The 7 Best Tips for Managing Your Money

Money issues can be extremely stressful and taking control of your finances can feel overwhelming.

To help, we’ve put together this guide to show you how a few simple steps can help you manage your money better.

1. Take a Financial Inventory

If you want to manage your money effectively, the first step is to take a snapshot of your current financial situation. The easiest way to do this is calculating your net worth.

Start by listing out all of your assets (home equity, savings, investments, etc.) and subtracting your total debts (mortgage, credit cards, auto loans, student loans, etc.).

Example: If you have $100,000 in total assets and $40,000 in total debt, your net worth is $100,000 - $40,000 = $60,000.

This will give you a gauge of how well you are managing your finances, and show you areas where you can improve.

2. Track Your Spending

Once you’ve created your financial inventory, stay on top of your spending by finding a way to track it. This will give you control over your daily spending and keep yourself accountable to your financial decisions.

Start by reviewing your bank and credit card statements for the past few months. Organize all your spending into categories to see exactly where your money has been going.

Once you’ve categorized your spending, you’ll have a clearer picture of where every dollar has gone. This will quickly help you find areas of waste and make better money decisions going forward.

What Are the Best Money Management Apps?

There are a few great apps that can automatically help you track your spending.

Personal Capital

Personal Capital is a free money app that syncs with your financial accounts to help you track your spending and investments. It also provides a simple monthly summary of your spending and automatically categorizes your spending over time.

Mint

Another free money management app, Mint has built-in budgeting and money tracking features. Mint will also sync with your financial accounts and show you your spending trends.

YNAB

The “You Need A Budget” app is a popular budgeting app with the ability to automatically track your expenses and “clear” every transaction as they come through (ensuring you don’t miss a thing).

3. Create and Modify A Budget

Tracking your spending is a great start, but the absolute best way to be proactive with your money is by creating a monthly budget. This will help you make a plan for your money – before you spend it.

Wondering how to budget your money? To get an overview of your upcoming monthly budget, write down your:

- monthly income

- monthly bills (non-discretionary expenses)

- estimated daily expenses (e.g. groceries, gas, shopping)

- one-time expenses (e.g. birthday party, repairs)

Remember, every month is different, so schedule time to create a new budget before the start of every month

Can I Manage Money Without a Budget?

Yes, it’s possible to manage your money without creating a monthly budget. Automating your savings and investing can help you hit your financial goals – without needing to stick to a strict budget.

For example, if you want to save 20% of your income, automatically transfer 20% of your income every payday toward your savings and investing goals. Then the remaining after-tax amount is effectively your budget for regular monthly expenses, with the goal to minimize the use of credit cards.

Though automation is a helpful tool to help you manage your money, the best way to take control is by starting with a monthly budget for a few months. This will help build a habit of spending less than you make.

4. Save an Emergency Fund

Once you have a budget put together, your first goal should be to save an emergency fund. This is a liquid savings account with 3 - 6 months of expenses saved in it. This will help you stay afloat in cases of financial emergency, such as job loss or other emergency expenses.

If saving 3 to 6 months of expenses seems intimidating, starting with a simple $1,000 emergency fund is a good goal to aim for.

Automate Your Savings

Automation can be a powerful tool, especially when you’re trying to save more money. Instead of paying all of your expenses first (and hoping you have money left over to save), automation flips the equation and allows you to prioritize paying yourself first.

You don’t need a lot of money to automate your savings: Start with a simple recurring transfer from your checking account to your savings account on payday. Even if it’s only $25, setting up an automatic transfer to your savings account can help you save money without you even noticing.

You can also automate your investing through an employer-sponsored retirement plan. You can fund this plan directly through paycheck deductions, making it easy to save without ever “seeing” the money.

Ideally, you’ll increase your automatic savings over time and will learn to live on slightly less while hitting your savings goals much quicker.

5. Make a Plan to Pay off Your Debt

For many people, paying off debt is one of their top financial goals. Putting together a simple debt payoff plan can help provide you with an exact debt payoff date and show you exactly which debts should be paid off first.

There are two main debt payoff methods, both offering a simple way to organize your debts.

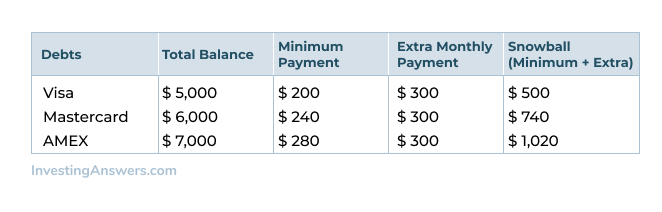

The Debt Snowball

The debt snowball method is the process of paying off your debts in order, starting with the smallest balance debt.

