Your credit score is a three-digit number that tells lenders the likelihood of you defaulting on your debts, based on your past and current behavior. Scores range from 300 to 850, with 850 being the highest (best) score you can get. The average person has a credit score between 600 and 750.

A credit score can make a big impact on your life. A good credit score can help you unlock affordable financing opportunities. But a bad credit score could leave you struggling to find a fair offer from a lender.

Let’s explore your credit score and learn about the best credit scores out there.

Credit Score Ranges - The Best Credit Scores

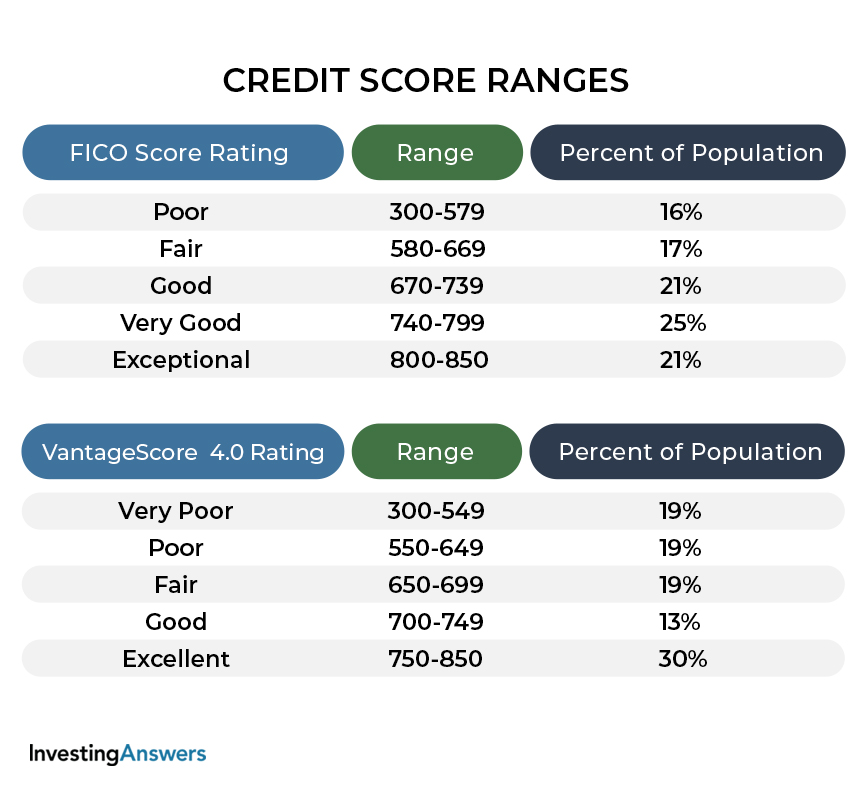

Credit scores range from 300 (worst) to 850 (best). Most people’s scores fall in the middle range.

What Is a Good Credit Score?

Each lender differs, but in general, a good credit score is between 670 and 739. Scores below 670 are fair or poor, and scores higher than 739 are very good or excellent.

What Is an Average Credit Score?

According to Experian's 2020 Consumer Credit Review, the average credit score in America was 710. This level represented a new record high, as well as a significant icnrease from a decade ago, when the average credit score was about 690.

What Is the Highest Credit Score?

The highest credit score is 850, but only about 1.2% of Americans actually achieve this score. Rarely, some credit models have credit scores that go up to 950, but most banks and lending institutions use FICO, which goes up to 850

Why are Credit Scores Important?

Lenders, employers, insurance companies, and even utility companies check your credit score to determine your creditworthiness. Your score also determines how risky you are as a borrower. The higher your credit score, the better terms you’ll get on loans and the more loan options you’ll have. You may even get a better job or lower insurance rates because of it.

How Are Credit Scores Calculated?

Credit scores are calculated using either the FICO Score 9 (2014) or VantageScore 4.0 (2017) models. These credit scoring models analyze sections of your credit report to generate your credit score. Scores will vary between the two models because they value factors on your credit report differently.

