What Is a SEP IRA?

A simplified employee pension (SEP) is a type of individual retirement account (IRA) that can be opened by an employer on behalf of an employee or by a self-employed individual. It may also be known as a simplified employee pension individual retirement arrangement (or SEP IRA).

Once opened, the employer can make tax-deductible contributions into the account, which will grow (tax-deferred) until the employee retires. These accounts are most popular with self-employed individuals and small businesses.

SEP IRA Eligibility

In order to benefit from an SEP IRA, both employers and employees must meet certain eligibility requirements:

Employers

Any type of business (including sole proprietor, partnership, and corporation):

- Must have one or more employees

- Self-employed individuals with any freelance income

- The SEP-IRA must include all eligible employees

Employees

- Must be at least 21 years old

- Must have worked for the company for three of the last five years

- Received at least $600 in compensation during the current year

How to Set up an SEP IRA

SEP IRAs are created by employers on behalf of their employees. Here’s how employers can set up an SEP IRA:

1. Complete a written agreement such as IRS Form 5305-SEP. However, you cannot use this form if you meet any of the conditions below:

- Have another qualified plan

- Use the services of leased employees

- Want a plan year that does not align with the calendar year

- Want to use an allocation formula that counts social security contributions you made for your employees

If any of the above points are met, the person opening the account cannot use form 5305-SEP. They must use a prototype document from a financial institution that provides SEP IRAs. You may need an individualized plan for your business.

2. Provide a copy of the form or prototype document to be signed by each employee, along with the following information:

- Notice that you have created an SEP IRA in their name

- Requirements to receive an allocation

- The terms regarding how contributions will be allocated

3. Set up an account for each employee

Who Can Contribute to an SEP IRA?

SEP IRAs are opened and funded by employers, so they are the only ones who can make contributions. That said, if you are self-employed, you can open and contribute to your personal SEP IRA.

Can I Open an SEP IRA for Myself?

Yes. It is possible for self-employed people with no employees other than themselves to open an SEP IRA.

When Can I Withdraw from my SEP IRA?

Technically, you can withdraw from your SEP IRA whenever you want. However, to avoid a 10% penalty on the funds, you shouldn’t make withdrawals before you reach retirement age (59 ½). Once you turn 72, you’ll be required to take withdrawals (required minimum distributions) each year, or you will be faced with a 50% tax on any amount that is not distributed as required.

If you want to make an SEP IRA withdrawal without penalty before retirement, the funds must be used for approved purposes (as seen on IRS Publication 590-B):

- Health insurance while unemployed

- Certain educational expenses

- Eligible unreimbursed medical expenses

- Certain expenses if the account holder is called to active duty from the military reserves

- Up to $10,000 for first-time homebuyers

SEP IRA Rules

Much like eligibility requirements, there are different SEP IRA rules for employers and employees.

SEP IRA Rules for Employers:

- The employer must use the same contribution rate for each eligible employee.

- Contributions must not exceed contribution limits (which vary by year).

- Contributions must be made before the deadline, which is the same date as the deadline for filing tax returns.

- The employer can use less restrictive employee eligibility requirements, but not more restrictive ones.

- The employer is not required to contribute every year, but when they do, they must contribute to all eligible employee SEP IRAs.

- Employees can only be excluded for the following reasons:

- Failure to meet requirements for age, time of service, or compensation received

- If they’re covered by a union agreement (provided that alternative retirement benefits were agreed upon in good faith)

- The employee is a non-resident alien who doesn’t have US source income

SEP IRA Rules for Employees:

- Unless self-employed, the employee cannot make contributions to their account.

- The account holder must start making withdrawals from SEP IRAs once they reach age 72.

- Contributions immediately belong to the employee.

- Funds withdrawn before the retirement age of 59 1/2 are subject to a 10% tax penalty.

SEP IRA Contribution Limits 2020 & 2021

The SEP IRA contribution limit for 2020 (tax year 2019) is either $56,000 or 25% of an employee's gross annual salary, whichever is less. Contributions for this year must be based on a maximum compensation of $280,000.

The SEP IRA contribution limit for 2021 (tax year 2020) is $57,000 or 25% of an employee's gross annual salary, whichever is less. Contributions for this year must be based on a maximum compensation of $285,000.

