As the holidays turn to tax season, feelings of joy are replaced with something more like confusion and dread. And for good reason. Various investments inevitably spark tax-related questions.

Master limited partnerships (MLPs) have stepped into the spotlight during the last decade, and today there are nearly 100 issuers with a combined market capitalization exceeding $350 billion. Along with this growth in MLPs, comes new tax terminology akin to alphabet soup. At the same time, there are a number of different MLP investment product structures with varying tax impacts -- which can be especially daunting to investors new to the sector.

Our goal with this guide is to clarify some of the tax terms and explain potential tax ramifications for an MLP investor.

MLP Taxation 101: The Overview

MLPs are similar to corporations in some respects but are vastly different in others, especially with regard to tax treatment. A corporation is a distinct legal entity, separate from its shareholders and employees. Like individual taxpayers, a corporation must pay tax on its income. To the extent the corporation pays dividends, shareholders must pay income tax on them as well.

MLPs, on the other hand, do not pay tax at the entity level if they qualify as “publicly traded partnerships” by meeting special “qualifying income” requirements. “Qualifying income” is generated from the exploration, development, mining or production, processing, refining, transportation (including pipelines transporting gas, oil or products), or marketing of minerals or natural resources. Energy MLPs were given special tax treatment to encourage capital investment in domestic energy infrastructure. Most MLPs today are in energy, timber or real estate-related businesses.

As partnerships, MLPs are flow-through tax entities, with the obligation to pay taxes “flowing through” to the partners. From a tax perspective, as a limited partner in an MLP (also called a “unitholder”), you are responsible for paying your own share of the partnership’s tax obligation. You are allocated a share of the MLP’s income, gains, losses and deductions based on your percentage ownership in the MLP. You report those numbers on your own tax return and pay any taxes due. This essentially eliminates the “double taxation” generally applied to corporations (whereby the corporation pays taxes on its income and the corporation’s shareholders also pay taxes on the corporation’s dividends).

The amount of income and deductions (such as depreciation) allocated to you is based on several factors, including the timing of your investment, your purchase price and the degree of reinvestment by the MLP in its business. It is important to note that as a unitholder, your taxable income will include your share of the MLP’s taxable income, regardless of whether you actually receive any cash distributions from the MLP.

Tax questions can arise soon after you purchase an MLP, so we will walk you through some of the common questions raised by new MLP investors.

The Ups and Downs of Tax Basis Accounting

When investing in MLPs, it is important to keep detailed records from the very beginning. This is because you will need to track the tax basis of your MLP investment from the time of purchase until the time you sell. It is helpful to keep comprehensive and up-to-date records of the items that impact your tax basis, because your tax basis is used to calculate your gain or loss upon the sale of an MLP.

Your initial tax basis simply reflects the value of your initial investment. As is the case with any investment, your initial tax basis is the starting point from which your future gains and losses on the investment are calculated.

But unlike other plain vanilla investments, it is what happens on a go-forward basis that can make MLP investing a bit more complicated. First, your tax basis is decreased by the amount of the cash distributions you received from the MLP. Next, your basis is increased by your share of an MLP’s taxable income (or decreased by your share of an MLP’s taxable losses).