Fico Scoring Model

The FICO Scoring Model is used by over 90% of US lenders. To calculate your credit score, it takes the following into account:

-

Payment history 35%

-

Credit utilization 30%

-

Length of credit history 15%

-

New credit 10%

-

Credit mix 10%

VantageScore Model

The VantageScore model weighs the following criteria to calculate your credit score:

-

Payment history 41%

-

Age/mix of credit 20%

-

Utilization 20%

-

New credit 11%

-

Balance 6%

-

Available credit 2%

Who Calculates Your Credit Score

Each credit bureau (ie. Equifax, Experian, and TransUnion) calculates your credit score based on the information reported to them. Some creditors only report to one or two bureaus while others report to all three. Your credit scores may differ slightly between the three bureaus.

Here’s a closer look at what these credit bureaus have to offer.

Experian

Experian offers consumers free access to an Experian credit report based on the FICO scoring model. You’ll quickly be able to determine where your credit stands.

Beyond simple access to your credit report, you can also enjoy access to free credit monitoring. Essentially, this means that Experian will send you a notification anytime there is activity associated with your account. With this helpful service, you will be able to catch any instances of identity fraud sooner rather than later.

Speaking of any issues with your credit report, you can take advantage of the free option for online disputes. If you find any inaccuracies on your Experian credit report, you can request a review for free.

Finally, Experian offers Experian Boost. As a free service, Experian Boost helps you get credit for bills like your utilities and popular streaming service. Of course, Experian cannot guarantee that you’ll be able to improve your credit score. But average users improve their score by 12 points using this service.

Transunion

Transunion is another credit bureau that keeps tabs on your credit report and gives you a credit score. In this case, your score will be based on the VantageScore 3.0 model.

The credit bureau offers several key features, including free identity protection through their TrueIdentity program, which can help keep your credit safe. Plus, you’ll have $25,000 in identity theft protection available for free.

As you tap into your free report access, you’ll have TransUnion’s CreditCompass to help point you in the right direction. Basically, CreditCompass takes the factors that comprise your credit score into account and shows you where you should improve first.

Equifax

Last but not least, Equifax is a credit bureau that calculates your score based on the VantageScore 3.0 model.

Like the other two credit bureaus, you will be able to tap into your report for free. Unlike the other credit bureaus that offer access to free scores, here you’ll have to pay for anything more than a quick one-time look at your credit report via annualcreditreport.com.

After that, you’ll pay between $9.95 to $19.95 per month to enjoy any of Equifax’s services. Here’s a quick look at those services:

-

Equifax Complete. In this plan, at $9.95 per month, you get access to credit monitoring at one credit bureau and identity theft protection for one adult. Plus, up to $500,000 in identity theft insurance.

-

Equifax Complete Premier. In this plan, at $19.95 per month, you get access to credit monitoring at all three credit bureaus and identity theft protection for one adult. Plus, up to $1,000,000 in identity theft insurance and stolen funds replacement options.

-

Equifax Complete Family Plan. In this plan, at $19.95 per month, you get access to credit monitoring at all three credit bureaus and identity theft protection for your entire family. Plus, up to $1,000,000 in identity theft insurance and stolen funds replacement options.

Equifax offers more expensive services. However, it could be a good option if you are interested in extensive identity theft protection.

When Do Credit Scores Update?

On average, credit scores update every 30 to 45 days, depending on the credit bureau and your creditor’s reporting schedule. Equifax, Experian, and TransUnion don’t require a specific reporting schedule. However, you’ll find that your credit score can change daily, weekly, or monthly, depending on the type of credit pull or lender.

What Credit Score Do Banks Use?

Most banks use FICO Score 9 (latest model) but it varies by bank. Some banks use VantageScore, which is just as reputable as FICO. However, since banks may choose which model suits their evaluation of risk, it’s best to ask your bank what they use. This is important if you’re looking to understand which score lenders will see.

How to Monitor Your Credit Score for Free

Credit Karma

Credit Karma offers a free credit score, but you’ll have to allow Credit Karma access to information about your spending habits. The service is free because Credit Karma can use your information for advertisement purposes.

Beyond a credit report, Credit Karma offers services such as credit monitoring. Plus, you can search for personalized loan offers through Credit Karma without impacting your credit score.

Credit Karma takes a big look at your financial picture. If there is room for improvement, you’ll receive free advice along the way. The company offers a series of products to help you at any point in your credit building journey, including a checking account, savings account, and personalized loan offers.

How Accurate is Credit Karma?

