What's better than earning rewards for using your credit cards? Getting paid hundreds of dollars in sign-up bonuses in three months or less – just for trying out a new one.

Whether you're looking for plastics that offer a free stay at a five-star hotel, hundreds in bonus cash, or $750 in sign-up bonuses, we've found a variety of top sign-up bonus credit cards sure to fit your needs.

Assuming you have good or excellent credit (FICO score above 670), here are 2022’s top credit cards for sign-up bonuses:

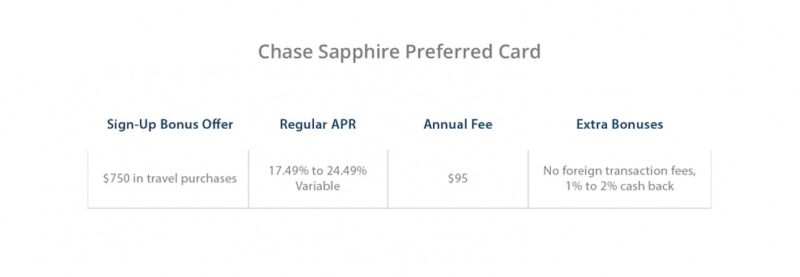

1. Chase Sapphire Preferred Card

Do you need a quick vacation? Chase's Sapphire Preferred Card could help you pay for it with a generous 60,000 bonus point sign-up offer for spending $4,000 in the first three months. That’s the equivalent of $750 toward travel.

The Sapphire Preferred card also doesn't charge foreign transaction fees and pays 2% cash back on both travel and restaurant spending.

Highlights of the Chase Sapphire Preferred Card

Get 60,000 bonus points (equal either to $600 cash or $750 at the Chase Ultimate Rewards store) by spending $4,000 within the first three months.

Earn 5 reward points on Lyft rides through March 2022, 2 reward points per dollar on travel and restaurant spending, and 1 point per dollar elsewhere.

Receive 25% more value when you redeem for airfare, hotels, car rentals, or cruises through Chase Ultimate Rewards.

Auto Rental Collision Damage Waiver: unlike most credit cards this provides primary coverage for rental car insurance reimbursement, so you can decline the rental car company’s collision insurance as long as you charge the entire rental to this card.

No foreign transaction fees or blackout dates on flights.

Who This Card Is Best for

Frequent travelers who don't carry a credit card balance and want some extra vacation spending money fast.

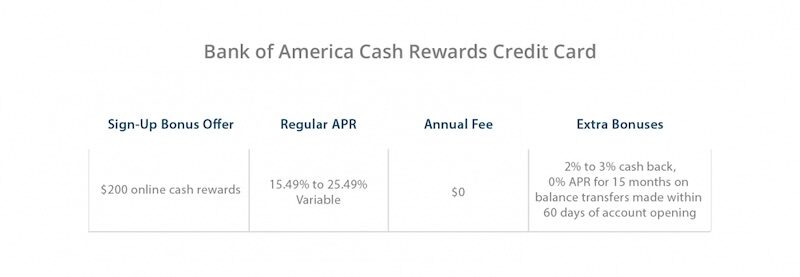

2. Bank of America Cash Rewards Credit Card

Looking for a card that’s great for everyday spending? The Bank of America Cash Rewards Credit Card pays a jaw-dropping 3% cash back on a category of your choice – on top of its $200 sign-up bonus for spending $1,000 on purchases within the first 90 days. And they won’t charge you an annual fee!

As an added cash back perk, you'll also earn 2% at grocery stores and wholesale clubs, and 1% everywhere else with this card.

Highlights of the Bank of America Cash Rewards Credit Card

$200 online cash rewards bonus if you spend more than $1,000 within 90 days after account opening.

3% cash back on a category of your choice, 2% back on groceries and wholesale club spending (for the first $2,500 each quarter on gas, groceries, and wholesale clubs), and 1% cash back everywhere else.

No annual fee

Who This Card Is Best for

Everyday spenders looking for an easy $200 sign-up bonus and no annual fees.

