What Is the Debt to Equity Ratio?

An essential formula in corporate finance, the debt to equity ratio (D/E) is used to measure leverage (or the amount of debt a company has) compared to its shareholder equity.

All companies have a debt to equity ratio, and while it may seem contrary, investors and analysts actually prefer to see a company with some debt. That’s because debt can be used to help companies finance activities that lead to long-term growth.

Consider debt as the amount of capital contributed by creditors, compared to the amount of capital contributed by shareholders (equity). Lenders want to see just how much a company owes others (debts) versus how much capital is available.

Is a Low Debt to Equity Ratio Better?

Lenders and investors usually prefer low D/E ratios because their interests are better protected in the event of a business decline. Thus, firms with high debt to equity ratios may not be able to attract additional capital (equity). If a company owes too much, it may not be able to take on more debt or obtain additional capital from shareholders.

The video below offers more insight how the D/E ratio can be used to assess a company’s potential by investors:

How to Calculate Debt to Equity Ratio

To calculate the debt to equity ratio, you’ll need to find the total liabilities and total shareholder equity (located on a company balance sheet). Liabilities are what the company owes others. Shareholder’s equity is the company’s book value – or the value of the assets minus its liabilities – from shareholders’ contributions of capital.

A D/E ratio greater than 1 indicates that a company has more debt than equity. A debt to income ratio less than 1 indicates that a company has more equity than debt.

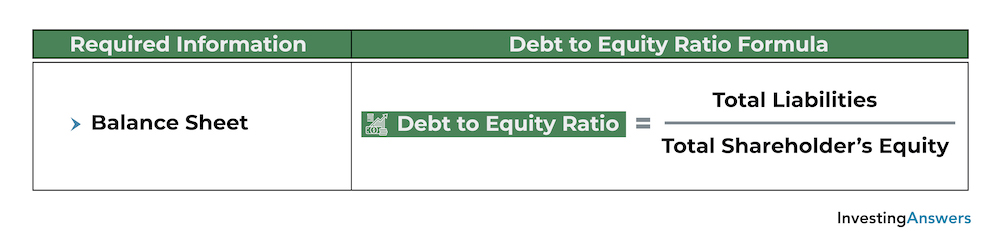

The Debt to Equity Ratio Formula

Calculate the D/E ratio with the following formula:

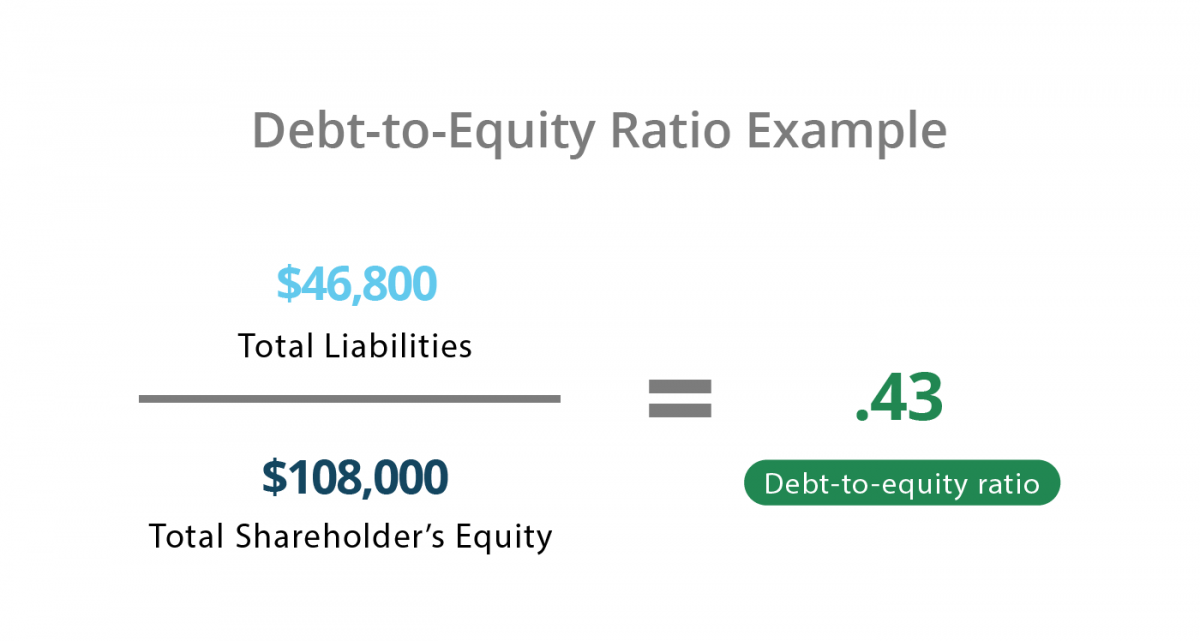

Debt to Equity Ratio Example

Check out the debt to equity ratio example below:

What Is an Ideal Debt to Equity Ratio?

Although a low debt to equity ratio may be more desirable, it’s not always practical: Some industries require more significant investments than others, especially when it comes to equipment and infrastructure.

Analysts, investors, and lenders use industry benchmarks to assess whether a company’s debt to equity ratio is high or low for the relevant industry average. D/E ratios of comparable companies (within the same industry) provide additional context to judge whether the ratio is too high, too low, or acceptable.

What’s a Good Debt to Equity Ratio?

Investors typically look for a D/E ratio that hovers around the middle of the average industry range. Industry benchmarking sites provide the average ratio for a wide range of industries each year.

Industries with Lower D/E Ratios

Industries that tend to have low debt to equity ratios:

Forestry

Metal mining

Agricultural services

Personal services

Industries with Higher D/E Ratios

Industries with higher debt to equity ratios tend to invest more heavily in infrastructure and equipment to deliver their products and services, such as:

Finance and banking

Insurance

Airlines

Auto dealers

Railroads

Telecommunications

Railroads, for example, take on higher debt to pay for the equipment necessary to deliver their services. A new diesel locomotive costs between $500,000 and $2 million. If a railroad needs to replace several locomotives per year – or wishes to add to its fleet – it may need to take on debt, which can increase its debt-to-equity ratio.

What’s a Negative Debt to Equity Ratio?

A negative debt to equity ratio occurs when a company has negative equity. If the book value of its shareholders’ capital is eroded by losses/negative profits – and the company is unable to earn profits – it may be unable to pay back its debt.

Before determining whether a negative D/E ratio is worrisome, analysts require further research to understand the situation and its implications.

Limitations of the Debt to Equity Ratio

As with all financial metrics, the debt-to-equity ratio is only part of the whole picture. By itself, a low debt-to-equity ratio may not mean that a company is a good potential investment.

For example, if a company took on debt for expansion purposes, their debt to equity ratio may be high this year – but it may be a positive sign of growth. Reading through their entire annual report – and conducting further research – will provide a far clearer picture.

Lastly, capital-intensive industries (with high D/E ratios) may be a good investment after considering all factors. It is, however, only one of many financial ratios that investors and analysts consider while reviewing potential investments.

Why Is the Debt to Equity Ratio Important?

Generally, a high debt to equity ratio indicates that a company may not be able to generate enough cash to satisfy its debt obligations. However, low debt to equity ratios may also indicate that a company isn't taking advantage of the increased profits that financial leverage may bring.

It’s important to remember that the comparison of debt to equity ratios is generally most meaningful among companies within the same industry, and the definition of a 'high' or 'low' ratio should be made within this context.