As you work with Credit Karma, it is important to realize that the service is operating on less than the complete picture. The company uses information from TransUnion and Equifax credit reports. With that information, Credit Karma calculates your score based on the VantageScore 3.0.

However, Credit Karma may be missing potentially important information about your credit score because it doesn’t tap into the Experian report. With that, it is possible that the score presented through Credit Karma is just a little bit off. But importantly, the score should be relatively close to your actual score, which will help you when planning your credit usage.

Pros of Credit Karma

-

Free credit score

-

Free credit monitoring

-

Additional financial services such as free tax help

Cons of Credit Karma

-

It doesn’t include information from all three credit bureaus

-

VantageScore instead of FICO score

-

Spending habits shared with other companies

Open a Free Credit Karma Account

Credit Sesame

Credit Sesame offers the opportunity to check your credit score for free. Through this company, you also have access to free credit monitoring services.

Once you create an account, you’ll find a free credit report card. Essentially, this helps you understand where your credit stands. There are helpful tips in the report card that can help you take action to improve your score.

An interesting feature offered by Credit Sesame is their Sesame Cash debit account. The no-fee debit account rewards you with cash for improving your credit score.

How Accurate is Credit Sesame?

Credit Sesame only uses information from TransUnion. With that, your free credit score may not be entirely accurate.

But you can upgrade your Credit Sesame account to a premium version for the company to take credit report information from all three credit bureaus to ensure the most accurate score.

Pros of Credit Sesame

- Free credit score

- $50,000 of identity insurance

- Personalized suggestions to improve your finances

Cons of Credit Sesame

-

No customer service phone number

-

Premium features are pricey

Discover Credit Scorecard

The Discover Credit Scorecard offers a closer look at your FICO score.

You don’t have to be a cardmember to take advantage of the free credit scores offered by Discover. Instead, you can unlock a free FICO credit score with Discover completely free.

How Accurate is Discover Credit Scorecard?

Like the competitors above, Discover doesn’t use information from all three of the credit bureaus. Discover only looks at the information on your TransUnion credit report.

Unlike the competitors above, Discover calculates your FICO score, not your VantageScore. In general, lenders are more likely to check out your FICO score, so you may be seeing a more accurate version of your credit score. But some information may still be missing if your reports don’t match up at all three credit bureaus.

Pros of Discover Credit Scorecard

-

Free FICO credit score

-

Credit monitoring is free, whether or not you are a Discover cardholder

-

Easy to access customer support

Cons of Discover Credit Scorecard

-

No personalized guidance on how to improve credit score

-

No free identity theft insurance

Chase Credit Journey

The Chase Credit Journey product is available as a free tool for anyone, which means you don’t need to be a Chase customer to use it.

Once you sign up for Chase Credit Journey, you’ll have instant access to your credit score. As you continue to work with Chase, the service will perform regular identity monitoring to ensure that your information is secure. Additionally, you’ll receive alerts when your credit is impacted by an action.

Chase Credit Journey also analyzes your credit information to help you build and maintain your score. Not only will the company recommend pathways to boost your score, but it also provides appropriate loan opportunities.

Finally, Chase Credit Journey offers up to $1 million in identity theft insurance.

How Accurate is Chase Credit Journey?

Chase Credit Journey operates with data provided by Experian to create a credit score using the VantageScore 3.0 model. The Chase Credit Journey calculation doesn’t take the information at every credit bureau into account. But the score you receive should be relatively close to accurate.

Pros of Chase Credit Journey

-

Free credit score

-

Weekly updates

-

Credit score simulator tool

Cons of Chase Credit Journey

-

Only uses Experian credit report

-

Only Chase offers recommended

Credit.com

Credit.com provides a comprehensive credit score experience.

You will be able to view your FICO score for free, and with that version, you’ll have the ability to see what factors are impacting your credit score and receive advice on how to improve it.

But if you choose to upgrade your account to ExtraCredit, you’ll be able to view 28 different FICO scores. The goal of providing you with such a wide array of FICO scores to share your credit score from your lender’s point of view.

When you choose to work with ExtraCredit, you’ll be able to take advantage of one free month. But after that, you’ll be billed $24.99 per month. The perks of Extra Credit include rent and utility reporting, cash rewards, and credit monitoring.

How Accurate is Credit.com?

