For the majority of Americans, taking on a student loan is a requirement to pay for college. A 2019 report estimated that 43 million American adults have federal student loans – with a combined total balance of $1.5 billion.

What many people may not know is that different student loan options are available, ranging from refinancing to deferral. If you have a student loan, it’s important to understand all the options for repaying your debt.

What Is a Student Loan?

A student loan is money borrowed for thecost of attendance at institutes of higher education. This may include tuition payments, books, fees, and room and board. After leaving/graduating college, students are expected to begin repaying loans.

Who Is Qualified to Receive a Student Loan?

To qualify for federal student loans, you must be enrolled at least half-time at a college or university which participates in the Direct Loan Program. Those who don’t qualify (e.g. enrolled in a non-participating school, attending less than half-time classes) may still qualify for private education loans.

Types of Student Loans

There are two primary types of loans: Direct Student Loans through the U.S. Department of Education, and private loans. Which loans you end up taking depend on many different factors, including financial need demonstrated by the Free Application for Federal Student Aid (FAFSA) and tuition price.

Federal Loans

There are two types of FAFSA student loans you may qualify for, based on your financial situation and your year in college. If you went to school before 2017, you may have a third type of loan that is no longer offered by the U.S. Department of Education.

Stafford Loans

Direct Subsidized Loans and Direct Unsubsidized Loans are most commonly known as Stafford Loans (or Direct Stafford Loans). These loans are distributed directly to your college or university from the U.S. Department of Education. They are based on your financial need.

PLUS Loans

PLUS Loans are available to graduate students continuing their education at participating universities. Parent PLUS loans are available to parents helping graduate students pay for their education. Grad PLUS loans are available to students . Again, the loan is offered through the Department of Education and paid directly to the university.

Perkins Loans

The Federal Perkins Loan program was a low-interest loan available to students with exceptional financial need. The program was discontinued on Sept. 30, 2017, with the final payments sent to colleges on June 30, 2018.

Private Student Loans

If you go to a school that doesn’t participate in the federal student loans program – or your need exceeds what’s available from the government – you could qualify for a private student loan. These loans are offered directly through lending banks (including Sallie Mae), and may not necessarily conform to Department of Education guidelines. Repayment terms and interest rates are dictated by the lender.

Refinanced Student Loans

If you have multiple loans, you may qualify for student loan refinancing. Direct Consolidation Loans are offered by the government to consolidate all federal student loans into one loan at no cost. The result is a single payment for all of your student debt at a single interest rate.

Banks may also offer student loan refinance programs for both federal and private debts, depending on the lender. Private loans may have a higher fixed interest rate than government loans. Additionally, interest rates may not be guaranteed by the lender.

Subsidized vs. Unsubsidized Student Loan

Through the Direct Stafford Loan program, you may qualify for one or both student loan types: subsidized loans and unsubsidized loans. These are available to students going to community colleges, universities, trade schools, and career colleges who participate in government student loan programs.

Subsidized Student Loan

A subsidized student loan is often made available to students who demonstrate financial need through their FAFSA. As long as the borrower is a half-time student, the US Department of Education will pay the loan interest. The government will also cover the interest payments for the first six months after the student leaves college (or during a deferment period).

Unsubsidized Student Loan

Regardless of need, anyone going to a college that participates in the federal student loan program qualifies for an unsubsidized student loan. Your college will determine how much you can borrow, based on your overall financial aid package. Unlike a subsidized loan, you will be responsible for interest payments from the day you open the loan. You have the option to defer interest, but the total interest accrued (while in school) will be added to the balance after you leave.

How Do I Apply for Student Loans?

The process of applying for loans differs, based on the kind of student loan you want. Federal student loans are handled through colleges while private student loans are handled through banks.

