It’s no secret that real estate is one of the biggest wealth generators in American history. That’s especially true of the very wealthy, many of whom became so because of real estate investing.

While we normally think of real estate investing in terms of residential properties, commercial real estate may have even more investment potential. Properly structured commercial deals provide generous cash flow from rents, as well as the potential for greater capital appreciation.

In fact, commercial real estate is the third largest asset class in the U.S. investment markets. At 17% of the investment market, commercial real estate is right behind bonds (44%) and stocks (36%).

It’s not hard to see why commercial real estate is such a popular choice, especially for larger investors. For the 25 years ended March 31, 2021, commercial real estate has produced an average annual return of 10.3%, versus 9.6% for the S&P 500 over the same term. Not only is the return on commercial real estate slightly higher than stocks, but it offers an opportunity to diversify into an entirely different asset class.

Apart from purchasing a commercial property on your own, there are two ways you can invest in commercial real estate with relatively small investments.

The most common are real estate investment trusts (REITs). But a new class of commercial real estate investments has come up quickly in the past decade. Loosely referred to as real estate crowdfunding, it’s an investment method that enables you to invest in individual properties, with more choice over your investments, and the potential for even higher returns than those offered by REITs.

Let’s take a closer look at REITs vs. real estate crowdfunding, to help you determine which might be the better way to diversify into commercial real estate investing.

What Are REITs and How Do They Work?

REITs are corporations that own and manage commercial-type investment properties. These can include office buildings, retail space, warehouse facilities, hotels, apartment complexes, senior and student housing, industrial space, and other properties. Some REITs specialize in a specific type of commercial property, like office buildings or large apartment complexes.

REITs come in three general types; mortgage REITs, equity REITs, and hybrid REITs. A mortgage REIT invests in mortgages secured by commercial property but does not take an ownership interest in those properties. An equity REIT takes an equity position in the properties held in the trust. Meanwhile, a hybrid REIT can involve both mortgage and equity positions.

You can think of a REIT as something like a mutual fund, but one that holds commercial real estate rather than stocks or bonds. It works on the same principle since a single REIT will own and manage dozens or hundreds of properties. Typically, properties within the trust will be owned in various markets across the country.

With the combination of multiple properties and geographic locations, a REIT enables investors to achieve a type of diversification within commercial real estate that would be impossible by purchasing individual properties – unless, of course, you’re a billionaire.

You can earn money from a REIT in two ways; dividends and capital gains.

Dividends are the profits paid out of the rents – less operating expenses – earned on the properties held within the REIT. REITs are required to pay at least 90% of their taxable income to shareholders in the form of dividends. Though, due to depreciation that lowers net earnings, the 90% figure can be a bit misleading.

A REIT may also generate capital gains on the sale of properties held within the trust, if the properties are sold for more than the price at which they were purchased.

What Is Real Estate Crowdfunding and How Does It Work?

Real estate crowdfunding similarly focuses on investments in commercial real estate. Those can also include large projects, like office buildings, retail space, and apartment complexes. But because they also offer individual property deals, you may be able to invest in single-family properties.

“Crowdfunding” is the operative word with real estate crowdfunding. The platforms operate entirely online, bringing real estate developers – called sponsors – together with individual investors. The sponsors present the properties, and investors choose which they will invest in.

Real estate crowdfunding involves both individual deals and non-publicly traded REITs. Those REITs are largely unlike publicly-traded REITs, since they can only be bought and sold through the crowdfunding platform. This makes them illiquid unless the platform offers some form of early redemption.

The non-publicly traded REITs offered by real estate crowdfunding platforms are typically smaller than publicly-traded REITs, in both the number of dollars and properties under management.

And where publicly-traded REITs are perpetual investments, the non-publicly traded REITs offered by real estate crowdfunding platforms commonly have a beginning date, which will be when the trust is fully funded, and a termination date. Referred to as “fully realized,” the termination date is the point at which properties held within the trust will be sold, and funds will be returned to investors. If those sales result in gains in excess of initial purchase prices and the cost of renovations, investors will earn a capital gain upon liquidation.

Real Estate Crowdfunding Examples

Two popular real estate crowdfunding platforms are CrowdStreet and Fundrise.

