Saving money? That’s amazing, but you might be wondering what’s the best account to store your savings. Below we break down your options by looking at money market accounts vs savings accounts so you can store your hard earned cash in a place that works with your future financial goals.

What Is a Money Market Account?

A money market account (MMA) is a type of savings account that is offered by a variety of financial institutions. Money market accounts are a safe and accessible place to store your money while earning a higher interest rate than a regular savings account. MMA holders also have the unique feature of being able to write a check.

Note: A money market account is a savings account. A money market fund, however, is an investment account.

What Is a Savings Account?

A traditional savings account is offered by a bank or credit union. You will often have a savings account at the same institution as your checking account. Traditional savings accounts may be able to link to your checking account as a backup for overdrafting, but the interest they pay is nominal.

The Main Differences Between Money Market and Savings Accounts

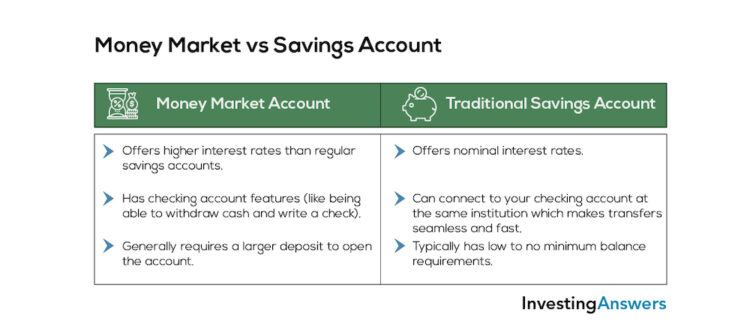

The table below breaks down the major differences between a money market account vs a savings account.

Both regular savings accounts and MMAs are insured by the FDIC (or the NCUA if you have a credit union). If the bank was to fail, up to $250,000 of your money is safe and secure.

Money Market and Savings Pros and Cons

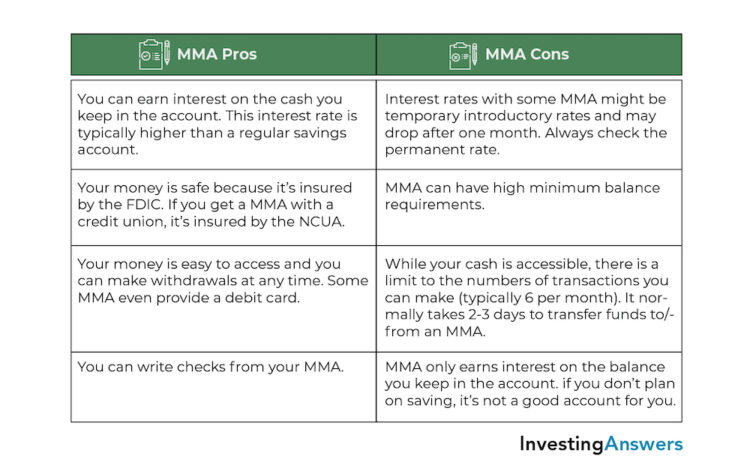

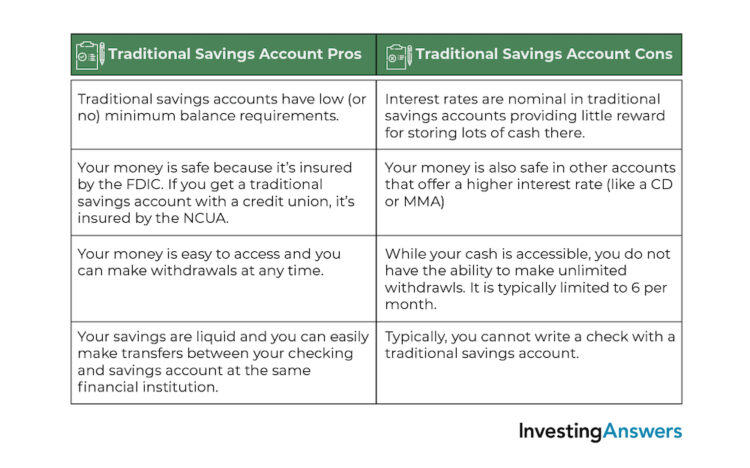

If you’re debating between a money market account vs. a savings account, it’s always good practice to weigh the pros and cons.

Money Market Account vs Savings Account: How to Choose

The savings account you choose really depends on your financial situation.

If you have a high savings balance and want to earn interest on that money (while also maintaining easy access), a money market account is probably your best option.

If you don’t have enough cash to meet the minimum balance requirements for a money market account, then a traditional savings account will be a better choice.

Can I Have Both a MMA and a Savings Account?

Yes! Eventually, you may want to move your savings to an MMA when you meet the minimum deposit requirement. That doesn’t mean you need to get rid of your traditional savings account. You can actually have both and make them work for you.

You may decide to store your emergency fund in a money market account because you want that money to earn interest. You can quickly access it in an emergency, but you don’t really need it sitting in your bank causing the temptation of spending it.

Your traditional savings account may be a good place to store your short term savings like the funds to purchase a new piece of furniture the next month. This way it’s only one quick transfer away from your checking account.

Money Market vs. Savings Accounts: How to Find the Best Rate

The interest rates on traditional savings accounts aren’t really worth shopping around for since they’ll be low. But you should definitely shop around for the best interest rate on a money market account. Use our table below to find the best rates based on your location.