Fidelity is one of the largest investment firms in the U.S., offering a full suite of investment services, as well as a wide range of low- and no-cost index funds. Fidelity launched Fidelity Go, its robo-advisory service, in 2016. It helps investors automate investing for a low monthly cost. With no account minimums, low fees, and 24/7 customer support, Fidelity is a great option for beginner investors.

Fidelity Go Overview

| Features | Details |

| Account Fees | No annual management fee for balances under $10,000 $3 per month for balances from $10,000 to $49,999 0.35% annual fee for balances $50,000 and above |

| Expense Ratios | 0.00% (only Fidelity Flex funds available) |

| Account Minimums | $0 |

| Investment Options | Fidelity Flex mutual funds in seven asset classes such as stocks, international stocks, and bonds |

| Investment Account Options | Taxable brokers accounts IRA, Roth IRA, Rollover IRA Joint accounts |

| Portfolio Construction | Automatic portfolio rebalancing on all accounts |

| Tax Strategy | Access to municipal bonds, but no tax-loss harvesting |

| Customer Service and Support | 24/7 phone support Live chat and email support, Monday - Friday, 8am to 6pm EST |

| Mobile Compatibility | Mobile apps available Website is mobile-friendly |

| Account Setup | Simple account setup, all done online Sign up for free with your email address, provide personal information and goals, and fund the account (no minimum balance required, but $10 needed to make an investment) |

| Security | Bank-grade data protection, two-factor authentication |

| Ease of access | Fidelity offers two mobile apps for access to Fidelity Go accounts, including the Fidelity Spire goal-setting app |

What Is Fidelity Go?

Fidelity Go is a low-cost robo-advisory service that includes no management fees for investors with a $10,000 balance or less. It offers a range of no-fee index funds to create a diversified portfolio across U.S. and foreign stocks, as well as several bond funds. These funds are exclusive to Fidelity managed accounts, and are operated by Fidelity fund managers.

Fidelity Go is aimed at younger investors and helps make it simple to start investing toward your financial goals. Fidelity also offers an easy-to-use mobile app to manage and monitor your account, as well as set financial goals you can track. With no minimum account balance required and very low fees for those starting to invest, Fidelity Go is one of the best robo-advisors for beginners.

How Fidelity Go Works

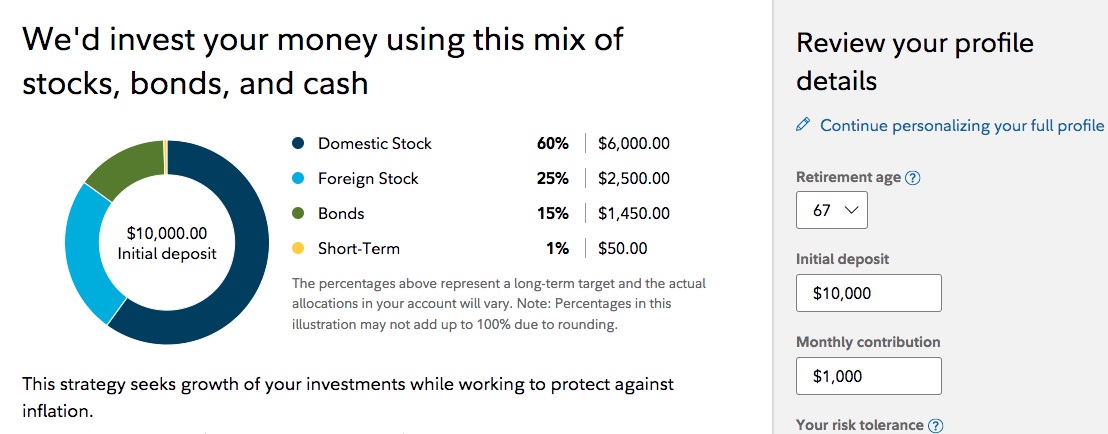

Fidelity Go offers a straightforward account setup process, walking users through a series of simple questions to help create an appropriate portfolio. After answering the questions, Fidelity will then present a suggested investment portfolio allocation, including a breakdown of funds included.

Adjustments can be made to the suggested portfolio by adjusting the risk assessment questions. Fidelity also shows the exact costs associated with signing up for a Fidelity Go account, which is $0 for deposits of under $10,000.

Once an asset allocation is selected, users can select the type of account they want to open (IRA or taxable brokerage account), and complete the account sign up process.

While there are no minimum deposit or balance requirements to open a Fidelity Go account, users must deposit at least $10 at Fidelity to start investing.

Main Features

Fidelity Go isn’t the most feature-packed robo-advisory service available, but it makes investing easy and low cost. Here are a few of the best features available on Fidelity Go:

Fee-Free Mutual Funds

Fidelity Go offers its Fidelity Flex mutual funds that are exclusive to Fidelity clients. These funds come with no annual fees. The mutual funds are managed by actual human advisors, not just algorithms, so strategic investment decisions are made by a team of fund managers.