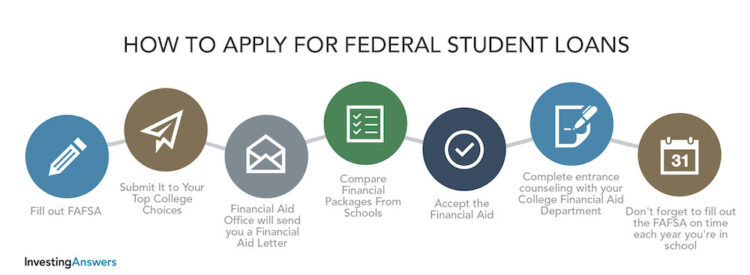

Applying for Federal Loans

Applying for federal student loans starts by filling out the FAFSA. Once it’s sent to your college of choice, the financial aid office will put together a student aid package (which may include loans). If you decide to accept the FAFSA student loan package, the school’s financial aid department will help you work through entrance counseling and the signing of the master promissory note.

Applying for Private Loans

Private student loans are handled differently by each bank, with varying requirements based on how much you are asking to finance. To apply for a private student loan, you will need to start by speaking with a bank loan officer. Your application will be evaluated on several different criteria, including your school, major, employment information of the borrower and cosigner (if needed), and your financial aid package.

What Credit Score Is Needed for a Student Loan?

If you are applying for federal student loans, your credit score won’t be taken into consideration. Because the loan is arranged by your college as part of a financial aid package, these loans are available to all students, regardless of their credit history.

If you are seeking a private student loan through a bank, however, your credit score will be one of many factors they will consider. Students who are just starting out and don’t have a credit file or steady source of income will need a cosigner to apply for the loan (usually a parent or guardian). If you have a cosigner on your loan, their credit score will also be considered.

As a general rule, banks require private student loan recipients to have a minimum credit score of between 650 and 680. If your credit score (or the credit score of your cosigner) is below this cutoff, you may have difficulty securing a private student loan.

How Long Does It Take to Qualify for Student Loan Disbursement?

Once you have accepted a student loan, paying them to your college can take up to 10 weeks, depending on who issued the loan. Federal student loan disbursements usually take 1-3 weeks since they’re tied to financial aid packages. Private student loans can take anywhere between 2-10 weeks to pay out, depending on bank policies and who the loan is paid to.

How Do I Find My Student Loan Number?

Instead of all debt going through a national student loan data system, loans are serviced by one of 11 loan servicers working with the Department of Education. Instead of contacting the Direct Loans program about your student loan, you will contact your loan servicer directly to get your student loan number, make payments, and change your student loan repayment option.

Student loan account numbers are typically found at the top of your monthly statement, on the payment coupon near the due date, and on annual tax documents.

When Does Student Loan Repayment Start?

Student loan repayment dates vary between private lenders and the Direct Loan Program. If you take a loan from Sallie Mae or another bank, your repayment terms and grace period will be determined during the acceptance process.

Federal student loans are deferred while you are at least a half-time student in an accredited college. The repayment period starts six months after you leave school.

As a general rule, PLUS loan payments start when the loan is paid, but may be deferred. Graduate and professional PLUS loans are put on an automatic deferment while you are in grad school. Repayment will start six months after you leave and/or graduate.

Can I Defer My Student Loans?

Student loan deferment is handled differently, based on where your loan originated. Sallie Mae and other private lenders offer deferment if you go back to college or graduate school, or if you decide to take a credit-earning internship, clerkship, fellowship or residency. Deferment terms and policies differ between banks, so it’s best to check with your lender to see when you may qualify for a student loan deferral.

Federal student loans may qualify for deferment for several reasons, including economic hardship, medical treatment, graduate fellowship, or active duty military service during wartime/national emergency. While loans are deferred, they continue to collect interest (which can change your repayment terms or amount). If you have any problems repaying student loans, contact your loan servicer to discuss your options.

Can I Lower My Student Loan Amount?

It’s possible to lower your federal student loan payments based on the chosen repayment option. The Direct Loan program offers six different repayment programs with lower payment options than the 10-year standard payment program.

Do I Qualify for Student Loan Forgiveness?

Depending on the career you pursue, you may qualify to have your federal student loans forgiven. There are student loan forgiveness plans for those who enter the military or become a teacher or medical professional.

