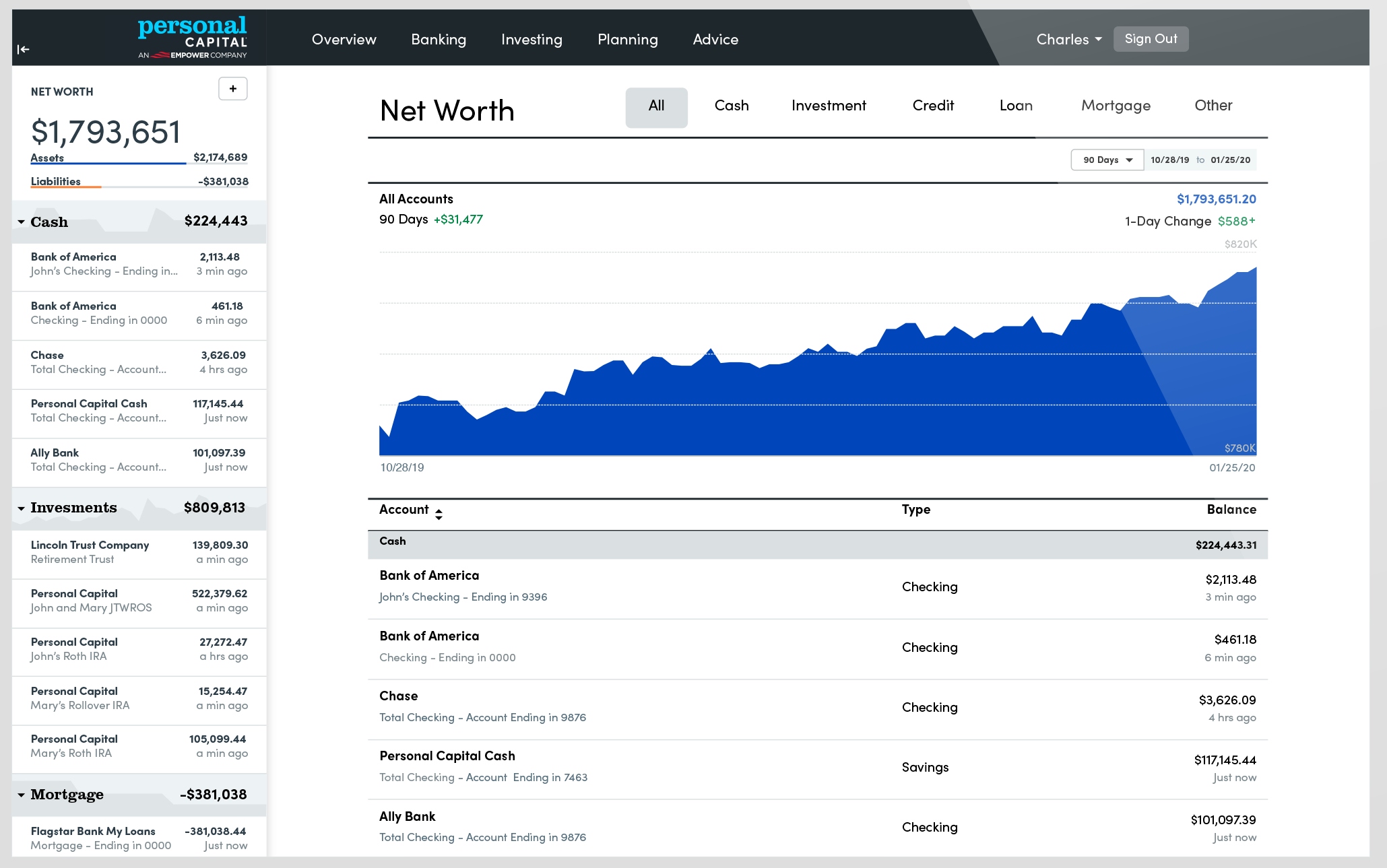

Financial Dashboard

When you first log in with your accounts connected, you're greeted with the financial dashboard. This is a quick snapshot of your current financial situation, including account balances and a net worth tracker. From this screen, you can see your accounts organized by cash, investment, credit, and loan accounts.

