What is a Federal Housing Administration (FHA) Loan?

Loans insured by the Federal Housing Administration (FHA) are designed for borrowers who can't qualify for a conventional mortgage. They offer relaxed credit and underwriting guidelines, and even have specific program types for various financing situations.

One of the common misconceptions with FHA loans is that the agency actually provides the mortgages. But the reality is that FHA only provides insurance on the loans, which is designed to reduce the risk of borrower default for lenders. With FHA insurance as part of a mortgage, the lender is much more likely to approve the loan.

Much like private mortgage insurance with conventional mortgages, borrowers pay for FHA insurance mortgage coverage. The mortgage insurance premium, or 'MIP,' is based on an annual premium factor, and charged monthly with your total house payment.

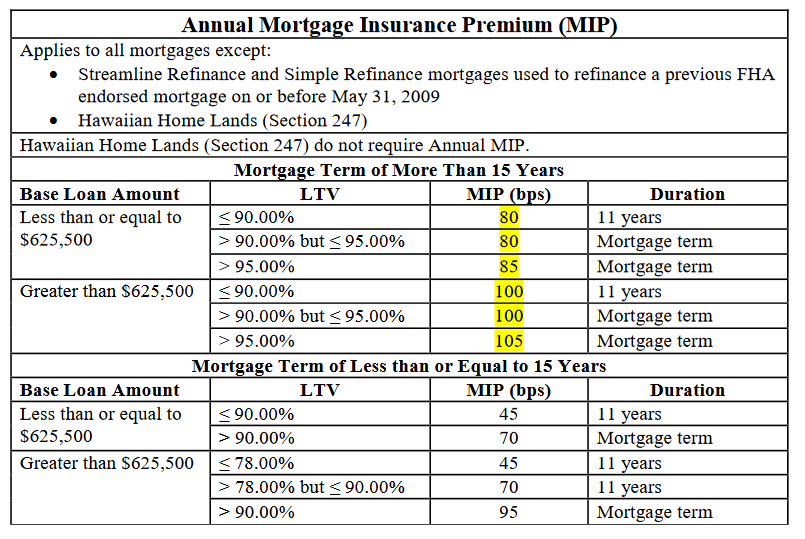

The MIP factors for 2021 are as follows:

LTV = Loan to Value

MIP (bps) = The multiplier used to determine your MIP payment. An MIP of of 80 bps means you multiply your mortgage amount by 0.0080.

Duration = How long you will pay the MIP for.

As you can see from the screenshot above, how much you'll pay for MIP varies based on your mortgage amount and the percentage of the home value you are borrowing.

For example, let's say you're taking a 30-year, $200,000 mortgage on a $210,000 home.

The mortgage is equal to more than 95% of the purchase price of the home, which means your MIP factor is 85. This translates into an annual premium of $1,700 ($200,000 times 0.0085). When divided by 12 months, the MIP will add $141.67 to your monthly house payment. And you'll pay this additional amount for the entire duration of your mortgage.

Assuming you never refinance, the MIP will cost a total of $51,000

However, if you could come up with more money down and borrow $186,000 instead, you'd pay $124.00 per month and only have to pay it for 11 years. This gives you a total cost of $16,368.

Lower MIP rates are available for refinances.

FHA loans also have an upfront mortgage insurance premium (UFMIP). It's equal to 1.75% of the loan amount. Though it can be paid at the time of purchase, either by the borrower or by the seller, it's most commonly added to the mortgage amount and financed over the life of the loan.

For example, UFMIP will be $3,500 on a $200,000 mortgage ($200,000 X 0.0175). When added to the mortgage amount, the borrower will finance $203,500 over the life of the loan.

Types of FHA Loans

Though discussions of FHA loans tend to focus on a single loan type, there are actually several varieties. Each is designed to serve a specific market niche and has its own requirements and benefits.

Basic Home Mortgage: 203(b)

This is the most common type of FHA mortgage. It's available to the general buying public for the purchase of owner-occupied, 1-to-4 family residences.

Loans are available in terms of 15 or 30 years and can be either fixed or adjustable, though fixed rate FHA loans are by far the most popular. Interest rates on 203(b) loans are competitive with those on conventional mortgages.

Rehab Mortgage: 203(k)

This program enables both homebuyers and current homeowners to buy or refinance a home and include the cost of property rehabilitation in the loan. It provides the borrower with the benefit of having a single monthly payment on just one loan.

This arrangement avoids the need to obtain two types of financing:

The purchase money mortgage, and

a rehabilitation loan to make the desired renovations.

When a 203 (k) loan is taken, proceeds are first used to either purchase the home or pay off the existing indebtedness (in the case of a refinance). The additional funds are then allocated to the property renovation.

Funds for the renovation portion are held in escrow, and released as renovations are completed. The cost of the renovations must be a minimum of $5,000 in total, and be used for approved improvements, like structural alterations and reconstruction, or the elimination of health and safety hazards, among others.

