CD laddering is typically used by investors as a safe way to lock in better CD rates when interest rates are rising. These CDs will have staggered maturity dates to help you “ladder-up” your interest rates over time.

It might sound complicated, but we’ll show you how to build a CD ladder to lock in better rates – and show you a few real-world examples.

What Is a CD Ladder?

CD laddering is the process of splitting CD investments across multiple CD accounts, with different term lengths on each one. This keeps some of your money accessible in the short-term while taking advantage of the higher rates of the longer term CDs.

How Does a CD Ladder Work?

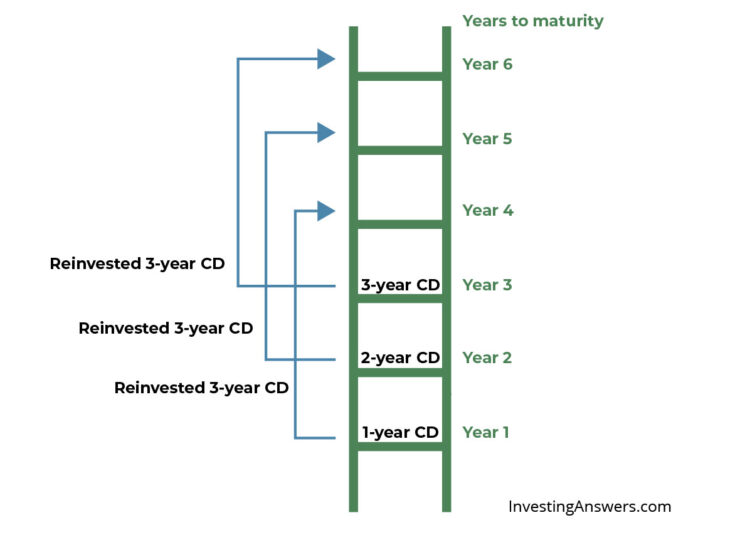

A CD laddering strategy works by splitting your investments into short-, medium-, and long-term CDs. These CDs will mature at different intervals (e.g. 1-year, 2-year, 3-year), like the steps of a ladder.

As the shorter term CDs mature, you’ll reinvest those funds into longer-term CDs and lock in the higher rates. Instead of initially locking up your money in the longest-term CD with the highest rate (up to 5 years or more), you create a CD ladder to safely move your money into higher rate CDs over time.

Eventually, you’ll have a ladder of CDs, all earning the highest interest rate available for your term. Ideally, at least one CD will mature each year, giving you access to some of your money as you need it.

The Benefits of CD Laddering Strategy

CD laddering can be a massive asset to both your short- and long-term investing plans.

More Access to Your Money

Creating a CD ladder gives you access to the better rates that come with long-term CDs while still giving you access to your money in the short term. It’s the best of both worlds.

Better Interest Rates Over Time

Laddering allows you to ramp up your CD terms and interest rate over time. In a rising rate environment, a properly-executed CD ladder will lock in higher rates at regular intervals.

You Don’t Have to Time the Market

When using a CD ladder, you can choose when and how to invest – without needing to know the future. If interest rates are rising, you can double down and reinvest when your short term CD matures. If rates stop rising or start to decline, you’ll still have some of your money locked into more favorable rates in long-term CDs.

Example of the CD Ladder Strategy

Let’s say you have $75,000 to invest in a CD ladder. You can split that investment into 3 different CDs.

$25,000 goes into a 1-year CD with a 1% interest rate

$25,000 goes into a 2-year CD with a 2% interest rate

$25,000 goes into a 3-year CD with a 3% interest rate

As you can see, each CD account is a “rung” on the CD ladder.

When each CD matures, you’ll invest those funds into another 3-year CD, locking in the highest interest rate.

After 3 years, your CDs will all be earning the 3% interest rate (or more, if rates rise), with one CD maturing each year. You’ll still have yearly access to a portion of your funds, but you’ll “ladder up” your CDs and earn the highest rate available.