Yes, this includes tracking your crypto holdings from certain exchanges, such as Coinbase.

Personal Capital has also added the ability to manually track your cryptocurrency holdings as well, using pricing information from CryptoCompare.

You can also manually track other assets, such as cars or other valuables to keep your net worth up to date.

Net Worth Tracking

Under the dashboard drop-down, Personal Capital also has a simple net worth tracker that lists the balances of all your cash, investments, assets, as well as debts. It shows your overall net worth over time. This allows you to quickly see if you are headed in the right direction.

Investing

Under the investments section, Personal Capital allows you to track your investment accounts all in one place. This shows your overall portfolio balance over time, including performance against popular indices. You can also analyze your portfolio based on a few different views:

Holdings. This view shows your total portfolio holdings, which can be sorted by type, such as fund, stock, bond, or cash.

Balances. This view shows your overall portfolio balance over time, including your rate of return on each of your holdings.

Performance. The performance view shows the overall performance of your accounts during a selected time period (which you control), with an ability to compare to other portfolios, such as US stocks or foreign bonds.

Allocation. This view breaks down your holdings by asset class, including cash, bonds, stocks, international holdings, and alternative investments.

Sectors. This section shows which industry sectors you are invested in, such as in energy, healthcare, financial, or technology.

These tools help you see how your investments are performing and shows you exactly what you are invested in. This can help quickly show if your investments are performing how you expect them to, or if you are overweight in any particular asset class, such as stocks or bonds.

Planning

The planning section of Personal Capital offers some of the most powerful investing tools available on any platform. These tools will help you plan for future goals, such as retirement, analyze your investing fees and asset allocation, and even set goals for short-term savings (such as a house down payment).

Here's how each of the planning tools works:

Retirement Planner

The retirement planner tool takes your current financial information and shows you if you are on track with your retirement savings. You can set specific spending goals (such as monthly retirement spending), record savings and social security income, and the planner will model what your retirement may look like.

If you are not on track, it will give recommendations on how much to save each year, how to adjust your asset allocation, and how to maximize your tax savings.

Savings Planner

The savings planner is a simple tool that tracks your progress on retirement savings, emergency funds savings, and debt paydown. You can use the recommend savings goal amount, or set your own, and track your progress along the way

