You’ve probably heard of a checking and savings account before, and you might even have your own accounts. But which is the best place to keep your money? Below we’ll compare the features of checking vs. savings accounts so you can better manage your finances.

Checking vs. Savings Accounts: The Major Differences

Checking and savings accounts are different products which serve different purposes. Simply put, checking accounts are typically for money you plan to spend while savings accounts are for money you want to save.

Here’s an overview of the differences between checking and savings accounts:

| Major Differences between Checking vs. Savings Accounts | ||

|---|---|---|

| Checking Accounts | Savings Accounts | |

| Purpose | Spending | Saving |

| Interest Bearing | Sometimes | Yes |

| Minimum Age To Open | Varies by bank. Must open with adult guardian co-owner. | No minimum, but must open with adult co-owner. |

| Access to Funds |

|

|

| Withdrawal Limits | None | Convenience withdrawals limited to six per month** |

| Service Fees | Sometimes | Less often |

**Source: Federal Reserve

The Full Breakdown of Checking vs. Savings Accounts

Let’s examine checking accounts vs savings accounts even more thoroughly:

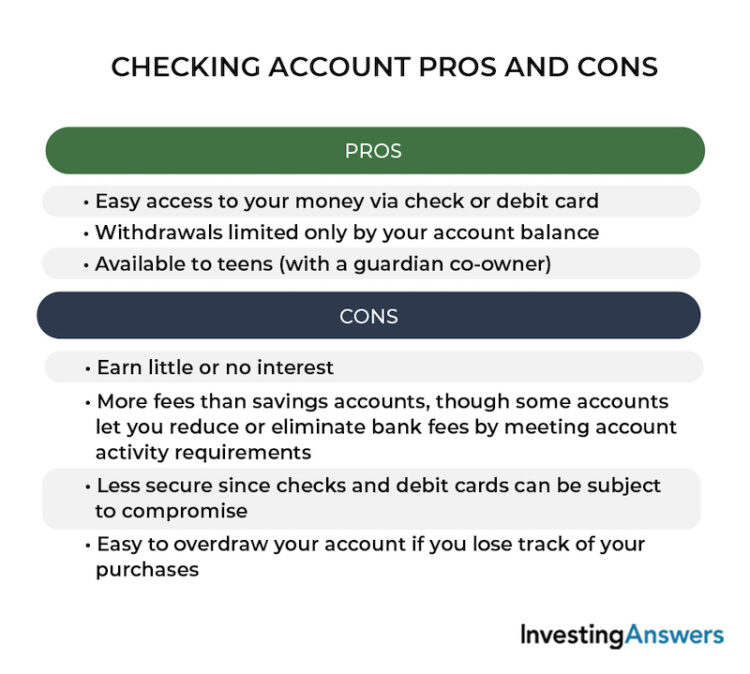

Checking Account Pros and Cons

A checking account is meant to be transactional — that is, the bank expects you to tap into the money often to cover your day-to-day expenses, and it gives you several ways to do so.

By definition, transaction accounts allow unlimited withdrawals. This makes it easy to use your checking account to pay bills, pay for purchases with your debit card, draw cash from an ATM, or send money using a third-party money app (e.g. PayPal or Venmo).

Although there’s no legal limit to how often you withdraw funds, your bank might impose a maximum daily ATM withdrawal and debit purchase amount. Out-of-network ATM withdrawals might also be subject to fees.

Special Features of a Checking Account

Checking accounts have special features to help manage your day-to-day spending.

- Ability to open a joint account with another individual

- Check-writing capabilities

- The ability to receive direct deposits

- Insured against bank failure by the FDIC.