Construction-to-Permanent Loan

Sometimes referred to as a 'one-time close loan,' FHA construction-to- permanent loans can be used to finance the construction of a new home, from the purchase of the land, through the completion of the home, and the transition to a permanent mortgage. And it all happens with a single closing.

The program can be used for the construction of single-family primary residences, including 'stick built' and manufactured homes.

The one-time close feature eliminates the need to have two loans, a construction loan during the home building phase, and permanent financing upon completion.

Title 1 Property Improvement Loan

While a 203(k) loan is a standalone mortgage that can be used to improve the property, a Title 1 loan is a separate loan that can be used in conjunction with an existing mortgage or even a 203(k) loan.

Title I loans are used to finance alterations, repairs and improvements for a home which has been occupied for at least 90 days, a non-residential purpose, or to finance the construction of a new exclusively non-residential structure. Improvements must substantially protect or improve the basic livability or utility of the property.

Title I loans are available through banks, credit unions, and mortgage companies, in terms ranging from as little as six months to more than 20 years.

Depending on the property type and purpose, loan amounts are available for up to $60,000, though amounts exceeding $7,500 must be secured by a lien on the subject property.

Energy Efficient Mortgage

Energy Efficient Mortgages (EEMs) are designed to help homeowners reduce utility bills by providing financing for energy-efficient improvements. Those improvements can include active and passive solar and wind technologies. The program is available for both new and existing homes.

There are specific requirements for the energy improvements made, as well as guidelines that determine the amount of financing available.

Home Equity Conversion Mortgage

Home equity conversion mortgages (HECMs) are more commonly known as reverse mortgages. Designed for homeowners 62 and over, they enable homeowners to withdraw a portion of their home equity to cover living expenses. But the primary attraction is that rather than a homeowner making monthly payments to the lender, the lender makes payments to the homeowner. That's where the word 'reverse' comes into the picture.

The amount that can be borrowed is based on the value of the home and the equity in it, using a formula based on the homeowner's age. Proceeds from the loan will be paid to the homeowner on a monthly basis.

To qualify, a homeowner must meet the age requirement, and either own the property outright or have a large amount of equity. The home must be occupied as a principal residence, and the owner cannot be delinquent on any federal debts.

In addition, the homeowner must demonstrate the ability to pay the other costs of homeownership, including property taxes, homeowner's insurance, utilities, repairs and maintenance.

Section 245(a) Loan

These loans are what are known as growing equity mortgages. Designed specifically for borrowers with rising incomes, they start out with reduced mortgage payments in the early years that gradually rise over time.

The program is designed for first time home buyers purchasing primary residences. There are a total of five plans within the program, and each provides for monthly payments to increase by a fixed percentage during each year of the loan. The increase can be between 1% and 5% per year, depending on the plan selected.

How to Apply for an FHA Loan

Not all lenders offer FHA insured loans. They're available only through banks, credit unions and mortgage companies that participate in, and are approved by, the US Department of Housing and Urban Development, which is the overseer of the FHA program.

Many lenders advertise FHA loan availability. But if you're not sure which lenders participate in the program, you can take advantage of the HUD Lender List Search page. You can use it to find lenders who make the loans available in your area.

How to Qualify for an FHA Loan

Similar to qualifying for conventional financing, FHA loan qualification is based on a combination of your credit, income, and down payment.

Credit Requirements

Lenders generally require a minimum credit score (FICO) of 580. However, some will go as low as 500 if you make a down payment equal to at least 10% of the purchase price of the home you're buying, or you have at least 10% equity in the property you're refinancing.

But lenders will also look at the specific components of your credit. Chief among them will be your current house payment history, whether that's rent or a mortgage. A pattern of consistent late payments here may disqualify you even if you meet the minimum credit score requirement.

FHA also has specific requirements for both prior bankruptcy and foreclosure.

For example, you generally must wait at least two years after the discharge of a Chapter 7 bankruptcy to be eligible for an FHA loan. If you are currently in Chapter 13, you must be in the plan for at least 12 months with a satisfactory payment history. In the case of foreclosure, at least three years must pass.

Whether it's a bankruptcy or a foreclosure, the event must have been the result of extenuating circumstances. If not, the required timeframe will be longer.

In the case of either a bankruptcy or foreclosure, the borrower must maintain good credit since the event took place.

In addition, amounts owed by borrowers as a result of either judgments or government liens must be paid prior to closing.

It's also possible to be approved for an FHA loan if you don't have a credit score. Under FHA guidelines, you may qualify based on a consistent payment history for recurring expenses, like rent and utilities, as long as you don't normally use traditional credit. Naturally, your payment history for those expenses will be carefully evaluated for on-time performance.

Income Requirements

Lenders generally look for a minimum history of two years of stable or increasing income. Short periods of unemployment may be acceptable as long as the borrower is currently re-employed with a high likelihood of continued employment.

