Whether you dream of a bungalow with a white picket fence in the suburbs or a sleek condo in a city, InvestingAnswers will guide you through the mortgage maze to reach homeownership. To help you get started, let's first take a closer look at some of the most attractive mortgage rates in your local area...

Mortgage Basics For New Home Buyers

If you’re new to mortgages, no worries. We’ve put together a complete guide to mortgage basics for new home buyers.

What Is a Mortgage?

A mortgage is a loan used to purchase real estate. The property serves as collateral to secure the loan. If the borrower defaults on their loan, the property can be sold by the lender to someone else and the tenants would be evicted. This process is known as foreclosure.

Mortgages may be used by businesses or individuals to purchase property, but typically, individuals seek mortgages to buy a home. The mortgage (loan) amount is usually 80% of the value of the home’s purchase price with the buyer expected to put up 20% of their own money.

The term “mortgage” is actually a catchall term for several components which together make up the loan’s legal paperwork:

Promissory Note

The promissory note (“note”) lists the details of the loan, including the interest rate, the time period, and how you’ll pay it off. It also provides details on when a payment is considered “late”, as well as the amount of principal and interest.

The Mortgage

The mortgage itself gives the lending institution ownership of the property and the right to seize it (foreclose) in the event that the note terms aren’t met.

Deed of Trust

A deed of trust adds a third party (called a “trustee”) between the lending institution and the borrower. Deeds of trust are recorded by the lending institution in county clerk offices where the property is located. They act as evidence of the security of the debt.

A deed of trust is required in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia.

How Does a Mortgage Work?

Borrowers may apply for mortgages from banks, credit unions, or lending institutions that are authorized to issue mortgages. To apply for a mortgage, contact the lending institution and complete the mortgage application. You’ll need to supply the lender with copies of your W2 form, several paycheck stubs from your employer, copies of previous tax returns, and other information that enables them to check your credit score and credit history.

Note: It’s best to avoid submitting other credit applications when you’re in the midst of applying for a mortgage. Too many requests for credit can be a red flag to potential lenders. Wait until your mortgage is approved before requesting additional credit cards, student loans, car loans, etc.

Home Inspection

The lender wants to know what their collateral is worth, so they will wish to inspect the property you intend to buy. A home inspection may be required. During a home inspection, the inspector will note any problems that may devalue the home, like aging heating systems or old wiring that should be fixed before the sale is finalized. The buyer and seller can negotiate a discount from the offer to compensate for any necessary repairs or the seller may choose to have issues fixed before the sale is finalized.

Closing Date and Documents

Once the home inspection is complete and problems are addressed, lawyers for the buyer and seller agree on a closing date and the terms of the closing. This includes ensuring that the house is ‘broom clean’ (or generally neat and tidy) and that the seller has moved all their belongings from the home.

At the closing, all of the paperwork (including the mortgage) is signed and the deed is transferred to the buyer. Congratulations! You own a home!

Mortgage Amortization

Depending on the type of mortgage you’ve secured, you may now begin making payments on the principal and the interest on a fixed schedule. A mortgage amortization table lists each payment and the portion of the payment that goes to the principle or the interest. The principal reflects the amount of equity, or ownership, you have in the home. The remaining amount is the mortgage interest.

How Does a Mortgage Interest Rate Work?

A mortgage’s interest rate may be fixed or variable/adjustable. In a fixed-rate mortgage, the interest percent remains the same over the entire mortgage period. The interest rate in a variable or adjustable-rate mortgage changes over time, with the parameters guiding the changes listed in the mortgage agreement.

Most mortgages are fully amortized, meaning that the monthly payment remains the same, and the ratio of principal to interest changes for each payment. At the start of a mortgage, a greater portion of the monthly payment goes to pay interest than principal. An amortization table breaks out interest and principal so that mortgage holders know how much equity, or ownership, they have in their home.

What Are Today’s Average Mortgage Rates?

