M1 Finance is an investing app that offers a simple way to build an investment portfolio quickly, without any additional fees or commissions for using the app. M1 Finance allows users to invest using “Investing Pies,” which are a way to create a simple investing portfolio, split between multiple investments (such as stocks, bonds, and ETFs). Users can create their own portfolio, or select from a list of “Expert Pies,” which are pre-made portfolios that range from conservative to aggressive in nature.

This investing approach helps marry the automation of traditional robo advisors, with the flexibility to create your own investment portfolio. M1 Finance offers a large selection of individual stocks and ETFs, giving users more flexibility than most investing apps, while keeping fees to a minimum. Overall, M1 Finance is a good choice for beginner investors that want access to a wide range of investments, but with a simple approach to building a long-term investing plan.

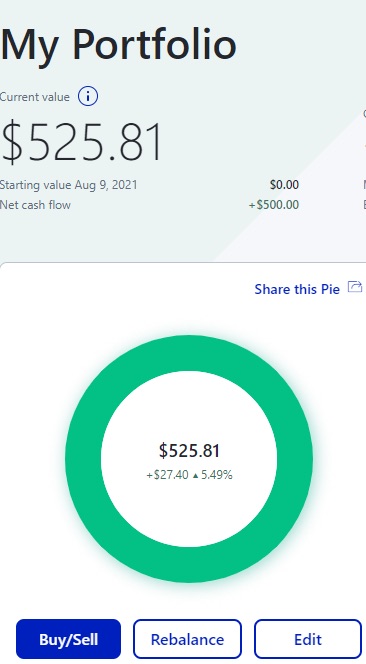

I personally opened a Roth IRA with M1 Finance in 2021 and have invested $500 so far. And as a personal finance coach and writer, I recommend M1 Finance to family and friends that are looking for the easiest way to open an investing account and start investing for the first time.

Here's a quick summary of M1 Finance, along with category ratings (on a scale of 1-5).

M1 Finance Summary

| Account Fees (4) | No trading fees No account fees $100 IRA termination fee $20 Inactivity fee for accounts under $20 with no activity for 90+ days $125/year for M1 Plus membership |

| Expense Ratios (4) | Varies by ETF $0 on individual stocks owned |

| Account Minimums (4) | $100 for investment accounts $500 for retirement accounts |

| Investment Options (4.5) | ETFs from multiple asset classes (including stocks, bonds, emerging markets, commodities, and real estate) Access to thousands of individual U.S. stocks |

| Investment Account Options (4.5) | Taxable investment accounts Traditional, Roth, and SEP IRA Checking accounts Joint accounts Trusts |

| Portfolio Construction (4) | “Dynamic” rebalancing on all accounts Can select an “Expert Pie” to build your portfolio, or create a custom pie |

| Tax Strategy (2) | IRA accounts available |

| Customer Service and Support (3.5) | Email support only (no phone support available) 9 AM to 5 PM EST. Emails are responded to within 1 business day. |

| Mobile Compatibility (5) | Well-designed mobile app for both iOS and Android Ability to open cash and investing accounts directly from app |

| Account Setup (4.5) | To open an investment account, simply select the type of account you want to open, fill in your personal details, select your investing pie, and transfer funds to invest. |

| Education and Security (3.5) | Vast library of educational articles, but sparsely populated help center. Bank-grade data protection, two-factor authentication, FDIC insurance (on cash accounts), and SIPC insurance (on investment accounts). |

| Ease of access (5) | M1 Finance is easily accessible on web browsers and through the mobile app. |

What Is M1 Finance?

M1 Finance is a free investing app that allows users to open an investment account and start investing with no fees. M1 Finance charges no commissions or fees on any trade, and there are no annual fees for basic accounts. Users can invest in up to 6,000 different individual stocks or ETFs, and either select from hand-picked expert portfolios (“Pies”) or create their own.

M1 Finance offers both standard brokerage accounts, as well as retirement accounts for investing. Users can also set up recurring investments, which helps automate the process of investing by transferring funds to M1 Finance on a regular schedule, and those funds are automatically invested based on a user’s selected investment portfolio.

M1 Finance has expanded to add a host of other services, including:

- M1 Borrow. Investors can borrow against their taxable investment accounts, with current interest rates as low as 2%.

- M1 Spend. A simple checking account with a debit card and no annual fees

- M1 Credit Card. Exclusive to M1 Plus members, this rewards credit card offers cash back that can be invested directly into your M1 Finance account.

M1 Plus

For users that want access to even more features from M1 Finance, the M1 Plus is a subscription that unlocks more functionality to M1 Finance users, including;

- Lower interest rates on M1 Borrow

- Custodial accounts for your children

- Multiple trade windows for intra-day trade execution

- 1% interest on the M1 Spend checking account

- 1% cash back on qualifying debit card purchases

M1 Plus also gives users access to more ATM fee reimbursements per month, and the exclusive M1 Credit Card.