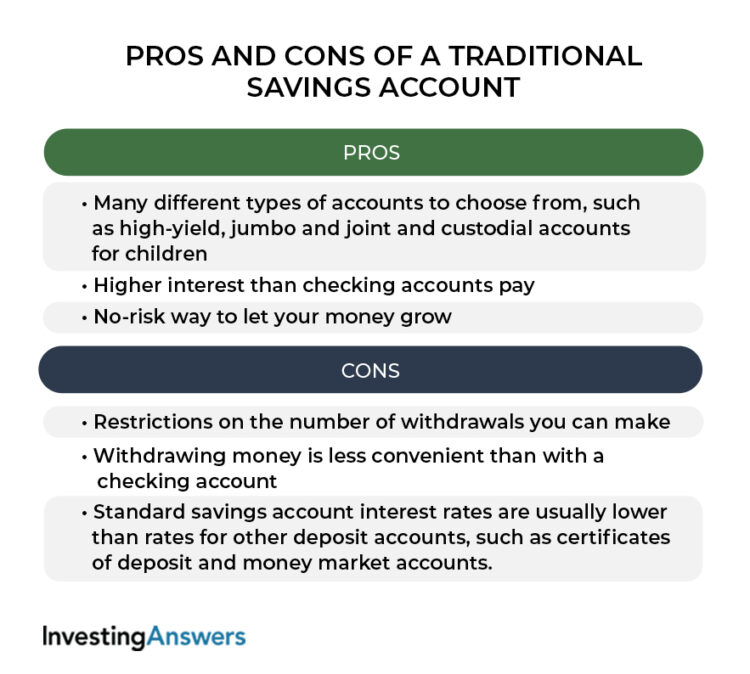

Savings Account Pros and Cons

Savings accounts provide fewer ways to access your funds, and federal law restricts the number of withdrawals you can make to six per month (although the Fed authorized banks to temporarily lift that limit in April 2020). Under normal circumstances, if you exceed the six-withdrawal limit, the bank can charge you a fee, convert your account to a checking account, or even close it altogether.

Not all banks offer debit cards with savings accounts, so chances are, you’ll have to link your savings account to your checking account debit card if you want to be able to withdraw funds from an ATM. Otherwise, you can withdraw money by transferring funds to a checking account and then writing a check or using a debit card or ATM, or by going to the bank with a withdrawal slip.

On the upside, savings accounts pay interest (which is a good incentive to keep saving). Checking accounts sometimes pay interest, too, but at lower rates.

Special Features of a Savings Account

Savings accounts’ special features help your money grow.

Can be used as a source of funds for checking account overdraft protection

Can receive direct deposits

Might have auto-save features that transfer money from your checking account at regular intervals to make saving easy.

Can be managed via bank’s website and mobile app

FDIC insured

What Savings and Checking Accounts Have in Common

When comparing checking accounts and savings accounts, it’s also helpful to understand that both accounts:

- Might be subject to minimum opening deposits and account balances

- Can usually be managed online via the bank’s website or mobile app

- Can receive direct deposits

Simple Savings Account Calculator

To see how interest adds up with a savings account, experiment with this simple savings account calculator.

| Current Amount Saved: | ||

| Monthly Savings Amount: | ||

| Annual Rate of Return (%): | ||

| Number of Years: | ||

The Power of Interest and a Savings Account

Compounding interest is the savings account’s superpower because it pays interest on both the money deposited and the interest your deposit earns.

Compound Interest Example

Say that you use your $2,500 tax refund to open a savings account that pays 0.02% interest. To calculate the interest earnings for the first year, multiply 2,500 by 0.0002 to arrive at $0.50. At the end of a year, your account is worth $2,500.50 even though you didn’t contribute a cent after the initial deposit.

In Year Two, you earn interest on the entire balance, which is the deposited amount plus the interest on your deposit ($2,500.50 x 0.0002 = $2501). Your account would be worth $2,501. By the end of Year Five, your account would be worth $2,502.50. That’s $2.50 in free cash – just from having the account.

Use the compound interest calculator to run your own numbers. Pay particular attention to the exponential growth you’ll see if you make regular monthly payments into the account.

Why You Need a Checking and Savings Account

Chances are, you need both a checking and a savings account because each one serves a specific purpose for managing your money.

Your checking account is a transactional account that’s meant for everyday living expenses. But it won’t earn you much interest, if it earns you any at all, so it doesn’t make sense to keep too much money there.

A savings account is meant for money you don’t plan to spend for a while. The convenience withdrawal limit makes it a poor choice for use as your primary transaction account. However, keeping your extra money separate from your everyday money lets you earn more interest on cash. It also makes budgeting easier and reduces the risk of overspending.

For most people, it isn’t so much a choice between checking and savings accounts but the realization that a well-rounded money management plan probably needs both.

How To Find the Best Checking and Savings Accounts

Any account can provide a place to keep your money, as well as ways to transfer and withdraw it. The best accounts do that at low cost, and they reward you for your efforts. Here’s how to find them:

1. Cast a Wide Net

In addition to looking for traditional brick-and-mortar bank accounts, investigate offerings from online-only banks and credit unions. The low overhead of online banks and not-for-profit status of credit unions often let them pass greater savings along to their customers.

2. Watch out for Fees

Avoid checking account fees in particular. These include fees for monthly maintenance, using out-of-network ATMs, and overdraft and overdraft protection, to name a few. Look for accounts that have low or no fees, or those that provide ways to have them waived.

3. Compare Interest Rates

Research high-yield savings accounts that pay higher interest. You might come across high-yield checking accounts, too, but your checking account interest rate is less important if you’re only using the account for routine spending.

4. Go for Convenience

Your bank should make it easy to deposit and access your money. Local branches (if you prefer to bank in person), a mobile app with robust money management tools, and 24/7 customer service can all improve your banking experience.

Find the Best Savings Account Rates

Savings account interest rates average less than 1% (sometimes much less). But you can do better. Take a look at these current rates.

Find the Best Checking Account Rates

Average checking account rates are even lower, so it pays to compare rates from a variety of financial institutions.