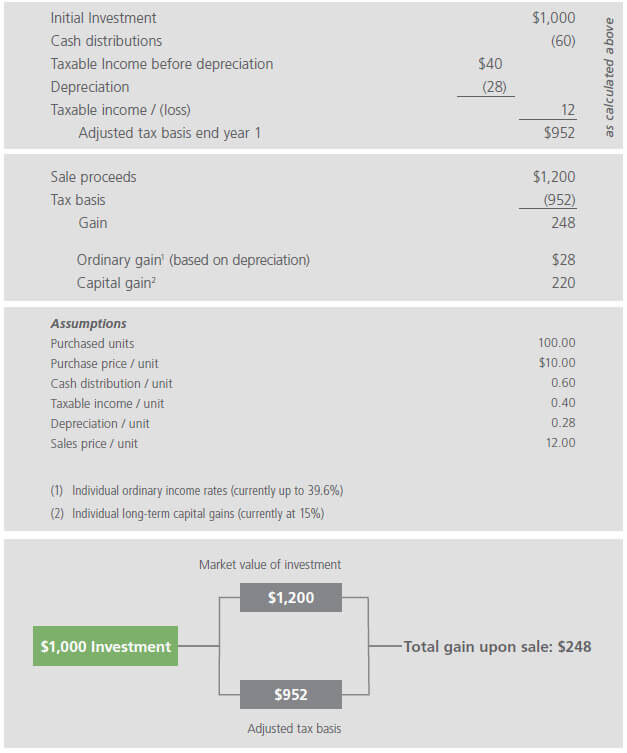

For example, let’s say you make an initial investment of $1,000 in MLP XYZ by purchasing 100 units for $10 per unit. A few months after year-end, you receive tax documents (called a Schedule K-1) noting that you received $60 in cash distributions over the course of the year. The tax documents also state that your pro rata share of taxable income is $12 (we will expand on these terms in the following sections).

After one year, your adjusted tax basis is as follows:

.jpg)

Note: The $12 is what is reflected on your K-1. The $40 and $(28) are not provided by the MLP on a K-1, but are illustrated above to provide an example of how the MLP calculates taxable income / (loss).

The Ds: Distributions, Depreciation & Deferral

Although they resemble corporate dividends, MLP cash payments to unitholders are referred to as “distributions.” Under their partnership agreements, MLPs generally are required to distribute the majority of their distributable cash flow to their unitholders. The levels of these distributions have historically been very attractive -- currently averaging about 6% of their current market price. MLPs typically pay quarterly distributions to their unitholders.

Cash distributions paid by an MLP to its unitholders are based on an MLP’s cash flow, as generated by its underlying assets. As a result, cash distributions are typically not the same as (and are significantly larger than) the MLP’s taxable income. This is because non-cash items, such as depreciation, are deducted from an MLP’s taxable income. This is also why it can be confusing at first blush to compare an MLP’s income statement (which is reduced by non-cash depreciation) with its cash flow stream of distributions (which is not impacted by the non-cash depreciation).

As a MLP unitholder, your proportionate share of the partnership’s depreciation expense is included in your share of the MLP’s taxable income. The amount of depreciation expense allocated to you is determined by a variety of factors, including your purchase price. Additional depreciation from new investments in infrastructure by the MLP may also be generated.

The depreciation deduction essentially means that your overall tax bill may be deferred. The extent to which your MLP distribution is treated as deferred depends on your share of an MLP’s taxable income. Because many MLPs have little or no taxable income, cash distributions in excess of taxable income received from an MLP are tax-deferred. These tax-deferred distributions are considered to be a “return of capital” because they reduce your tax basis in the MLP.

This tax-deferred characterization makes sense when you consider the assets that tend to be owned by an MLP. The underlying assets of an MLP (such as pipelines) are extremely long-lived, with minimal obsolesce risk and low maintenance expenditure requirements. Properly maintained, pipelines have a multi-decade lifespan -- with the value of their “right-of-ways” arguably having a lifespan exceeding that. However, for tax purposes, pipelines depreciate faster than they wear out (their economic usage). This resulting depreciation shield can provide an attractive tax deferral for an MLP investment, particularly in its early years.

The mechanics behind the tax deferral can be rather complex. You may be familiar with MLP lore that 80% of an MLP’s distributions tend to be tax-deferred. This is an oversimplified assumption (and highly dependent on the timing of your investment and a particular MLP). In our experience, we have found the amount of tax deferral associated with an MLP investment to be variable, based on specific circumstances of each MLP, as well as the timing and price of the investment in an MLP.

Closing Your Books Upon MLP Sale

When you sell an MLP, you will calculate your gain or loss, just as you would with any other investment. Your taxable gain is the difference between the sales price and your adjusted tax basis. However, this entire gain is not taxed at the same rate and must be split into two components.

First, the portion of your gain that is attributable to depreciation is taxed at ordinary income rates (called “recapture”). This information is provided in a supplemental sales schedule of the K-1 package (we look more closely at the K-1 in the next section). Think of the recapture portion this way -- instead of paying applicable ordinary income rates when you received your cash distribution, you deferred some of the tax (due to the depreciation deductions passed through by the MLP). Therefore, upon sale, the government “recaptures” (and you pay) the tax that was deferred.