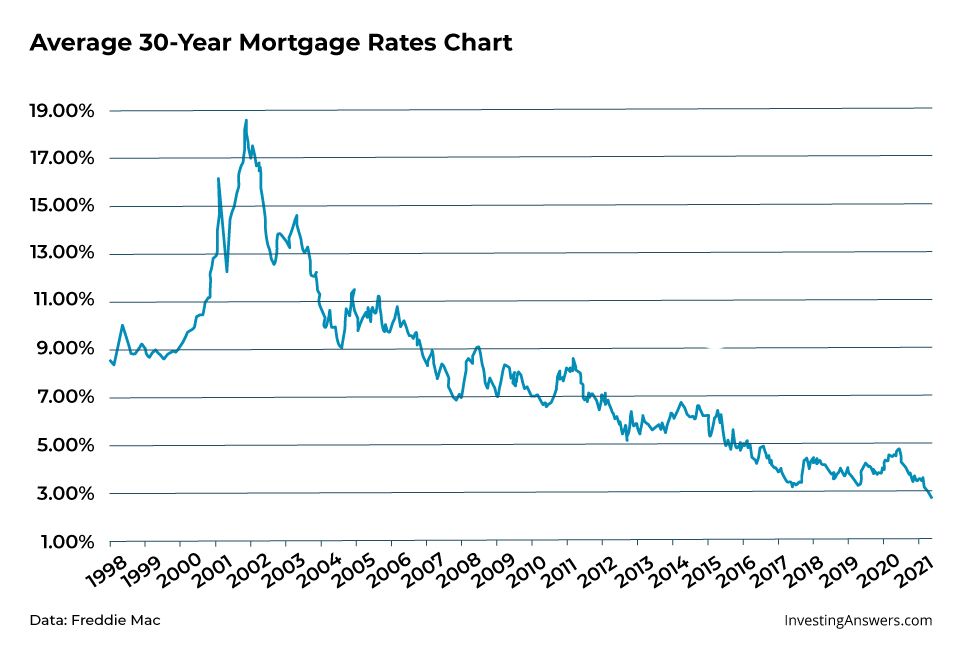

Mortgage rates have continued to drop since the 1980’s.

Currently rates hover just below the 3% mark. If you’ve waited for the lowest mortgage rates possible, now may be the perfect time to secure a mortgage and make a move toward home ownership.

What’s the Difference Between the Interest Rate and APR?

Interest is the amount charged by the lending institution to borrow money. APR rates include the cost of the interest plus other fees (including broker fees, discount points, and some closing costs). Interest rates and annual percentage rates vary among lenders and borrowers can use these to compare various offers.

What Are the 3 Different Types of Mortgages?

There are many types of mortgages, but the three most common types include conventional, government-backed, and jumbo mortgages.

Conventional Mortgages

Conventional mortgages aren’t backed by the federal government. Borrowers receive a loan amount with principal and interest payments made to the lender at a fixed rate on an agreed-upon schedule. Conventional mortgages require borrowers to put down 20% of the loan’s value (or take out mortgage insurance if they pay less than 20%).

Conforming vs. Non-Conforming Loans

Within a conventional mortgage, you’ll find conforming loans and non-conforming loans. Conforming loans fall within the maximum limits set by Freddie Mac and Fannie Mae, which are government-sponsored enterprises related to housing. Non-conforming loans are mortgages for large amounts that fall above the Fannie Mae threshold. A jumbo mortgage (discussed below) is a type of non-conforming loan.

Fixed-Rate Mortgages

Fixed-rate mortgages are a fully amortized loan with a fixed rate of interest charged over the lifetime of the loan. Although the mortgage’s interest rate remains the same, the proportion of each payment that is interest and principal changes over time. The balance of the payments shifts towards paying for the principal as the loan ages.

Variable-Rate Mortgages

Variable-rate mortgages, also called adjustable rate mortgages (ARMs), are a type of mortgage in which the interest rate may change over time. Variable-rate mortgages often start with a benchmark rate that’s tied to a credit index with points (additional percentage points of interest) added by the lender. The interest rate may shift up or down along the lifetime of the loan.

