One of the most powerful forces in the financial world is the magic of compounding interest. Whether you’re investing in stocks or a more secure financial instrument like a certificate of deposit, over time, compounding money will result in exponential growth of your investment.

But what is compound interest, and how does it work, exactly? Let’s dive into the details of how compounding works in stocks and CDs.

What Compound Interest Is and How It Works

Compound interest is the result of reinvesting interest earned on an investment. Compounding is a process of earning interest on both the principal invested and any interest accrued since investment. In a broader sense, compounding can apply to investments that earn returns in the form of capital gains, dividends, interest, or other earnings, if those returns are then reinvested into that asset for exponential growth over time.

As Benjamin Franklin put it: 'Money makes money. And the money that money makes, makes money.'

Compounding happens when your earnings start to generate earnings of their own, leading to an exponential growth of your investment (as opposed to the linear growth of simple interest).

How Compounding Works in Stocks and CDs

Compounding is a fantastic concept for those looking to grow their wealth long term, and some of the most popular instruments that harness the power of compounding are stocks and CDs.

Compounding With Stocks

Stocks are ownership interests in a company. When you buy a share of stock, you then own a small piece of that company.

Stocks can increase in value and/or issue dividends. When you can choose to “reinvest” those earnings by purchasing more shares), you are now using the power of compounding money. To put it another way, your money is earning more money.

Over time, the more earnings you reinvest, the more growth you will see. The value of your stock can also decrease, however, so investing in stocks is not without risk.

Compounding With CDs

When you invest in a CD, you’ll earn a fixed interest rate based on an annual percentage yield (APR). This means that the earned interest is based on the total interest earned on your investment over the year.

The interest on your CD is usually reinvested and added to your original investment amount, which in turn generates income based on your CD’s interest rate. This is how CDs compound year over year – and it’s the perfect example of “your interest earning interest.”

To see this plays out in real life, let’s take a look at a few examples below.

Example of Compounding with Stocks

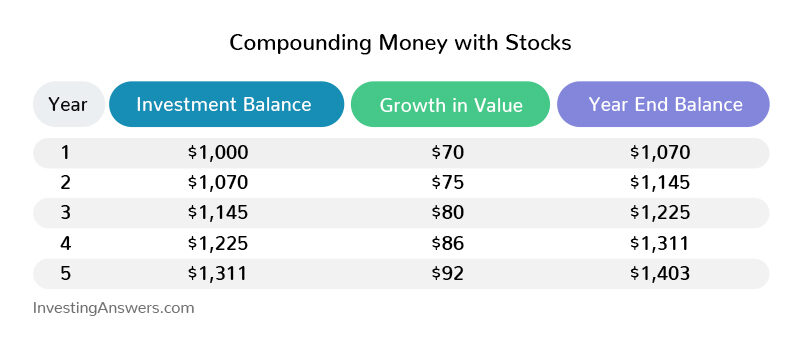

Let’s say you buy a company stock for $1,000, and it grows by an average value of 7.0% per year.

In your first year, your $1,000 investment would grow to $1,070 ($70 in total earnings). The next year, your stock would grow another 7.0%, which would net you an additional $75.

The following year, your stock would be worth $1,145, growing another 7.0% (based on its current value) and for each subsequent year.

This example table shows what your $1,000 stock (invested at 7.0% for five years) might look like:

Note: We understand that stocks do not grow the same amount each year, but for the purposes of this example, we wanted to show the expected (average) return over time.

Example of Compounding with CDs

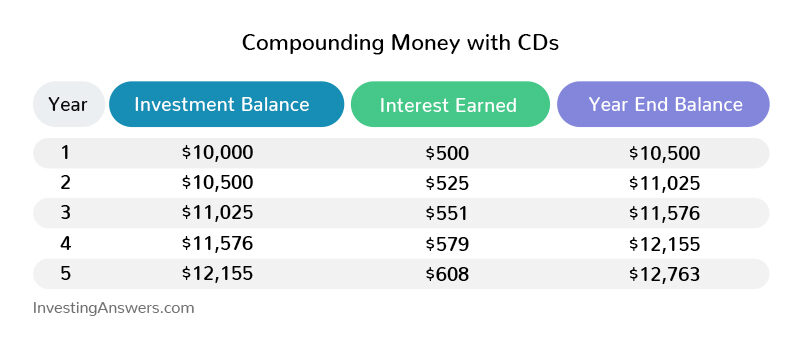

Let’s say you invest $10,000 into a CD account with a fixed 5.0% interest rate (APR). This means that your $10,000 will earn $500 in interest for that first year, bringing your total CD investment to $10,500.

The next year, your 5.0% interest would be calculated on that $10,500 balance. This means that you’d earn approximately $525 in interest, bringing your CD balance up to $11,025.