Second, the remainder of the gain (the difference between your sales price and tax basis minus the ordinary gain reflected on the K-1 sales schedule), is your capital gain and is taxed at the applicable capital gains tax rate, depending on holding period.

The following example illustrates what the tax treatment on a hypothetical MLP sale might look like. In our example, a year after purchase of 100 MLP units at $10 per unit, you sell the 100 units for $12 per unit, for total sales proceeds of $1,200. With a tax basis of $952, your gain is $248, of which $28 is taxed as “recapture” at ordinary income rates (based on the depreciation deduction you received earlier) and $220 is taxed as capital gains:

The Tax Package Itself: Understanding the Components

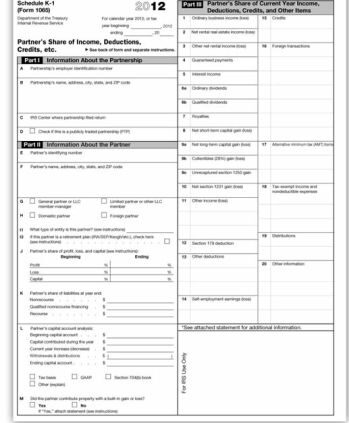

Partnership tax information is provided to you annually by the MLP on IRS Schedule K-1 (Form 1065) and in other important supplemental tax schedules. This information typically arrives in investor mailboxes between mid-February and early April. The K-1s are also available on MLP websites, accessible using your name and federal tax ID. Each separate MLP investment will generate its own K-1.

The good news is that qualified tax preparers should be familiar with MLP K-1s and should be able to accommodate them at some incremental cost. Personal tax preparation software also may accommodate K-1s. However, K-1s do add a layer of complexity to tax preparation, and at times, uncertain timing.

The first thing you should do upon receiving your tax documents is to confirm the number of units reflected in the supplemental schedule of your K-1. Accounting firms hired to prepare K-1s use the holding and transaction data provided by your custodian or brokerage firm. Occasionally, such data may be incomplete or incorrect and can result in errors. The potential for incorrect information is increased if you changed your custodian or account information during the year. Should any of the information not match your understanding, it is important to call the MLP’s tax line to get the information corrected.

Additionally, unitholders may be required to file separate state income tax returns in each state in which an MLP operates. Depending on the size of an investor’s MLP portfolio, MLP income attributable to states other than your state of residence could result in additional state income tax filing requirements.

What is in a K-1 Package?

Each K-1 package includes a Schedule K-1, an ownership schedule, a sales schedule and a state schedule.

Part I: Provides information about the partnership, including its address and if it is a publicly traded partnership (i.e. a master limited partnership).

Part II: Provides information about you as a limited partner. Be sure to carefully check this area to ensure it has your correct information.

Part III: Provides details regarding your share of income, deductions/credits and other items for the current year.

Ownership schedule: Your history of purchases and sales, and the dates and quantities of each, are listed here.

Sales schedule: If you had a taxable sale during the year, this schedule is used primarily to provide information regarding your ordinary gain (recapture). This schedule will be provided if you sold units during the year.

State schedule: This schedule lists all the states in which the MLP operates and the limited partner’s share of income (loss) attributed to such state. You may be required to file tax returns in these states. Your tax adviser should be able to assist you in understanding any state filing requirements.

Additional details for the boxes on the Schedule K-1 and where such information generally feeds into your tax returns are outlined as follows:

Additional Tax Complexities: UBTI, Passive Activity and Estate Planning

Ownership of MLPs by certain investors may create additional tax complexities and inefficiencies. Employee benefit plans, tax-exempt organizations (foundations, charitable remainder trusts, corporate pension plans) and certain tax-advantaged retirement accounts (including individual retirement accounts and 401ks) are normally, by definition, very tax efficient.

Unfortunately, they also have special tax rules regarding unrelated business taxable income (UBTI), which is almost always generated by investing in MLPs. In simple terms, an “unrelated” trade or business is defined by the IRS to not be substantially related to an account’s or organization’s charitable, educational or other purpose. An investment in an energy-related MLP can be classified by many tax-exempt investors as “unrelated” to their day-to-day mission.

Most income allocated to MLP limited partners is characterized as UBTI and may be subject to taxation if UBTI from all investment sources exceeds $1,000. Essentially, in such a circumstance, your tax-exempt account could become subject to taxation. Furthermore, gains upon sale could be subject to tax if either the MLP or the investor finances the MLP investment using debt.