The free version of Credit.com only takes your Experian credit report into account. With that limited information, you’ll get a look at your FICO score. However, it could be a little bit inaccurate due to possible missing information.

But the premium version of Credit.com -- ExtraCredit -- offers one of the most accurate looks at your credit score. With ExtraCredit, Credit.com will consider information from all three of your credit reports when determining your credit score. The additional information should lead to a very accurate score.

Beyond that, ExtraCredit provides a glimpse at 28 different FICO scores. Since a lender may choose to look at any of those scores, ExtraCredit gives you a better idea of what lenders are seeing on the other side of the table.

Pros of Credit.com

-

Free FICO score

-

Ability to see 28 different FICO scores with paid features

-

Premium version factors in reports from all three credit bureaus

Cons of Credit.com

-

Must upgrade to the premium version to enjoy best features

-

Premium version has a steep monthly cost

WalletHub

WalletHub offers a unique twist to your free credit report. Instead of updating your credit report on a monthly or weekly basis, WalletHub offers free updates to your credit score on a daily basis. In addition to daily updates, you’ll find free credit monitoring to prevent potential identity theft.

As you continue to use WalletHub, the site uses your information to provide advertisements to you for loan products.

Finally, WalletHub scours your financial habits to look for ways that you can improve your credit score.

How Accurate is WalletHub?

WalletHub uses the information in your TransUnion credit report to provide a credit score using the VantageScore 3.0 model.

As we’ve mentioned before, a credit score based on the information from a single credit bureau could be a little bit inaccurate based on potential missing information. But the daily updates ensure that you are looking at the latest information available from TransUnion.

Pros of WalletHub

-

Credit reports updates on a daily basis

-

Free to use

Cons of WalletHub

-

Limited additional financial tools

-

Credit score not based on comprehensive information

What Factors Contribute to Your Credit Score

There are several factors that contribute to your credit score. Each credit scoring model will weigh them differently in their calculation:

-

Payment history: Since you first established credit, on-time and late payments on your accounts have been tracked and will impact your score.

-

Credit utilization: The amount of credit you use – compared to the amount of credit you have – should not exceed 30%.

-

Length of your credit history: The longer your credit history, the better. It’s recommended to keep your old accounts or credit cards open unless it’s essential to close them.

-

Credit mix: It’s best that your credit types vary, including installment debt and revolving debt.

-

Time since you last applied for credit: Every time you apply for credit through a hard inquiry, it causes your credit score to drop a couple of points.

-

Total balances and amount of debt: Keep the balances on your credit cards low and pay them off every month. The amount of credit you have versus your available credit is important.

How To Raise Your Credit Score

There are many ways to raise your credit score, however, it won’t be a quick fix. To make a difference in your score over time, keep the following points in mind:

1. Pay Your Bills on Time

If you’re trying to boost your credit score, one of the easiest things you can do is pay your bills on time. Avoid missing payments by setting up automatic payments or putting a reminder on your calendar. Making frequent payments can also help. This lowers your credit utilization more often than if you paid once per month.

2. Get Credit for Utility and Cell Phone Payments

You can use services like Experian Boost to instantly improve your credit score. Once you provide access to your bank account, Experian will add up to 24 months of utility and cell phone bill payments to your credit history.

3. Pay off Debt and Keep Balances Low

Your credit utilization ratio measures the amount of credit you have used compared to your total available credit. In an effort to maintain or boost your score, you should not use more than 30% of your available credit. Simple methods include paying off your credit card each month and working towards debt repayment. This shows lenders that you understand how to manage credit responsibly.

4. Don’t Close Old Credit Cards

If you close old cards, it will affect your score and increase your credit utilization ratio. Keep them open unless you have an important reason (like high membership fees) to close them. A positive history can boost your score more than you might realize.

5. Only Apply for Credit You Need

When trying to raise your credit score, only apply for credit that you actually need. Avoid multiple inquiries, as they can cause your score to take a hit (by up to five points). Credit pulls become hard inquiries and stay on your credit report for two years and multiple inquiries over a short period of time may make lenders think you are a risky borrower for loans or credit cards.

6. Become an Authorized User

If you have a relative or friend with good credit history and a high credit limit, they may be willing to help you build your credit by adding you as an authorized user to their credit card. You don’t have to use the card or hold the account login details to reap the benefits. People who have little-to-no credit history can gain some history as well as a lower credit utilization.

