If you’re considering refinancing your mortgage to lower your monthly payment – or lower your rate – check out the offers from our partners in the rate table below.

Refinancing your mortgage is the process of replacing your current home loan with a new one. It’s a great way to lower your monthly payment and your interest rate at the same time. But how do you know if you’re getting a good deal?

Finding the best refinancing mortgage rates is as easy as comparing the top lenders, but to truly understand whether it’s a good fit for your finances, you’ll want to understand all the details of the refinancing process.

Here, we break down how a mortgage refinance works, the different types of refinancing options available, and different loan terms to be aware of. We also provide an overview of some of the top mortgage refinance companies on the market today.

How Does Refinancing a Mortgage Work?

Refinancing a mortgage is the process of securing a new loan for your home and paying off the old one. There are a number of reasons to refinance, including lowering your interest rate, changing your loan term length, or pulling out cash from home equity.

Most people start by comparing lenders and looking for the best interest rates and loan terms.

Once you decide on a lender and loan terms, you can complete the application, provide any documentation needed, and close on the new loan.

Types of Refinancing

There are many ways to refinance your loan, and each has a purpose. Review the different types of refinancing options available below to choose one that fits your financial goals.

1. Rate-and-Term Refinance

The rate-and-term loan is the most common type of mortgage refinance. These loans help homeowners take advantage of lower interest rates – or a change in loan term length – without changing the total amount of the loan.

You can select any term length that your lender offers and refinance your adjustable rate mortgage into a fixed-rate mortgage. Or, you can refinance your current fixed rate to a lower fixed rate.

If your goal is simply to lower your rate, lenders can keep your loan term the same as your current loan.

For example: If your original loan was a 30-year mortgage and you only have 26 years left on the loan, you can refinance your loan to a 26-year term loan.

Best for: Homeowners looking to reduce their rates, lower their monthly payments, or both.

2. Cash-Out Refinance

If your home has appreciated over the years and you’re looking to use some of your home equity, consider applying for a cash-out refinance. This loan refinances your home at a higher amount than your original loan (usually requiring an appraisal). Part of that loan is then used to pay off the old loan, and the excess funds are pulled out as cash.

While this is a way for homeowners to turn their home equity into cash, it also results in a larger mortgage balance and higher monthly payment. These loans typically have higher interest rates than standard rate-and-term refinancing.

Best for: Homeowners looking to tap into their home equity and pull out cash for home improvements, debt payoff, or other needs.

3. Cash-In Refinance

While not as common as a cash-out loan, cash-in refinancing allows homeowners to bring extra funds to the table, effectively lowering their mortgage balance and monthly payments.

These loans may be a good choice for homeowners who want to minimize their monthly payment, get rid of Private Mortgage Insurance (PMI), get out from being underwater on their mortgage, or qualify for a lower interest rate.

Best for: Homeowners looking to lower their loan balance and their monthly payments.

4. Streamline Refinance (FHA)

Streamline Refinance is a program managed by the US Department Housing and Urban Development (HUD). This loan process is only available to homeowners with current mortgages that are backed by the Federal Housing Administration (FHA).

The goal of this program is to help borrowers refinance their mortgage to more favorable terms (e.g. lower rate, lower payments) without the need for an appraisal or – for some loans – even a credit check.

There are two types of Streamline Refinance options available: credit qualifying and non-credit qualifying loans.

Credit qualifying loans are designed for major adjustments to your mortgage, such as adding or removing a person from the loan. Non-credit qualifying loans are for simple rate-and-term refinances to lower rates and/or change loan terms.

Best for: FHA Homeowners looking to reduce their rates or lower their monthly payments.

Drawbacks of Streamline Refinance

The Streamline Refinance can be a great options for FHA loans, but there are a few drawbacks to this type of refinance:

- You have to pay closing costs up front with this refinance option

- A new 1.75% mortgage insurance premium must be paid at closing (or wrapped into the loan)

- If you opt for a “no cost refinance” option, your interest rate will be higher

5. Refinancing Mortgage vs. Home Equity Loan

When you refinance your mortgage, you’ll receive a new loan for your home while simultaneously paying off the old one. When you pull out a home equity line of credit (HELOC), you’re tapping into your current home equity by taking out a second loan against your home.