The idea is to only make the minimum payments on all of your debts except the one with the smallest balance. Once you pay off the smallest debt, you’ll focus on the next smallest balance, letting your payments “snowball” as you eliminate each debt.

While this method ignores interest rates (and may cause you to pay more interest in the long run), it focuses on the psychology of quick wins to keep you motivated. This method has a long track record of success and is scientifically backed by a study from the Harvard Business Review as an effective debt payoff method. This method is also the quickest way to alleviate your cash flow concerns as it allows you to eliminate monthly payments more quickly.

The Debt Avalanche

The second most popular debt payoff method is known as the “debt avalanche.” This method also focuses on paying off one debt at a time while only paying minimum payments on the others, but instead focuses on paying the least interest possible across all loans.

To follow the debt avalanche, put your debts in order from highest to lowest interest and only focus on paying off the highest interest debt first. Once that debt is paid off, you’ll focus on paying off the second-highest-interest debt.

The debt avalanche ensures that you pay the least amount of interest possible, but this method can occasionally feel demotivating if your highest interest debt takes a longer time to pay off.

6. Invest in Your Retirement

While paying off debt and saving money are always important, investing for retirement isn’t something to put off. Taking advantage of compounding interest means you should start your investing journey as soon as possible.

Start With Your Work Plan

You don’t need to be rich to invest in your retirement. In fact, one of the easiest ways to get started is signing up for an employee contribution plan, such as a 401(k) or 403(b), that lets you start investing any amount of money directly from your paycheck. Better yet, many company plans offer a matching contribution to supercharge your investing.

You can invest up to $19,500 into your work retirement plan per year (or $26,000 if you’re 50 years old or over).

Open an IRA

Another way to invest toward retirement is opening your own Individual Retirement Account (IRA). These accounts allow you to invest your money toward retirement and are not tied to your job. You can invest up to $6,000 per year into an IRA (or $7,000 if you are age 50 or older).

Both IRA and 401(k) / 403(b) accounts provide tax incentives to save for retirement. The more you can invest – and the longer you are invested – the greater your returns (and tax savings) can be.

7. Expand Your Investments

After you max out your tax advantaged retirement accounts, you can continue investing with a brokerage account. While these accounts don’t have the same tax advantages as traditional retirement accounts, there are no contribution limits.

Outside of investing in securities, you may also want to look at additional assets classes. Investing in rental real estate or commodities (such as gold) can help diversify your investments further.

How to Make Your Money Work During Life’s Ups & Downs

Life isn’t a straight line – and neither are your finances. There will be roadblocks and setbacks, but paying off debt, saving up a full emergency fund, and investing wisely will help you reach financial freedom. No matter what life throws at you, follow these steps to help grow your net worth.

Pay off Debt

Debt slows down your financial goals and takes your money in the form of interest payments. We recommend using either the debt snowball or debt avalanche method (listed above) to help you pay off your debts one at a time. Eliminating burdensome debt will help you feel more financially confident and give you a boost to your bottom line.

Stay out of Debt

Paying off debt is a great goal, but it’s equally important to stay out of debt. To keep more of your money, pay off your credit cards every month, avoid hefty car loans, and make other smart financial choices that keep you debt free.

While this may require sacrifice in the short-term, you’ll be able to save and invest more of your hard-earned money. Less money toward interest payments means hitting those important financial goals quicker!

Only Take on Good Debt

Not all debt is equal. When considering signing up for a loan, credit card, or other financial obligation, make sure you only take on good debt. There are definitely ways to use leverage to help your bottom line, but you need to know how to tell the difference between good and bad debt.

In general, low-interest loans that are attached to an appreciating asset (i.e. a home) or investment are a good option. Some of these debts can also be forgiven, like student loans.

Credit cards, car loans and personal loans that aren’t attached to any assets – or are attached to assets that go down in value (i.e. new cars) – are hurtful to your finances. This kind of debt drains your wealth.

No matter what financial products you are considering, make sure they help your net worth in the long-term.

Save as Much as You Can

The best way to avoid financial pitfalls is to set aside some money in an emergency fund. This will help you take care of any unexpected expenses – without ruining your monthly budget.

To build this fund more quickly, make it a regular habit to save money. Ultimately, you’ll want a full 3- 6 months of expenses in a savings account.

Invest Wisely

Investing is the key to growing your wealth. Put your money to work by investing in stocks, bonds, and other assets to help you reach retirement and other financial goals.

Even investing a few dollars from every paycheck can help. Challenge yourself to increase your investments each year, especially if you can increase your income.

How to Grow Your Money

Saving money won’t get you to financial independence, but harnessing the power of investing can.