CrowdStreet offers investments in individual properties, as well as proprietary funds. The minimum investment is $25,000, and you are required to be an accredited investor to participate. That requires a high income, high net worth, or both. This is due to the investment in individual properties, which are considered higher risk than multi-property funds, as well as the average investment holding period of 2.4 years.

Fundrise offers only non-publicly traded REITs, designed to produce a combination of income and growth. There is no accredited investor requirement, and minimum investments range from a low of just $10 to a high of $100,000 or more. Fundrise also offers a feature not available on all real estate crowdfunding platforms. It provides a quarterly redemption option, which will give you an opportunity to liquidate your investment early, if need be, and if Fundrise has the liquidity to cover the redemption.

Even with the early redemption option, an investment made through real estate crowdfunding should generally be expected to last for several years. Though the timeframe will vary from one platform to another, most investments do require several years to fully realize maximum profits.

REITs vs. Real Estate Crowdfunding: The Biggest Differences

Though REITs and real estate crowdfunding both invest in commercial real estate and do have many similarities, let’s look at the differences by specific feature.

Correlation with Stocks and Bonds

Even though commercial real estate is a separate asset class from financial assets, like stocks and bonds, the returns it provides are closely correlated with those investments.

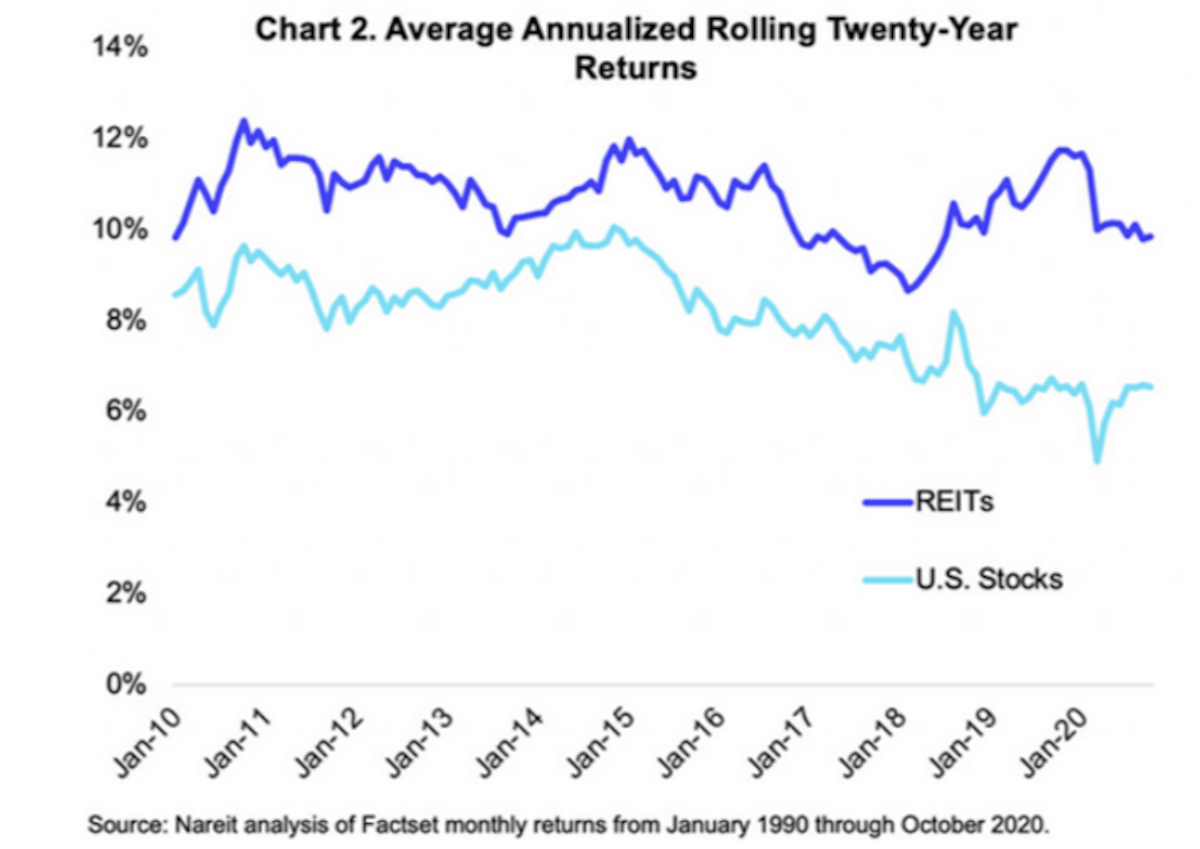

The screenshot below, from the National Association of Real Estate Investment Trusts (Nareit), shows the close correlation between the average annual returns on REITs and stocks:

The screenshot shows REITs have outperformed U.S. stocks between 2010 and 2020. But the trend line shows a clear correlation between the two. Except in 2018 - 2019, the peaks and valleys between the two asset classes closely parallel each other. Notice the steep drop early in 2020, when the COVID-19 pandemic caused a mini-crash in both asset classes. Clearly, REITs didn’t serve as a counter investment to stocks.

By contrast, a real estate crowdfunding platform investment is typically uncorrelated with the performance of stocks and bonds. That’s because it involves investment in individual properties, rather than the general real estate market. And since real estate crowdfunding investments don’t trade on public exchanges, their value is not impacted by sudden increases or declines in the broad financial markets.

Still, another reason is the relatively short-term nature of real estate crowdfunding investments. While a publicly-traded REIT is a perpetual investment, holding a portfolio of properties for an indefinite amount of time, real estate crowdfunding investments commonly have a termination date, which may only be five years after the trust is fully funded. This shorter duration makes correlation with the financial markets much less likely.

Liquidity

This feature clearly favors REITs over real estate crowdfunding, at least in regard to publicly-traded REITs. That’s because publicly-traded REITs can be easily bought and sold on public exchanges on a daily basis.

However, the liquidity of publicly-traded REITs isn’t entirely a pure play. Because the underlying real estate held within the trust is not readily liquid, investors pay a liquidity premium for the price of the shares. The purchase price of the shares is higher than the per share net asset value of the properties within the trust. It’s a premium paid for the ability to liquidate shares quickly and easily, without disturbing the underlying property investments.

By contrast, real estate crowdfunding investments are generally illiquid. They must be held until the underlying investment(s) have been sold, and investors’ contributions have been returned to them, with any resulting gains. This can take between several months and several years, depending on the specific investment or fund offered.

Diversification

Publicly-traded REITs can invest in hundreds of individual commercial properties, which may be located in multiple geographic locations. Real estate crowdfunding investments may be limited to a single property or a small group of properties.

The larger number of properties held in a publicly-traded REIT means the failure of any one property is unlikely to have a material negative effect on your investment.

By contrast, the smaller number of properties involved in a typical real estate crowdfunding investment means the failure of one could result in catastrophic losses.

Accessibility

Publicly-traded REITs are available to investors of all financial means and require only access to a brokerage account. And since the minimum investment is typically one share, you may be able to purchase a position for as little as $100, if that’s the current value of a REIT share. In addition, publicly-traded REITs have no accredited investor requirements.

By contrast, the minimum investment for a real estate crowdfunding platform has a wide range. One can have a minimum investment requirement of $25,000, while another can be as little as $10. More often than not, platforms with higher minimum investment requirements do require investors to be accredited. That will limit investment only to investors deemed to be high income, high net worth, or both.

Ready to learn more? Check out our CrowdStreet vs Fundrise review.

Investment Control

With both publicly-traded and non-publicly traded REITs, you’ll have no control over the investments or the investment activity within the trust. Your only option will be to invest in the trust or sell your position to get out. Management of the properties within the trust, including all investment decisions, are made by the managers or sponsors of the REIT.

Investment control with real estate crowdfunding platforms is something of a mixed bag. Given that many real estate crowdfunding platforms offer non-publicly traded REITs, you’ll have no control over the investments held in the trust.

But among real estate crowdfunding platforms that offer investments in individual deals, you’ll be able to choose which you’ll invest in. That will also give you a choice as to how you invest in a property. For example, you may choose an investment that will be purchased, renovated, held for several years to maximize appreciation potential, then sold for a large gain. Or you may invest in a deal involving a “fix and flip,” in which a property will be purchased, renovated (fixed), then sold quickly (flipped) for profit.

How to Invest in REITs and Real Estate Crowdfunding

REITs

When you invest in a REIT, you’ll purchase shares in the trust. Those shares may trade on a public exchange, in the case of a publicly-traded REIT, or be available only through the REIT itself for a non-publicly traded REIT.

