Tired of dragging credit card debt around with you? Then do a balance transfer to transfer debt from a high-interest credit card to one with a lower interest rate. This hack could save you thousands in interest charges and help you pay off your debt faster.

After spending countless hours analyzing dozens of credit cards, our research team has identified some of the best balance transfer cards on the market that:

Charge the lowest-possible balance transfer fees

Offer a 0% annual percentage rate (APR) on your balance for up to 21 months

Boast the lowest ongoing APRs as you pay down your debt

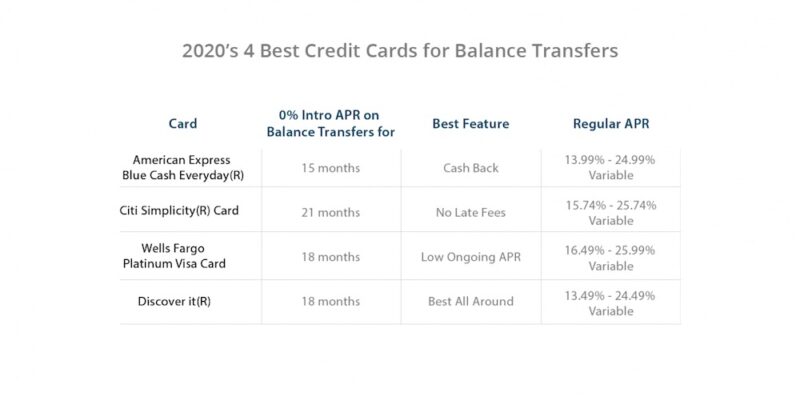

Assuming you plan to keep making payments and have great credit (above 670), keep scrolling to see our lineup of best balance transfer credit cards for 2022. First, here's a look at the cards at a glance:

2022’s Four Best Credit Cards for Balance Transfers

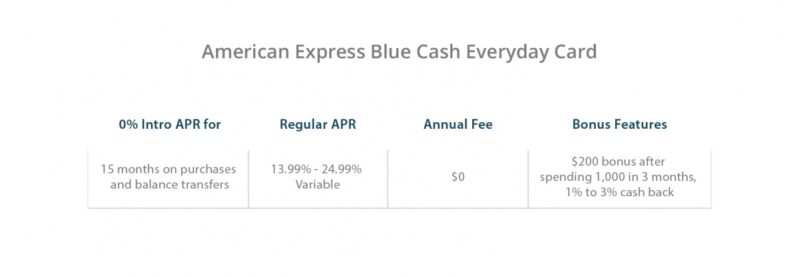

1. American Express Blue Cash Everyday Card

Balance transfer cards offer excellent cash back rewards as well. While the AMEX Express Blue Cash Everyday Card charges the standard 3% balance transfer fee, it also offers a $200 bonus if you charge more than $1,000 in purchases within the first three months of opening the account. This bonus is enough to recoup the fee on a $5,000 balance transfer and provide some cash back to pay down debt.

With this card offering 3% cash back on supermarket purchases (up to a $180 annual reward limit) and 2% cash back on US gas purchases, it won’t take long to build up some serious rewards cash.

Highlights of the Blue Cash Everyday Card

0% intro APR for 15 months on new purchases and balance transfers

3% cash back at supermarkets (up to a $180 cash back limit, 1% after)

2% cash back on US gas; select US department stores

1% everywhere else

$200 sign-up bonus (for spending $1,000 in the first 3 months)

Who This Card Is Best for

The Blue Cash Everyday Card is best for big spenders who plan to start paying off their debt in full every month, as well as those who want to earn cash back to supercharge their debt payoff plan.

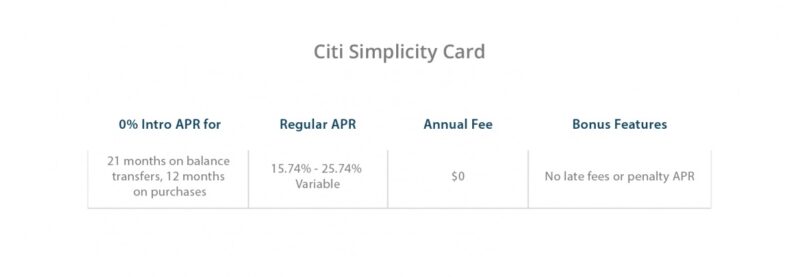

2. Citi Simplicity Card

Need extra time to pay off a large credit card balance? The Citi Simplicity Card offers a 0% intro APR for a full 21 months on balance transfers. This could easily save you thousands in interest charges as you pay off your debt.