A refinance is best for homeowners simply looking to lower their rates or monthly payments. A HELOC, however, is typically used for accessing your home equity without having to adjust your primary mortgage.

The Costs of Refinancing Your Mortgage

A refinance can help you save some serious money – but it’s certainly not free. To make sure you come out ahead, consider these costs associated with refinancing your mortgage:

Mortgage Origination Fees

Lenders make their money by charging an origination fee which covers their services, including processing, underwriting, and closing your loan. This can be anywhere from 0.5% to 1.5% of the total loan amount.

Appraisal Fees

To qualify for a refinance, most lenders require an appraisal of your home. This provides lenders with an idea of your home’s current fair market value. Typical appraisal costs are between $300 and $500.

Recording Fees

Mortgage refinance transactions are required to be recorded with your local county. These fees vary by location.

Credit Report Fees

To determine creditworthiness and loan qualification, most lenders require a credit report to be pulled. This fee may be included in the lender’s origination costs, but it may also be included in the closing costs separately. These reports are typically under $50.

Title Services

The lender may require a title search to verify ownership of the property, and most refinancing options also require a new title insurance policy. Title insurance covers the costs of undiscovered liens or ownership issues with the property (after the new loan has closed).

Title services can cost upwards of $1,000, but these vary by lender and location.

Other Fees

Other miscellaneous fees associated with loan refinancing can include:

- Tax service fees

- Survey fees

- Prepaid interest charges

- Underwriting fees (usually included in origination fee)

- Attorney fees

Always ask your lender for a list of fees before completing the refinancing process.

Do You Have to Pay Closing Costs on Mortgage Refinancing?

Not always. Some lenders also offer “no-cost refinance” options where you can opt for a higher interest rate (but avoid paying any out-of-pocket costs to refinance). This is an option for homeowners who don’t want to bring any cash to the table but still want to adjust their mortgage rate and term – or simply for people who want to take some cash out.

This doesn’t mean your mortgage refinance is free. It just means that you’ll pay more mortgage interest over the life of the loan.

Note: A no-cost refinance may also come with a prepayment penalty for paying off the loan too soon. This helps the lender recoup the refinancing costs to ensure they profit from the transaction.

Can I Negotiate My Refinance Rate for my Mortgage?

Yes – and you should.

Your mortgage interest rates and refinancing fees can all be negotiated by shopping around. Get estimates from multiple lenders, compare rates and fees, and negotiate by asking lenders to match (or beat) the lowest price.

Make sure to compare all of the fees associated with the refinance, not just the interest rate.

You can also lower your rates by:

- Bringing a bigger down payment

- Improving your credit score

- Purchasing points up front

Don’t go with the first offer you see. According to Freddie Mac, checking with multiple lenders can save you thousands.

