Full Wealthfront Review

Wealthfront is a one-stop-shop for all of your retirement planning needs. Their automated approach to investing – and suite of free planning tools – put them at the top of our list of recommended robo advisors.

Pros and Cons of Wealthfront

Pros

-

Detailed, free financial planning tools for every investor

-

Detailed goal-setting features for major purchases (including buying a home)

-

Automated investing based on risk tolerance (hands-off)

-

Low-fee management, inexpensive ETFs

-

Tax-loss harvesting

-

Automatic rebalancing

Cons

-

Portfolios under $100,000 cannot be customized

-

No access to human financial advisors

Wealthfront Overview

| Category | Highlights |

| Account Fees |

|

| Expense Ratios |

|

| Account Minimums |

|

| Investment Options/Choices |

|

| Investment Account Options |

|

| Portfolio Construction |

|

| Tax Strategy |

|

| Customer Service and Support |

|

| Mobile Compatibility |

|

| Account Setup |

|

| Education and Security |

|

| Ease of access |

|

Overall Score: 4.7 / 5

Wealthfront’s Best Features

Here’s what makes Wealthfront a smart robo advisor choice:

Investment Options

Wealthfront boasts a globally diversified portfolio of investments across 11 different asset classes, utilizing ETFs to automatically invest based on a user’s risk tolerance.

Depending on their investment goals and risk tolerance, most portfolios will see a mix of 6-8 of the following asset classes:

-

US stocks

-

Foreign stocks

-

Emerging market stocks

-

Dividend stocks

-

Treasury inflation-protected securities

-

Municipal bonds

-

US government bonds

-

Emerging market bonds

-

Natural resources

Wealthfront has selected its investments with the guidance of Chief Investment Officer, Burton Malkiel. Paired with a commitment to Modern Portfolio Theory (MPT), Wealthfront applies advanced algorithms and data sets to streamline the investing process.

Opening a Wealthfront Investment Account

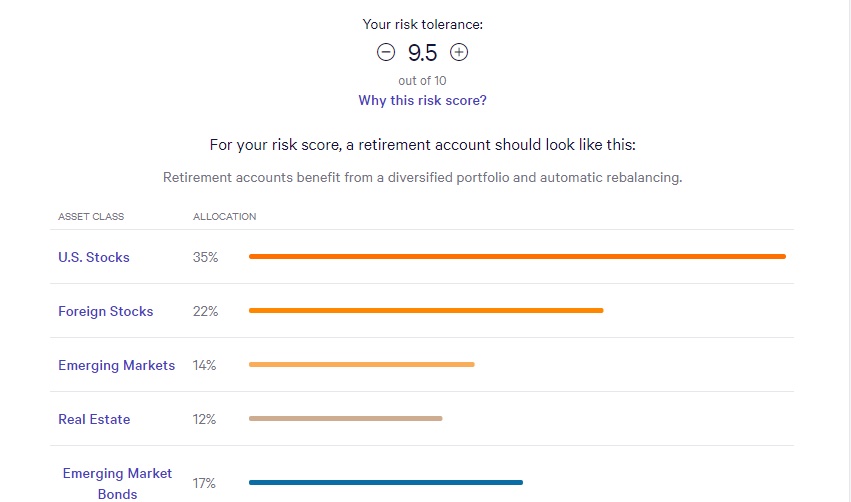

When you open an investment account, you’ll be expected to complete an onboarding questionnaire in order to create your asset allocation. Based on your answers to a few simple questions, they’ll give you a “risk tolerance score” between 1 and 10 (with 10 being the highest tolerance for risk).

Based on your age, risk tolerance score, total investments, and other factors, Wealthfront automatically creates a portfolio spread across a selection of their asset classes.

Automatic Rebalancing

Wealthfront will automatically rebalance your portfolio for you, although not on a set schedule, but when an asset class has drifted away from its target allocation by a certain percentage.

They refer to this as “threshold-based rebalancing” and it may be triggered by movements in the market, dividend reinvestment, or after deposits/withdrawals are made through the account.

Wealthfront Risk Parity Fund

For customers with portfolio sizes above $100,000 in a taxable account, Wealthfront has created their own “Risk Parity Fund” which offers potentially higher risk-adjusted returns. These do, however, carry a 0.25% expense ratio (much higher than the other ETFs in their portfolio).

