If you're spending money, why not get paid for it with one of the best cashback credit cards of 2022? When you receive a percentage of what you spend with every purchase (normally between 1 to 5%), you’ll get significant savings that can be used to pay down your balance (or cash out for something special).

Whether you're looking for credit cards with up to 6% cash back, double flight miles, or even a free hotel stay, discover highly-rewarding credit card options for those with low balances and excellent credit (read to learn about building credit):

Best Credit Card Rewards for Investing

After analyzing hundreds of reward credit cards, our experts have compiled five cards with the lowest annual fees, highest cashback rates on popular spending categories, and the most generous cardholder perks.

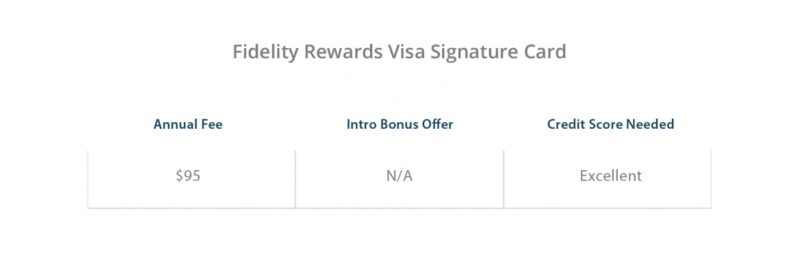

Fidelity Rewards Visa Signature Card

Looking to fund your retirement account? With the Fidelity Rewards Visa Signature Card, every dollar you spend goes into a Fidelity investment account, IRA, your kids' 529 college plan, or even a charity fund gets a 2% deposit.

Say you spent $4,000 per month on this card: You'd earn $960 in rewards every year. If you invested all of it and earned a 7% annual return on those funds, within 20 years, those rewards could grow to more than $41,000 in your Fidelity account!

Highlights of the Fidelity Rewards Visa

2% of purchases go to fund your Fidelity account

No limits on rewards

$0 annual fee

Who This Card Is Best for

Regular spenders and savers who want to earn an impressive 2% reward on every dollar spent. This is also ideal for people who want to invest those rewards in a brokerage account.

Best Credit Card Rewards for Cash Back on Everyday Purchases

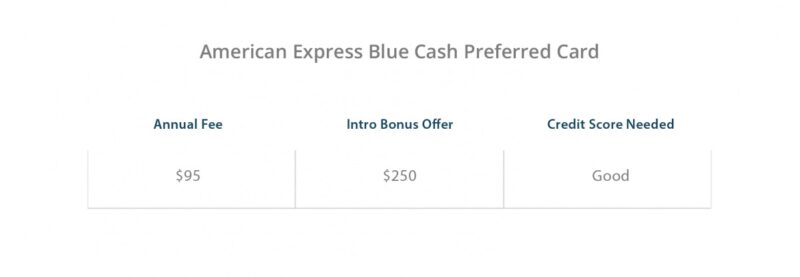

American Express Blue Cash Preferred Card

One of the best reward cards for everyday spending, AMEX's Blue Cash Preferred Card pays a whopping 6% cash back on US supermarket purchases (up to $6,000 per year in purchases which can net users up to $360 annually). You can also earn 6% cash back on streaming services like Netflix.

The card comes with a $95 annual fee. However, its $250 sign-up bonus – combined with cash back rewards – help to negate this fee.

Highlights of the Blue Cash Preferred Card:

6% cash back at U.S. supermarkets (on up to $6,000 in spending, then 1% after)

6% cash back on select US streaming subscriptions

3% cash back on transit (e.g. taxis, rideshares, parking, tolls, buses)

3% cash back at gas stations

0% intro APR for 12 months on purchases and balance transfers

Who This Card Is Best for

Car commuters and frequent supermarket/department store shoppers.

Best Rewards Credit Card for Travel

If you love to travel, Capital One's Venture Rewards Credit Card could help you budget for more vacations.

Capital One Venture Rewards Credit Card

The card's $95 annual fee (waived during the first year) is easy to recoup when you consider the $500 sign-on bonus (if you spend $3,000 in the first three months). What’s more, you get waived foreign transaction fees, travel discounts, and a generous $250,000 travel accident insurance benefit.

