What Is Net Cash Flow?

Net cash flow is the difference between a company’s cash inflows and outflows within a given time period. A company has a positive cash flow when it has excess cash after paying for all operating costs and debt payments.

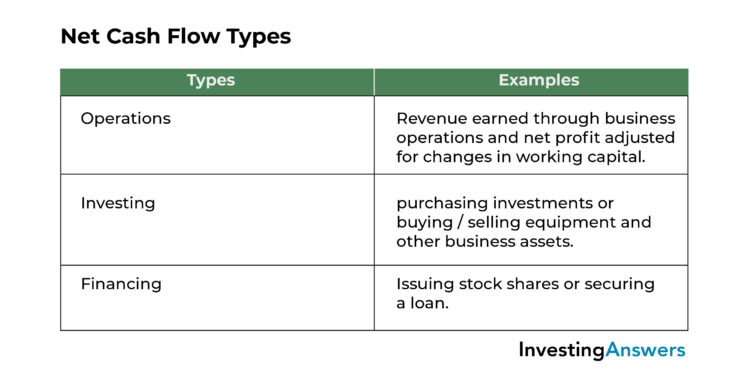

Net cash flow can be broken down into three components:

Is Net Cash Flow the Same as Profit?

While net cash flow and profit are often used interchangeably, they have different parameters for measuring performance in business. Net cash flow shows the amount of cash flowing in and out of a business at a given point in time. Profit, however, measures what remains after expenses are subtracted from revenue.

However, just because a business is profitable doesn’t mean it has a positive cash flow that can easily cover its expenses. For example, revenue may be earned by performing a service for a client, but the cash may not be paid until some time later. Until the cash is paid, the company shows revenue, but not cash.

Where to Find Net Cash Flow

When using a balance sheet, the net cash flow is the cash balance difference between two consecutive time periods.

The cash flow statement compiles all of the income and expenses for a specified period and reveals the resulting net cash flow from operating, investing, and financing transactions. Using this information, the net cash inflow and outflow can help calculate net cash flow.

Why Is Net Cash Flow Important?

One of the most critical metrics for a business, net cash flow helps a company to expand while also ensuring that day-to-day operations run smoothly. Companies can use cash flow for product development, marketing efforts, technology investments, buying back stock or issuing dividends, reducing debt, or improving employee benefits.

Business executives use these pieces of data to make decisions about the future of their company. Over time, a company that does not have a positive net cash flow will fail.

The Net Cash Flow Formula

The formula for net cash flow calculates cash inflows minus cash outflows:

Net cash flow = cash inflows - cash outflows

It can also be expressed as the sum of cash from operating activities (CFO), investing activities (CFI), and financing activities (CFF).

Net Cash Flow = CFO+CFI+CFF

How to Calculate Net Cash Flow

For example, if Company ABC had $250,000 cash inflows and $150,000 cash outflows during the first quarter of their fiscal year, their net cash flow would be equal to $100,000. This would be considered positive cash flow. If they reproduce this same result throughout all four quarters of the year, they would have a $400,000 annual net cash flow.

Net cash flow (Quarter 1) = $250,000 - $150,000

Net cash flow (Quarter 1) = $100,000

Net cash flow (Fiscal Year) = $100,000 x 4

Net cash flow (Fiscal Year) = $400,000

Can Net Cash Flow Be Negative?

Yes, net cash flow can absolutely be negative if a company spends more than it earns over a period of time. To cover costs, the company may be required to pull funds from savings, investments, and financing.

For example, if Company ABC has $10,000 in expenses this month, but customers only pay $5,000 worth of invoices, there would be $5,000 in negative cash flow.

While negative cash flow may indicate that a company is losing cash, it’s not necessarily an indicator of poor performance. The income and expenses may simply not line up, but the company could very well end up with a substantial net profit at the end of the fiscal year. Additionally, the company may have just paid off a large amount of debt or invested a significant portion of its reserves into new equipment.

Examples of Net Cash Flow

Calculating net cash flow is an essential factor in understanding the financial health of a company. It allows senior-level managers to make decisions about operations moving forward.

