What Is Deadweight Loss?

When supply and demand are out of equilibrium, the market inefficiency created and the societal cost is known as deadweight loss.

When used in economics, deadweight loss will be applied to the deficiency that has occurred due to the inefficient allocation of economic resources. Often, inefficiency is created by the imposition of regulations such as price or rent controls, minimum wages, excessive taxation, trade policy, and other laws.

Deadweight Loss Formula and How to Calculate Deadweight Loss

Deadweight loss can be calculated in four steps:

- Identify what amount of good or service is currently being produced (Q1).

- Identify the optimum societal amount of the good or service (MC= supply and MB=demand) and where the equilibrium should occur (Q2).

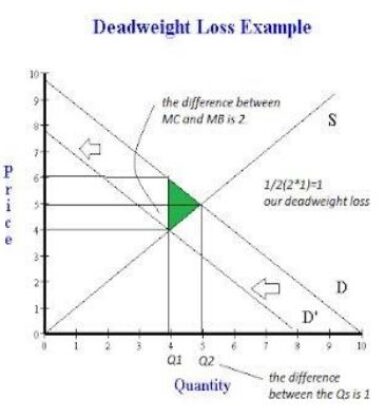

- The supply and demand curves will create a triangle shape which will cross at Q2. The base will be the difference between Q1 and Q2 with the base being the difference between MB and MC (the most common price differences).

- The equation for the area of the triangle is ½ (base*height). Therefore to calculate the deadweight loss, ½ (difference between Q1 and Q2 * the difference between MB and MC).

Causes and Examples of Deadweight Loss

Market inefficiency leads to deadweight loss due to supply and demand being out of equilibrium. In an efficient market, as prices rise or fall, profits also adjust and encourage or discourage supply, keeping the market in equilibrium.

If demand for a good is elastic, meaning that demand will fluctuate in response to price, and prices rise, consumers will buy less of that good. If demand remains low, the product may vanish from the marketplace altogether and those resources devoted to producing something else that consumers demand.

However, if demand for a good is inelastic, as it may be for necessities such as housing or health care, and prices rise, demand will remain high but many consumers will simply not have access to that good; they will be “priced out” of the market. In those cases, public policy makers have often sought to remedy the situation by imposing price limits on such goods, for example, by using rent control. Those price limits then discourage suppliers, who supply less at the lower price. The resulting market inefficiency is the deadweight loss.

Taxes or import tariffs on certain goods can also cause deadweight loss. For example, higher taxes imposed on fuel can add to the price of gasoline. As the increased price causes consumers to drive less, this will shrink producer profit margins as well, so that both producers and consumers are realizing less utility from an inefficient market.

The Importance of Deadweight Loss

Being able to calculate and recognize deadweight loss is important to help policy makers determine when certain policies may be ineffective or damaging to the efficient market.

Recognizing market inefficiencies early can help to determine if and which measures are needed and to prevent further economic decline by removing market unfriendly policy or applying stimulus where needed. Investors or business managers can also benefit from recognizing deadweight loss as an opportunity to create efficiency.