Student loans might be necessary to attend school, but they can also leave you with a mountain of debt that can quickly get confusing. From student loan basics to monthly payment plans, learn how to develop a payoff plan and discover your refinancing options.

Compare Private Student Loan Rates

If you’re looking to refinance your student loans or searching for the right private student loan, the table below will show you the best rates according to your location.

Student Loan Basics

Not all student loans are created equal. Whether you’re just starting school, are in the middle of your studies, or are on your path to repayment, understanding student loan basics is vital.

The Two Types of Student Loans

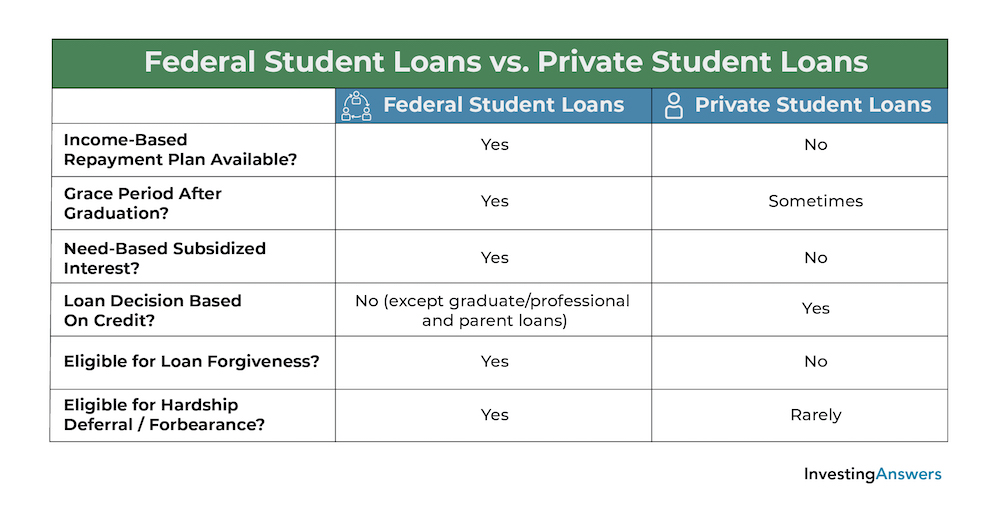

The two main types of student loans are private student loans and federal student loans. Each has specific characteristics that can impact your finances.

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. Because these loans are offered by various lenders, eligibility criteria will also vary.

You’ll need to apply for a private student loan either as an individual or with a co-signer. You’ll also be required to start paying back your student loan right away.

Private student loans don’t have as many borrower protections as federal student loans. For example, there’s no option for income-driven repayment plans, forbearance, or deferment in case of a financial crisis. Private student loans are not eligible for student loan forgiveness.

Federal Student Loans

Federal student loans are offered to students after completing the Free Application for Federal Student Aid (FAFSA). Federal student loans are funded by the federal government, and applicants may be eligible for:

- Direct Subsidized Loan: For undergrads with demonstrated financial need

- Direct Unsubsidized Loan: For undergrad and graduate/professional students. There is no financial need requirement.

- Direct PLUS Loan: For graduate/professional students and parents of dependent undergrads. Borrowers must be creditworthy.

- Direct Consolidation Loan: Combines multiple federal loans into one loan

After you complete the FAFSA, your school(s) of choice will send you a financial aid award letter. This letter details the federal loans you can choose to accept as part of your financial aid package.

Federal student loans may be eligible for forgiveness programs like Public Service Loan Forgiveness or Teacher Student Loan Forgiveness. You also have the option of entering an income-driven repayment plan which gives you the financial flexibility to pay off your student loans.

Understand Student Loan Principal, Interest, and Capitalization

Every student loan has principal and interest. In some cases, the interest is capitalized.

Loan Principal

Loan principal is the amount borrowed. Principal balance, however, is the amount of principal that hasn’t been repaid. Principal includes only the debt itself and is the amount on which interest is calculated.

