What is Operating Ratio?

Operating ratio is the ratio of operating expenses to net sales. Operating ratio is also a common term in the insurance business, where it refers to an issuer's profit from underwriting and investment activities.

How Does Operating Ratio Work?

The formula is for operating ratio is:

Operating Ratio = Operating Expenses / Net Sales

It is often expressed as a percentage.

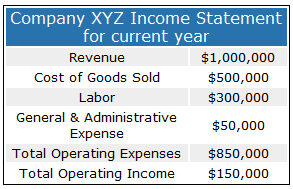

To see how operating margin works, consider Company XYZ's income statement:

Using this information and the formula above, we can calculate that Company XYZ's operating ratio is:

Operating Ratio = $850,000 / $1,000,000 = 0.85 or 85%

In this example, Company XYZ pays out $0.85 of operating expenses for every $1 in sales. It therefore has the remaining $0.15 to cover nonoperating expenses such as interest payments, nonrecurring items, taxes, and other costs not directly related to the company's day-to-day operations.

Why Does Operating Ratio Matter?

The operating ratio is a useful way to evaluate a company's core operations. Because it is based on operating income, it is (in theory) not influenced by variations in companies' capital structures or financing decisions (those expenses are nonoperating expenses). The operating ratio is also an indirect measure of efficiency. The lower the ratio, the more efficiently the company is creating profits.

It is important to note, however, that some industries have higher or lower operating expense requirements than others. Thus, comparing operating ratios is generally most meaningful among companies within the same industry, and the definition of a 'high' or 'low' ratio should be made within this context.