What is Liquidity Risk?

Liquidity risk is the risk of companies and individuals not meeting their short-term financial obligations, specifically because they’re unable to convert assets into cash without incurring a loss.

Why Is Liquidity Risk Important?

When liquidity risk occurs, businesses or individuals hold an asset (such as securities) that they want to sell in order to meet their financial obligations. However, these assets will need to be sold below their market value for a wide variety of reasons, including (but not limited to):

Inefficient markets: Assets may not reflect their fair or true market value.

Limited cash flow: Limited cash flow can affect a business’ ability to meet its financial obligations.

Market structure: Markets can vary in depth, width, and size, directly affecting the ability to sell an asset.

Asset type: Different types of assets vary in liquidity, affecting the time it takes to sell. For example, marketable securities and inventory are easier to sell than land or property.

Urgency: The amount of time before a financial obligation is due can affect the business or individual’s ability to meet that obligation.

Market conditions: Both a lack of buyers and an abundance of sellers can limit a business or individual’s ability to sell an asset.

Liquidity risk can help companies and investors manage their investments, holdings, and operations to ensure that they’re always able to meet financial obligations. Without this information, they may purchase assets that cannot be sold without incurring a loss or other financial distress.

Liquidity Risk Example

Company ABC is a trucking business that operates out of a large warehouse. Its margins are thin so it doesn’t hold much cash. It does, however, have a second unused warehouse that is valued at $250,000. It currently has 10 trucks that cost $100,000 each, and in order to meet the monthly commitments to its client, it relies on all of them being fully operational.

On the way back from a delivery, one of the drivers gets into an accident and their truck is totaled. The company’s insurance provider is trying to deny the claim, so the company does not expect to receive a payout for at least four months (if ever). The company still needs to deliver on its monthly commitments, but cannot do so with only nine trucks.

The company must now purchase a new truck for $100,000 or it risks losing its contract. It doesn’t have the cash on hand, so it must sell off its second warehouse in order to meet these obligations. However, there aren’t many buyers for the warehouse, so Company ABC is forced to sell it to the highest bidder at a loss or it will fail to meet its monthly commitment to its clients (and lose its contract).

Because Company ABC cannot meet its financial obligations without incurring a loss from the sale of its asset, it is experiencing liquidity risk.

Types of Liquidity Risk

There are two types of liquidity risk:

Market Liquidity Risk

Market liquidity risk refers to the risk that an asset cannot be sold on a market without incurring a loss.

Funding Liquidity Risk

Funding liquidity risk refers to the inability to meet financial obligations caused by a lack of funding.

How to Measure Liquidity Risk

Measuring market liquidity risk requires three elements: depth, width, and resilience.

1. Depth

Market depth is a measure of the volume of securities being traded, as well as the effect that orders have on market price:

- If a market is “deep”, there are many shares being traded. A large order would not have a significant effect on the market price.

- If a market is “shallow” there are fewer shares being traded. A large order would have a significant effect on the market price.

2. Width

Market width refers to the bid-ask spread. This is the difference between the offer price and the asking price of an asset:

- If the gap is “wide”, there is a big difference between the price that sellers are asking and the price buyers are willing to pay. It is more difficult to complete these types of transactions.

- If the gap is “narrow”, there is a small difference between the price sellers are asking and the price buyers are willing to pay. It is easier to complete these types of transactions.

3. Resilience

Market resilience refers to the speed at which prices return to previous levels following a large transaction.

How to Measure Funding Liquidity Risk

Funding liquidity risk can be measured using two liquidity ratios: the current ratio and the quick ratio:

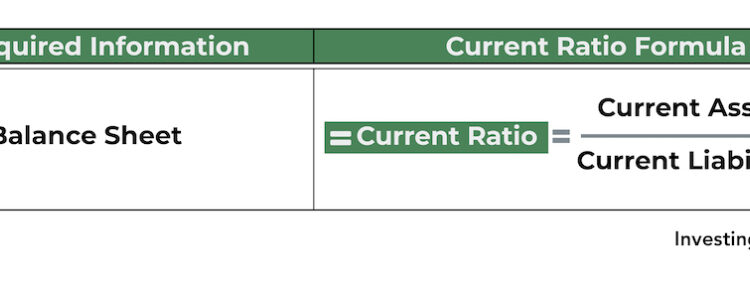

Current Ratio

Current ratio measures a company's ability to pay its current liabilities using its current assets. It is calculated by dividing current assets by current liabilities.