Loan Interest

Loan interest is the percentage of loan principal that you’re charged for taking out the loan. The amount of interest paid depends on the type of loan, whether the loan is federal or private, and credit history.

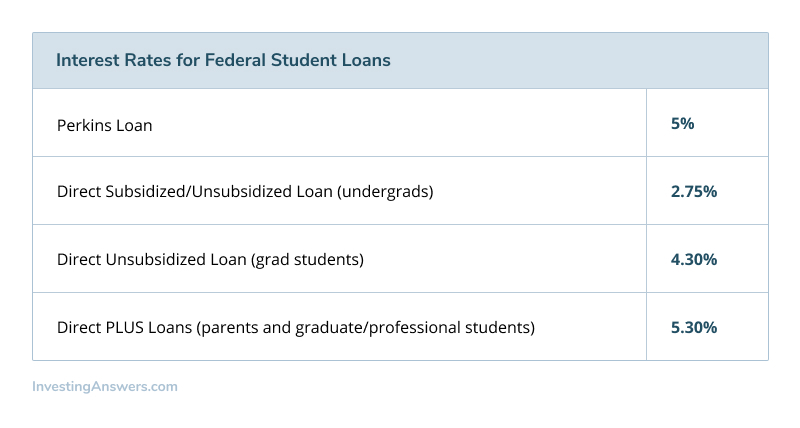

Federal loan interest is typically lower than interest on private loans (which is determined by each lender). Federal loan interest rates are set each year and are the same for everyone.

The interest rates for federal student loans disbursed from July 1, 2020 through June 30, 2021 are as follows:

Lenders capitalize unpaid interest you’ve accrued by adding it to your principal balance. Capitalization thereby increases your principal balance. It also results in higher interest payments because interest is paid on the capitalized balance.

For example, if you have a $10,000 loan and $1,000 in unpaid interest accruals, the lender can capitalize the $1,000. Since your principal balance would be $11,000 ($10,000 + $1,000), you’d pay interest on that sum (instead of $10,000).

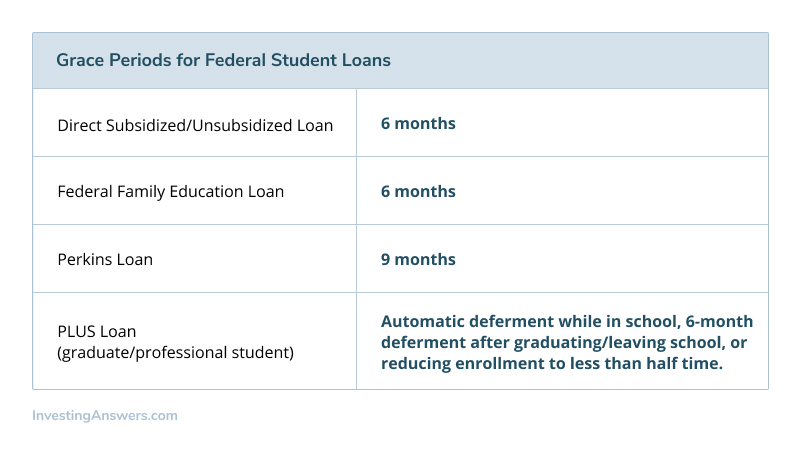

Grace Period on Federal Student Loans

Some federal student loans offer a grace period, allowing you to delay repayment until you graduate, leave school, or reduce your course load to fewer than six credits (part-time). Thanks to student loans offering grace periods, you may have some breathing room before your first payment is due.

Once a lender disburses loan money, it sometimes turns day-to-day management over to a loan servicer. Servicers handle customer service, collect and process loan payments, and even help people avoid default by setting up special repayment terms. If you hold more than one loan, it’s possible that they’re managed by different servicers.

If You Have Federal Student Loans, You Can Choose a Payment Plan

Federal student loans have some built-in safety nets (like changing your repayment plans) to help you through rough patches. A number of plans are available to eligible borrowers with qualifying criteria and include loan type, outstanding balance, and overall debt amount.