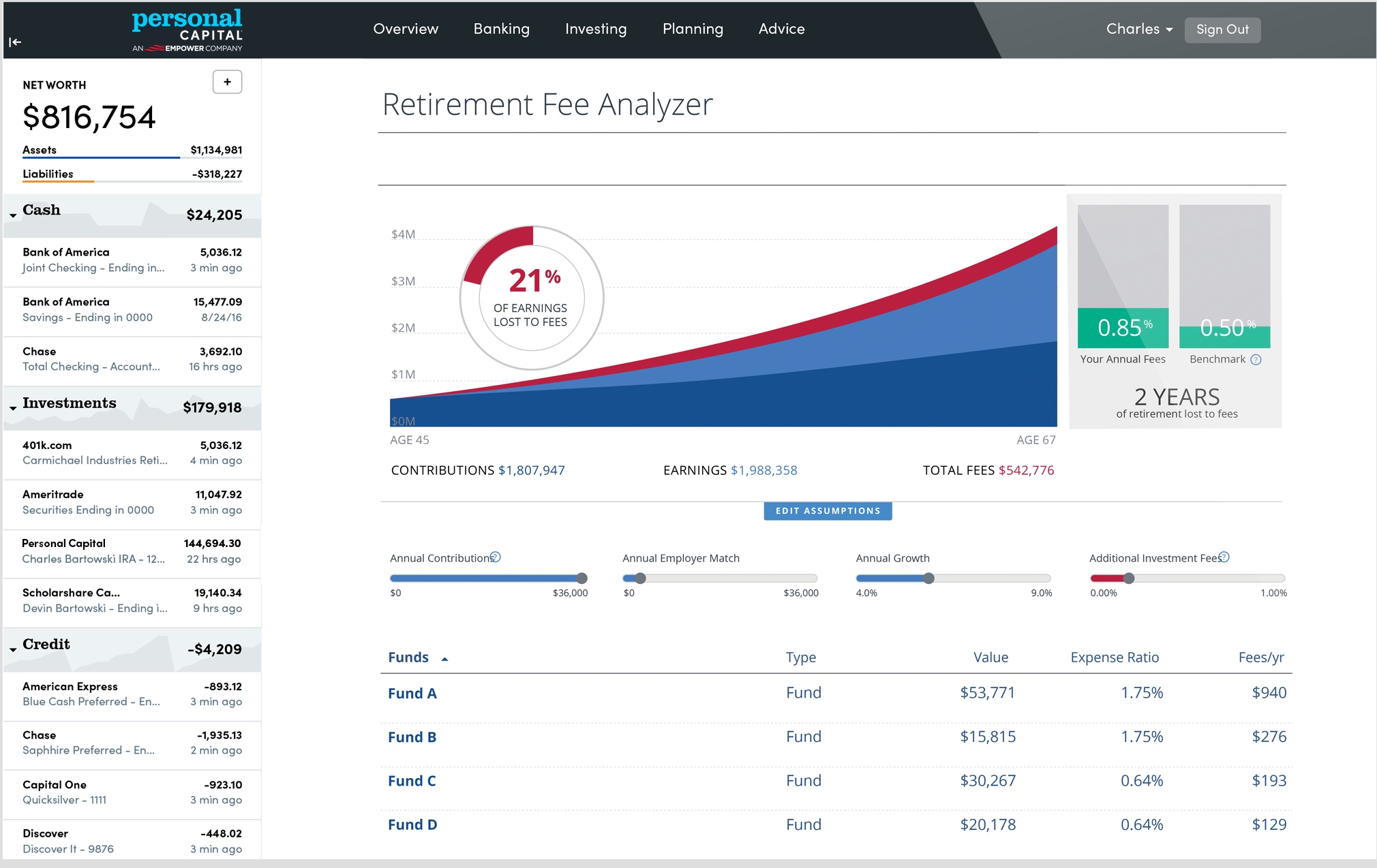

Retirement Fee Analyzer

The Personal Capital fee analyzer tool is possibly the most helpful investing tool offered on this platform.

It quickly shows you exactly how much you are paying in fees for every investment in your portfolio and will give you a projection for home much money you will pay over time. In fact, the fee analyzer will even show you how many years of retirement are lost to fees.

Investment Checkup

This tool takes an overall view of your investment portfolio and gives advice specific to your asset allocation, stock investment analysis, and overall costs associated with your investment accounts.

It's a quick way to see if you are staying within your stated risk tolerance, or possibly paying too much in investment fees.

Banking

Personal Capital offers cash management tools, such as budgeting, bill, and cash flow tracking, as well as its own banking product, Personal Capital Cash.

While the cash flow view shows a simplified view of your income and expenses, the budgeting tool offers more useful information.

Personal Capital Budgeting

The budgeting tool is admittedly simple, compared to other full-featured budgeting apps, but it gets the job done.

You cannot set individual budget line items but instead set an overall spending goal for the month. Each transaction is imported (from your credit card or bank account), and they are automatically categorized for you. The tool then shows you a quick breakdown of how much you are spending in each category with a color-coded pie chart, making it easy to quickly see where your money has been going.

If you are not wanting to deep dive into the details of your budget, but just want a simple spending tracker to make sure you're on track, the Personal Capital budgeting tool fits the bill nicely.

Personal Capital Cash

The Personal Capital Cash account is a simple bank account that acts as a checking and savings account for clients.

It is FDIC insured up to $1.5 million, and allows quick transfers to and from your investment accounts. This account is ideal for Personal Capital wealth management customers who want a holding account for their investments. The account is managed and insured through its partner, UMB Bank.

Check out our full article comparing Personal Capital to Betterment.