How a CD Ladder Can Boost Your Income

As interest rates rise, using a CD ladder can help you take advantage of rate increases and boost your income over time.

Let’s say you invest your $75,000 in a 5-year CD at 2% APY. If interest rates rise 1 percentage point each year, the rate on a 5-year CD would be 5% after 3 years. You’d be missing out on those higher rates if your money was locked in for 5 years at 2%.

But let’s say you take that same $75,000 and split it up into the CD ladder from the above example.

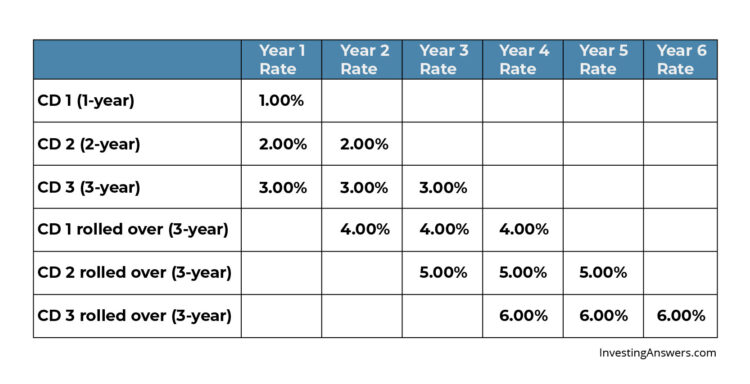

Assume that interest rates rise at 1 percentage point each year. After one year, your first CD would mature and you could invest it in a 3-year CD at the improved 4% interest rate.

The next year, rates rise again and your next CD matures. You can now invest those funds into a 3-year CD at 5% interest. Finally, your original 3-year CD matures and you can reinvest at the new 6% interest rate.

Here’s what rising rate CDs look like over time using a CD ladder.

As you can see, as interest rates rise, you can continue rolling money into the high-rate CDs and increase your annual interest income.

How to Build a CD Ladder in 4 Steps

Here are 4 simple steps to build your own CD ladder:

1. Determine How Much You Want to Invest in a CD

Before you open any CD accounts, determine the amount you want to invest in your laddered CD strategy. This needs to fit within your total asset allocation strategy and the money needs to be able to be locked away for a period of time.

2. Evaluate the Term Length That’s Best for You

Once you’ve determined the amount you want to invest, look at the term lengths for each part of your CD ladder. Remember: You’re opening short-term, medium-term, and long-term CDs, at equal intervals (usually annually).

If you might require access to your money sooner, consider opening CDs that mature every 6 months. Keep in mind that the shorter the term length, the lower your interest rate will be.

3. Open Your CDs at Staggered Intervals

Once you’ve determined how much to invest and the term lengths, it’s time to open your CD accounts. Split your money between each account and stagger when each CD will mature.

This will give you several “rungs” in your CD ladder to grow over time, allowing you to reinvest and “ladder up” your interest rates.

4. Continue the CD Laddering Strategy

As each CD matures, climb up the interest rate ladder by reinvesting those funds into the longest-term CD in your strategy.

This will give you regular access to your money (at your set interval) and allow you to lock in the highest rates available. Continue this as long as it suits your investment strategy – enjoy the returns.

How to Use Your CD Ladder

Once you’ve opened up your CD accounts, there are several ways to use your CD ladder funds.

CD Ladders for Emergency Funds

If you plan on building a CD ladder for the purposes of an emergency fund, make sure you have more frequent access to the funds. Instead of annually maturing CDs, consider ones that mature monthly or every 3 months.

You may need to open several accounts to take advantage of the longer-term rates, but this can be a great way to put your emergency fund to work (without losing access to short-term funds if needed in a pinch).

You can also consider using a low-penalty CD account with a longer term. This gives you the advantage of the high rates on a long-term CD without the huge early withdrawal penalties.