Government-Backed Mortgages

Government loans are either issued or backed by the federal government. Such loans are often issued with lower interest rates, making them affordable to people who might not otherwise be able to afford a mortgage.

In a government-backed mortgage, the government backs up the loan. This means that the lender has the assurance that they will still receive payment if the borrower defaults.

There are several types of government-backed mortgages available.

VA Home Loan

Veterans, active military personnel, and certain surviving spouses qualify for VA home loans. These loans are backed by the US Department of Veteran’s Affairs. Although there is no minimum credit score to apply for a VA home loan, most lenders prefer a score of 620 or higher.

FHA Home Loan

FHA loans are backed by the Federal Housing Authority. FHA loans are available for a lower interest rate and a lower down payment than conventional mortgages, making them appealing to many people who might not otherwise qualify for a conventional mortgage. FHA loans require a credit score of 580 or higher. They are sometimes granted with the buyer putting as little as 3.5% down.

USDA Home Loan

USDA home loans are mortgages available in rural and some suburban areas. They are backed by the US Department of Agriculture. Eligible homeowners may not need to put any money down to own their own home: The total amount of the purchase price may be funded through a USDA home loan.

Jumbo Mortgages

Jumbo mortgages occur when the borrowed amount exceeds the maximum threshold guaranteed by the government (through Freddie Mac and Fannie Mae). For most areas, that jumbo mortgage limit is $510,400, but it varies according to the housing market where the purchased property is located. Jumbo mortgages are often used to finance luxury homes and homes in very high-priced markets.

Qualifying for a jumbo mortgage may be out of reach for many. You need an impeccable credit score and a very low debt-to-income ratio.

Choosing the Right Mortgage

Choosing the right mortgage is almost as important as finding the right home. The right mortgage for your financial situation, loan needs, and long-term financial plan is essential to your peace of mind.

What Home Loan Should I Take?