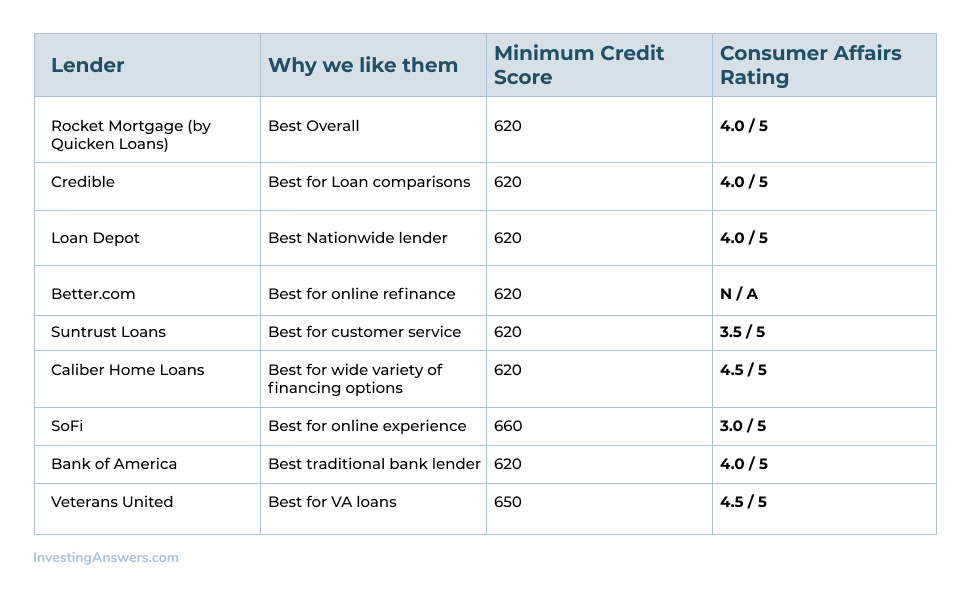

Top Mortgage Refinancing Companies

If you want to take advantage of historically low interest rates, compare the top mortgage refinancing companies below:

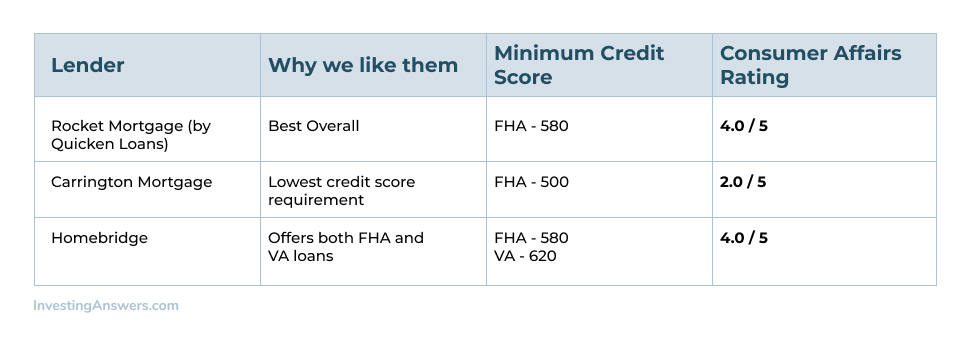

Where to Refinance Mortgages with Bad Credit

There are many loans available for those with a credit score under 600. The FHA offers loans with a credit score of 580, with some lenders going as low as 500. If your credit score is under 500, however, most lenders will not approve your mortgage application.

Here are a few places you can refinance your mortgage with bad credit:

Is Refinancing My Home a Good Idea Right Now?

Is it a good time to refinance your mortgage? For many, the answer is a resounding “yes.” Lowering your mortgage interest rate can save you thousands of dollars (or more) in the long run.

But before you apply for a new home loan, there are a few things you need to consider:

How Long Do You Plan on Staying in Your Current Home?

Make sure you know how long you plan on living in your home. If you’re planning on moving soon, it may make sense to look at a shorter, adjustable rate mortgage (for better rates over the short-term).

If you plan on staying at your home for 5 years (or longer), it may be better to take a look at getting a fixed-rate mortgage to lock in a lower rate for the long-term.

How Long Until You Recoup Refinancing Costs?

A mortgage refinance typically costs between 2% - 5% of the total loan value. This means you’ll pay thousands of dollars to lower your interest rate and/or change your loan terms.

Calculating how long it will take to break-even can help you determine whether it’s the right time to refinance.

Example: You refinance a $200,000 mortgage and pay $6,000 in fees to lower your monthly payment by $200. It will take 30 months to recoup your costs.

Do You Currently Pay for Mortgage Insurance?

If you put less than 20% down to get your initial mortgage, you may be paying monthly mortgage insurance. For conventional mortgages, this insurance will automatically go away after you reach 78% loan-to-value (LTV), which means you’ve paid off 22% of your home loan. You can also request the mortgage insurance be dropped once you’ve paid down 20% of your original mortgage.

Note: For FHA or USDA mortgages, the mortgage insurance is attached, regardless of your down payment size.

If you believe your home has gained 20% equity (or more), getting an appraisal and refinancing may be able to eliminate mortgage insurance costs.

What Is Your Credit Score?

If your credit score has improved since you first took on your mortgage, you may currently qualify for better interest rates. This can lead to big savings on your monthly payments and total interest paid for the life of the loan.