Net Cash Flow Example #1

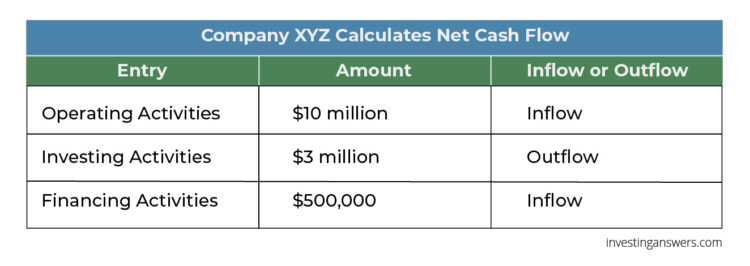

Company ABC is an established online retail company. The owner has contracted the services of an accountant who determines that the firm earned $10 million from operating activities, $500,000 from financing activities, and spent $3 million on investing activities.

Based on this information, the accountant utilized the following formula to calculate the net cash flow.

Net cash flow = $10 million - $3 million + $500,000

Net cash flow = $7.5 million

The net cash flow for Company ABC is $7.5 million.

Net Cash Flow Example #2

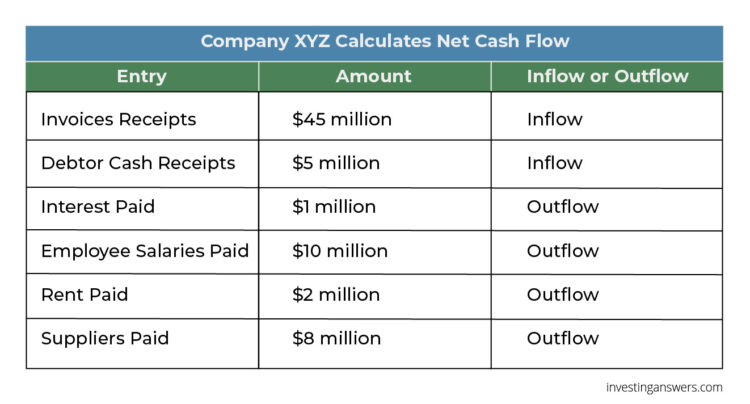

Mr. Smith is the owner of Company XYZ and is looking to apply for a loan from his local bank for future expenditures. After analyzing income and expenses, he has narrowed the cash flow down and would like to use this data to calculate the company’s net cash flow.

The cash inflows for Company XYZ total $50 million, and the cash outflows for Company XYZ total $21 million. Thus, Mr. Smith can calculate the following equation:

Net cash flow = $50 million - $21 million

Net cash flow = $29 million

Net Cash Flow Example #3

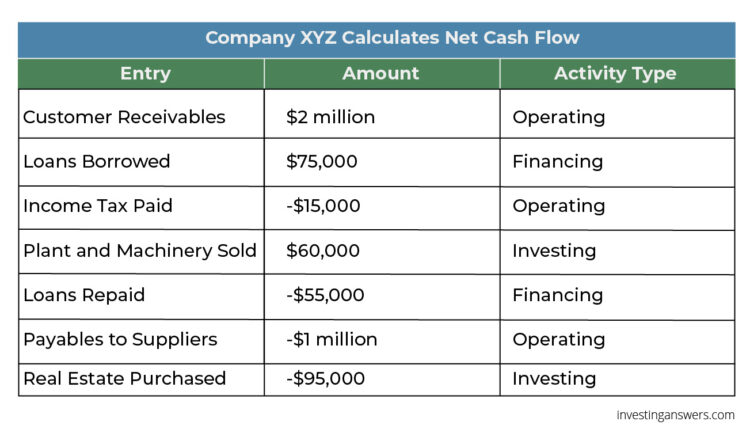

The senior-level managers at Company ABC are preparing their cash flow statement to understand which business activities bring positive and negative cash flows. They have compiled the following data and want to determine how to work out net cash flow from operating activities, investing activities, and financing activities.

Operating activities = $2 million - $15,000 - $1 million

Operating activities = $985,000

Investing activities = $60,000 - $95,000

Investing activities = -$35,000

Financing activities = $75,000 - $55,000

Financing activities = $20,000

For Company ABC, operating activities total $985,000, investing activities total -$35,000, and financing activities total $20,000.

Net cash flow = $985,000 - $35,000 + $20,000

Net cash flow = $970,000

Company ABC has a positive net cash flow of $970,000.

This means that the company earned enough cash from operations to support investing and financing activities. If Company ABC had a negative net cash flow, however, this could indicate that borrowing was supporting operations. It would not be a sustainable way to continue financing the company.