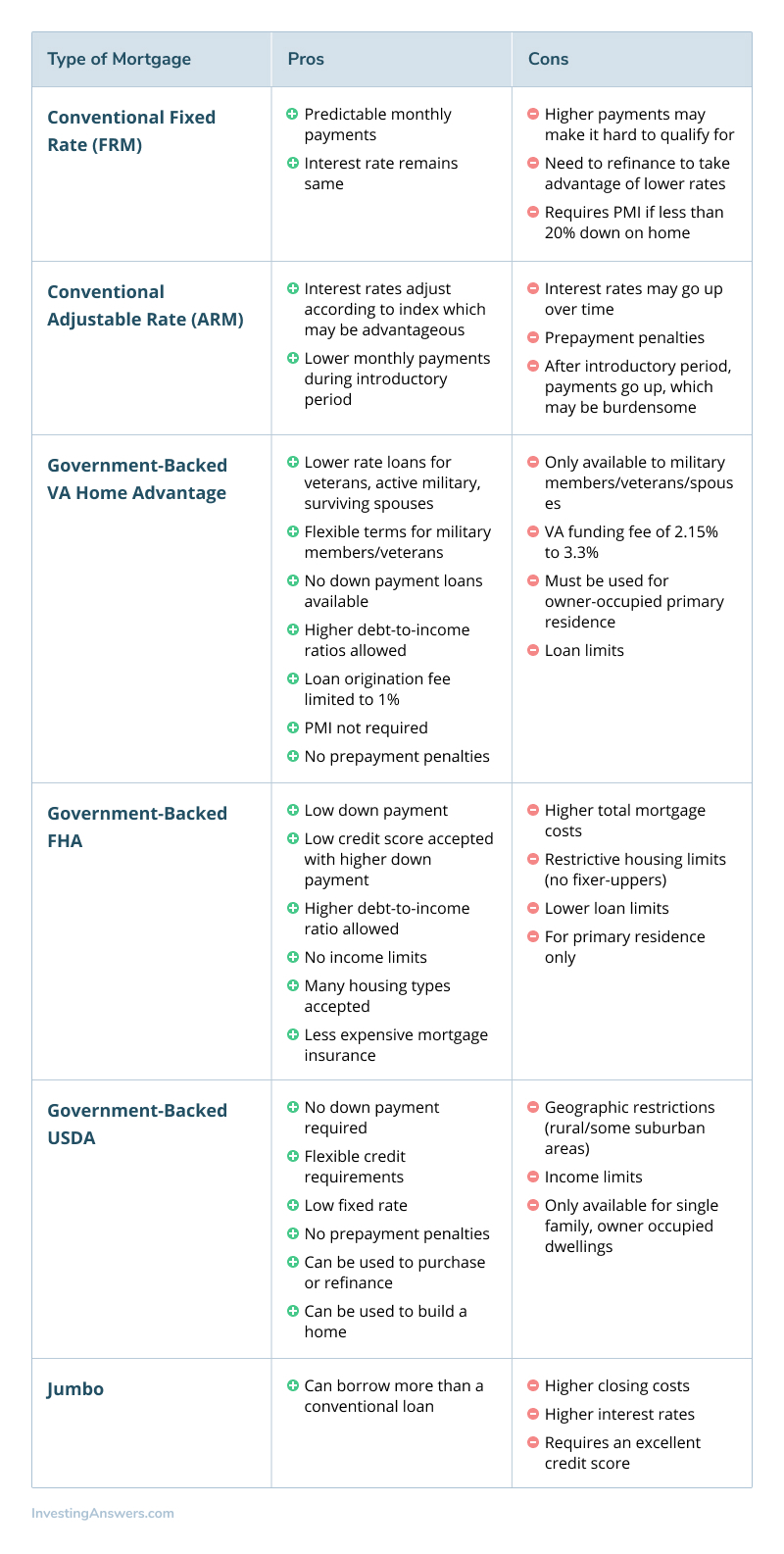

The basic mortgage types – fixed-rate and adjustable-rate mortgage (ARM) – offer advantages and disadvantages. We’ve put together a handy table for you to compare mortgage types.

How to Compare Mortgage Types

The table below compares various mortgage types to help you choose the right one for your needs.

Knowing How Much House You Can Afford

Knowing what you can afford is the first step in your quest for a new home and mortgage. Many people worry about their ability to pay for their mortgages, especially during times of economic instability. According to a recent survey, 34% of people reported feeling worried about paying their mortgage. Our guide will help you get the most from your budget as you search for your dream home.

How Much Should I Borrow?

A general rule of thumb is that your mortgage should be no more than 28% of your monthly income. Lenders look only at your current situation, so if you’re anticipating a major career shift in the near future that improves your financial situation, you may be able to afford to borrow more.

Using the 28% rule, a waitress earning $3,000 per month could afford a maximum of $840 per month ($3,000 x 0.28 = $840.) Let’s assume that the waitress is going to college to become a registered nurse and she’s only one month away from graduation. She is certain that she will graduate (her grades are above passing) and she is already speaking with recruiters from several area hospitals about potential jobs. Registered nurses in her area start at $48,000 per year ($4,000 per month) so lenders may be persuaded to allow her to borrow up to $1,120 ($4,000 x 0.28).

In another situation, someone earning $3,000 a month may not be able to afford $840 per month in mortgage payments because he has a substantial credit card debt to pay off. His current apartment rent is $750 per month while paying off his debt, so $750 per month may be what he can put toward monthly mortgage payments.

How Can I Calculate My Mortgage Payment?

It’s great to understand how to determine how much of a mortgage loan you can afford. It’s even better to find the exact figure for your monthly mortgage so you can plan your finances around paying off your home.

Use a Mortgage Payment Calculator

InvestingAnswers offers an easy-to-use mortgage payment calculator to estimate your specific loan payments. Use it to find the amount of principle and interest contained in each monthly payment.

Don’t Forget About Possible Expenses

Appliances break. Roofs leak. Towns, cities, and municipalities levy taxes on homes to pay for things like sewage systems, roadway maintenance, snow plowing, and trash pickup. Monthly mortgage payments are only part of the financial responsibility of owning a home.

