What Is ROI?

ROI (or return on investment) is a key financial ratio that measures the gain/loss from an investment in relation to the initial investment.

Due to its flexibility and simplicity, ROI is one of the most frequently used profitability metrics. It's extremely useful to gauge the efficiency and profitability of investments. It’s often used to influence financial decisions, compare a company’s profitability, and analyze investments.

ROI Formula

You can calculate ROI by dividing net profit (current value of investment - cost of investment) by the cost of investment.

The simplest ROI formula is as follows:

.png)

Are There Different Methods of Calculating Return on Investment?

While the basic ROI formula can be used in a number of situations, variations can be used for other applications.

Real Rate of Return (RRR). Measures the return of an investment after adjusting for inflation, taxes, and other external factors.

Annualized ROI. Measures the return an investment generates in a single year. It’s calculated by dividing the ROI by the number of years the investment is held.

Net Present Value (NPV). Allows the reader to calculate the present-day value of an investment based on inflation-adjusted projections of its future earnings.

Return on Assets (ROA). Measures a company's profit for every $1 of assets it owns.

Return on Equity (ROE). Measures how much profit a company generates for every $1 of company equity held by shareholders.

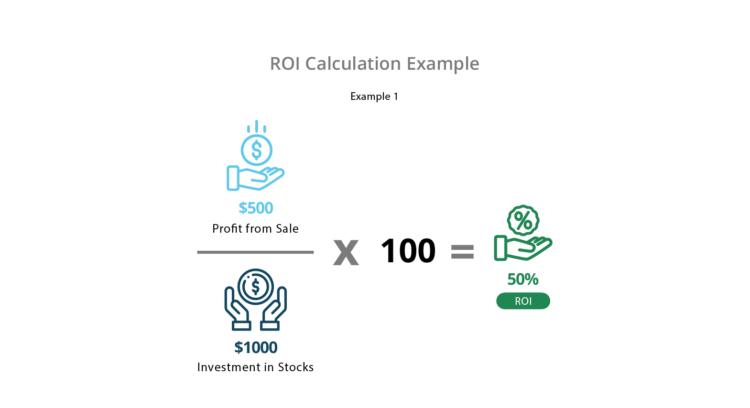

Return on Investment Example #1

An investor buys $1,000 worth of stocks and sells them 1 year later when their value reaches $1,500.

In this case, the net profit of the investment ( current value - cost ) would be $500 ($1,500 - $1,000), and the return on investment would be:

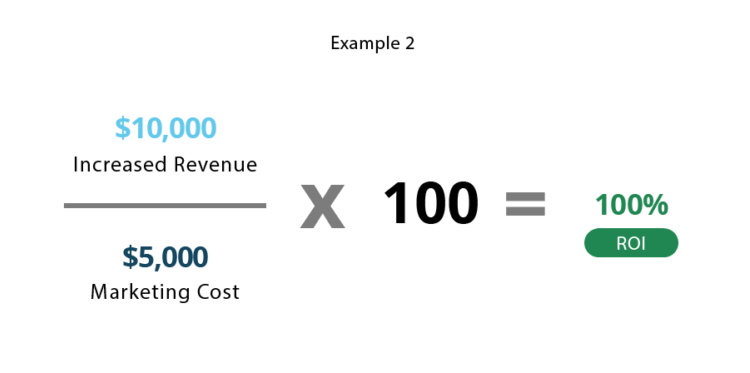

ROI Example #2

A company spends $5,000 on a marketing campaign and discovers that it increased revenue by $10,000.

In this case, the return on investment would be:

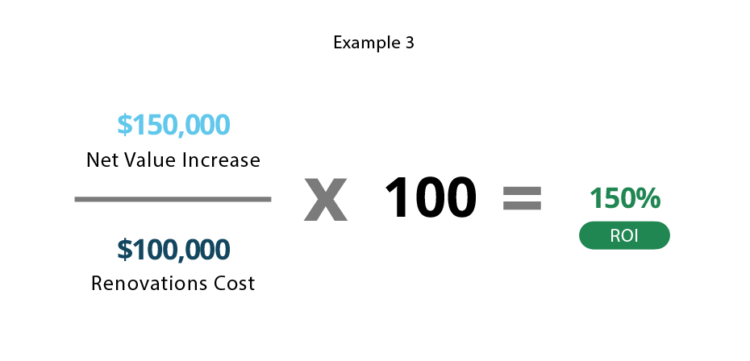

Return on Investment Example #3

A homeowner is considering a home renovation to add an extension and pool. The home is currently appraised at $500,000 and the renovations will cost $100,000 – but they're also expected to increase the value of the home by $250,000. In this case, based on the ROI formula, the return on investment would be:

Advantages of Return on Investment

Like any other profitability metric, there are advantages and disadvantages of using ROI. Consider the following benefits:

Simple Calculation - The ROI formula only requires a few inputs and provides a single output value, making it a very straightforward way to track efficiency and profitability.

Clear Results - A positive number indicates a positive return, whereas a negative number indicates a loss.

Flexibility - ROI works for a variety of investments such as marketing campaigns, stock purchases, vehicles, home renovations, and beyond.

Versatility - ROI can be used for a number of applications like tracking efficiency, measuring profitability, analyzing business decisions, and more.

Easy to Track - Since ROI measures the return of a single investment, companies can track the profitability of each business unit to optimize their operation and increase earnings.

Disadvantages of Using Return on Investment

Like any investment metric, there are a few drawbacks to consider:

Room for Error - One of the most common ROI mistakes is confusing cash flow and profit, which results in a much higher expected return. Additionally, to determine a useful ROI, you need to first understand your baseline to calculate any incremental profit.

Variance - The standard ROI formula is profit/cost, but the definition of those inputs can vary, depending on a company’s accounting policies. Factors like interest, tax, and net profit vs. gross profit can influence the outcome, making it hard to accurately compare companies.

Potential Bias - ROI is a great indicator of profit, but it doesn’t always consider the full picture. Investments with lower ROIs (but which improve the business as a whole) could be disregarded if the company only focuses on increasing their ROI.

Manipulation - Business unit managers can manipulate ROI by changing accounting policies & calculations, reducing spending on inputs, or even discarding old (yet functional) equipment. This practice can decrease cost or increase return to give the illusion of strong performance – even if the actions are detrimental to the company as whole.

Disregards Time - A 10% gain over one year is better than a 10% gain over two years, but when measuring the profitability of an investment, ROI doesn’t consider the holding period. This can lead to investors or managers avoiding new investments due to the uncertainty of returns or prioritizing short-term gain over long-term profitability.