Using a CD Ladder for Retirement

A CD ladder can be a great way to invest for retirement and to create predictable income during retirement. You can even invest in CDs inside of your IRA.

When you save for retirement, you can create a CD ladder with longer terms (such as 5 years), and build your ladder to start locking in the best interest rates. As your shorter-term CDs mature, you can reinvest them into 5-year CDs. Eventually, you’ll have a CD ladder full of 5-year CDs paying the highest rates.

When you retire, a CD ladder can help provide predictable income. If you start your ladder prior to retiring, you can complete the “laddering-up” process by the time you need the income – and have several years of high-interest income available.

Using a CD Ladder for College Savings

If you’re saving for college, many 529 plans offer the CD investment opportunities. You can create a college savings CD ladder to safely grow your interest earnings.

The great thing about using a CD ladder for college savings is that you can have a predictable rate of return. And if you start early, you will have many years to “ladder up” your CD investments.

Is a CD Ladder Strategy Right for You?

If you’re looking to create a predictable income stream in retirement – or simply want to grow your investments in a safer way – a CD ladder may be a good option to consider. If interest rates are on the rise, use this strategy to lock in higher rates and create an income ladder of your own!

CD Ladder Alternative

Though the CD ladder strategy is a great way to lock in higher interest rates while giving you frequent access to your money, it does take time to build it up. Plus, it locks your money away for a while.

There are a few alternatives to CD ladders to consider:

High Interest Money Market Account

These accounts are a great way to earn some interest from your savings. Though not usually as high as a CD, it is a great alternative to building a CD ladder, and your money is immediately accessible.

Low-Penalty CD Account

These accounts give you higher interest rates than a typical savings account – but they allow you to access your CD funds early with minimal penalties.

CD Ladder vs. Bond Fund – Which is Better?

Creating a CD ladder seems like a great way to capture higher returns, but what about bond funds? Which will give you the best return and stability over time? Your earnings are determined by the highest rate available on your longest-term CD in the ladder. In our example above, this was 3% for a 3-year term.

As interest rates rise, the CD ladder becomes more valuable because you reinvest your maturing CDs into the longer-term CDs at higher rates. Again, in our example, we were able to get up to 6% returns as rates rose over time.

Bond funds typically provide a monthly payment (as opposed to waiting for a bond to mature). They’re typically considered lower-risk than investing in stocks and mutual funds while providing average returns over time. Many bond funds can outearn CDs in a low-interest rate environment

But when interest rates rise, bond funds suffer and can produce lower returns (sometimes lower than inflation). In this scenario, they might not earn more than a good CD ladder strategy. It’s best to compare which is better for your specific circumstances and financial goals.

Find the Best CD Rates to Get Started CD Laddering Today

Who Should I Choose to Build My CD Ladder with?

Almost any bank or online broker will have CD accounts to choose from. When considering who to open your CD ladder accounts with, make sure to consider the following:

What term lengths do you need access to for your CD ladder?

What are the best interest rates?

What are the penalties for early withdrawal?

Is the account FDIC insured?

Do your research to find the best CD accounts to fit your investing strategy. As always, ask yourself what your goals are and check out these 5 things to know before opening a CD account.

What Is a Reverse CD Ladder? Should I Use One?

A reverse CD ladder is a strategy to save for a large, one-time expense (e.g. house down payments) at a planned date in the future. It allows you to save up for the expense in CDs while taking advantage of the highest rate available.

Set a date for your one-time expense (e.g. 5 years from now)

Put all your available savings into a long-term CD that will mature when you need the money. For example, if you need the money in 5 years, open a 5-year CD account.

Next year – after you have saved some more money – open up a 4-year CD and invest your savings into it.

Do this same strategy year after year until you have a “reverse” CD ladder. All of your CDs will then mature on the exact same date.

If you want to save for a large expense in the future – and don’t anticipate needing the money until then – the reverse CD ladder is a great strategy to consider. But if you may need access to your savings before your savings goal is met, you may not want to lock away your money into a reverse CD ladder.