While these features are great, M1 Plus does cost $125 per year, which may seem expensive compared to other robo advisors. Currently, M1 Plus is free for the first year.

Is M1 Finance Legitimate?

M1 Finance is a legitimate investing app that offers all the same consumer protections as any other investing firms, including FDIC insurance on cash holdings and SIPC insurance on investment holdings. It also boasts “military-grade” data protection with 4096-bit encryption.

M1 Finance has grown to over 500,000 clients with over $3 billion in assets under management. It is a trusted app that helps investors take a long-term investing approach, without annual fees and trading commissions. M1 Finance even allows users to directly check its status with FINRA on its website, showing that M1 is currently registered as a regulated broker in the U.S.

My Experience With M1 Finance

I opened an M1 Finance Roth IRA in 2021 and invested an initial $500 to get started. The onboarding process was simple, though I was forced to choose a minimum of three investments to create my investing “Pie” (I only wanted one fund). I was able to edit this later by creating my own investing pie with a single fund and investing in it. There were no fees or trading commissions, which makes it more flexible than investing directly with a company like Fidelity or Vanguard that charge commissions for buying mutual funds from competitors (e.g. buying a Vanguard mutual fund on Fidelity’s platform).

M1 Finance makes investing easier than most platforms, with a super-simple mobile app, and guided onboarding to help users get started. I personally recommend this app to family and friends who want an easy way to get started with a Roth IRA or similar investment account, as the simplicity and long-term investing focus make it an ideal app.

M1 Finance’s Pros and Cons

M1 Finance offers a wide range of features, but it’s not all rainbows and sunshine. Here are a few things we love about M1 Finance, plus some things we hope they improve.

Pros:

- Access to 6,000+ stocks and ETFs

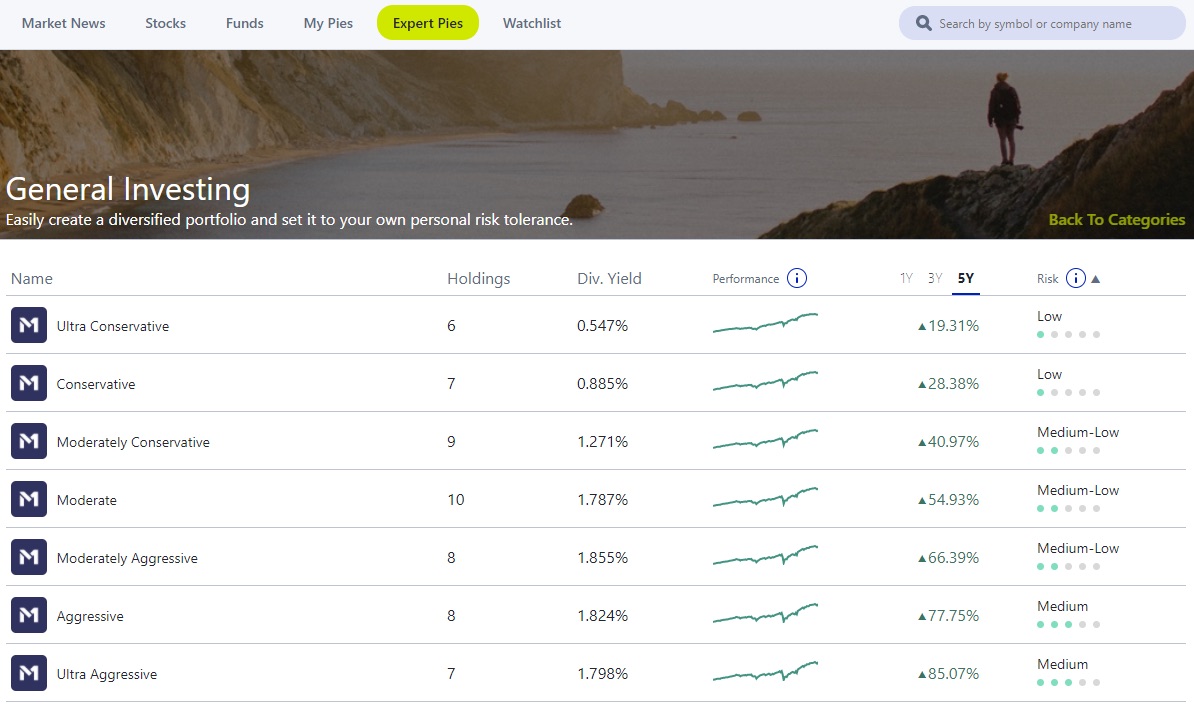

- 80+ expert portfolios (“Pies”) to choose from

- No trading commissions or annual fees (for basic accounts)

- Automated investing and dynamic rebalancing

Cons:

- Annual cost to add custodial accounts (M1 Plus Required)

- Customer service is email only

- Requires choosing portfolio and manually setting up investments

Is M1 Finance Good for Beginners?