Similarly, new college graduates and recently discharged members of the military can count their school or military service as part of their employment history. However, they must be currently employed to qualify.

On the income side, your debt-to-income ratio (DTI) shouldn't exceed 43%. However, some lenders will exceed that limit if you have certain favorable factors, like excellent credit, large cash reserves after closing, or an income source that isn't being included in the debt calculation.

DTI is your new monthly house payment, plus recurring monthly debts, divided by your stable monthly income. Those debts do not include utilities, payroll taxes or insurance premiums (other than the MIP and homeowner's insurance, which are part of your monthly mortgage payment). However, they will include court ordered payments, such as child support or alimony.

For example, let's say you have a stable monthly income of $5,000. The new monthly house payment will be $1,500, but you also have a $400 car payment and another $200 in credit card payments.

Your total fixed monthly obligations are $2,100. When divided by your stable monthly income of $5,000, your DTI will be 42%. Since it doesn't exceed 43%, your income will qualify for the loan you've applied for.

Down Payment

On most FHA loans, you'll be required to make a down payment equal to 3.5% of the purchase price of the home you're buying. That will come to $7,000 on the purchase of a $200,000 home.

There are three ways the down payment funds can be provided:

From your own funds

A gift from a family member

Down payment assistance

Down payment assistance is frequently available through state and local agencies. They'll provide either a grant or a forgivable loan (you'll make payments for a time, but the balance will be forgiven after a certain number of years have passed). In that way, it's possible to purchase a home using FHA financing with no down payment whatsoever.

But there are two other upfront cash requirements that need to be considered, closing costs and escrows.

Closing costs are fees incurred to obtain the mortgage, though they can also include other costs, like a home inspection, state and local mortgage taxes, and other fees. In a typical purchase or refinance transaction, closing costs can equal between 2% and 3% of the new mortgage amount.

Escrows are amounts collected at closing to cover home-related expenses, like real estate taxes and homeowner's insurance. These can range anywhere from a few hundred dollars to several thousand dollars, depending on escrow practices in your area, as well as the amount of your property taxes and homeowner's insurance.

Fortunately, closing costs, and escrows can and frequently are paid by the property seller. Under FHA loan terms, sellers can pay up to 6% of the loan amount toward closing costs and escrows.

FHA Loans vs. Conventional Loans

As a general rule, FHA loans are more flexible and accommodating than conventional loans.

The table below shows a side-by-side comparison of the two loan types:

| Criteria/Loan Type | Conventional | FHA |

|---|---|---|

| Minimum Down Payment | 3.0% | 3.5% |

| Properties Financed | Owner occupied 1 – 4 family homes, second homes and investment properties | Owner occupied 1 – 4 family homes only |

| Minimum Credit Score | 620 | 580, but 500 with a 10% down payment |

| Major Credit Event Waiting Period | Ch. 7 bankruptcy: two years with extenuating circumstances Ch. 13 bankruptcy: one year with extenuating circumstances Foreclosure: 3 years with extenuating circumstances | Similar |

| Down Payment Source of Funds | Own funds only | Own funds, gift, or down payment assistance |

| Mortgage Insurance Requirement | Required only on loans with less than 20% down | Required on all loans |

| Upfront Mortgage Insurance Premium | None required | 1.75% of the loan amount |

| Monthly Mortgage Insurance Premium | 0.17% to 2.33% of the loan amount, divided by 12 | 0.45% to 1.05% of the loan amount, divided by 12 |

FHA Loan Limits

FHA loan limits are set for each calendar year, typically increasing to reflect the rise in property values nationwide. But exactly what limit will apply will depend on where you live. This is generally determined by the county where the property is located that's either being purchased or refinanced.

FHA loans are determined by whether an area is considered to have low-cost or high-cost property values, or somewhere in between. They also consider the number of units in the property. Since FHA loans are available for 1-to-4 family residences, the maximum loan amount in your area will be different for each property size.

A real estate agent or mortgage lender will have access to the maximum FHA loan limits for your area.

If you want to know in advance what the maximum amount is in your area for the property type you're buying or refinancing, you can enter your property information in the FHA Mortgage Limits webpage.

History of FHA Loans

The Federal Housing Administration was created as part of the National Housing Act of 1934, in the depths of the Great Depression. It was designed to increase homeownership at a time when economic conditions created mass foreclosures and home financing was largely unavailable.

FHA operates within the United States Department of Housing and Urban Development (HUD), and provides mortgage insurance for lenders, rather than direct loans to homeowners and buyers.

Since its founding, FHA has provided more than 50 million mortgages, including 8.5 million loans currently outstanding.

Summary

If you're unable to qualify for a conventional mortgage, you may be approved for an FHA loan. The combination of relaxed down payment and credit guidelines may make homeownership possible, even if you've been turned down for other loan types.