How to Use the Compound Saving Calculator

Say you’re planning to buy a $10,000 car within 5 years. You think you can achieve a 2% return on your money each year. You would enter:

"$10,000" as the Goal Amount,

"5" as the Years to Goal, and

"2%" as the Annual Rate of Return

If you’ve already saved $1,000, enter "$1,000" as your Current Amount Saved.

If you start with $1,000 and save an additional $1,709.43 each year (while earning 2% on your savings), you’ll have $10,000 within 5 years.

How Compounding Helps You Earn Money

It’s easy to take advantage of compounding when you consistently save money while earning interest. In fact, it’s a great way to accumulate wealth over time.

What Is Compounding Interest?

At its most basic, compound interest is earning interest on interest. In the case of a savings account, you’d deposit your funds at regular intervals and that money earns interest (either monthly or annually). This interest is added to the total amount in the account and therefore starts earning interest.

How to Find the Best Savings Account Rate

The annual rate of return is dependent on the type of savings account you select. High-yield savings accounts and money market accounts typically offer higher interest rates than regular savings accounts (which can be as low as 0.25%).

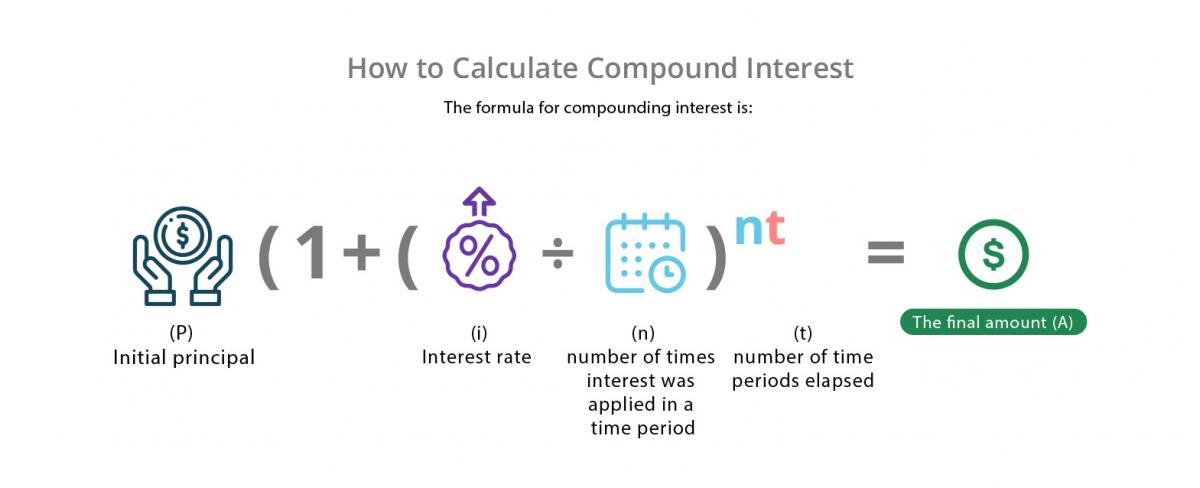

How to Calculate Compound Interest

The compound interest formula is as follows:

A = P (1 + r⁄n ) nt

P = initial principal (your deposit or “Current Amount Saved”

i = interest rate (the interest rate offered by the savings account)

t = number of time periods elapsed (how long your plan to save)

n = number of times the money is compounded per year (annually or monthly)

A = final amount, including the initial principal and all interest earned over n years

Or, use our simple compound savings calculator above.