What Is WACC?

In investing terms, WACC shows the average rate that companies pay to finance their overall operations. WACC is calculated by incorporating equity investments from the sale of stock, as well as any operational debt they incur (with respect to the firm’s enterprise value).

WACC shows how much a company must earn on its existing assets to satisfy the interests of both its investors and debtors. If you are considering investing in a company, understanding this measurement can help you determine whether its stock has room to grow or if its progress is limited by how the business is financed.

Where Is WACC on the Balance Sheet?

WACC is often simplified as the “cost of capital” and may be referred to as “right side finances”. In ledgers, the right side of the budget sheet always lists the combined financing sources that a company uses (including financing and debt). Thus, the key factors that are used to calculate WACC are on the right side of the balance sheet.

What Does WACC Tell Us?

For investors, WACC is important because it details how much money a company must make in order to provide returns for stakeholders. As its name suggests, the weighted average cost of capital can change based on several factors, including the rate of return on equity.

An increasing WACC suggests that the company’s valuation may be going down because it’s using more debt and equity financing to operate. On the opposite side, a decreasing WACC shows the company is growing earnings and relying less on outside funding.

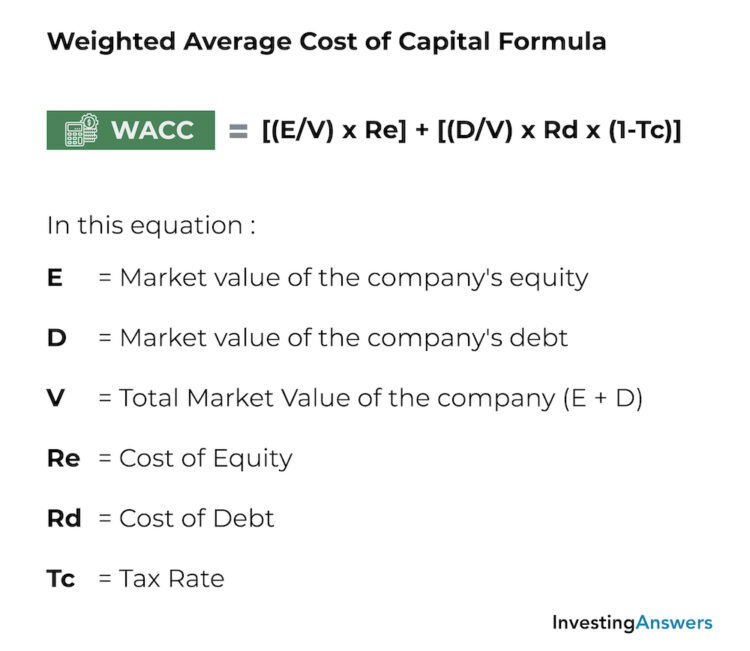

WACC Formula

Because WACC is not directly represented in financial statements, it must be calculated from the information available on quarterly statements. The weighted average cost of capital formula is:

What Capital Is Excluded When Calculating WACC?

When using WACC to calculate the cost of debt focuses on the two sources of financing: equity financing and debt financing. Accounts payable and accruals are not considered in the WACC formula. These sources of income are not supplied by creditors or investors, so they are not added to WACC.

What Is a Good WACC?

As a general rule, a lower WACC suggests that a company is in a prime position to more cheaply finance projects, either through the sale of stocks or issuing bonds on their debt. The business is producing enough through earnings to reduce the overall debt load and providing continuous returns to investors, which may encourage fundraising rounds to spur growth.

If a company has a higher WACC, it suggests the company is paying more to service their debt or the capital they are raising. As a result, the company’s valuation may decrease and the overall return to investors may be lower.

Is a High WACC Bad or Good?

Although a higher WACC may seem like a cause for concern, it isn’t necessarily a negative mark for a company. In some situations, a company may issue corporate bonds to fuel corporate expansion or purchase new physical assets. Even when WACC is minimized, it’s plausible that this will be negated over time. A company prospectus will often offer insight into why a company is raising debt or seeing equity financing, which – alongside WACC – can help you determine if it’s a good investment.

Can WACC Be Zero?

Because WACC considers both debt and outstanding equity in a company, WACC cannot be zero. If a company holds zero debt, then its WACC will only be the measurement of its equity financing, using the capital asset pricing model. On the contrary, if a company has zero investors, then the WACC is used to calculate the cost of debt.

Can WACC Be Adjusted?

In itself, WACC cannot be adjusted. However, if a company starts taking on additional risk through expanding their product line or services, the gains and risk aspects of WACC can be adjusted. For instance, adjusting a company’s beta measurement or the cost of debt can change the model, providing analysis on how likely a project will result in positive gains.

WACC and Discount Rate

WACC is used to determine a company’s potential based on its current financing options.

The discount rate, however, is the interest rate that investors use in calculating cash flow through the discounted cash flow valuation. An investor would use WACC to determine the potential in an investment today while they would use discounted cash flow to account for the time value of money and project future returns.

How WACC Can Be Used to Calculate NPV

WACC is important in the calculation of net present value (NPV) because it represents the current costs of financing. NPV is used to evaluate investment proposals for the future by taking the time value of money and discount rate into account.

When WACC is used to determine NPV, it ultimately provides a vision into the potential success rate of an expansion via investment. Projects with an NPV above 0 suggest that an investment project will provide a positive return, suggesting a potentially good investment.

WACC Example

Consider the financial position of two companies in the same quarter:

A Corporation | B Corporation | |

Outstanding Shares | 1,200,000 | 4,750,000 |

Market Price of Shares | $31 | $47 |

Market Capitalization | $37,200,000 | $223,250,000 |

Market Value of Debt | $15,000,000 | $46,500,000 |

Cost of Equity | 17% | 14% |

Cost of Debt | 4.7% | 6.9% |

Tax Rate | 35% | 35% |

Using the formula above, the WACC for A Corporation is 0.96 while the WACC for B Corporation is 0.80. Based on these numbers, both companies are nearly equal to one another. Because B Corporation has a higher market capitalization, however, their WACC is lower (presenting a potentially better investment opportunity than A Corporation).

Where to Find WACC on Financial Statements

Companies don’t usually advertise their WACC on their financial statements. However, by understanding several factors about a company, it’s easy to determine their weighted average cost of capital.

To calculate WACC, you will need to read through a quarterly statement to find the factors used in our example of weighted average cost of capital. While current market capitalization and the tax rate is easy to find, the market value of debt requires investors to calculate the entire debt load as one single bond coupon by using the bond quote formula.

WACC vs. CAPM

While WACC is a measurement of the average a company plans on paying on their financing options (including stock and debt).

The capital asset pricing model (CAPM) measures the potential rate of return on investments, especially where a high amount of risk is involved. While WACC shows how much money a company needs to make to offer value for stakeholders, CAPM suggests if a stock at a given price is a good or bad purchase based on risk and rate of return.

WACC vs. IRR

WACC and internal rate of return (IRR) measure two different concepts. While WACC measures the cost of operations through financing, the internal rate of return measures the break-even point for a specific project or investment. IRR is useful both for measuring the expected rate of return and determining whether an investment is worthwhile.