What Is Marginal Tax Rate?

Marginal tax rate is the rate at which an additional dollar of taxable income would be taxed. It is part of a progressive tax system, which applies different tax rates to different levels of income. As income rises, it is taxed at a higher rate (according to the marginal tax bracket it falls in).

Note: Income is not taxed at a single rate, but at multiple rates, according to each tax bracket it falls in. Each tax rate only applies to income that falls within the corresponding bracket – each additional dollar beyond that bracket will be taxed at the next highest marginal rate.

How to Determine Marginal Tax Rate

Sarah has a taxable income of $100,000 per year. Her income will be taxed using the following marginal tax rate examples:

| Tax bracket | Marginal Tax Rate | Amount taxable | Tax payable |

|---|---|---|---|

| $0-$20,000 | 0% | $20,000 | $0 |

| $20,000-$40,000 | 10% | $20,000 | $2,000 |

| $40,000-$60,000 | 20% | $20,000 | $4,000 |

| $60,000-$80,000 | 30% | $20,000 | $6,000 |

| $80,000-$100,000 | 40% | $20,000 | $8,000 |

| $100,000+ | 50% | $0 | $0 |

| Total | $100,000 | $20,000 |

As you can see, Sarah’s income will be taxed at different rates as it moves through the tax schedule, increasing as it enters each new bracket. Since any additional earnings would fall into the $100,000+ bracket, her marginal tax rate would be 50%.

How to Find Marginal Tax Rate

To calculate marginal tax rate, you'll need to multiply the income in a given bracket by the adjacent tax rate.

If you’re wondering how marginal tax rate affects an increase in income, consider which bracket your current income falls. If your income will remain in the same bracket after the increase, you’ll simply multiply the increase by the corresponding tax rate.

Marginal Rate Calculation Example #1

John’s taxable income is $50,000 per year, meaning that his marginal tax rate will be 20%. He gets a raise of $10,000, bringing his income to $60,000 per year. The additional income will be taxed at 20% because that income still falls within his current tax bracket. In this situation, his raise will be subject to: $10,000 x 0.20 = $2,000 in taxes.

| Tax Bracket | Tax Rate |

|---|---|

| $0-$20,000 | 0% |

| $20,000-$40,000 | 10% |

| $40,000-$60,000 | 20% |

| $60,000-$80,000 | 30% |

If an increase in income pushes his income into the next tax bracket, the increase is subject to two tax rates. First, it will be taxed at John’s current marginal tax rate until it reaches the top end of his current bracket. Secondly, any amount that exceeds his current bracket will be taxed at the next highest rate.

Marginal Tax Rate Calculation Example #2

Mary’s income is $50,000 per year, meaning her marginal tax rate is 20%. She gets a raise of $15,000, bringing her income to $65,000 per year. The first $10,000 of her raise will be taxed at 20% because it’s within her current bracket, but the next $5,000 will be taxed at 30% because it falls within the next bracket. In this situation, Mary’s raise will be subject to: ($10,000 x 0.20 = $2,000) + ($5,000 x 0.30 = $1,500) = $3,500 in taxes.

| Tax Bracket | Tax Rate |

|---|---|

| $0-$20,000 | 0% |

| $20,000-$40,000 | 10% |

| $40,000-$60,000 | 20% |

| $60,000-$80,000 | 30% |

Common Marginal Tax Rate Mistakes

Filing your taxes can be a daunting task, with all sorts of terms and forms to be aware of – and there are also a variety of different tax rates that are easily confused. Here’s how marginal tax rate compares to other common tax rates:

The Difference Between Marginal Tax Rate and Effective Tax Rate

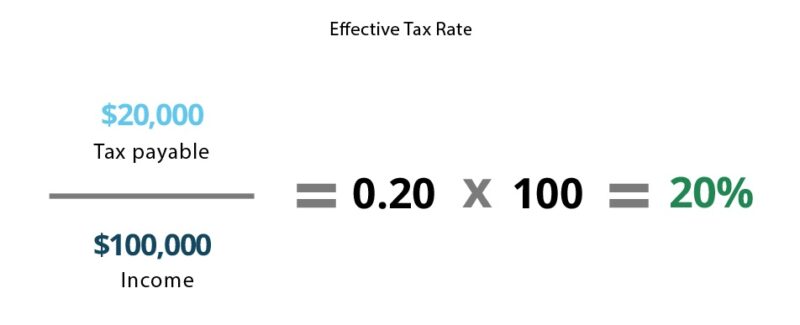

Unlike marginal tax rate – which is the highest rate that applies to your income – an effective tax rate is the overall percentage of your income that goes towards taxes. It’s calculated by dividing the total amount of tax payable by pre-tax income.

Using the example above, Sarah’s effective tax rate would be:

In this situation, Sarah’s effective tax rate would be 20% (compared to her marginal tax rate of 50%).

Marginal Tax and Flat Tax Rate

A flat tax rate is exactly what it sounds like: It’s a single tax rate that is applied to all incomes, regardless of the amount. Using Sarah’s $100,000 income example, a flat tax of 15% would mean that Sarah owes $15,000 in taxes.

It’s worth noting that some states utilize a flat income tax rate. These include Colorado, Illinois, Indiana, Massachusetts, Michigan, New Hampshire, Pennsylvania, and Tennessee.

US Federal 2020 Income Tax Brackets

Marginal tax rates and brackets can change from year to year, like the adjustments made by the Tax Cuts and Jobs Act in 2018. While rates and income brackets could be subject to change in the future, here are the marginal tax brackets for 2020:

| Tax rate | Single filer Income above | Married individuals filing jointly Income above | Married individuals filing separately Income above | Head of household Income above |

|---|---|---|---|---|

| 10% | $0 | $0 | $0 | $0 |

| 12% | $9,876 | $19,751 | $9,876 | $14,101 |

| 22% | $40,126 | $80,251 | $40,126 | $53,701 |

| 24% | $85,526 | $171,051 | $85,526 | $85,501 |

| 32% | $163,301 | $326,601 | $163,301 | $163,301 |

| 35% | $207,351 | $414,701 | $207,351 | $207,351 |

| 37% | $518,401 | $622,051 | $311,026 | $518,401 |

US Federal 2021 Marginal Tax Rates

For taxes due in April 2022, the following 2021 marginal tax rates apply:

| Tax rate | Single filer Income above | Married individuals filing jointly Income above | Married individuals filing separately Income above | Head of household Income above |

|---|---|---|---|---|

| 10% | $0 | $0 | $0 | $0 |

| 12% | $9,951 | $19,901 | $9,876 | $14,201 |

| 22% | $40,526 | $81,051 | $41,126 | $54,201 |

| 24% | $86,376 | $172,751 | $85,526 | $86,351 |

| 32% | $164,926 | $329,851 | $163,301 | $164,901 |

| 35% | $209,426 | $418,851 | $207,351 | $209,401 |

| 37% | $523,601 | $628,301 | $311,025 | $523,601 |