Highlights of the Venture Rewards Card

Earn two air miles per $1 spent (equal to 2% cash back)

Get 50,000 bonus miles (~$500) if you spend $3,000 in the first three months

No foreign transaction fees or blackout dates on flights

Who This Card Is Best for

High-income individuals who spend heavily on their credit cards and travel frequently throughout the year.

Best Credit Card Rewards for Hotel Stays

Looking for a free night’s stay in luxury hotels, just for being a cardholder?

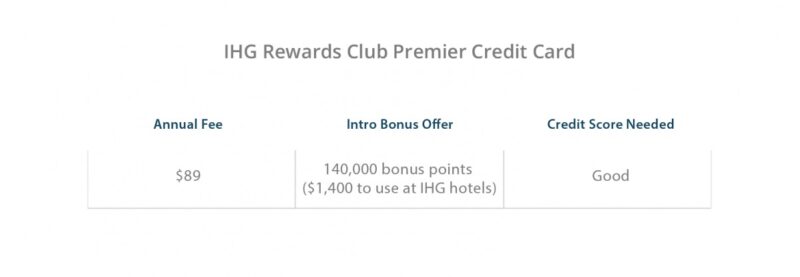

IHG Rewards Club Premier Credit Card

With the IHG Rewards Club Premier Card, the $89 annual fee is offset by one free night at IHG hotels (e.g. InterContinental Hotels & Resorts, Crowne Plaza Hotels & Resorts, and Holiday Inn).

It also offers 140,000 bonus points after sign-on (if you spend $3,000 in the first three months) to help you pay for reward nights, merchandise, airfare, and other inviting rewards.

Highlights of the IHG Rewards Club Premier Card

5% rewards for IHG hotel stays

2% rewards for gas, grocery, and restaurants

Free Anniversary Night at 5,000 hotels worldwide

Earn 140,000 bonus points if you spend $3,000 in the first three months

Who This Card Is Best for

Road warriors who want to maximize free hotel stays.

Best Credit Card Rewards for Gas

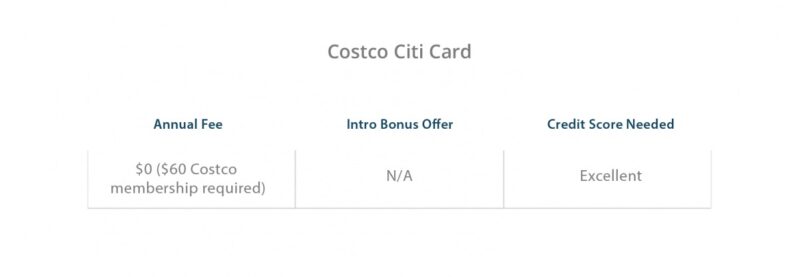

A personal favorite (and a beloved secret) among Costco members, the Costco Citi Card may offer the most lucrative cash back rate for gas and restaurant spending anywhere.

Costco Citi Card

Though it's only available with a $60 Costco Membership – and the cash rewards are only redeemable once per year – this high-value card comes with damage/theft purchase protection and extends the length of manufacturer's warranties.

Highlights of the Costco Citi Card

4% cash back on gas (up to $7,000 spent per year, then 1% cash back thereafter)

3% cash back at restaurants and on select travel purchases (e.g. hotel, airfare, car rental and purchases made at Costco Travel)

2% cash back on Costco and Costo.com purchases

1% cash back everywhere else

Who This Card Is Best for

Those who are frequent Costco shoppers, car commuters, restaurant connoisseurs, and overseas vacationers.

What's the Best Rewards Credit Card for Me?

It’s important to pick the card that best fits your lifestyle in order to enjoy your hard-earned rewards. Just remember to keep your credit score high and pay off your card balances to minimize interest charges while maximizing cash-back rewards.

Readers Like You Also Enjoyed:

3 Ways to Pay Off Your Mortgage up to 15 Years Early

The 4 Worst Home Refinancing Mistakes People Make

These Magic Words Can Slash Hundreds Off Your Credit Card Bills