There are numerous additional expenses that new homeowners must consider.

Private Mortgage Insurance

Private mortgage insurance (PMI) protects lenders if the borrower fails to make their mortgage payments. Lenders usually require PMI when conventional mortgages are taken out and less than 20% is paid with their own money. It can help you obtain a mortgage when you may not otherwise qualify for a conventional mortgage. You may also be required to take out PMI if you’re refinancing your mortgage and have less than 20% equity in the home.

The PMI premium cost is typically added to the monthly mortgage payment. You can find the premium costs on the first page of the Loan Estimator and Closing Disclosure documents provided by the lender. Some PMIs require an upfront fee and a premium cost. If so, this will be listed in the documents provided by the lender.

HOA Fees

Condominiums and some housing developments charge Homeowner Association (HOA) fees. These are membership dues/fees paid to the Homeowner Association to pay for maintenance and upkeep to common areas. In a condo, HOA fees cover building maintenance and maintenance of shared areas such as lobbies, elevators, gardens, and swimming pools. For a private home in a community governed by an HOA, the fees may include certain utilities, trash pickup, and maintenance of any common areas (e.g. community tennis courts, pools, playgrounds).

HOA fees vary according to the location, property, and amenities they cover. Some HOAs charge as little as $100 a month while others charge thousands. Before purchasing property with HOA fees attached, investigate how well the HOA manages the property and whether or not current residents are satisfied. Speak with potential neighbors, look at the amenities, and make sure you understand what the fees cover and what they do not.

Property Taxes

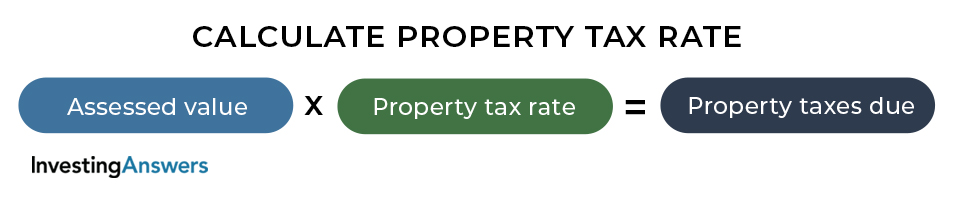

Town, city, and municipal governments levy taxes on property to raise money for essential services like road maintenance, fire and rescue squad services, and public schools. These taxes may be billed annually or monthly, depending on the local government.

Call or visit the website of your city or county to find the current property tax rate. Then, multiply the assessed value of your property by the tax rate.

Assessed Value vs. What You Pay

A common area of confusion among new homeowners is the difference between what they paid for a property and its assessed value. The assessed value is often less than the price paid for the home. Assessors look at different aspects than a real estate agent and typically assess the home’s value at about 80% of what it is worth.

Don’t worry if the assessed value is less than the market value: It has no bearing on the market value, or what your home is worth on the real estate market. It means a lower tax bill for you!

What Is Amortization?

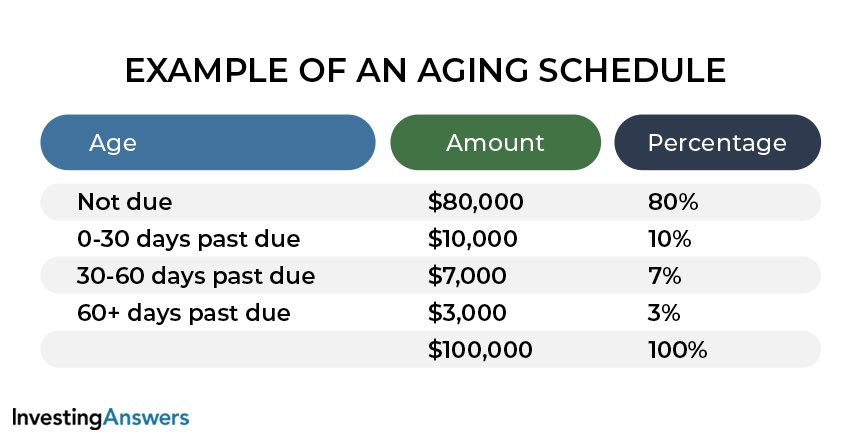

Amortization refers to paying off a loan’s principal over time. A portion of each monthly mortgage payment goes towards paying the interest and the remainder goes towards repaying the loan’s principal. An amortization schedule is a table that shows the amount of interest and principal in each payment.