A value above “1” indicates that the company owns more short-term assets than short-term liabilities and is able to meet its short-term obligations. A value below “1” indicates that the company has more current liabilities than current assets and may struggle to meet financial obligations.

Quick Ratio

Quick ratio is a measure of how well a company can meet its short-term financial obligations by converting short-term marketable assets into the cash needed to cover short-term liabilities. It is calculated by dividing the sum of cash, marketable securities, and accounts receivable by current liabilities.

A value above “1” indicates a strong ability to cover short-term liabilities, while a value below “1” indicates that it doesn't have enough liquid assets to cover current liabilities.

What Is Liquidity Risk in Banking?

Banks operate by accepting deposits from customers and using those funds to issue loans (e.g. mortgages, personal loans, student loans) to other customers. Received deposits are considered liabilities (since the funds must be accessible to customers) while issued loans are considered assets (since the borrowed funds are owed back to the bank).

Because banks are only required to keep a small percentage of their total deposits as cash on hand (the reserve requirement), they are free to invest the majority of their money into less liquid assets. This typically means more loans.

The fundamental nature of commercial banking involves the conversion of liquid liabilities (deposits) into illiquid assets. This creates an inherent liquidity risk in the banking sector.

Liquidity Risk in Investing

All investments have liquidity risk, though some have more than others. Companies and individuals must take this risk into account when establishing business plans, purchasing assets, or making investments to ensure that they can meet their financial obligations. Otherwise, they run the risk of owing late fees, requiring additional funding from high-interest loans, becoming insolvent, or even going bankrupt.

In order to reduce exposure to these risks, consideration should be given to factors (such as type of asset, current and future liabilities, cash flow, operating expenses, and risk tolerance).

Which Investments Have the Highest Liquidity Risk?

Investments with high liquidity risk are more difficult to sell without taking a loss. Examples include:

- Fixed assets (e.g. land, equipment, property)

- Real estate

- Certificates of deposit

- Art

- Vehicles

- Issuing long-term loans (e.g. mortgages)

- Infrequently-traded stocks

Which Investments Have the Lowest Liquidity Risk?

Conversely, investments with low liquidity risk are easier to sell without taking a loss. Examples include:

- Bonds

- Treasury bills

- Cash and cash equivalents

- Frequently-traded stocks

- Mutual funds

- Money market funds

Can Liquidity Risk Be Managed?

Liquidity risk is a crucial consideration for most companies and investors. While it is difficult to completely avoid, it can be managed with the right strategy.

Companies and individuals must take liquidity risk into account when establishing business plans, purchasing assets, or making investments to ensure that they can meet their financial obligations. Otherwise, they run the risk of owing late fees, receiving additional funding from high-interest loans, becoming insolvent, or even going bankrupt.

In order to reduce exposure to these risks, consideration should be given to factors such as:

- the type of asset

- current and future liabilities

- cash flow

- operating expenses, and

- risk tolerance.

9 Liquidity Risk Management Tips

There are a number of ways that banks, companies, and investors can manage their exposure to liquidity risk:

1. Forecasting Cash Flow

Cash flow forecasting estimates the amount of cash that businesses or individuals will have on hand in the future. This can help them better manage their finances.

2. Comparing Assets and Liabilities

By comparing assets and liabilities, businesses can determine how much cash they could generate on short notice and how much they might owe.

3. Creating a Buffer Between Earnings and Expenses

A large gap between the amount of cash coming in and going out can make it easier to cover unexpected expenses.

4. Holding Liquid Assets vs. Illiquid Assets

Short-term, liquid assets are generally much easier to sell than long-term assets. By emphasizing liquid assets over illiquid ones, businesses and investors can more easily generate cash without incurring major losses.

5. Analyzing Financial Ratios

Analyzing key financial ratios can help identify – and limit exposure to – liquidity risk.

6. Reducing Leverage

Taking on too much debt can be a major source of liquidity risk. By reducing leverage, companies and individuals can shrink the gap between the amount they have and the amount they owe.

7. Conducting Stress Tests

Simulations or other analyses can identify risk areas in the event of an economic shock. Using this information, the company or individual can develop processes and safeguards to mitigate risk.

8. Diversifying Investments

In the event that one investment loses value – or can’t be sold quickly enough – diversifying a portfolio can help limit exposure to risk and loss.

9. Gauging Potential Markets

Trying to sell an asset on short notice can be problematic without buyers, an abundance of sellers, or other undesirable market conditions. By analyzing potential markets in advance, sellers can get a better idea of how long it could take to sell an asset, as well as the possible selling price.