7. Use a Secured Credit Card

Apply for a secured credit card that reports your activity to the three credit bureaus. You’ll pay an upfront deposit that becomes your credit limit on the card, reducing the credit card issuer’s risk while helping you build credit.

8. Keep a Good Credit Mix

The credit account types you hold (such as installment accounts and revolving credit) are important factors that go into calculating your credit score. Aim to have both types of credit. Installment accounts include monthly payments based on your spending such as credit cards, retail store cards, gas station cards, and home equity lines of credit (HELOC). Revolving credit includes fixed monthly payments such as mortgages, auto loans, and student loans.

9. Dispute Credit Report Errors

Errors on credit reports can lower your score. Be sure to check your free credit reports for mistakes, and if you spot any, dispute them so they get removed.

How to Dispute a Charge on Your Credit Report

You can dispute a charge on your credit report by mailing the applicable information to each credit bureau. It is important to use certified mail and a request return receipt. This ensures that your personal information stays safe. The credit bureau has 30 days from the date of receipt to respond to your dispute. Provide as much proof as possible so that the inaccurate information can be removed from your credit report.

10. Avoid Bankruptcy, Delinquencies, Foreclosure, or Being Sent to Collections

Bankruptcies, delinquencies, and foreclosure will wreak havoc on your credit score. They will stay on your credit report for years and will make it hard to rebuild your history.

11. Increase Your Credit Limits

Asking to increase your credit limit is an easy way to lower your credit utilization – as long as your overall balances stay the same. When you inquire, ask your credit card company whether the change will reflect as a “hard inquiry” on your credit report.

Why Credit Scores Go Down

Credit scores drop for a variety of reasons, but the biggest is making late payments. Even a single late payment can lower your score 50-100 points, depending on the situation.

Other factors that may include:

-

Closing old credit card accounts

-

Applying for multiple lines of credit over a short period of time

-

High credit utilization

-

Making risky purchases

-

Using too many low-limit credit cards

-

Getting a divorce

-

Making only the minimum payment

-

Unpaid tickets and library fees

-

Not exercising your credit

-

Reducing your credit limit

-

Paying off debt

-

Negative remarks or a mistake on your credit reports

-

Becoming a victim of identity theft

How to Maintain and Protect Your Credit Score

Maintaining and protecting your credit score is easy when you have good financial habits. Make sure that you pay your bills on time, avoid racking up credit card debt, and avoid applying for new credit.

If you have a high credit utilization rate (ie. more than 30% of your credit line outstanding), pay the balance down, ask for a credit line increase, or consolidate your debt onto a balance transfer credit card. Also, be sure to check your credit regularly to spot any errors or fraudulent activity.

Credit scores above 700 will instill more confidence in your creditworthiness. With a credit score in the “good” range, you’ll show that you handle credit responsibly and are less likely to default on a loan. You’ll also receive significantly lower interest rates and will be approved for lines of credit more easily.

Check Your Credit Score Annually

At minimum, it’s important that you check your credit score annually. This will help you find opportunities for improvement and ensure that there are no errors or fraudulent transactions. If your credit score isn’t between 600 and 750, find out how you can raise it. To simplify the process, ask your credit card companies or bank for free credit monitoring.

Monitor Regularly for Changes

Sign up for credit monitoring with Experian and receive notifications whenever your credit score changes. There are also multiple avenues to receive free credit scores, such as through your bank and credit card companies, as well as credit bureaus each year.

Keep a close eye on your credit score to prevent fraudulent activity and ensure that all changes are accurate. If you experience a drop in credit score, determine how you can improve it moving forward, prevent drops in the future, and dispute the issue (if you weren’t responsible).

Build Your Score Over Time

It takes time to build a credit score, especially if you’re starting from a poor or fair credit rating. Positive financial habits will eventually pay off. Though you won’t see a drastic credit score change right away, consistent efforts should help your score to rebound over time.

Summary

A good credit score can open up financial doors to lower interest rates and better financing terms. If you ever plan to finance a major purchase, such as a vehicle or house, or even just need credit to rent an apartment or get a credit card, then working towards a good credit score is a smart move.

The good news is that you can absolutely improve your credit score with good money management habits. Keeping an eye on your credit score will help you keep things moving in the right direction.