What Is Leverage Ratio?

A leverage ratio is used to evaluate a company’s debt load in relation to its equity and assets. Investors use leverage ratios to understand how a company plans to meet its financial obligations and to determine how its debt is used to finance operations.

These types of financial ratios shouldn’t be used alone but alongside other metrics to determine a company’s overall economic health.

What Is a Good Leverage Ratio?

When the debt ratio is low (below 1.0), principal and interest payments don't command such a large portion of the company's cash flow. This means that the company isn’t as sensitive to changes in business or interest rates. However, a low debt ratio may also indicate that the company has an opportunity to use leverage as a means of responsibly growing the business.

Lenders and investors tend to prefer low leverage ratios. Their interests are better protected if the business declines and the shareholders are more likely to receive at least some of their original investment back in the event of a liquidation.

What Is a High Leverage Ratio?

When the debt ratio is high (above 1.0), principal and interest payments will take a significant amount of the company's cash flows. Any sort of hiccup in financial performance (or even a rise in interest rates) could result in the company defaulting.

High leverage ratios may also prevent a company from attracting additional capital.

Common Types of Leverage Ratios

The most common leverage ratios are the debt ratio and the debt-to-equity ratio.

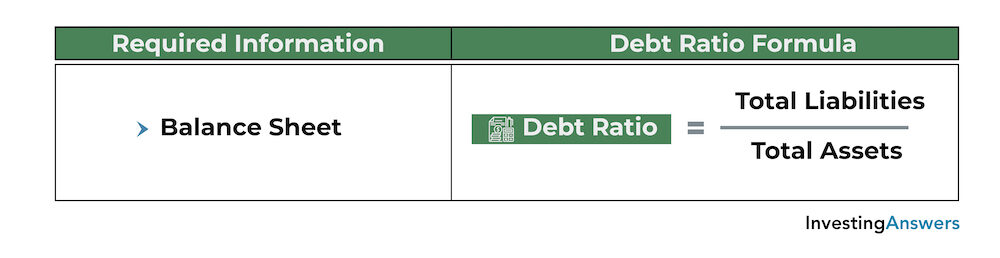

What Is Debt Ratio?

A debt ratio is simply a company's total debt divided by its total assets.

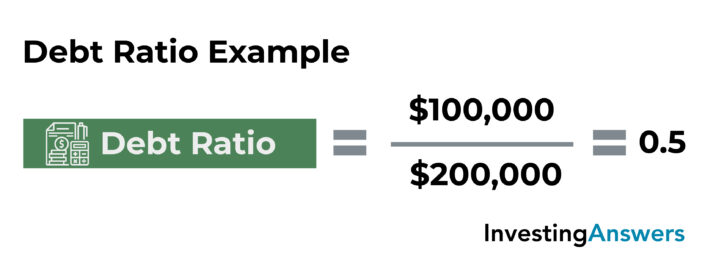

Debt Ratio Example

Company ABC has $200,000 in total assets and $100,000 in total liabilities. Their debt ratio can be calculated thusly:

Company ABC would have a debt ratio of 0.5, meaning that its debt accounts for half of its assets.

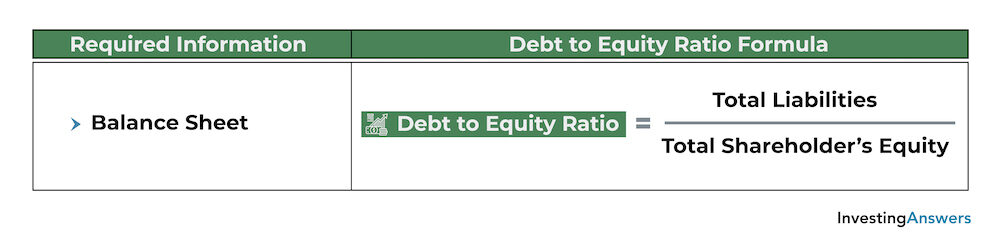

What Is Debt-to-Equity Ratio?

Debt-to-equity ratio (also referred to as D/E ratio) measures the relationship between the capital contributed by creditors and the capital contributed by owners. It also shows the extent to which shareholders' equity can fulfill a company's obligations to its creditors (in the event of a liquidation).

Debt-to-Equity Ratio Formula

The formula for the debt-to-equity ratio is as follows:

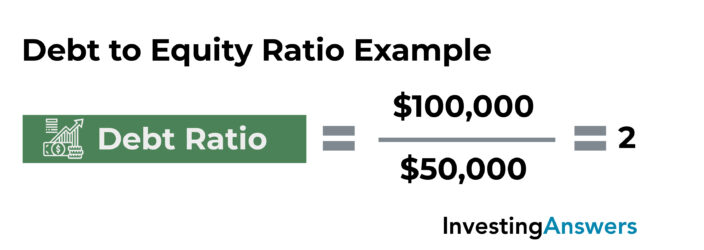

Example of Debt-to-Equity Ratio

If Company XYZ had $100,000 of liabilities on its balance sheet and $50,000 of shareholders’ equity, then Company XYZ's debt ratio would be:

For every dollar of Company XYZ assets, Company XYZ had $2 of debt. This means that its shareholders’ equity wouldn’t be able to cover all of its debt.

Debt-to-Equity Leverage Ratio Analysis

A high debt-to-equity ratio may indicate that a company isn’t able to generate enough cash to satisfy its debt obligations. However, low debt-to-equity ratios might also indicate that a company isn’t taking advantage of the increased profits that financial leverage can bring.

Because there are multiple ways to calculate D/E ratio, it is important to clarify which types of debt and equity are used when comparing these ratios.

The timing of asset purchases – and differences in debt structures – can generate differing debt ratios for similar companies. This is why debt ratios are typically most meaningful between companies within the same industry (and the definition of a 'high' or 'low' ratio) should be made within this same context.