Veteran Student Loan Forgiveness

Under the Public Service Loan Forgiveness program, students in the military for 10 years – or who work in a qualifying public service job for 10 years – may have their student loans forgiven. Qualifying jobs include law enforcement, emergency management, or public safety. If you are a disabled veteran, you may qualify for student loan forgiveness through Total and Permanent Disability.

Teacher Student Loan Forgiveness

Teachers can qualify for student loan forgiveness through the Teacher Loan Forgiveness Program. Educators who work full-time in a low-income school or at an educational service agency can earn forgiveness on up to $17,500 of their federal student loans. To be eligible, your loans must originate before you begin your five-year teaching period.

Nurses Student Loan Forgiveness

Nurses, nurse practitioners, and clinical-setting nurses may qualify for the Public Service Loan Forgiveness program if they work full-time for an eligible organization. However, you must make at least 120 minimum payments on your repayment plan to qualify.

What Student Loan Repayment Plan Is Best?

After leaving college, it’s time to consider how to start repaying student debt. Federal borrowers have multiple student loan repayment options for their balances, based on what works best for their budget.

Standard Repayment Plan

Under the standard repayment plan, students pay a fixed monthly payment to ensure that the balance will be paid in 10 years. Those who refinanced their student loans with the Direct Consolidation Loan may be able to extend their payments up to 30 years.

For students who can afford their payments, the standard repayment plan is best. Through this plan, students usually pay less over time than through other plans.

Graduated Repayment Plan

Graduated repayment plans are designed to grow with your income. Payments start low at the beginning, increasing every two years. Like standard repayment plans, graduated plans ensure that loans are paid off within 10 years.

This student loan repayment option is best for students whose career income levels grow alongside experience. Because the payment increases every two years, the payment will ideally be affordable alongside career trajectory paths. However, those who use graduated repayment plans tend to pay more over time than those on standard repayment plans.

Extended Repayment Plan

For borrowers with more than $30,000 in federal student loans, an extended payment plan is available. Through this option, payments can be fixed or graduated, ensuring that loans are paid off in 25 years (instead of the standard 10).

If high student loan payments are cause for concern, an extended repayment plan may be the best option. Although you will pay more than those on standard or graduated student loan repayment options, payments are usually more affordable.

Revised Pay As You Earn Repayment Plan (REPAYE)

Through the Revised Pay As You Earn Repayment Plan (or REPAYE for short), your monthly payments are capped at 10% of your discretionary income every month. This amount is calculated based on your income and family size. For married applicants, repayment amounts will consider loan amounts (as well as the loans of spouses). Income and family size must be updated every year, even if there are no changes.

After 20 years, any outstanding balance on an undergraduate student loan will be forgiven (or 25 years for graduate or professional study loans). You must make all the payments and may potentially be required to pay income tax on any forgiven loan amount. Although you will pay more compared to the standard student loan repayment option, this is a good option for those with very high debts or those who expect to benefit from a student loan forgiveness program (like the Public Service Loan Forgiveness Plan).

Income-Based Repayment Plan

For people with high federal student loans compared to their income, the Income-Based Repayment Plan (IBR Plan) may be the best option. With this plan, borrowers pay either 10 or 15% of their discretionary income (based on when they accepted their loan), but never more than the standard repayment option. Like the REPAYE plan, factors such as income, family size, and spouse’s student loans are all considered and must be updated every year.

The IBR plan also forgives your debt after 20 or 25 years if you made all the applicable payments, but you may be required to report it as income on your tax return. This is also another great option for those with high balances or those who may benefit from a student loan forgiveness program.

Income-Contingent Repayment Plan

The final option to repay federal student loans is the Income-Contingent Repayment Plan (ICR). Those who select this plan will either pay a fixed monthly payment over 12 years or a monthly payment that’s equivalent to 20% of your income after essential bills (e.g. housing, utilities), whichever is cheaper. The payments are recalculated every year based on income, family size, and the amount owed on the loans. However, spousal student loan debt will only be considered if taxes are filed jointly or loans are paid together with the spouse.

