What Are Negative Points on a Mortgage?

For mortgages, negative points are a strategy for qualified borrowers to decrease the amount of cash they need upfront to finance their home. A mortgage company will pay fees and closing costs on the borrower’s behalf (in the form of points) in exchange for a higher interest rate on the mortgage.

Negative points are also known as rebates, yield spread premiums, or no-cost mortgages. One negative point is equal to one percent of the overall loan.

How Do Negative Points Work?

When they use negative points, borrowers will pay more in interest for their mortgage over the long-run because they opted to reduce upfront fees. This will increase monthly payments and the amount paid in interest throughout the life of the loan. In addition, borrowers will still need to come up with a down payment for their home purchase.

When a borrower chooses to use negative points, they will receive a percentage of the mortgage in cash. In exchange, the lender will increase its loan interest rate.

Negative vs. Positive Points

When starting the home-buying process, you will work with a mortgage lender for your financing. The lender may offer you the ability to either apply negative points or buy positive points towards the loan. You’ll find this information on any lender worksheets you receive. The breakdown of your loan details will also be found on the paperwork you sign on the day of the home closing.

If you elect to use negative points, the lender will increase your interest rate but give you cash towards your closing costs. Applying one negative point can increase your mortgage interest rate by about 0.25%, and give you 1% of the loan value to help pay closing costs. As a result, you’ll have a higher monthly payment and end up paying more in interest throughout the life of the loan.

If you elect to use positive points, you will pay the mortgage company to decrease your loan’s interest rate, increasing your upfront costs. Buying one positive point can reduce your mortgage interest rate by about 0.25%. You’ll also have a lower monthly payment and save a significant amount of money over the course of a 15-year or 30-year mortgage. However, make sure that you are calculating your break-even point. This is how long you will need to stay in the home to make the cash you’ve put into any positive points worthwhile.

How to Calculate Mortgage Points

One of the secrets for surviving the mortgage process is being able to track the math. Otherwise, you’ll be lost on what your terms are and may be signing your contracts blindly.

Calculating Negative Points

A borrower is looking to buy a home that will result in a $500,000 mortgage and a 5% interest rate on a 30-year fixed term. To help cover closing costs, they’re asking their lender to apply two negative points.

.jpg)

Calculating Positive Points

A borrower is looking to buy a home that will result in a $500,000 mortgage and a 5% interest rate on a 30-year-fixed term. This time, however, they want to buy points from their lender to reduce their interest rate.

.jpg)

Example of Negative Points

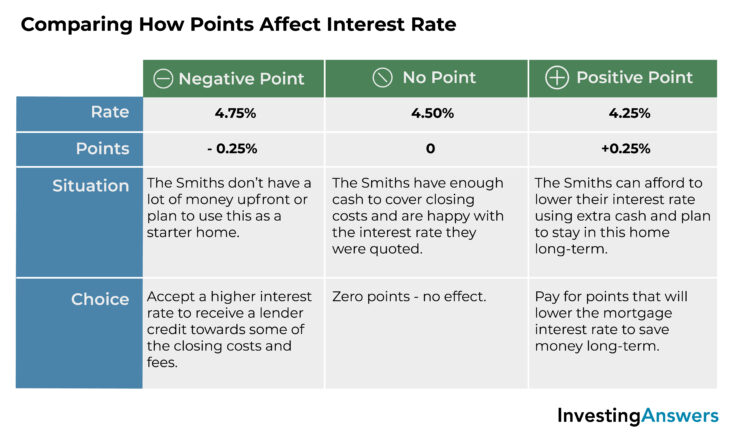

The Smith family is looking for a new home with the help of their real estate agent. They have prequalified for a mortgage and will need to decide if they should use negative points on their mortgage to help cover closing costs and fees. They are presented with three options: using negative points, no points, and positive points.

If their mortgage totals $250,000 and they apply a negative mortgage point, the interest rate will increase from 4.50% to 4.75%. They will receive $2,500 in lender credits to cover costs at closing.

While this may help the Smiths afford the purchase of their new home, it will increase the total cost of their mortgage from $456,017 to $469,483. Their monthly payment will also increase from $1,267 to $1,304. This totals $37 more each month – and $13,466 more over the 30-year term of the mortgage.

Are Mortgage Points Bad or Good?

On the surface, negative mortgage points may seem great, but depending on your situation, they may not make sense.

If you’re looking to stay in the home for an extended period, you may want to reconsider using negative points. Since the mortgage interest rate will increase, this will cost a homeowner a substantial amount of money over the course of the loan. It could be thousands of dollars more than the original closing cost amount. By the same logic, if you are planning to stay in your home for a long time, using positive points and lowering your monthly payment may be to your advantage.

How to Use Mortgage Points to Buy Down the Rate

When you’re ready to buy a home, you need to know many mortgage terms and numbers you’ll require. A mortgage calculator can help you determine how much your monthly mortgage payment will be. To use it, you’ll need to know your mortgage amount, loan term, and annual interest rate (to split it into the total principal and interest of each payment).

If the monthly mortgage payment seems too high for your budget, you can always use extra on-hand cash to buy down the rate by buying mortgage points. Each positive mortgage point is worth 1% of the mortgage, and will typically lower your interest rate by 0.25%. The lower interest rate will help you to reduce your monthly payments.

For example, if you were quoted a 4.75% interest rate on a $450,000 mortgage, you could pay $4,500 to lower the interest rate to 4.50% or pay $9,000 to lower the interest rate to 4.25%.