Fixed Rate Certificate of Deposit Definition

A certificate of deposit (CD) is a savings investment where the investor commits to depositing funds for a set period of time, such as six months, one year, or five years. In exchange for the investor’s commitment of the funds for that time, the issuing bank pays higher interest than for a demand deposit.

For a fixed-rate CD, the interest rate is set when you invest and does not change over the period invested, hence the term “fixed.” The longer the term of the fixed-rate CD, the higher the fixed interest rate.

When you cash in or redeem your CD, you receive the money you originally invested plus any interest. Certificates of deposit are considered to be one of the safest savings options.

How to Calculate Your Interest from a Fixed-Rate CD

CDs earn compound interest, which grows your money faster, but it also makes calculating your return a little more challenging.

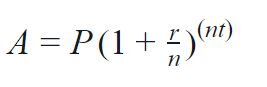

Here’s the formula to calculate the value of a fixed-rate CD:

- A is the total that your CD will be worth at the end of the term, including the amount you put in.

- P is the principal, or the amount you deposited when you bought the CD.

- r is the rate, or annual interest rate, expressed as a decimal.

- n is the number of times that interest is compounded every year; n = 365 if compounded daily.

- t is time, or the number of years until the maturity date.

Fixed-Rate CD Example

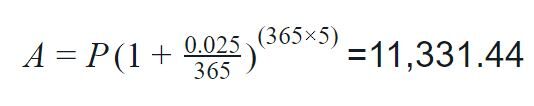

Here is the calculation for a $10,000 deposit into in a five-year CD at 2.50% APR, compounded daily:

The total at the end of five years would be $11,331.44. The $10,000 you deposited earned $1,331.44 in interest over five years.

What Is a Callable Fixed Rate CD?

A callable CD is a certificate of deposit that an issuer can “call back” from an investor after a specified protection period, but before the CD matures. Such an investment can seem appealing because it may offer a higher initial yield during the protection period but might be risky during the time the issuer can call it back.

The issuer would want to call the CD if interest rates fall, in order to refinance at a lower rate. The risk of fluctuating interest rates is shifted to the consumer.

Can You Hold a Fixed-Rate CD in Your IRA?

You can use any CD as part of an IRA. Some financial institutions also offer CDs that are specifically for retirement. These CDs usually have term lengths of 10 years or more. They are also likely to have higher yields and higher minimums than a CD with a shorter term.

Best Fixed CD Rates

If you’re looking to open up a fixed-rate CD account, you’ll typically earn a higher return online. Check out the best CD rates every day by clicking here.