Investing in Stocks and Bonds

Investing in stocks or bonds is one of the easiest ways to put your money to work. You can choose to invest in companies you like or diversify with an index fund.

Possibly the simplest way to invest in stocks and bonds is selecting a target date fund. These funds automatically diversify your investments across stocks and bonds for a low annual fee. They also adjust your asset allocation automatically based on the target retirement date selected.

Investing in Real Estate

Outside of investing in the market, you might want to consider investing in real estate. From house flipping to rental houses, there are plenty of real estate investment options.

The most “hands-off” approach is finding a good real estate investment trust (REIT). Essentially, you invest money toward real estate projects and earn a return on those projects – without having to become a landlord.

Note: A majority of REIT distributions are treated as ordinary income, and can have significant tax implications. Please consult a licensed tax professional before investing in an REIT.

Where to Manage Your Money

There are plenty of places to grow your cash.

High-Yield Savings Account

For an emergency fund or other short-term savings goals, a good high-yield savings account will help you earn some interest. These accounts have higher-than-average interest rates while keeping your money accessible.

Online Broker

When you decide to dive into stocks, bonds and mutual funds, finding a good online broker can help save money while providing helpful investing tools.

Whether you want to passively invest toward retirement or try your hand at actively trading stocks, compare top online brokers to find one that fits your investing style.

Robo Advisors

If you want some help investing your money – but don’t want to pay expensive fees to an investment firm – consider checking out a reputable robo advisor. These companies use algorithmic artificial intelligence to help maximize returns (and even lower taxes).

The best robo advisors charge extremely low fees compared to typical investment advisors. If you want the advantage of advanced investing – without the headaches or fees of a large firm – consider investing with robo advisors like Wealthfront and Betterment to help you start investing for retirement and other large financial goals.

How to Double Your Money with Compounding Interest

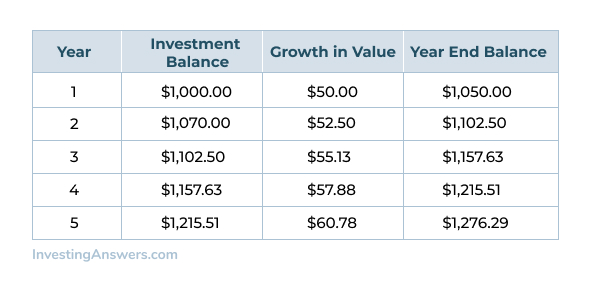

The best way to build wealth is to grow your money using the power of compounding interest. Compounding means that your money is earning interest on interest, steadily increasing your returns over time.

Compounding Interest Example

If you invest $1,000 and earn 5% annual interest on that investment, you’ll earn $50 by the end of year one.

During the second year, you’ll be earning 5% interest on your new $1,050 balance. By the end of Year Two, you’ll have earned $52.50 in interest, bringing your total balance to $1,102.50.

Each subsequent year will earn more and more interest as you leave your earnings to “compound” on itself.

Use The Compound Interest Calculator and Watch Your Money Grow

If you want to see how compound interest works in real-time, check out our compound interest calculator.

How to Protect Your Money

Saving and growing your money is great, but it’s important to make sure all those dollar bills are protected.

Make Sure Your Financial Accounts Are Insured

If something were to happen to your bank or investment account, you want to make sure you won’t lose all of your money. There are two types of insurance to consider when putting your money into any financial account:

FDIC Insurance

FDIC insurance typically protects bank accounts up to $250,000 per individual in the event that your bank fails. It is fully-backed and protected by the US government.

SIPC Insurance

SIPC insurance typically protects up to $500,000 in your investment account in case your investment broker fails. It is also fully-backed and protected by the US government.

Check Your Credit Score

Staying on top of your finances means knowing your credit history details. Regularly checking your credit score and credit report will let you know whether there are any delinquent accounts – or even signs of identity theft.

The simplest way to get a copy of your free credit report is by using the Annual Credit Report service. Once a year, download a complete copy of your credit report from all three credit bureaus (Experian, Equifax, and Transunion).

Get the Right Kinds of Insurance

Protecting your assets means protecting yourself against life’s disasters. Finding the right, low-cost insurance can lower the risk of losing your money to uncontrollable life events. There are plenty of important types of insurance to consider including (but not limited to):

- Auto insurance

- Life insurance

- Health insurance

- Homeowners/Renters insurance

- Umbrella insurance

- Long-term care insurance

Consider Identity Theft Protection

Protecting your identity has become a top priority in the digital age. According to a study by Javelin Strategy & Research, identity fraud cost nearly $17 billion in 2019.

To protect your identity (and your money), compare the top identity theft protection services and find one that can help protect your personal information online.