Real estate investing might be enticing. But finding and managing all of the deals yourself can be a challenge. That’s where a crowdfunding real estate platform like Cadre can step in to save the day.

Accredited investors will find a lot to like about Cadre. Let’s explore what the platform has to offer in our Cadre review.

What Is Cadre?

Crowdfunded real estate platforms offer the opportunity for investors to build out a well-rounded portfolio. Cadre is no exception. Since its founding in 2014, the platform has allowed accredited investors to invest in individual deals and a Direct Access Fund. Notably, the platform is focused on commercial real estate. The deals include hotels, multifamily apartment buildings, office space, and more.

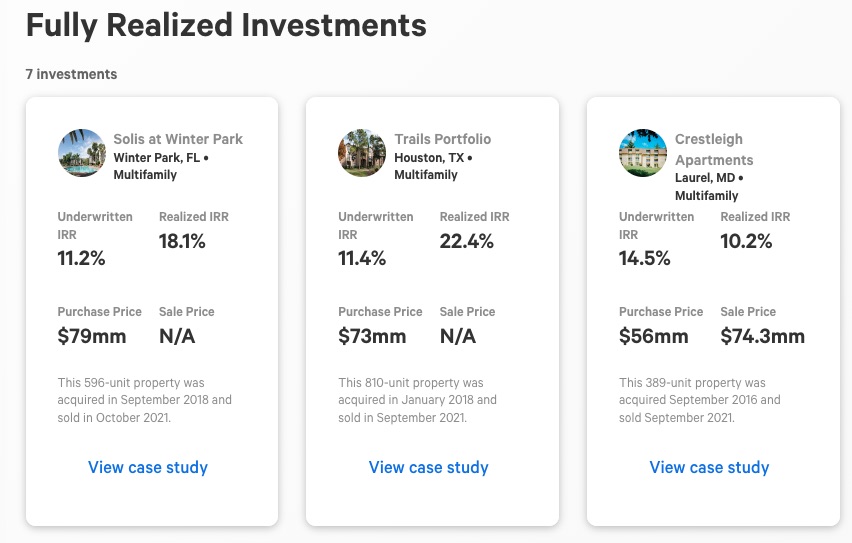

With its transparent track record, investors can consider all of the details of Cadre deals before diving in. Throughout the course of its business, Cadre has created a 17.8% historical rate of return and has made over $184 million in gross distributions to its investors.

The team that manages Cadre has an impressive background. The co-founder of Cadre, Ryan Williams, worked at both Blackstone and Goldman Sachs. Others in the top management team have decades of experience working for successful companies like Four Seasons, Prudential Real Estate, and Goldman Sachs.

How Does Cadre Work?

The process of working with Cadre starts with a streamlined onboarding process. Accredited investors will set up an account; it should take around 2 minutes to sign-up. Once you are a member, you can choose between two investment products -- a Deal-by-Deal approach or the Cadre Direct Access Fund.

Here’s a closer look at the inner workings of both.

Deal-by-Deal

The deal-by-deal approach offers investors the option to buy equity in individual properties.

Cadre aims to launch a new individual investment opportunity once per month. Importantly, Cadre often puts a portion of a property’s available equity into the Direct Access Fund. The remaining equity will be available for individual investors to purchase. You’ll likely need to act quickly due to Cadre’s first-come, first-served access to deals.

If you have specific tax goals, you can look for Individual assets that may be in an opportunity zone for unique tax advantages.

Cadre offers more liquidity than most real estate crowdfunding platforms. The majority of deals will take 5 to 8 years from start to finish,but if you need to get out early, you have the opportunity to put up your equity for sale once per quarter. There is no guarantee you’ll recoup your investment or be able to sell the shares. However, the chance of liquidity is something that most crowdfunding platforms don’t offer.

The other piece of the secondary market puzzle is investors that buy existing equity. As an investor, you can invest in an asset in Cadre’s secondary market. Typically, there is a discount involved because you are providing the original investor an exit.

Cadre Direct Access Fund

The Cadre Direct Access Fund is another way for accredited investors to work with Cadre. According to Cadre, the portfolio is highly diversified with a mix of commercial real estate in high-potential markets. Assets within the fund range in total value from $50 million to $200 million.

Cadre chooses investments for the fund with consistent annual cash flow in mind. The properties are selected in areas within the Cadre 15 -- which are 15 markets the investment team believes exhibits top growth potential.

If the investments produce an income, you’ll receive distributions quarterly. Like the deal-by-deal approach, you can use Cadre’s secondary market for liquidity. Although finding a buyer is not guaranteed, it is nice to have the option.

Still Deciding? Check out REITs vs Real Estate Crowdfunding: Which Is Best?

Cadre Pros and Cons

No Cadre review would be complete without a look at the pros and cons.

Pros:

- Opportunity zone investments are available

- Liquidity options in the secondary market

- Impressive leadership team

Cons:

- Relatively low volume of investment opportunities

- Only available to accredited investors

- High investment minimums

- No guarantee of liquidity

Who Can Invest With Cadre?

Cadre is open to accredited investors. Accredited investors must have a net worth of over $1 million (excluding your primary residence). Or an income of $200,000 in each of the last two years, or $300,000 if you are married filing jointly.

Many new investors won’t be able to work with Cadre given this requirement. CrowdStreet, a favorite in the real estate crowdfunding industry, is also for accredited investors. Check out our CrowdStreet review for more details.

Cadre Minimum Investment and Fees

The minimum investment to work with Cadre is relatively steep.

You’ll need to make a minimum investment of $25,000 to invest in the Cadre Direct Access Fund. But if you want to work with the deal-by-deal options, then you’ll need to invest at least $50,000 per deal.

Cadre charges a one-time 3% commitment fee when you invest in the Direct Access Fund. Additionally, there is an annual 0.50% administration fee and a 1.5% annual assets under management fee.

Investors making deal-by-deal investments will pay a 1% transaction fee and a 1.5% annual assets under management fee.

How Do Investors Make Money?

Investors can make money on Cadre’s platform in a few ways.

First, an investor in a cash-flowing individual deal will receive distributions quarterly. If and when the property is sold, deal-by-deal investors will receive a distribution after the sale.

Second, investors in the Cadre Direct Access Fund may receive quarterly distributions. But these will vary based on the performance of the assets within the fund.

Don't Miss: Arrived Homes vs Fundrise: How to Choose

Biggest Difference Between Cadre and Other Platforms

When you think of crowdfunded real estate, you may think of a real estate investment trust (REIT). Cadre doesn’t offer any REITs for investors. Instead, you’ll have access to deal-by-deal investments and the Cadre Direct Access Fund.

Unlike some real estate crowdfunding platforms, you’ll need to be an accredited investor to work with Cadre. That might make this platform off-limits for some investors. Finally, the minimum investment amount of $25,000 is relatively high. For example, investors can invest with Fundrise for as little as $500.

If you want to invest in crowdfunded real estate, you can find other platforms with a lower minimum to fit your budget. Here are the best real estate crowdfunding sites we've found.

What Can Commercial Real Estate Do for My Portfolio?

Commercial real estate provides the physical location for companies to conduct business -- and generate a profit. With that, commercial real estate can be very valuable. When you include commercial real estate in your portfolio, you are adding in more diversity. Plus, there is a potential for high returns.

Summary

Cadre provides an opportunity for accredited investors to dive into real estate. Although the minimum investment requirement is significant, the extensive track record and potential liquidity may make this platform the right choice.

Ready to look into Cadre more? Check out Cadre today.

References:

https://cadre.com/deal-by-deal...

https://cadre.com/direct-acces...

https://cadre.com/support/