Note: Though this fund is designed for balancing risk with potentially higher returns, the Risk Parity Fund did decline further than most standard index funds during the pandemic in 2020. Always consider the risk of investing before choosing your funds.

For investors who don’t want to invest in the fund, you can easily choose not to, but will be reminded of your eligibility to access the fund once your taxable account reaches a $100,000 balance.

Wealth “Smart Beta”

For customers with $500,000 or more in a taxable investment account, Wealthfront offers access to Smart Beta at no additional cost. Smart Beta is a proprietary investment strategy using multiple factors to create the best asset allocation for your goals.

To determine the weighting of stocks in a portfolio, this multi-factor system uses 5 factors: value, momentum, dividend yield, market beta, and volatility.

Management Fees

Wealthfront offers a competitive 0.25% management fee to handle your investments.

You can also refer a friend to Wealthfront and get management fees waived on $5,000 for both of you. There is currently no discount for larger balances.

Their financial planning tool, Path, is offered for free as well as their “Cash” account for savings.

Tax Optimization

One of the major advantages of using robo advisor services are the advanced algorithms that can help you optimize your tax efficiency while investing. Wealthfront does this on a daily basis with tax-loss harvesting on any taxable investment account.

When fluctuations in the market cause an ETF to decline in value, Wealthfront will sell that ETF at a loss (to help offset ordinary income or investment gains) which in turn lowers your overall tax bill. Any ETFs sold will automatically be replaced by a correlating ETF, keeping your asset allocation in place.

Wealthfront also offers tax efficient transfers of funds into their account. They use their advanced fund-matching and tax efficient analysis of your current holdings to minimize – or completely offset – any taxes.

For users with a $100,000 (or higher) taxable account balance, they offer “stock-level tax-loss harvesting”, which gives you the option to exclude certain stocks from being sold. This is especially helpful for socially-responsible investing.

High Yield Savings Account (“Cash”)

Wealthfront’s “Cash” account is a savings account that offers a competitive interest rate. It has many of the same features you’d find at a traditional bank, such as bill pay, auto-pay and a debit card. It also offers $1,000,000 in FDIC insurance – four times that of a traditional savings account.

This account also offers a two-day advance on paychecks if a customer is signed up for direct deposit on the account.

“Path” Financial Planning Tool

Path is Wealthfront’s free financial planning tool, giving users insights and suggestions on their current financial situations and upcoming goals.

Path takes inventory off all of your financial accounts, assets, your savings rate, and shows you a clearer path to reach your goals. Whether you want to purchase a home, pay for college, or even take a year off to travel, Path will crunch the numbers and tell you if you’re on track.

Home Purchase Goal Setting

Their home purchase goal setting is particularly impressive. By pulling in data from Zillow and Redfin, Wealthfront gives you real-time estimates on housing prices in the area you are looking to buy.

Combining that with your credit score – and other financial holdings – the tool will estimate your total housing costs (e.g. mortgage, taxes, insurance) and tell you whether the purchase is “comfortable”, “manageable”, “a stretch”, or “unaffordable.” If you can’t currently afford your dream home, Path will show you the steps you need to take to get there.

Time Off to Travel

Path also has a unique feature called “Time off to Travel.” This goal-setting feature uses your current financial information to show you the maximum amount of time you could “comfortably” afford to travel, including monthly estimated costs and the start date.

How Goals Impact Your Retirement

When setting goals with Path, the tool always takes into account the impact on retirement and other goals in your plan. Each goal added has a section called “How Will This Impact My Plan?” which allows you to quickly see exactly what is possible and how it will affect your future goals.

For example:

If you decide to take a year off to travel (with no income), it will drain your current savings and stop you from contributing to your investments for a year. Path will instantly show you the long-term implications and allow you to adjust your goals on the fly.

Line of Credit

Wealthfront customers with a taxable account balance of $25,000 or more can borrow up to 30% of their taxable portfolio without a formal application. The Portfolio Line of Credit is designed to give customers quick access to cash by using their taxable investments as collateral.

This line of credit gives borrowers access to very low interest rates (typically below 4%). This rate is better than most personal loans and credit cards, letting savvy consumers take advantage of great rates by borrowing against their investments.

If your portfolio balance falls below a certain percentage of your borrowed funds, however, Wealthfront will require immediate repayment of some of your balance. You can do this with a deposit into your Wealthfront account or by selling investments from your taxable Wealthfront account.