The following year, the 5.0% interest would be calculated on that $11,025 balance (and so on, for however long the CD investment lasts).

See this example table for what your $10,000 CD – invested at 5.0% for five years might look like:

Note: 5.0% interest rates are rare in today’s low interest rate environment, but CDs still out-earn typical savings accounts.

As you can see, you don’t just earn $500 per year, but your annual earnings grow over time due to the “magic” of compounding interest.

How to Use Stocks to Build Your Wealth

Stocks are one of the most popular ways to build wealth over the long term – and for good reason: Compared to other investment vehicles, they offer great long-term growth. Compounding returns over years (and decades) can turn a relatively small amount of money into a tidy sum!

One of the most common ways to invest in stocks are retirement plans such as a 401(k), 403(b), or even an Individual Retirement Account (IRA). These accounts are a great way to save for retirement, but your access to your investment is limited until you reach retirement age. They have great tax advantages as well.

However you choose to invest in stocks, the key is to simply start!

How to Use Certificates of Deposit (CDs) to Build Your Wealth

CDs are typically seen as a “low-risk” investment as they have fixed interest rates and are typically FDIC insured.

CDs typically pay higher interest rates than most savings accounts. To take advantage of compounding interest, consider using a CD account for your short-term savings goals (five years or less). You may also consider a CD account as a cash-equivalent investment that’s part of your retirement portfolio.

Before opening any account, make sure to do your research on CDs, as there are a few limitations.

CDs will usually play a small part of your total investment portfolio but they may still be a great option for those looking for a safe place to park short-term savings (5 years or less). CDs may also lower your portfolio risk while you earn a bit more than a typical savings account.

Two Key Tips to Maximize Compounding Interest

You can’t grow your wealth exponentially by sitting on the sidelines. Compounding only works if you invest.

There are two key ways you can take advantage of compounding your money.

1. Start As Soon As You Can

There’s no question that the true power of compounding happens when you give it enough time. Compounding doesn’t have the wealth-growing effect when only done for a few years.

For example, let’s compare two different people trying to save $1,000,000 for retirement (using a simple savings calculator).

Savvy Susan starts investing at age 30. She invests in stocks that grow at 8% on average. Investing only $450 per month, Susan will have over $1,000,000 saved by the time she is 65 years old.

Delayed Daryl decides to wait until he’s age 40 to start investing. He invests in the same stocks that grow at 8% on average. In order to grow his savings to $1,000,000 by the time he’s 65 years old, Daryl will have to invest $1,055 per month.

Not only does Daryl need to invest twice as much per month, but also, his total investment contributions are $316,500. Susan only had to invest $189,000 to achieve the same goal.

2. Make Consistent and Frequent Contributions

The second most important rule to investing is consistency. Compounding has the biggest impact when you consistently contribute more principal to be compounded to your investment accounts – then simply let it grow. There are a few ways to do this.

First, if you have a job that gives you access to a 401(k) or 403(b) retirement account, you can make a contribution with every paycheck. Some employers even offer a “match”, which earns even more money and amplifies the compounding money effect.

Next, you can look at “automating” your investing through an online brokerage or bank account. You can set up a “recurring” transfer from your checking account over to your investment account. This will automatically invest your money on a set schedule and it can be done on a regular schedule (e.g. monthly, bi-weekly).

Otherwise, simply commit to investing yourself by manually transferring money into an investment account.

No matter how you choose to invest, make sure you are doing it at least once a month to continue growing your wealth and take advantage of the magic of compounding.

Best Compounding Accounts

There are many types of accounts that take advantage of compound interest. Here are a few of the best ones.

Stocks and Investments

Investments (such as mutual funds) are some of the very best options for harnessing the long-term growth of compounding.

The best compounding accounts for investing in stocks and mutual funds are:

- Work 401(k) or 403(b) plans

- Individual Retirement Accounts (e.g. Roth, traditional IRAs)

- Health Savings Accounts (e.g. HSAs)

- Self-Employed Retirement Accounts (e.g. solo 401k, SEP IRA)

- Standard Brokerage Accounts (e.g. taxable)

WIthin these accounts, you can purchase individual stocks and mutual funds.

As mentioned earlier, the key to exponential compounding growth is consistent and frequent contributions. So make sure to fund these accounts regularly.

CDs

In addition to compounding your investment, CDs are a great way for balancing your investment portfolio with a safe cash-equivalent.

A traditional CD is usually offered by a bank, but they can also be found at many brokerage firms. They are usually offered in various term lengths (e.g. 6 months, 3 years), with the longer terms typically offering higher rates. If you’re planning on leaving the money alone for a while, you can find better rates on longer term CDs.

Check out some of the best rates on CDs below:

Money Market Accounts and Savings

Compound Interest Calculator

If you want to find out how much you can earn by putting your money into a compounding investment account, check out our compound savings calculator and plug in your own numbers.