SEP IRA Contribution Deadlines for 2020 & 2021

The SEP IRA contribution deadline for 2020 (tax year 2019) is July 15, 2020.

The SEP IRA contribution deadline for 2021 (tax year 2020) is April 15, 2021.

SEP IRA Pros and Cons

SEP IRAs are one of many ways to save for retirement. Like most products, there are pros and cons of SEP IRAs that should be taken into consideration before opening an account.

Pros of SEP IRAs

High Contribution Limits

Contribution limits for SEP IRAs are over $50,000 per year, (much higher than most other retirement plan options).

Low Fees

Most SEP IRAs don't have account opening or maintenance fees.

Hassle-free for Employees

SEP IRAs are opened and maintained by employers, so the employees don’t have to worry about deadlines, contributions, or other details.

Tax-deferred

Contributions to SEP IRAs grow tax-deferred until retirement, allowing the account holder to earn more return prior to withdrawal.

Variety of Investment Options

Contributions can be invested in a variety of different investment vehicles such as mutual funds, ETFs, stocks, and bonds.

Tax-deductible for employers

Contributions made by employers are tax-deductible, allowing them to reduce business expenses and taxable income.

Flexibility

Employers can open and contribute to SEP IRAs up until the deadline. They can also choose if, when, and how much they want to contribute each year.

100% Vested

Unlike some other workplace benefits, contributions to SEP IRAs are 100% immediately vested, meaning that the employee has full control as soon as the funds reach their account.

Simple Reporting

Employees are not required to report information about their SEP IRAs to the IRS. Employers just need to fill out IRS form 5498 for contributions.

Can Be Combined with Other IRAs

Employees can have other retirement accounts in addition to their SEP IRA, allowing them to save more for retirement.

Cons of SEP IRAs

No Loans

Unlike 401(k)s and other employer-sponsored plans, it is not possible to take loans from an SEP IRA.

Penalties for Early Withdrawal

Like most retirement plans, there are penalties for withdrawals made before retirement age (though some exceptions apply).

Required Minimum Distributions

Once the account holder reaches age 72, they must begin making withdrawals. Otherwise, penalties may apply.

Employees Cannot Contribute

Unlike many other retirement savings plans, employees cannot contribute to their own SEP IRA (although some exceptions apply).

Eligibility Requirements

In order to be eligible for an SEP IRA, employees must meet certain eligibility requirements relating to their length of employment and minimum compensation.

Contributions May Vary

SEP IRAs are entirely funded by employers. Contributions are therefore made at their discretion.

No Catch-up Contributions

401(k)s and regular IRAs that allow savers over the age of 50 to make catch-up contributions, but SEP IRAs do not.

No Roth Option

Unlike Roth IRAs that are funded with post-tax income and are tax-free upon withdrawal, SEP IRAs are funded with pre-tax income and distributions are taxable upon withdrawal.

Maximum Compensation Limit

While employers must contribute the same percentage to all employees, there is a cap on the amount of compensation this rate can be based on ($285,000 for 2021)

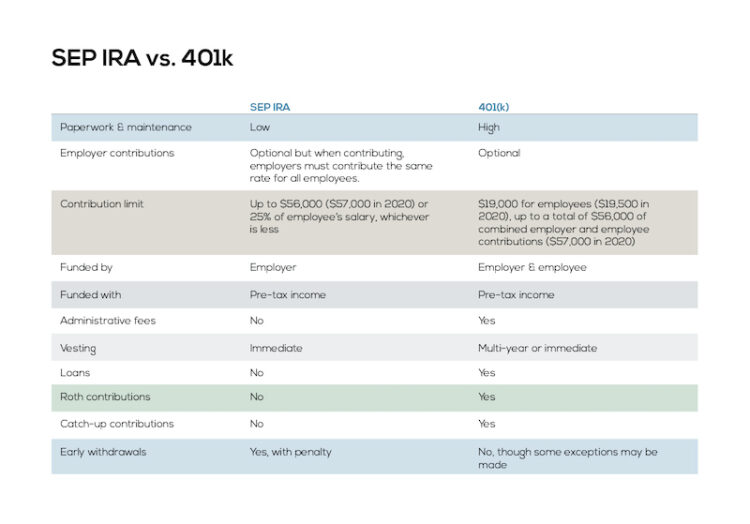

SEP IRA vs. 401k

SEP IRAs and 401(k)s are two of the most popular employer-sponsored retirement plans. Here’s how they compare

Can SEP IRA Be Rolled into a 401k?