A new repayment plan can help you stay on top of your payments by:

- Limiting your payment amounts to a percentage of your income

- Ensuring that your loans are paid off within a specified period of time

- Reducing your payments now and increasing them later (when you expect to be earning more).

Work with your loan servicer(s) to change your repayment plan and begin researching your options with the Federal Student Aid Loan Simulator.

There Are Several Student Loan Forgiveness and Relief Options

If you have a federal loan owned by the US Dept. of Education, you automatically qualify for a forbearance program that will suspend your loan payments and waive your interest through Dec. 31, 2020 (under the CARES Act). If you do make payments during this period, they’ll be applied to your principal balance.

Note: At the time of publication, the CARES Act had also temporarily suspended efforts to collect on pre-existing loan defaults.

Forgivable Loans

Some federal student loans are forgivable loans, meaning that you don’t have to repay the debt. Forgiveness programs have strict eligibility criteria, such as working for the government, being employed by a non-profit organization, or teaching in an underserved area.

Loan Discharge

Loan discharge is another possibility for eligible federal loan borrowers. This means you can stop making payments (e.g. your school has closed, you become disabled). Private lenders typically don’t forgive or discharge loans, but many have student loan relief options of their own.

What Are Student Loan Deferment and Forbearance?

Two options available to borrowers with private student loans are deferment and forbearance. If your lender offers them – and you meet eligibility requirements – you can reduce or temporarily suspend your payments.

Of the two, deferment is usually the better choice because your principal balance won’t accrue interest while your payments are deferred. Interest does accrue on a loan in forbearance, so your loan balance will grow, and it might take you longer to repay your loan.

Contact your loan servicer to find out what options it offers and what the eligibility criteria are.

Student Loans Are Not Going Away

Student loans are different from other forms of debt: There’s usually no way to get out of repaying them if you don’t qualify for forgiveness. For example, whereas credit card debt can be discharged in bankruptcy, you’d have to prove special circumstances and navigate through a separate process to use bankruptcy to discharge your student loan debt.

Tips for Managing Your Student Loans

The best way to keep your loans in good standing is to stay on top of them. On-time payments don’t just keep you on track to pay off your loans on time: They also help build the credit you need to qualify for car and home loans. Some jobs and professional licenses require credit checks, so staying on top of loan payments could even help you land your dream job.

Keep Track of All Your Loans

Keeping track of all your loans can be tough, especially if you have both private and federal loans (or your loans are managed by multiple servicers). Start by making a list of all your loans. Search your federal loans on the Federal Student Aid Loan Simulator. For private loans, check your statements or – if you don’t have your statements – your credit report.

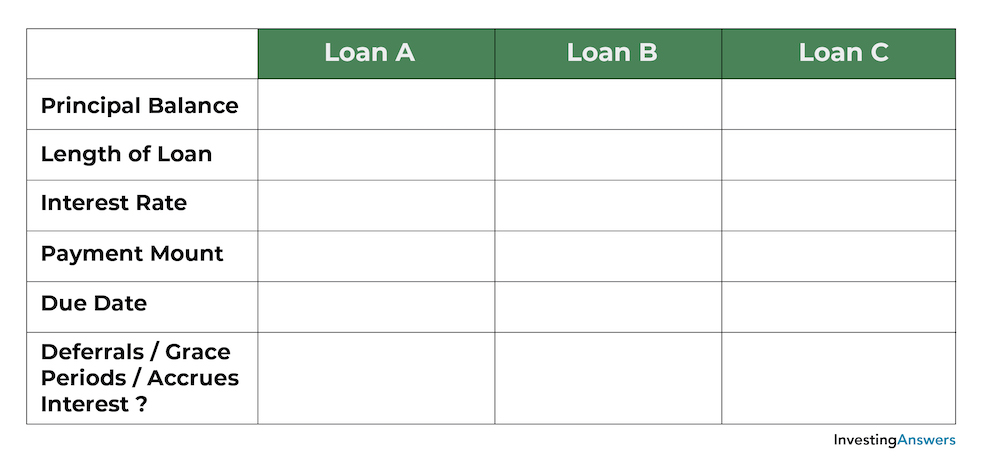

Once you’ve identified all your accounts, create a spreadsheet using the following information for each loan:

- Principal balance

- Length (term) of the loan

- Interest rate

- Payment amount

- Payment due date

- Deferrals and grace periods, and whether they accrue interest

Here’s an example of what that might look like:

Create a system for keeping your loan documentation organized. Consider using a notebook with folders or a digital folder on your computer’s desktop where you can keep everything loan-related.

Create a Student Loan Debt Payoff Plan

Now that you know where you are with all of your loans, make a plan for paying off your student loan debt. First, set a target date to have your loans fully paid. Then decide what you need to do to meet that target. Perhaps you should repay loans early or consider refinancing them so the terms are consistent with your goals.

Stay in Contact with Your Loan Servicers

To ensure you don’t miss important communications, keep your contact information up to date with each of your loan servicers. In the event of a major financial setback, contact your servicers to discuss your options.

Should You Refinance Your Student Loans?

Deciding to refinance your student loans is a serious decision, especially if you’re moving your federal student loans to a private lender. Do your homework before jumping in.

When to Consider Refinancing Your Student Loans

Some circumstances make refinancing worth considering, especially if you have private loans.

For example:

- You have a long repayment period you can afford to reduce. This would save on interest over the long term.

- You could save money on interest by refinancing at a lower rate.

- Improved credit might give you better loan options than you had previously.

When You Shouldn’t Refinance Your Student Loans

Because you can’t refinance a federal loan into another federal loan, private loans are your only option. That’s not always a great idea because federal loans offer benefits that private loans don’t.

For example, only federal student loans allow you to change your repayment plan at any time – and even select one with payments that are proportionate to your income. They also allow you to defer your payments due to financial hardship.

The following situations should make you think twice about refinancing private loans:

- You might need to use credit for other things (e.g. buying a car). Refinancing your loans can reduce your credit score in two ways:

- initiating hard credit inquiries

- reducing the average age of your accounts.

- You don’t qualify to borrow on your own. If you need a cosigner to qualify for the loan, you can’t probably afford it. It’s probably better to improve your credit before refinancing.

Student Loan Refinancing Terms

Reading about student loan refinancing might leave you feeling a little lost. The following glossary breaks down some of the most important terms you’re likely to encounter:

APR

Annual percentage rate (APR) represents the true cost of your loan. It includes your interest rate as well as fees charged by your lender. It’s more comprehensive than interest rate alone, and it provides a more accurate way to compare loans.

Fixed vs. Variable Interest Rates

A fixed interest rate means that the rate stays the same over the life of the loan, and your payment stays the same, too. All federal student loans have fixed rates.

Private lenders occasionally lend money at variable rates that change over the life of the loan. Although a variable-rate loan might start you at a lower rate that keeps your payment in check initially, your payment will increase if the interest rate goes up.

Co-Signer

A co-signer is someone who agrees to repay your loan if you default. Although the co-signer has equal responsibility for repayment, they have no claim on the money you borrow. Having a co-signer can increase your chances of qualifying for a loan or getting better interest rates.

Loan Term

The loan term is the period of time the lender gives you to repay the loan. The standard student loan term is 10 years.

Consolidating Student Loans vs. Refinancing

While refinancing lets you trade one loan for another, consolidating lets you convert all of your loans into a single new one. Consolidation is available for both federal and private loans.

The primary benefit of consolidation is that you have just one loan to keep track of (and therefore a single payment to make each month). The downside: Your new interest rate could be higher and consolidation might extend your loan term. That means you’ll potentially pay more interest over its lifetime.

There’s no charge to consolidate your federal student loans into a Direct Consolidation Loan. However, some private lenders charge an origination fee.