Like the REPAYE and IBR plans, the ICR plan will forgive any amount unpaid after 25 years (but may have to be claimed on your tax return). Although you will pay more over time compared to the standard repayment plan, this option is great for parents refinancing PLUS loans into a Direct Consolidation Loan, or those looking to erase debt from student loan forgiveness.

Can Student Loans Change Their Interest Rates?

Depending on your student loan, the interest rate may change over time. It depends on whether you have a fixed interest rate or a variable interest rate. Note that all federal loans are by law fixed rate loans, whereas private loans may be variable.

Fixed interest rate student loans are locked into place and will not change over the life of the loan. These interest rates only change if your student loan is refinanced or goes into default. Variable interest rate loans can change based on several factors, including the prime rate, payment history, and creditworthiness.

What Happens If I Never Pay My Student Loan?

Because federal student loans are governed under federal law, there are high penalties for not paying student loans. It all depends on how long borrowers ignore their debts.

A student loan is considered delinquent after missing the first payment. If the borrower doesn’t pay after 90 days, the delinquency is reported to the three credit bureaus, which may lower your credit score. Private student loans held by banks will report to the credit bureaus per their policy. If you miss enough payments, your student loans could go into default.

When Will My Student Loans Go into Default?

If federal student loans remain delinquent for 270 days (around nine months), they will go into default. Private student loans can go into default if no payments are made in three months, depending on the loan conditions. Once a student loan goes into default, the entire balance is due immediately, and the U.S. government has many different ways to force you to repay.

Can Student Loans Take My Salary or Tax Refund?

While private lenders can send your outstanding student loan debt to a collection agency or use a lawsuit to compel you to pay, the federal government has many more options available to them. If your federal student loans are in default, the government can garnish your salary, use tax refunds, or withhold federal benefit payments to satisfy the student loan balance.

In addition, those in default can no longer request a forbearance or new payment plan on their loan, or qualify for new federal student loans in the future. The government can also take away your ability to purchase or sell real estate.

Can I Declare Bankruptcy on Student Loan Debt

If you become financially insolvent and are forced to declare bankruptcy, it’s possible (though fairly difficult) to discharge your federal student loan through bankruptcy. In order to determine eligibility, you must declare either Chapter 7 or Chapter 13 bankruptcy, and prove that paying student loans would create undue hardship. “Undue hardship” is proven if you can’t maintain a minimal standard of living and pay the loan, the situation will continue for a significant time through the life of the loan, and you attempted to pay the loan before bankruptcy.

Does Student Loan Debt Ever Get Wiped?

Unless you qualify for one of the student loan forgiveness programs (or get debt discharged through bankruptcy), it’s very difficult to get student loans wiped entirely. Before giving up on your student loans, talk to your loan servicer about best student loan repayment options for your situation.

Can I Go to Jail for Not Paying My Student Loans?

In recent history, there’s only been one report of an arrest for a delinquent student loan. In 2016, CNN reported the U.S. Marshals took a Texas man into custody after they claimed he would not appear in court over a student loan debt. After meeting with the judge, he agreed to pay off a student loan he did not know he had from 1987.

This situation is an anomaly, and you will not go to jail for not paying a student loan. However, if your federal student loan goes into default, you could be served with a court order to answer to the balance due.

Are There Student Loan Forgiveness Scams?

There are several student loan forgiveness scams targeting borrowers. The most common scams include services that help fill out the FAFSA form, offer to send forgiveness payments to your bank account, and even work on your behalf with loan servicers to lower payments.

Legitimate companies working with the Department of Education will never reach out to you to offer their help. The easiest way to avoid student loan forgiveness scams is to talk to your loan servicer to determine whether you qualify for a forgiveness program or a lower payment through a different payment plan.

Student Loan Calculator

Before borrowing a student loan, it’s important to understand how much you may be able to afford – and all your options. Start by using a student loan calculator to understand how factors like interest rates and monthly payments can affect your budget. From there, you can make an educated determination on how much to borrow from federal student loans or potentially private lenders.