Yes. A SEP IRA can be rolled over into a number of other retirement accounts, such as IRAs and 401(k)s. Here are the options for rolling an SEP IRA into a 401(k):

Direct Rollover

The institution where your SEP IRA is held will send you a check made payable to your new account, which you will then deposit into your 401(k).

Trustee-to-Trustee Transfer

The financial institutions in charge of your accounts will work together to transfer funds from your SEP IRA to your 401(k) to avoid any tax liability.

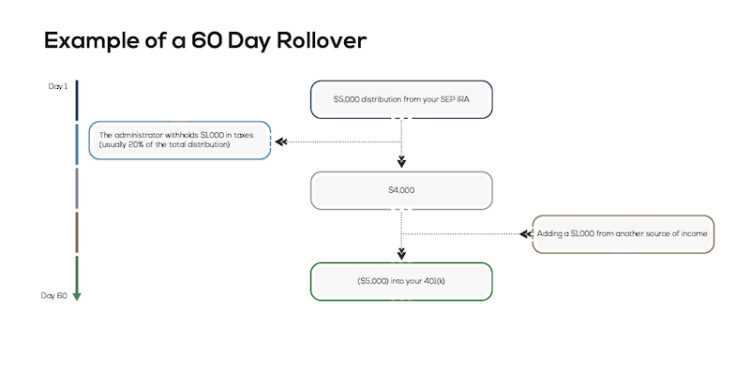

60-day Rollover

The funds are sent directly to you but taxes are withheld. Once you receive the funds, you have 60 days to deposit the full amount into another retirement plan. Otherwise, they are treated as a withdrawal and taxed as such. Since taxes are withheld, you will need to make up for that amount with other funds (or you’ll owe taxes on the withheld amount).

Can SEP IRA Be Converted to a Roth IRA?

Given the many pros and cons of Roth IRAs, some retirement savers wonder if an SEP IRA can be converted to a Roth IRA. The answer is yes, but a SEP IRA-to-Roth conversion is a bit more complicated than a rollover to a 401(k) due to the way taxes are handled. SEP IRAs are funded with pre-tax income while Roth IRAs are funded with post-tax income. You can use any of the three methods listed in the previous section, but your distribution will be considered taxable income and taxed at your marginal tax rate.

When it comes time to file your taxes, you are required to report the conversion using Form 1040 or Form 1040A. You’ll list the entire amount as a nontaxable IRA distribution, then use Form 8606 to determine your taxable portion. Finally, you’ll report that taxable amount as a taxable IRA distribution.

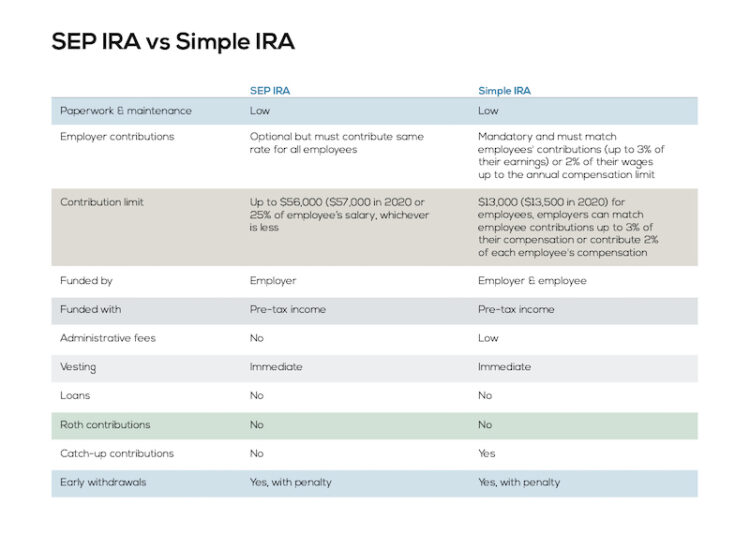

SEP IRA vs Simple IRA

SEP IRAs and Simple IRAs are two popular retirement plans for self-employed individuals and small business owners. Here’s how they compare: