What Is Equity?

Put simply, equity is ownership of an asset of value. Ownership is created when the owner contributes to the financing of the asset purchase. Another way to finance the asset purchase is with debt.

The amount of equity used to purchase an asset is relative to the amount of debt. This is referred to as “the equity position.”

Types of Equity

There are various types of equity, depending on how the term is used.

In investing, equity refers to stock as ownership in a corporation.

In corporate finance, equity (more commonly referred to as shareholders’ equity) refers to the amount of capital contributed by the owners. Put another way, equity is the difference between a company’s total assets and total liabilities.

In real estate, equity refers to the difference between a property’s market value and the debt owed on the property.

Shareholders' Equity

Shareholders' equity is how much of a company’s net assets belong to shareholders.

How to Calculate Shareholders' Equity

You can calculate shareholders' equity by using the company balance sheet.

On this sheet, there are three essential components:

Assets - what a company has

Liabilities - what a company owes

Equity - what a company owns: the book value of shareholder capital (what shareholders have contributed to purchasing the assets).

Shareholders' Equity Formula

Equity represents a proportionate share of a company’s assets and earnings.

You can find shareholders' equity by using the following formula:

Example of Shareholder Equity

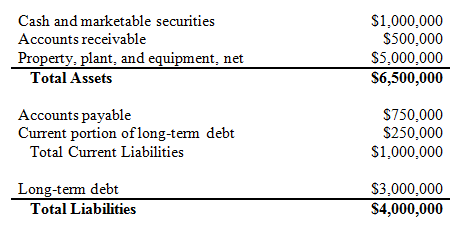

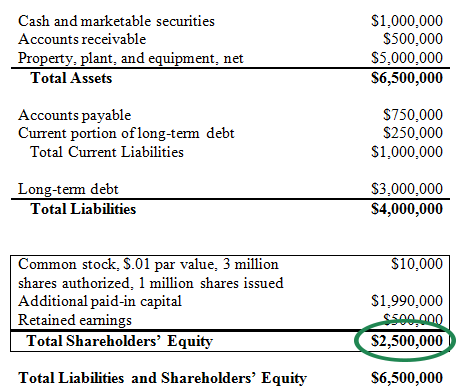

Let’s use the following company balance sheet to calculate total shareholder equity:

$6,500,000 (Assets)- $4,000,000 (Liabilities) = $2,500,000 (Shareholder Equity)

You can refer to the bottom of the balance sheet to see that this is true.

Market Value vs. Book Value

Market value is the value of company assets, liabilities, and shareholder equity as traded in the market on a particular date. This price moves up and down as shares trade, which is why it’s often preferred by investors as the most current value.

Book value is the value of a company reported on the balance sheet. The report uses accounting standards to value assets, liabilities, and equity. The amount of shareholder equity reported on the balance sheet is defined as the book value of shareholder capital.

Both of these numbers are used by investors and shareholders to determine value. It is important to understand that the book value of shareholder equity represents the company’s net worth. Remember: Shares are only worth what buyers are willing to pay for them, which could be more or less, depending on the market.

Investing and Shareholders' Equity

It’s important to know how equity value works in relation to investing. When a company is profitable, the value of equity – both the book value and the market value – can be expected to go up. When a company has experienced a loss, equity goes down.

Stocks and Shares: How They Relate to Equity

How do stocks and shares relate to equity for investors?

A stock represents a portion (or share) of a company. When you purchase stocks, you have equity (value) in that company. There are two common types of equities, both representing an ownership interest in a corporation:

preferred stock has additional advantages (like priority for dividends and additional voting rights).

A company only has a certain amount of shares to sell, outlined in its corporate charter. When a company decides to sell additional shares to new or existing shareholders, this is sometimes referred to as “raising equity.”

Equity entitles the owner of a share(s) to vote on certain matters. Each company has certain shareholder rights but generally, the voting is done in proportion to the number of shares owned. The company’s articles of incorporation determine the number of votes each share is entitled to.

Other Common Equity Examples

Shareholder equity and equity in stocks are only two types. Other equity types include:

Home Equity

When you own a home, the equity is your investment in said home. This initial investment is typically done as a downpayment and you borrow the rest with a mortgage. As you pay down the mortgage debt, your equity (share of ownership) becomes a larger share of the home’s value. Assuming you take on no new debt, If the home’s value increases, so does your home equity. But if the home’s value drops, your equity does the same.

When you sell, ideally, you’ve built home equity and made money beyond the initial investment.

Related: 5 Key Terms to Know Before Getting a Mortgage

Personal Equity

Personal equity is the amount of wealth-building equity that an individual has. A person can own assets that provide a return, such as investments in securities or income properties. Personal equity is the total combined value of these assets, minus any debt financing you may have used.

Related: 8 Steps to Prepare for a Personal Financial Crisis

Brand Equity

Brand equity is the added value (in the form of a higher price) that consumers are willing to pay, based solely on the name associated with a product or service. Companies usually pay a higher premium to work with brands that have high brand equity.

Private Equity

Private equity is a direct investment in shares of private companies. These shares are not publicly traded since most private equity funding comes from private equity firms. To obtain funding for investments, these firms are in partnerships with wealthy individuals, investment banks, endowments, pension funds, insurance companies, and even corporations.

Why Equity Is Important

Equity is an important term to understand for both personal investing, real estate purchases, and company shareholders. Comparing this ownership value metric over time indicates growth or loss, and changes in your own or your investment’s net worth.