Real estate investing can serve as a foundation for anyone seeking to build wealth. But finding the right deals can be tricky. That’s where PeerStreet can help out.

PeerStreet is a real estate crowdfunding platform that offers accredited investors the opportunity to make private lending investments. As an investor, you can use a straightforward platform to build a portfolio that meets your goals.

Could PeerStreet be the real estate investment opportunity you’ve been waiting for? Let’s take a closer look in this PeerStreet review.

What Is PeerStreet?

PeerStreet is a real estate crowdfunding platform that showcases private lending investment opportunities to accredited investors.

Founders Brew Johnson and Brett Crosby built PeerStreet with a vision of a more transparent way to invest from start to finish. After watching the 2008 financial crisis unfold, the founders sought to create a stronger system rooted in transparency for investors.

The platform offers the opportunity to make private lending investments in deals with a range of yields, terms, and loan-to-value (LTV) ratios. The properties available can be residential or multifamily deals. In any situation, all of the details about the particular opportunity are easily accessible on the site.

Investors can cherry-pick deals that align with their investment goals to build a portfolio that reflects their goals.

How Does PeerStreet Work?

Here’s how the PeerStreet process works.

The entire process kicks off when a borrower needs funding for a short-term loan to improve a property to sell or rent. A need for capital leads these entrepreneurs and real estate investors to seek a loan from a private lender.

At this point, a lender from PeerStreet’s network steps in to provide the funds. From there, the lender will submit the loan to PeerStreet for review. If the loan meets quality and demand standards, then it will be published to the platform. As new deals become available, PeerStreet posts them to the site every business day at noon (Pacific Time).

Once the opportunity has been published to the platform, PeerStreet investors can select the loans they are interested in funding. You can make these selections by exploring the options or by setting up Automated Investing. With Automated Investing, PeerStreet will reserve your spot in investments that meet your criteria as soon as the deal is available. But you’ll have 24 hours to consider the opportunity before committing your funds to the deal.

The last leg of the journey starts after the loan is funded. The PeerStreet team will take over the loan for its entire life cycle. As the payments are collected, the platform will distribute the funds to investors via their PeerStreet account. But if the deal goes awry, a team can wade into the fray to recoup as much as possible for the investor.

Importantly, investors should expect their cash to remain tied up for the duration of the loan. You’ll find short-term loan opportunities starting with terms of just one month. Although the capital will be inaccessible throughout the term, you will receive interest payments on the 1st and 15th of every month.

The investment may be inflexible, but the potential for above-average returns is there. PeerStreet is able to offer investments with an average APR ranging from 6% to 9%. That's because borrowers are willing to accept higher rates to ensure fast access to capital.

PeerStreet Pocket

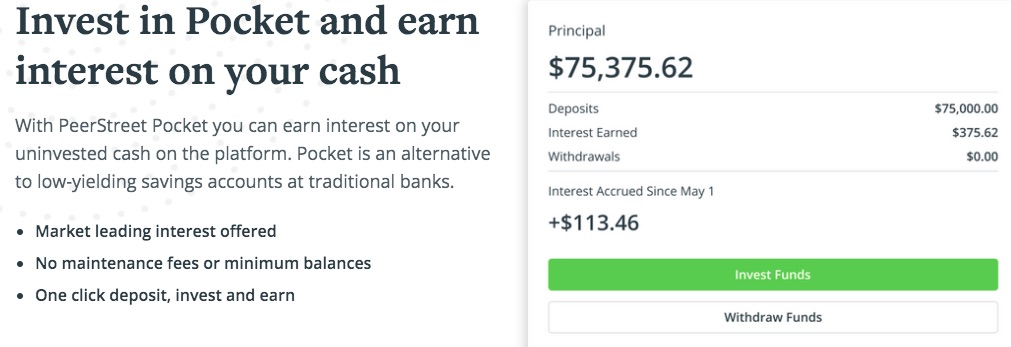

PeerStreet Pocket is an additional option for investments on the platform. Unlike the other investment options on the platform, Pocket is not tied directly to a loan. Instead, the product allows investors to earn interest on their available cash.

Through Pocket, you can withdraw your funds once per month. Based on the most recent information, PeerStreet Pocket users can earn 2% in annual interest.

Self-Directed IRAs

If you are interested in a self-directed IRA, PeerStreet offers this opportunity. You can set up your self-directed IRA through PeerStreet to invest in real estate within the account.

Although this choice isn’t right for everyone, it might be the right fit for accredited investors on the PeerStreet platform.

PeerStreet Pros and Cons

Here are the pros and cons to consider before working with PeerStreet.

Pros:

- Potential for passive income from real estate investment

- Easy to use platform

- Low investment minimums ($1,000)

- Self-directed IRA available

- PeerStreet Pocket offers returns on available cash

Cons:

- Accredited investors only

- Illiquid strategy

- Limited number of deals

Not an accredited investor? Check out Fundrise.

Who Can Invest With PeerStreet?

PeerStreet only allows accredited investors to work with the site. In order to be considered an accredited investor, you’ll need to have a net worth of over $1 million (excluding primary residence). Or have an income of $200,000 in each of the last two years, or $300,000 if you are married filing jointly.

Based on those numbers, many new investors likely won’t be able to work with PeerStreet.

PeerStreet Minimum Investment and Fees

PeerStreet allows investors to get started with as little as $1,000. That’s a relatively low bar to entry considering that all investors must be accredited.

The fees associated with your PeerStreet investments can add up quickly. The exact fee will vary based on the unique investment. But the fees can range from 0.25% to 1.00%. You’ll see a disclosure about the fees for any investment before anything is finalized.

How Do Investors Make Money?

Investors can earn money with PeerStreet in two ways.

First, you can earn a return on your uninvested cash on the platform through PeerStreet Pocket. The funds held in cash are FDIC-insured for up to $250,000.

But the more interesting way to earn money through the platform is to make investments. When you invest in a private loan, the assumption is that the borrower will make on-time monthly payments. As those payments are made, you will receive your share of the payments in your PeerStreet account.

If things don’t go according to plan, the borrower may default on the loan. In that case, the PeerStreet team will work to protect the investors interests and maximize proceeds quickly. Keep in mind that it is absolutely possible to lose money on these investments as the funds are not FDIC-insured.

Is Real Estate Debt Right for Me?

Investing in real estate debt could be the right move for your portfolio. But like all investment decisions, the answer will vary significantly based on your goals.

If you are hoping to build a relatively passive income stream, real estate debt could be a smart choice. But if you aren’t comfortable with the risks associated, then you may want to pursue other investment options.

Still Deciding? Check out REITs vs Real Estate Crowdfunding: Which Is Best?

Biggest Difference Between PeerStreet and Other Platforms

Unlike many other crowdfunding real estate platforms, PeerStreet doesn't offer standard real estate investment trusts (REITs). Instead, the platform is designed for accredited investors to build a customized portfolio based on their individual needs.

With PeerStreet, you will be limited to private lending investments. But that might be exactly what you are looking for. If you prefer REITs or aren’t an accredited investor, there are plenty of other real estate crowdfunding sites.

Want more? Check out all of the best real estate crowdfunding sites.

Summary

PeerStreet offers the opportunity for accredited investors to access private lending investments. The relatively low investment minimum allows you to try your hand at this potentially lucrative vehicle.

Ready to give PeerStreet a try? Sign up with PeerStreet today.

References:

https://www.peerstreet.com/howitworks?ps_src=header

https://info.peerstreet.com/faqs/what-are-peerstreets-fees/

https://info.peerstreet.com/faqs/are-my-funds-insured-by-the-fdic/