What Is Operating Margin?

Operating margin is a financial metric used to measure the profitability of a business. The operating margin shows what percentage of revenue is left over after paying for costs of goods sold and operating expenses (but before interest and taxes are deducted).

Where to Find Operating Margin

Operating margin is typically found on a company’s income statement. It may also be referred to as “operating profit margin.”

What Are Operating Earnings?

In order to find the operating margin, you first need to determine the operating earnings. Operating earnings refer to business earnings before interest and taxes.

Operating expenses are costs associated with running a business, such as:

- Staffing

- Marketing

- Rent

- Equipment

- Insurance

- General administrative costs

Operating Earnings Formula

Also known as EBIT, operating earnings are calculated by taking a company’s total revenue and subtracting the company’s total operating expenses and cost of goods sold (COGS).

COGS refers to any expenses related to producing the goods and services offered by a business (such as materials and labor).

The formula for Operating Earnings is as follows:

Revenue − COGS − Operating Expenses = Operating Earnings

Operating Margin Formula

Operating margin is calculated by dividing operating earnings by revenue.

Operating Earnings / Revenue = Operating Margin

An Operating Margin Example in Use

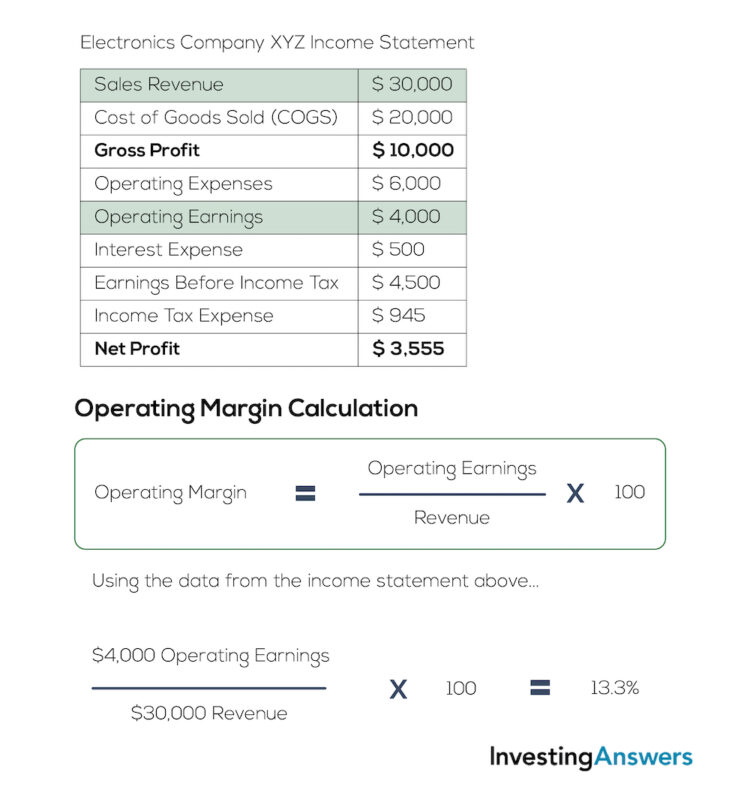

To see how operating margin works, take a look at the hypothetical income statement for Electronics Company XYZ:

Using this information and the formula above, we can calculate Electronics Company XYZ's operating margin by dividing $4,000 (operating earnings) by its $30,000 (revenue).

$4,000 / $30,000 = 0.13 or 13%

This means that for every $1 in sales, Electronics Company XYZ makes $0.13 in operating earnings.

What Is a Good Operating Margin?

As a general rule of thumb, a good operating margin is one that equals or outperforms competitors in its industry.

Because of variance in competition levels, capital structures, expenses, and other economic influences, average operating margins tend to vary widely by industry. When assessing the overall operational efficiency of a company, it is good practice to only compare operating margins among industry competitors.

For example, Electronics Company XYZ has 13% operating margin (as seen above). The average operating margin for electronics in 2020 was 9.92%. This means that the company has a good operating margin because it’s above the average for the electronics industry.

Average Operating Margins by Industry

Below, we’ve listed examples of average operating margins by industry based on 2020 data hosted by New York University:

| Industry | Average operating margin |

|---|---|

| Electronics: | 9.92% |

| Engineering/Construction: | 4.26% |

| Entertainment: | 15.30% |

| Farming/Agriculture: | 4.21% |

| Restaurant/Dining: | 16.46% |

| Retail (General): | 4.39% |

| Tobacco: | 39.77% |

| Transportation: | 5.67% |

You can access additional industry data by going to this page.

Why Is Operating Margin Important?

As a financial metric, the operating margin can reveal how efficiently a business is working and how well it is managed, compared to the industry average. This is because it considers costs associated with normal business operations (like staffing, marketing, and rent).

The Three Margins You Can Use to Analyze Business Profitability

There are three common financial metrics to use when analyzing the financial health of a business:

- Operating margin

- Gross profit margin

- Net profit margin

Operating Margin vs. Gross Margin

Like operating margin, gross margin is a financial metric that measures the profitability of a business. Operating margin considers both the cost of goods and operating expenses. Gross margin – also called gross profit margin – considers only the cost of goods involved in production.

How to Calculate Gross Margin

Gross margin is calculated by taking a company’s revenue and subtracting the COGS.

Revenue - COGS / Revenue = Gross Profit Margin

Operating Margin vs. Net Margin

Net margin (also referred to as net profit margin) is the third financial metric that can be used to measure business profitability. While operating margin considers only the cost of goods and operating expenses involved in production, net profit margin also factors in the interest and taxes.

How to Calculate Net Margin

Net margin is calculated by taking a company’s operating earnings and subtracting interest and taxes, then dividing this number by total revenue.

Operating Earnings - interest and Taxes / Revenue = Net Profit Margin

Using the Operating Margin (and Other Metrics)

Reviewing these metrics can give you a lot of insight into how a business is doing. To understand how to use these three metrics to make your next investment decision, check out our margin analysis guide.