What is a W-Shaped Recovery?

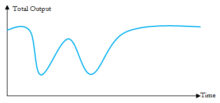

A W-shaped recovery refers to two consecutive cycles of economic decline and growth that graphically resemble the letter 'W.'

How Does a W-Shaped Recovery Work?

A W-shaped recovery graphically expresses what is frequently termed a 'double-dip recession.'

In a W-shaped recovery, the first phase of economic expansion follow a recession does not last, and the economy falls back into recession relatively soon thereafter. However, the second recovery, shown as the right upward stroke of the W, does gain traction and long-term economic expansion persists.

Why Does a W-Shaped Recovery Matter?

A W-shaped recovery typically stems from an inherently volatile economic climate combined with inflationary pressures and a generally bearish outlook. Most analysts agree that a W-shaped recovery characterized the recession of 1981.