College Savings 529

Wealthfront is one of the only robo advisors to offer a college savings 529 plan, sponsored through the state of Nevada (Nevada residents can get their first $25,000 in assets managed for free). In addition to the 0.25% Wealthfront advisory fee and ETF fees, their 529 account includes an additional 0.07% in administrative fees.

You can open an account directly through your Wealthfront account or through the Path tool. When using Path, college cost estimates are based on your chosen school.

For example, attending the University of Florida has an estimated 4-year cost of $240,000 (including tuition & fees, room & board, books, etc.). Path will show you how much you should start saving to meet that goal, then you can open a 529 account.

Note: Many states offer tax incentives to invest in a state-sponsored 529 plan. Investing in Wealthfront’s 529 plan would not offer these incentives. Check with your state to see what is available before opening a Wealthfront 529 account.

Areas Where Wealthfront Can Improve

Wealthfront is a great financial planning app, but there are a few places where Wealthfront can improve its service:

Lack of Portfolio Customization

Wealthfront is great for those who want a “set it and forget it” approach to their investing, but it lacks customization for those who don’t have at least $100,000 invested. You cannot adjust your individual investments or asset allocation beyond changing your risk tolerance.

The only way to customize your portfolio beyond asset allocation is by using the “stock-level tax-loss harvesting” feature to exclude certain stocks from being sold off. This feature is only available for taxable portfolios with at least a $100,000 balance.

Risk Parity Fund Has High Fees

The Wealthfront Risk Parity Fund is available for investors with $100,000 or more in assets but it’s much pricier than the other ETFs available. In addition to the 0.25% management fee for all users, the Risk Parity Fund carries an additional 0.25% fee.

Wealthfront vs. Betterment

Both Betterment and Wealthfront boast a low 0.25% fee for digital management of your investments and both have access to low cost ETFs. Both have advanced investing tools such as tax-loss harvesting and automatic portfolio rebalancing. But which service is best?

There are a few differences between these two robo advisors, so here’s a quick list to help you decide which one is best:

|

|

|

| Higher account minimum: $500 | Lower account minimum: $0 |

| Ability to open 529 college savings account | Premium plan for customers with minimum $100,000 balance giving direct access to financial planners (over Zoom) |

| Portfolio line of credit for taxable accounts above $25,000 | Multiple portfolio models to choose from |

| Full-featured financial planning and goal-setting app “Path” |

Overall, Betterment is great for people who want to start investing with little up-front cost while Wealthfront will provide access to more in-depth planning tools for investors who want everything under one roof.

Wealthfront vs. Ellevest

Both Ellevest and Wealthfront offer digital management of your investments, access to low cost ETFs, advanced investing tools such as tax-loss harvesting (Ellevest uses their Tax Minimization Method), as well as automatic portfolio rebalancing. How do you know which service to choose?

There are a few differentiators that will help you find the best fit for your investing goals.

|

|

|

| 0.25% assets under management fee | Focused on women’s unique needs (e.g. longer lifespans, lower-than-average wages) |

| Ability to open 529 college savings accounts and joint accounts | Monthly subscription fee (as opposed to assets under management fee) |

| Portfolio line of credit for taxable accounts above $25,000 | Direct access to financial planners (for a fee) |

| Full-featured financial planning and goal-setting app “Path” | Impact Portfolio invested in ETFs that focus on gender diversity and women’s leadership |

| Stock-level tax-loss harvesting | Access to Ellevest banking with savings and checking account capabilities |

Wealthfront is an all-in-one investing and planning tool that gives you access to all of their investment accounts for a simple 0.25% fee. If you want everything in one place, Wealthfront is a great choice. Ellevest is best for individual women investors who want access to impactful investing management for a low fee. Ellevest offers access to funds that help push for broader diversity in the workplace and help close the gender wage gap.

How Does Wealthfront Work?

To get started with Wealthfront, simply enter in your personal information, including your name, email, and phone number (for two-factor authentication).