How Do I Calculate the Amortization Schedule?

Use this tool to calculate the amortization schedule for your mortgage.

Does Amortization Occur for All Loan Types?

Among loan types, two are typically amortized: auto loans and mortgages.

Is There a Way to Lower My Mortgage Payment?

There are several ways to lower your mortgage payment. You can:

- Pay a larger down payment on your home to lower the amount you borrow.

- Comparison shop for your mortgage and choose the lender with the lowest rate.

- Refinance your mortgage to one with a lower rate.

- Choose an adjustable rate mortgage (especially if the interest rate is likely to go down over the lifetime of the loan).

- Improve your credit score to help you negotiate a lower interest rate and lower your monthly mortgage payment.

Refinancing

Refinancing a mortgage means taking out a new mortgage to pay off the first loan. It also means going through the mortgage approval process again, which can be as complicated as the original loan approval process. There are, however, plenty of benefits to offset the hassle and headaches of refinancing your home.

Is Refinancing My Mortgage the Right Move?

Refinancing your mortgage is the right move when it helps you take advantage of lower interest rates. Interest rates have been falling for a 30-year fixed rate mortgage, making them lower than in years past. If you bought your home when rates were higher, you can save money by refinancing and securing a lower rate now.

Just as the lender will do their homework and look into your credit score, payment history, and home’s value, you should do your own homework, too. Compare rates among lenders and types of loans (such as ARMs and FRM). Assess which may be beneficial to you based upon the terms of the loan, the interest rate, and other factors depending on the lender.

Also, make sure your credit score is the best it can be. Avoid opening new lines of credit, changing jobs, or any other dramatic financial moves when applying for refinancing.

What to Expect When Refinancing

Refinancing simply means getting a new mortgage to replace the first one, so expect the process to be similar to when you first secured your loan. There are several steps in the refinancing process, starting with the appraisal.

Appraisal

One factor used to determine the refinancing amount available is an appraisal, or an evaluation of your home’s current value by an independent expert.

Most states require home appraisers to be licensed and/or certified. Determine if your state requires home appraisal licensing to find an appraiser near you.

Appraisals are a crucial step in the refinancing process. To qualify for the loan, the appraised value must be greater than the refinancing amount. It must also demonstrate that you have 20% (or more) equity in your home or you’ll be forced to pay for private mortgage insurance. That’s an additional cost that may make refinancing a poor option.

You’ll be expected to pay for the home appraisal during the refinancing process. It can cost anywhere from $300 to $500, depending on where you live and the appraiser’s qualifications.

How an Appraisal Works

During a home visit, an appraiser examines your residence inside and out and then compares it to similar homes in the neighborhood. Take time beforehand to spruce up your home. Repainting helps, as does cleaning the interior and making sure that areas the appraiser will visit (e.g. furnace room, kitchen, bathrooms) are clean and free from clutter.

Underwriting Fees

Underwriting fees are charged by the lender to cover their time and cost of assessing the risk of lending money. Lenders must go through numerous steps to review the borrower’s credit history, current outstanding debts and income, and other aspects of their financial history and health. They want to be sure that borrowers are a good loan risk.

Underwriters look at three areas in particular to assess credit worthiness during refinancing:

- Your credit score - must meet the lender’s minimum requirement.

- Your credit report - especially the history of loans and ability to repay them on time.

- The property appraisal

The underwriter verifies your identity and collects all of the necessary documents, reviews them, and prepares a report for the lender. Based on this report, the lender makes a decision about whether to lend you money, how much, and under what conditions.

