What Is Working Capital?

Working capital is money that’s available to a company for its day-to-day operations. Simply put, working capital indicates a company's operating liquidity and efficiency.

A company's working capital reflects a host of company activities, including cash, inventory, accounts receivable, accounts payable, and the portion of debt due within one year (as well as any other short-term accounts). This can extend to inventory management, debt management, revenue collection, and payments to suppliers.

What Is the Working Capital Formula?

You can calculate the working capital of an organization by using the following formula:

Working Capital = Current assets - Current liabilities.

What Are Current Assets?

Current assets include a company’s liquid cash as well as other assets that can be converted to cash within one year or less. Some examples of current assets include money in checking accounts, inventory, supplies, equipment, and temporary investments.

What Are Current Liabilities?

Current liabilities include all the expenses and debts that a company needs to pay within one year. Examples of current liabilities are accounts payable, dividends, and income taxes owed.

Working Capital Example

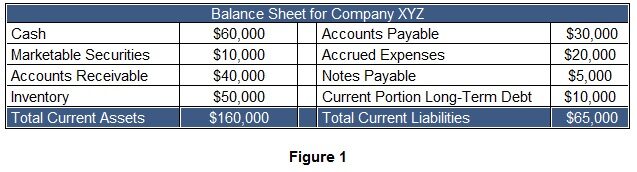

In the following example, we calculate a company's working capital by reviewing its simplified balance sheet:

Using the working capital formula and information from the table above, we can calculate the company's working capital:

Working Capital = $160,000 - $65,000 = $95,000 (a positive sum).

Positive vs. Negative Working Capital

Positive working capital generally indicates whether a company is able to quickly pay off its short-term liabilities. Negative working capital generally indicates that a company is unable to do so.

Analysts are sensitive to decreases in working capital since this may suggest whether a company is becoming overleveraged, struggling to maintain/grow sales, paying bills too quickly, or collecting receivables too slowly. Increases in working capital, on the other hand, suggest the opposite.

The working capital formula (current assets - current liabilities) demonstrates that if a company has positive working capital, it will be able to repay its payables and other short-term debt – even if business were to suddenly dry up.

Companies with positive working capital may face a problem if they have only enough cash to pay for 'day-to-day' operations and not enough cash for further expenses. If this occurs, it might mean that the company is:

having trouble moving its inventory

collecting receivables from customers too slowly, or

paying its vendor's payables too quickly.

If the company has little cash available and is unable to perform well in the three previously-mentioned situations, it may run into problems paying bills and vendors.

What Is a Working Capital Loan?

Unlike loans that are used to cover long-term expenses, working capital loans can be used to pay for day-to-day operational expenses (e.g. rent, payroll). Working capital loans can also be available as a line of credit, and the company can withdraw money as it sees fit to cover the expenses. Loans can be borrowed from banks or other lenders and are usually unsecured, meaning they are not backed by collateral.

Loans often come with a requirement for proof of revenue. However, working capital loans may have different requirements (such as monthly revenue requirements and documentation to prove income).

For small businesses, the US Small Business Administration offers a 7(a) loan program. Businesses can obtain a maximum loan amount of $5 million at a negotiable interest rate (currently between 6.50% and 11.25%). Companies also must meet certain requirements such as having a net income under $5 million, official registration as a for-profit business, and be in an SBA-eligible industry.

Working Capital vs. Net Working Capital

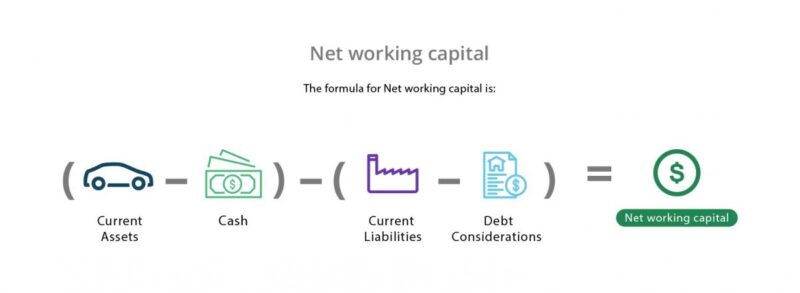

Working capital represents a company’s overall liquidity and ability to meet short-term demands. However, net working capital is determined by removing the cash from the asset category and short-term debt from the liability side of the equation. Net working capital can be calculated as follows:

Say that a company has $100,000 in current assets and $25,000 in cash. Its current liabilities are $30,000 and debt considerations are $15,000:

Net working capital = ($100,000 - $25,000) - ($30,000 - $15,000) = $60,000

This shows that the company has $60,000 to actually run the business. A lower net working capital would be ideal as that would mean a lower cost of running the business.

Difference Between Working Capital and Cash Flow

The main difference between working capital and cash flow is that the former represents a company’s current financial situation. Cash flow, on the other hand, demonstrates how much cash a business can generate over a specified period of time (e.g. monthly, quarterly, annually).

Working Capital vs. Fixed Capital

Working capital is the measure of the liquidity required to operate the company on a daily basis.

Fixed capital (also known as a fixed asset) refers to an investment that benefits the company over the long term. This type of investment could be related to upgraded manufacturing equipment, expansion/construction of a plant/facilities, or even the launch of a new division or product line.

What Causes Working Capital Changes?

The most common factors that can positively and negatively impact a company’s working capital are listed below.

Credit Policy

If a company tightens its credit policy, outstanding accounts receivables will shrink since customers are required to pay more quickly. This will increase the amount of cash the company is bringing in. However, customers may buy less as a result. Conversely, if a company grants customers more time to pay, cash will come in more slowly, but customers may be encouraged to buy more goods on credit.

Inventory Planning

In anticipation of sales growth, a company may increase its inventory levels. Increasing inventory will use cash, and shrinking inventory will free up cash.

Purchasing

In an effort to reduce unit costs, a company may reduce its costs by purchasing materials in greater volumes. While the initial outlay may be attributed more to larger volume, more cash would be available over the long term due to cost savings.

Accounts Payable

A company may decide to change the way it pays vendors. Switching from 30-day net (where bills are paid monthly) to a 45-day net policy to free up cash.