3. IHG Rewards Club Premier Credit Card

Ever had the chance to stay a night in a five-star hotel for free? There’s a reason that many industry experts call the IHG Rewards Club Premier Credit Card one of the best hotel cards on the market: Just for being a cardholder, you’ll be rewarded a free night stay.

If that isn't enticing enough, the card offers 140,000 bonus points for spending $3,000 on purchases within the first three months. That's enough to cover more IHG hotel stays or pay for $350 worth of merchandise, airfare, and other inviting travel rewards.

Highlights of the IHG Rewards Club Premier Credit Card

Get a free night each year of your card membership, redeemable at 5,000 IHG hotels worldwide including InterContinental and Crowne Plaza Hotels & Resorts, Holiday Inn, and even five-star IHG resorts.

Earn 140,000 bonus points ($350 cash equivalent or 14 IHG hotel stays) if you spend $3,000 in the first three months.

Earn 25 points per $1 for IHG hotel stays and 2 points per $1 spent on gas, grocery, and restaurants. Earn 1 point per $1 spent on everywhere else.

Who This Card Is Best for

Five-star hotel dreamers, international hotel travelers, and everyday spenders.

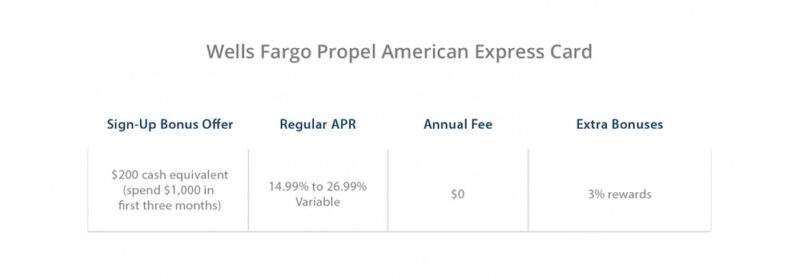

4. Wells Fargo Propel American Express Card

Always on the go with little time to cook for yourself? Watch your rewards points balance fly as fast as you do with the Wells Fargo Propel AMEX Card.

This card offers 20,000 bonus points (a $200 cash redemption value) when you spend $1,000 within the first three months. That’s on top of rewards of 3 points per dollar spent on eating out, ordering in, gas stations, rideshares, transit, and travel expenses (e.g. flights, hotels, homestays, car rentals).

Highlights of the Wells Fargo Propel American Express Card

Earn 20,000 bonus points ($200 cash redemption value) for spending $1,000 in the first three months.

Get 3 points per $1 spent on eating out and ordering in

3:1 points for gas stations, rideshares and transit

3:1 points for travel (on flights, hotels, homestays, and car rentals)

3:1 points on streaming services

1:1 points for everything else.

Who This Card Is Best for

Travelers, restaurant frequenters, to-go lovers, commuters, and ride sharers.

5. Citi Premier Card

When it comes to cash-equivalent sign-up bonuses, the Citi Premier Card is king. The card offers 80,000 bonus points for spending $4,000 in the first three months.

That's enough points to buy a whopping $800 in gift cards. Citi's card also pays 3% back on travel and gas, and 2% back on dining out and entertainment.

Highlights of the Citi Premier Card

Get 80,000 “ThankYou” bonus points (equal to $800 in gift cards, merchandise, travel, cash and more) for spending $4,000 in purchases within the first three months.

Earn 3 points per $1 spent on travel and gas, 2:1 points on restaurants and entertainment, and 1:1 points everywhere else. Get 25% higher redemption value through ThankYou Travel Center.

No foreign transaction fees on purchases.

Who This Card Is Best for

Commuters and travelers that want $600 in gift cards and extra cash back rewards for gas and travel spending.

Which Bonus Credit Card is Right for Me?

Bonus credit cards help you enjoy excellent perks from travel rewards to gift cards. Choosing the right one comes down to your spending preferences. From there, be sure to maximize your rewards by paying off your balances in full each month.