M1 Finance is aimed at beginner investors that want assistance with picking the right investments, and automating the investing process. While it does not offer the same level of onboarding help and portfolio management of other robo-advisors, it does help educate and empower users to build a properly diversified investing plan. And with no trading or annual management fees, it is a much lower-cost option than other services.

That being said, M1 Finance requires that users understand what they are investing in, choose a standardized portfolio, or create their own. There are no financial advisors on staff to consult with, and new users may feel a bit overwhelmed with all the choices. Overall, beginners can thrive by following the M1 Finance onboarding process, but may be better served with a more automated service, such as Betterment or Wealthfront.

Can You Lose Money on M1 Finance?

As with any investment service, investing in stocks and ETFs carries the risk of loss. While M1 Finance is set up for long-term investing, there is always a downside risk to any investment in the stock market. So yes, you can lose money on M1 Finance.

As far as insurance goes, M1 Finance carries both FDIC and SIPC insurance to cover your assets in case of fraud or theft. FDIC insurance covers up to $250,000 (per individual) in coverage for bank deposits and M1 Spend checking account balances. SIPC insurance covers up to $500,000 (per individual) of your investable assets.

Don't Miss: Robo Advisors vs Financial Advisors: Which One Is Right for Me?

How Easy Do Robo Advisors Make Investing?

Robo advisors help you start investing by taking on most of the hard work of investing, including research and planning. You can sign up for an account, answer a few simple questions, and have a customized portfolio built for you automatically. In the case of M1 Finance, there are dozens of pre-built portfolios (“Pies”) you can choose from to fit your risk tolerance and investing goals.

In addition, investing services like M1 Finance allow you to automate your investing by setting up recurring investments on a regular schedule. This hands-off approach helps you build wealth in the background, automatically, without worrying about the day-to-day management of your investments.

Robo advisors are ideal for new investors that don’t want to manage their own portfolio, but want access to professional advice at a fraction of the cost of a financial advisor.

Don't Miss: Are Robo Advisors Worth It?

How Does M1 Finance Compare to Competitors?

M1 Finance offers quite a few features for no fees, but it may not be the best fit for everyone. Here’s how M1 Finance stacks up against the competition:

Stash

Stash is a low-cost investing app that offers investing advice and access to thousands of stocks and ETFs for building an investment portfolio. While it is comparable to M1 Finance with its advice and offerings, it does charge a monthly fee from $1 up to $9 for top-tier accounts. Stash focuses on user education to help users feel confident in their investing approach.

Learn More: Our complete Stash review.

Wealthfront

Wealthfront is a true robo-advisory service that manages your investing from end-to-end. This includes comprehensive financial planning, goal-setting, banking, and automated investing services. Wealthfront manages user accounts for a 0.25% annual fee, investing in low-cost ETFs across a wide range of asset classes. Its services include portfolio construction, automatic rebalancing, tax-loss harvesting, as well as the ability to borrow against taxable portfolios.

Want more? Check out our full Wealthfront review.

Betterment

Betterment is another top-notch robo advisor that offers a hands-off investing approach for a reasonable annual fee. It is our top-ranked robo advisor for beginners, with a user-friendly mobile app, low investing minimum ($10), and access to live human advisors (for a fee). It also offers automatic rebalancing, tax-loss harvesting, and recurring investments. Betterment charges a 0.25% annual fee for standard accounts, and 0.40% for Premium accounts (with a $100,000 minimum).

Don't Miss: Our full Betterment review.

Summary

M1 Finance is a simple-to-use investing app designed for do-it-yourself investors that want a more automated approach to investing. Beginners will benefit from the user education and pre-built investing “Pies,” making it easy to choose investments and get started. But intermediate investors with a firm grasp of basic investing concepts will benefit the most from M1 Fiance's flexible investing approach. With access to thousands of stocks and ETFs to choose from, no account fees, and low minimum investments, M1 Finance offers a wide range of features for no additional cost.

M1 Finance may also benefit those that want to manage their finances under one roof. With the M1 Spend no-fee checking account, M1 Borrow portfolio loans, and new M1 credit card, users can automate most of their financial life. M1 Finance “smart transfers” also give users the ability to automatically invest any extra cash they have, helping you reach your financial goals quicker.

Overall, M1 Finance offers educated investors a simple way to automate long-term investing. If you're ready to learn more or get started, check out the M1 Finance site for more info.

References:

https://www.m1finance.com/lega...

https://support.m1finance.com/...

https://www.m1finance.com/star...

https://support.m1finance.com/...

https://www.globenewswire.com/...