Wealth Management

While Personal Capital offers free investing tools through its app, it is primarily a full-service investment firm that offers professional wealth management services with access to a team of licensed financial advisors. This service is available to investors with a cumulative accounts balance of $100,000 or more in investable assets.

When your account reaches $200,000 you'll receive a dedicated financial advisor.

Note: Once your account reaches $100,000 in total investable assets, a Personal Capital advisor will call you to chat about advisory services.

Personal Capital Advisors

Personal Capital is a fee-only financial planning firm that offers access to a team of licensed financial advisors to manage your investments. They offer a below-average annual management fee (0.89% or less), access to a personal advisor, and financial advice based on your goals.

This service is a hybrid robo-advisory model, though Personal Capital will tell you they are more of a digital asset management service. With automated investing tools, and access to real, live advisors, you get the best of both worlds to invest with confidence.

Personal Capital's Investment Strategy

Personal Capital adheres to modern portfolio theory, which is a diversified investing strategy based on your risk tolerance and expected return. In fact, Harry Markowitz (who invented modern portfolio theory) is listed as one of the portfolio strategy contributors.

Portfolios are constructed using individual stocks and ETFs, and along with Personal Capital’s selection of pre-constructed portfolios, clients can customize their investments. This includes socially responsible investing (SRI) portfolios as well.

Personal Capital also offers several efficient investing methods, including tax-loss harvesting, dynamic rebalancing, and Smart WeightingTM to make sure no specific investment sector outweighs your portfolio.

Personal Capital Pricing

Personal Capital offers its app for free, with all of the analysis and investing tools to help you get an accurate snapshot of your money, and plan for the future.

Personal Capital wealth management services are available for an annual assets-under-management fee (AUM) starting at 0.89% per year. The fee decreases on a sliding scale, depending on the amount of assets that are managed.

-

$100,000 to $1 million - 0.89%

-

$1 million to $3 million - 0.79%

-

$3 million to $5 million: 0.69%

-

$5 million to $10 million - 0.59%

-

Over $10 million - 0.49%

How to Sign up for Personal Capital

Signing up for Personal Capital is as simple as providing your name and email address. Online accounts are free, and you can access all the online tools the Personal Capital app has to offer with your free account.

If you have $100,000 or more in investable assets, you can schedule a call directly with a financial advisor to join the wealth management services, or open a wealth management account directly online.

Get started with Personal Capital today.

Pros and Cons

While Personal Capital offers one of our favorite free investing apps and quality investment advisory services, it's not perfect. Here's where Personal Capital shines, and a few things we'd like to see improve.

Pros

-

Access to free financial planning tools

-

Wealth management services offer unlimited access to licensed financial advisors

-

Lower fees than most financial planning firms

-

Tax optimization available for wealth management clients

-

Retirement fee analyzer can save you thousands!

-

Mobile app available (iPhone, iPad, Android, smart watch)

Cons

-

$100,000 minimum for advisory services

-

Solicitation phone call (after hitting $100,000 in assets)

-

Budgeting tools very basic

Is Personal Capital Legit?

Personal Capital offers a lot of helpful financial planning advice for free, as well as a professionally managed service for those who want access to a team of financial advisors. For online accounts, Personal Capital offers bank-grade security, including two-factor authentication and 256-bit AES encryption (yes, the same level used by the U.S. military).

As for the advisory services, Personal Capital gives a good blend of automated investing and hands-on advisory services for sub-1% management fee.

This hybrid approach takes advantage of some of the cutting-edge technology offered by modern robo-advisors but gives you the personal assurance of a financial professional to make sure your money is managed well.

Is Personal Capital Right for You?

Personal Capital is a fantastic free financial app that can add value to any investor and offers a quality financial management service that combines technology with professional expertise.

If you are a do-it-yourself investor that simply wants access to a suite of free tools that enhance your portfolio management, Personal Capital is a no-brainer, and a great companion app to any other money management app out there.

Personal Capital's wealth management services are great for investors who are looking to build a robust retirement plan and have access to a live financial expert to guide them along the way. If you are looking to set some of those bigger financial goals, but want to make sure you are maximizing your investment potential, Personal Capital's advisory services may be for you.