It is also important to note that income from MLPs is considered UBTI for charitable remainder trusts. Even $1 of UBTI can be fatal to the exempt status of a charitable remainder trust.

MLP Passive Activity Rules Require Active Tracking

“Passive” investments in MLPs result in certain unique tax ramifications that increase complexity. An investment in an MLP by an individual, estate, trust, personal service corporation or closely-held corporation is deemed to be “passive activity” by the IRS.

This means that an investor cannot aggregate taxable income from one MLP with a taxable loss from another MLP. In essence, a “loss” you received from “MLP A” is suspended -- it cannot be applied to offset “income” in a different investment (such as “MLP B”) or other ordinary income (such as wages). You may not recognize these suspended losses until income from the same “MLP A” is allocated to you or your entire interest in “MLP A” is sold.

For example, assume that in a particular year “MLP A” generated a $10 loss and “MLP B” generated a $10 gain. You must report the $10 gain from “MLP B” on your current year’s tax return. You suspend the $10 loss from “MLP A” and may use it to offset income from “MLP A” in the future or upon sale of “MLP A”, but you can’t use it to offset gains from “MLP B.”

A key takeaway here is that it is important to track your passive activity, particularly the losses that you suspend.

MLPs Can Be Golden in Estate Planning

MLPs may provide an attractive investment for estate planning purposes. Similar to other investments, the tax basis in an MLP will reset (or be 'stepped up') to the current market value when the investment is passed on to an heir upon a unitholder's death. The stepped-up value will be included in the descendant’s estate and may be subject to estate tax, based on the current market value of the investment, just like other investments. However, because of the potential for tax deferral on an MLP’s distributions, the distributions received during the deceased unitholder’s life may never be taxed.

Simplify MLP Tax Complexities With an MLP Fund

For some investors, a direct ownership in MLPs may be unattractive due to, among other things, their complexity, uncertain treatments or UBTI. A properly structured MLP fund solves these issues and provides a viable investment alternative.

In 2002, Tortoise Capital Advisors (Tortoise) was founded when it recognized the investor need for such a product. It formed the first listed MLP fund in 2004, paving the way for investors to access a diversified portfolio of MLP investments with a single 1099 and no UBTI implications for tax-exempt investors (such as your IRA).

Funds that invest in MLPs can either be structured as regulated investment companies (RICs) or taxable corporations. In the broader investment universe, funds are typically structured as RICs, but are limited to investing up to 25% of their capital in MLPs.

By organizing as a taxable corporation, a fund can invest up to 100% of its capital in MLPs, providing the opportunity for a pure-play (essentially 100%) MLP fund. While the corporation structure was not a readily apparent alternative at the time, Tortoise recognized that the nature of the underlying assets’ depreciation shield made it viable.

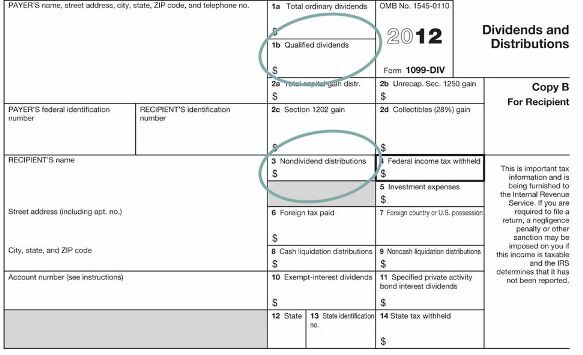

An MLP fund organized as a taxable c-corporation receives distributions from MLPs, and after deducting expenses, makes distributions to its stockholders. What typical funds call “dividends” or “income” are referred to as “distributions” by MLP funds, consistent with MLPs. These fund distributions are treated as qualified dividend income for federal income tax purposes to the extent of the fund’s earnings and profits, then return of capital to the extent of the tax basis, and then as capital gain.

From an individual tax perspective, the tax characterization of the distributions to MLP fund investors is based on the fund's earnings and profits, which is highly dependent on a variety of factors, including portfolio turnover and before holding period of investment.