If you're currently paying 20% APR on a $30,000 credit card balance, for example, you could save more than $8,000 in interest charges over the first 21 months (easily making up for the card's 5% balance transfer fee).

Highlights of the Citi Simplicity Card

0% intro APR for 21 months on balance transfers

0% intro APR for 12 months on purchases

No late fees or penalty rate

No annual fees

Who This Card Is Best for

This will appeal to debt slayers with heavy credit card balances or someone looking to buy a big-ticket item without the financing charge. They’ll be sure to reap the biggest savings from this card's exceptionally lengthy 0% intro APR offer.

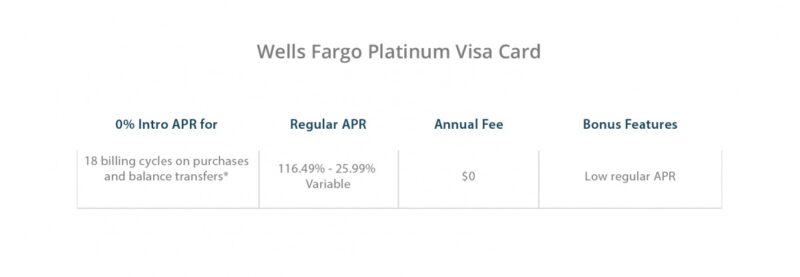

3. Wells Fargo Platinum Visa Card

Borrowers with excellent credit (who need two years or more to pay down debt) may appreciate the Wells Fargo Platinum Visa Card.

For those with excellent credit, this ‘classic plastic’ couples a lengthy 0% intro APR (for the first 18 months) with one of the lowest ongoing APR rates on the balance transfer card market. That should help maintain minimal interest charges as you steadily pay down your balance.

Highlights of the Wells Fargo Platinum Card

0% intro APR for 18 billing cycles on balance transfers and new purchases

Low ongoing APR

3% balance transfer fee

Who This Card is Best for

This card may be ideal for borrowers who require a long 0% APR intro period and low ongoing APR to steadily pay down large balances.

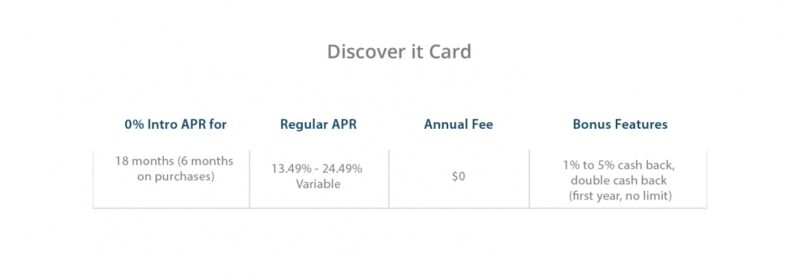

4. Discover it Card

The Discover it card offers generous cash-back rewards of up to 5% on rotating categories (like gas, Amazon, restaurants, and wholesale clubs), a lengthier 18-month 0% intro APR, and one of the lowest ongoing APRs on the balance transfer card market.

To top it off, Discover will double your cash back at the end of the year (no limits!), potentially turning $200 in rewards into $400 to slash your debt or take a well-deserved vacation.

Highlights of the Discover it Card

0% intro APR for 18 months on balance transfers, 6 months on purchases

5% cash back in rotating categories, 1% cash back elsewhere

Double your cash-back rewards at the end of the first year (no limit to rewards)

Who This Card Is Best for

The Discover it card might be ideal for large-balance borrowers looking for a mix of lucrative cash-back rewards and ultra-low APRs to help them save thousands in interest charges.

Which Balance Transfer Card Is Right for Me?

These balance transfer cards are filled with features designed to please all types of card users who are carrying a balance. Borrowers with heavy debt loads may save the most on interest charges by choosing a balance transfer card with a lengthier 0% intro APR offer. Big spenders that plan to regularly pay off their monthly balance may prefer racking up rewards on cash-back cards to help pay down past debt.

Related: 6 Secrets to Saving Money on Credit Card Balance Transfers

If you need to pay off credit card debt, it's up to you to take advantage of a 0% APR introductory offer and commit to debt pay off. The goal is make progress in paying down credit card debt with a balance transfer and avoid the habit of transferring a balance one after another. This will make the transfer fee worthwhile.

Related: 5 Devastating Mistakes That Turn 0% Credit Cards into Nightmares

Read each card's fine print to find the card that saves you the most money and puts you on track toward financial freedom.