Note: You can check your credit scores from all 3 credit bureaus at Annual Credit Report.

What Are Your Financial Goals?

While refinancing might save you some money, keep your financial goals in mind before changing the terms of your current mortgage. Consider your debt payoff, investing, and other life goals.

If you need immediate cash flow, a refinance may help lower your monthly payments. If your goal is to become completely debt-free, it might be good to consider refinancing via a 30-year to a 15-year mortgage. If you plan on moving soon, refinancing to a long-term, fixed-rate loan may not make fiscal sense.

No matter what your financial goals are, make sure you run the numbers before committing to a refinance.

The Pros and Cons of Refinancing Your Home

Refinancing your mortgage can be a great financial move, but it’s not right for everyone. Consider these pros and cons before deciding whether a refinance is a solid choice for you.

Pros

- Lower your monthly payment

- Pay less in interest over life of the loan

- Get rid of mortgage insurance

- Pay off mortgage faster (shorter-term loan)

- Convert to a fixed-rate loan (less volatility)

- Turn home equity into cash

Cons

- High closing costs (up to 5% of loan)

- Pay more in interest (longer-term loan)

- Break-even point too far away

- Cash-out refinance means higher payments

- Second loan against your home (HELOC)

How Can I Find the Best Mortgage Refinancing Rates

When searching for the best possible rates on your mortgage, follow these simple rules to help you save the most money.

Shop Around for Mortgage Rates

Shopping around for mortgage rates is a no-brainer, but according to a 2015 study, less than 25% of American applied to more than 1 lender when shopping for home loans.

Lender rates can vary dramatically, so it’s best to get estimates from at least 3 different lenders to get the best rates. Many offer a “best rate guarantee” which promises to match or beat any competitive offer. Shop around and take advantage of the best offer available.

Know Your Credit Score

A critical factor in qualifying for the best rate is your FICO credit score. Knowing your current score can help you get the most accurate rate estimates from lenders and show you how much you can save on your mortgage.

If you’re unsure of your current credit score, consider grabbing a copy of your credit report and score from each credit bureau through Annual Credit Report.

Compare Loan Terms

It’s not all about the interest rate: Compare the terms of each loan to find one that fits your financial goals best.

Whether you’re looking to shorten the length of your mortgage term, get rid of mortgage insurance, or simply tap into your home equity, review lender details to see who offers the best options for your refinance.

The 7 Steps to Refinancing Your Home

To prepare for and complete your home refinance, you will need some documentation and information on hand. Follow these steps to complete your mortgage refinance:

1. Check Your Credit Score

Knowing your credit score will help you determine what you can qualify for. The higher your score, the more favorable the interest rates.

2. Use a Mortgage Calculator

To understand the impact to your monthly finances and total interest paid, use simple monthly mortgage calculator to see what your new payments could be.

3. Compare Rates

Once you have an idea of your credit score – and what your monthly payment could be – it's time to compare lenders. Check out our top lenders list above to get a few estimates.

4. Apply For the Loan

Once you find the right lender, you’ll need to apply for the new loan in much the same way that you applied for the original mortgage. The lender will also run a hard credit inquiry to check your credit score(s), which helps to determine the interest rate on your loan.

Here’s a quick list of documents you’ll need to provide:

- Tax returns

- Pay stubs

- W-2

- Proof of ID

- Bank statements

- Investment account statement

- Current mortgage information

- Other outstanding loan information

- Credit card statements

- Address history

- Social security number

There may be more documentation required by your lender during the application process.

5. Lock in Your Interest Rate

Once you’ve completed the application process, your lender can lock in your mortgage interest rate to ensure that it doesn’t go back up. This lock gives you a window of time to complete the refinancing process.

6. Appraise Your Home (if Applicable)

You may be required to hire a home appraiser. This provides lenders with a better idea of your home’s current fair market value and protects you from borrowing too much.

7. Fill Out the Closing Paperwork

After your refinance has been approved, it's time to close on your new loan. This requires filling out a sizable stack of paperwork, though many lenders are making this a completely digital process.

Once the closing paperwork is submitted, your lender will complete the process and fund your new loan (paying off the old mortgage in the process).