“Return of capital” is a tax characterization of distributions, and not necessarily the traditional “return of principal” parlance. If your distribution is characterized as “return of capital” in an MLP fund, it is likely a result of the accelerated tax depreciation of the underlying MLP assets. Any distributions that are characterized as return of capital are tax-deferred at such time and will reduce your tax basis in an MLP fund, increasing your potential gain (or decreasing your loss) upon sale of fund shares, similar to a direct MLP investment.

[We discuss MLP return of capital in the InvestingAnswers Tax Center article, 'MLP Tax Issues Every Investor Must Know.']

MLP funds structured as corporations can make the tax reporting process significantly simpler as you will receive a 1099 and not K-1s. The fund will receive K-1s and process them at the fund level. On your 1099-DIV, return of capital distributions will appear as nondividend distributions in box 3. Taxable dividend distributions will appear in box 1a and qualified dividend will appear in box 1b.

The 1099 will be sent from your brokerage house, typically by late January. Often, fund managers (such as Tortoise) will provide tax information on their websites that details the per share characterization of the fund’s distribution.

Upon sale of MLP fund shares, you will recognize capital gain or loss measured by the difference between your sale proceeds and your tax basis -- there is no recapture of deprecation at ordinary rates at the investor level for an MLP fund.

In effect, an MLP fund can simplify the complexities associated with MLP investments for some investors by providing a diversified MLP portfolio, one 1099, no K-1s and no UBTI. As a corporation, an MLP fund is not subject to passive activity rules and therefore is able to aggregate income and loss from its MLP investments.

Concluding Thoughts

We hope this information proves useful as you begin making preparations to pay Uncle Sam this year. While the tax terminology may appear challenging at first, it can be worthwhile to spend some time understanding the opportunity offered by MLPs or MLP funds and whether they are a good fit for your portfolio. MLPs have historically demonstrated investment characteristics that many investors view as attractive for their portfolios. Now that you understand some of the tax terms, you may surprise even your accountant with your knowledge of MLPs! If nothing else, you’ve got a few new words to use in your next game of Scrabble or Words with Friends.

Note from the Editor: This article is a guest post from Tortoise Capital Advisors. Tortoise Capital Advisors, L.L.C. is an investment manager specializing in MLP and other listed energy infrastructure investments. Tortoise has the longest tenure of managing registered MLP funds and pioneered the first MLP listed fund in 2004. As of Dec. 31, 2012, the adviser had approximately $9.2 billion of assets under management in NYSE-listed closed-end investment companies, an open-end fund and other accounts.

(866) 362-9331

About the Authors:

Shobana Gopal, CPA, joined Tortoise Capital Advisors in 2006 and serves as Director - Tax. She is primarily responsible for all aspects of tax functions. Previously, Ms. Gopal worked in public accounting for 13 years where her responsibilities included tax returns for large partnerships, corporations, S Corporations and individuals; preparation of multi-state tax returns for partnerships, corporations and individuals; and tax planning for both individuals and companies. Ms. Gopal received an undergraduate degree from P.S.G College of Arts & Science in India and a Master’s of Science in business with an emphasis in Information Systems from the University of Kansas.

Michelle Kelly, CFA joined Tortoise Capital Advisors in 2006 and serves as Director focused on business and product development. Prior to joining the company, Ms. Kelly was an investment banker for Goldman, Sachs and Co. for several years in its Industrial & Natural Resources Group in Chicago and its Financial Institutions Group in New York. Ms. Kelly graduated Summa Cum Laude from DePauw University with a Bachelor of Arts degree in Economics.

Disclaimer

Tortoise Capital Advisors does not provide tax advice. This information is for educational purposes only and is not intended to be, nor should it be construed as, tax advice or the basis of tax advice under any circumstances. Tax matters are very complicated, and the tax consequences of an investment in MLPs and MLP investment products will depend on the particular facts of each investor’s situation. Investors are advised to consult their own tax advisors with respect to the application to their own circumstances of the general federal income taxation rules and with respect to federal, state, local or foreign tax consequences.

This tax discussion is not intended to be used for the purpose of avoiding tax or penalties, and may not be relied upon by you to avoid penalties. This material is property of Tortoise Capital Advisors and may not be re-purposed for any reason without prior written consent. This publication is provided for educational information purposes only and shall not constitute an offer to sell or a solicitation to of an offer to buy any securities.