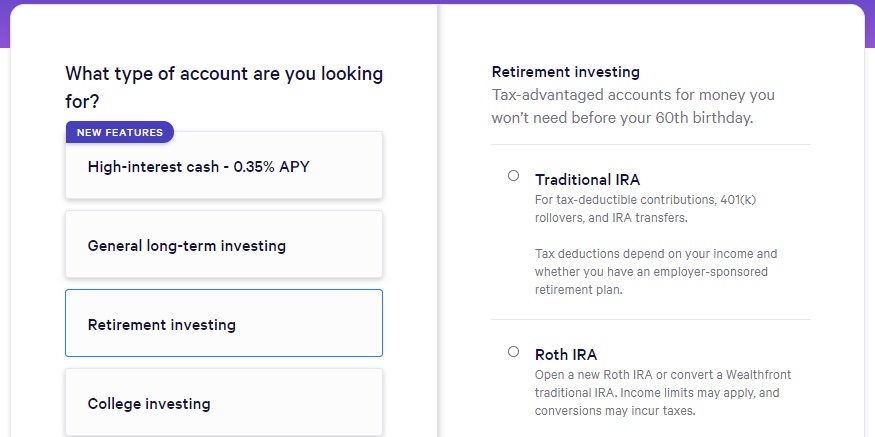

Once you’ve created your account, you’ll be able to choose the type of account you’d like to open. Wealthfront gives you four main choices:

-

Wealthfront cash account

-

Taxable brokerage account

-

Retirement account (IRA, etc.)

-

College savings account (529)

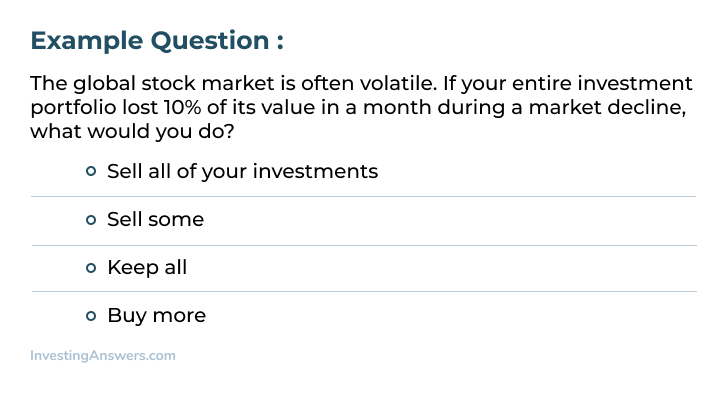

When you choose an investing account, Wealthfront will ask you a few questions to help determine your risk tolerance and design your portfolio. In particular, they will ask what you would do in case of a market downturn.

After answering these questions, Wealthfront will produce a risk tolerance score (out of 10). Based on that score, they’ll show you a breakdown of your asset allocation and investments within your Wealthfront account.

The higher your risk tolerance, the more aggressive your portfolio will be (with more allocation to stocks). The lower your score, the more you will have invested in lower-risk assets, such as bonds.

After you’ve chosen your account and asset allocation, you’ll need to fund the account by connecting your bank account. Investment accounts have a minimum $500 deposit while cash accounts have a $1 minimum deposit.

How Does Wealthfront Manage Investments?

As mentioned above, Wealthfront automatically manages your investment portfolio based on your risk tolerance, automatically rebalancing to keep your asset allocation the same over time.

Wealthfront’s investing methodology is based on Modern Portfolio Theory (MPT) which optimizes portfolios across a broad set of asset classes (usually 6 to 8 within a portfolio).

This optimization includes tax-loss harvesting – and the use of Wealthfront’s “Risk Parity” fund – to reduce risk while increasing potential returns.

Wealthfront is extremely transparent about their investment returns. In fact, you can find the overall performance of each portfolio in their historical performance archive.

What Is the Pricing Breakdown for All Wealthfront Features?

Wealthfront has many free tools, including a huge educational library and their mobile-friendly financial planning tool (Path). They also have a no-fee cash account with a better-than-average interest rate.

Their investment services are competitive at only 0.25% on assets under management – no matter how much you’ve invested with them.

Here’s a quick breakdown of how much it costs to use Wealthfront:

| Feature | Cost |

| Path - Financial planning tool | Free |

| Tax-loss harvesting | Free |

| Automatic rebalancing | Free |

| Cash account |

|

| Investment account |

|

| Investment Management |

|

| ETF Fees |

|

| 529 Fees |

|

| Stock-level tax-loss harvesting (accounts over $100k) |

|

| Smart Beta (accounts over $500k) |

|

Is Wealthfront Right For You?

Wealthfront is the current leader in the robo advisor space for a reason. They have helpful free tools and more powerful investing features than most of the competition – plus, they do it all for a low fee of 0.25% of your assets. If you’re looking to invest in a simple and intelligent way, Wealthfront is a great option to consider.