Other Common Fees to Expect When Refinancing

Below is a chart of common fees during home refinancing.

Taxes

Refinancing can impact your taxes, so it’s important to understand the potential tax implications after refinancing your mortgage.

The IRS views refinancing as “debt restructuring” and treats tax deductions differently between initial mortgages and refinanced mortgages.

For an initial mortgage, taxpayers can deduct points paid on the mortgage if they itemize deductions on their tax return. Taxpayers who refinance may deduct an amount equal to the number of mortgage points paid divided by the lifetime of the loan. You can get this amount from the lender.

Note: For more details on the different tax implications of an initial mortgage versus refinancing, please see IRS Tax Tip 2003-32.

Timeline

In general refinancing takes between 20-45 days, depending on the lender. However, that timeline varies according to the lender. Ask in advance how long the average refinancing takes.

Find The Best Mortgage Rate

It’s likely that the mortgage on your home is the largest debt you will ever incur, so it pays to shop around.

How Do I Find the Best Mortgage Rate?

Getting the best mortgage rate takes more than checking with different lenders. There are numerous things you can do to help yourself obtain the lowest mortgage rate possible.

Improve Your Credit Score

The higher your credit score, the more attractive you are to lenders. The lower your credit score, the greater potential risk of default.

Lenders generally follow guidelines laid out by Freddie Mac and Fannie Mae. They also use the Indicator Score Requirements (a chart of credit scores and average risk) to assess credit scores and risk. A score of 620 is usually the minimum needed to obtain a mortgage, with some flexibility depending on the type of loan and lender.

Maintain a Steady Employment History

A steady employment history shows lenders that you are trustworthy and have a steady, reliable source of income. During the initial mortgage application and refinancing period, it’s important not to change jobs abruptly.

Pay Bills and Loan Installments on Time

A history of meeting loan and credit card payments also provides evidence to lenders that you are a good risk. Past behavior often predicts future behavior, so a history of paying bills and loan installments on time demonstrates that you can meet payment obligations.

Compare Various Lenders and Mortgage Types

Take the process of refinancing as seriously as you did shopping for the initial mortgage.

- Compare various lenders including banks, credit unions, and mortgage brokers and find the best rates.

- Read the fine print to ascertain all of the costs.

- Determine whether you prefer an adjustable rate mortgage (ARM) or fixed rate mortgage (FRM).

What to Remember When Shopping for a Mortgage

There are several tips to keep in mind when shopping for a mortgage.

You Can Get Multiple Quotes

There’s no rule that says you can only get one quote. Most credit scores aren’t affected by multiple requests for information for mortgage loans, so it’s fine to request quotes from many different lenders and for different types of mortgages.

Look at the Big Lenders (But Also the Small Ones)

Often, borrowers consider only the “big name banks” they’re familiar with or have an account with. There are many small financial institutions that offer competitive mortgage rates, too.

Smaller lenders offer numerous advantages, including personalized service, more flexible loan terms, and lower interest rates.

Big lenders have the advantage of name recognition. Many people have an established relationship with a large national or global bank and use their services for checking or savings accounts.

There’s no rule that you have to use one institution for all of your financial needs. A large bank may be an excellent choice due to multiple local branches being able to handle your daily financial needs, but a smaller lender may offer other advantages for your mortgage or refinancing needs. Consider all of your options and comparison shop.

When Is the Right Time to Get a Mortgage?

The right time to get a mortgage does depend on factors under your control, such as your credit score and employment history, but it can be affected by the lender’s business cycle, too.

Generally speaking, lenders are more amenable to applications for loans at the start of the month. They typically like to review loan applications mid-month and approve loans by the end. If you can, take advantage of this cycle and apply for a mortgage early in the month.

Of course, the best time to get a mortgage is when you’re financially secure enough to repay it. A strong credit score and steady employment history demonstrate to lenders that you are mature and reliable enough to repay what may very well be the biggest loan of your life.