Shares of publicly-traded REITs can be purchased and sold through major investment brokerage firms, and share prices fluctuate throughout the day. The minimum investment is typically the price of one share of stock in the REIT.

Non-publicly traded REITs commonly have a minimum investment based on a flat dollar amount. That can be $1,000, $2,000, $3,000, or whatever minimum is set by the non-publicly traded REIT. Some REITs even have a $100,000 minimum investment.

However, since this type of REIT is not available for trading on public exchanges, it is highly illiquid. The company offering the REIT may provide limited redemption options, or none at all. Instead, the REIT may have an anticipated termination date, upon which the properties within the trust will be liquidated, and funds will be returned to investors, closing out the REIT completely.

Real Estate Crowdfunding

The investment process for real estate crowdfunding is much less standardized than it is for publicly-traded REITs. Each platform has its own minimum required investment, and many require investors to have accredited investor status.

As mentioned earlier, CrowdStreet – with its individual property deals – requires accredited investor status. But Fundrise – using non-publicly traded REITs – has no such requirement.

Real estate crowdfunding investments are not available on public financial exchanges. Investments must be made through the crowdfunding platform itself. The platform offers individual property deals, and you can choose the properties you will invest in. You’ll then be required to make at least the minimum investment, which will buy you a slice of the deal.

In the case of non-publicly traded REITs, which are commonly offered by real estate crowdfunding platforms, you’ll make an investment in the trust, but have no control over the individual investments held within it.

Whether the investment is in an individual property or a non-publicly traded REIT, you’ll be expected to maintain your investment position for the number of years required before the deal or fund is considered fully realized, and will be liquidated and paid out.

This is just a general description of how real estate crowdfunding platforms work. There are a large number of excellent real estate crowdfunding platforms, and you should investigate several before deciding which to invest in.

Want to learn more? Check out our comparison of DiversyFund vs Fundrise.

How Much Money Can You Make with Real Estate Crowdfunding?

It can be difficult to measure expected returns with real estate crowdfunding platforms. The first complication is that the asset class only came into existence since the passage of the JOBS Act in 2012. As a result, the majority of real estate crowdfunding platforms have a history of significantly less than 10 years.

Second, returns vary by platform. For example, CrowdStreet projects an annual rate of return of 17.3% on fully realized deals, while Fundrise provides a range of between 8.81% and 16.11%.

Third, returns also vary based on the specific type of investment made through a real estate crowdfunding platform. Typically, you can expect higher returns on investments in individual property deals, and lower returns on non-publicly traded REITs.

But at least when it comes to investments in individual property deals, recent returns have been more impressive than those offered on publicly-traded REITs.

And since you’ll have an opportunity to choose individual investment deals, potential returns can be even greater than those published averages. For example, CrowdStreet offers individual property deals with returns projected in excess of 20%.

Check out CrowdStreet and Fundrise to learn more.

RELATED: CrowdStreet Returns & Investment Performance

Can You Get Rich Investing in REITs?

The primary attraction of REITs is income. Though they can sell underlying properties and generate capital gains, this is typically a secondary source of revenue. A REIT doesn’t have the capacity for the kinds of 5-to-1 or 10-to-1 returns that can be possible on, say, a growth type high-tech stock.

Put another way, a REIT is an investment vehicle designed to provide steady income and build wealth over time. Though it may be possible to get rich investing in REITs over 20 or 30 years, the main purpose is income generation, not rapid capital appreciation.

That said, REITs do have a long-term history of outperforming stocks. According to Nariet, stocks returned an annual average of 11.64% between 1978 and 2016, while publicly-traded equity REITs returned an average of 12.87%.

We've done the research. Check out the best real estate crowdfunding sites today.

References:

https://www.reit.com/sites/default/files/media/DataResearch/QuickFacts%2...

https://www.ncreif.org/globalassets/public-site/webinar--education-page-...

https://www.sec.gov/files/reits.pdf

https://www.reit.com/news/blog/market-commentary/reit-average--historica...

https://www.reit.com/news/blog/market-commentary/comparing-average-reit-...

https://corporatefinanceinstitute.com/resources/knowledge/finance/liquid...

https://fundrise.com/

https://www.crowdstreet.com/