Fidelity Flex funds cover seven asset classes, but portfolios do not offer access to REITs or commodities.

Human Portfolio Management

Fidelity Go is unique in the robo-advisory world in that portfolios are managed by human advisors. More of a hybrid robo-advisory model, advanced algorithms paired with a team of advisors from Fidelity’s subsidiary, Strategic Advisors.

24/7 Customer Service

Fidelity is known for its customer service and offers 24/7 support over the phone for Fidelity Go customers. This allows you to stay in contact with Fidelity to address any questions or account issues you may have at any time.

During regular business hours (Mon - Fri, 8am - 6pm EST), Fidelity can also be reached via live chat on its website or over email. Fidelity also boasts a large educational library and helpful investing tips on its My Money website.

Fidelity Spire App Integration

Fidelity Go customers can track and manage their accounts via the Fidelity mobile app, but Fidelity also offers a financial goal-setting app, Fidelity Spire. Fidelity Spire helps users prioritize their goals, showing the impact on their finances when choosing to fund one goal before another. This app is also integrated with your Fidelity Go account, allowing you to track your long-term goals (e.g. retirement), along with shorter-term savings goals with the app.

Don't Miss: Robo Advisors vs. Financial Advisors: Which One Is Right for You?

Is Fidelity Go Best for You?

Fidelity Go is ideal for beginner investors. With no minimums, no fees (on balances under $10,000), and a simple-to-use mobile platform, Fidelity Go helps make investing for retirement easy. Fidelity also offers a large library of user education videos and articles to help new users become comfortable with investing.

While Fidelity Go can manage larger balances, its 0.35% fee on accounts over $50,000 is more expensive than its competitors, and offers fewer features.

Is Fidelity Go Legit?

Fidelity is one of the largest investment firms in the U.S., with a trusted reputation for low fees and fantastic user education. Fidelity Go is its robo-advisory offering aimed at helping young investors get started (for free). Fidelity Go uses a combination of algorithm-based investing and human oversight to ensure portfolios are in good hands.

Fidelity also offers bank-grade security, two-factor authentication, and both FDIC and SIPC insurance for its bank and investment accounts. With trillions in assets under management, Fidelity is our top overall pick for online brokers.

How to Get Started

To get started with Fidelity Go, users simply need to answer a few questions, pick an asset allocation, and open an account. Fidelity allows users to browse sample portfolios and make adjustments before signing up for anything, which goes along with its mission to help educate consumers on investing.

Once you have opened an account, you will need to connect your bank account to deposit funds for investing. While there is no minimum balance required to open an account, Fidelity won’t invest until you deposit at least $10 into your account.

Pros and Cons

Pros

- No fees for accounts balances under $10,000

- No fees on investment funds

- Human advisors manage accounts

- Mobile app integration

Cons

- Balances over $50,000 are charged a 0.35% fee, higher than competitors

- No tax-loss harvesting available

- Limited fund selection (Fidelity-owned funds only)

Fidelity Go Alternatives

Fidelity Go offers a great way for beginners to start investing with no fees under $10,000, but it may not be the best for all investors. Here are a few alternatives to Fidelity Go that may fit your investment needs better:

Schwab Intelligent Portfolio

Schwab is a large U.S. investment firm that offers no-fee investment management via its Schwab Intelligent Portfolio robo-advisory service. Schwab offers a large selection of low-fee ETFs, automatic rebalancing of portfolios, and the option to upgrade to a premium service for access to a licensed financial advisor. While the minimum to open an account is a bit higher than Fidelity Go ($5,000 minimum), this advisory service is a great option to keep fees to a bare minimum.

Learn more in our Schwab Intelligent Portfolios review.

Sofi Automated Investing

Sofi Automated Investing is a robo-advisory platform that offers automated investment management with access to licensed financial advisors. Sofi does not charge an annual management fee (for any account size), but does offer its own funds as part of each portfolio. Sofi also offers access to career coaches, and Certified Financial Planners (CFPs) at no additional cost.

Learn more in our Sofi Automated Investing review.

Wealthfront

Wealthfront is our top pick for robo-advisory services, offering a wide range of features for investors, including stock-level tax-loss harvesting, ETFs in 11 asset classes, a portfolio line-of-credit, and a free financial planning app that projects saving for things like buying a home and paying for college. Wealthfront support staff are all licensed financial advisors. Wealthfront charges a 0.25% annual management fee.

Learn more in our full Wealthfront review.

Summary

Fidelity Go is a simple robo-advisory service that offers a no-fee way for beginners to start investing with little money. With the first $10,000 managed free, and Fidelity’s vast library of educational content, Fidelity Go is ideal for new investors.

Clients who are looking for access to more advanced features (such as tax-loss harvesting), or who have over $50,000 may want to look at other robo-advisory services instead, as the fees for larger accounts are much higher.

Overall, Fidelity Go is a great starting point for investors, with the backing of one of the largest investment firms in the U.S.

Want more? Check out the best robo advisors.

References:

https://www.fidelity.com/manag...

https://www.fidelity.com/about...