What is a U.S. Savings Bond?

U.S. savings bonds are bonds sold by the U.S. Treasury. The U.S. Treasury has issued many different series of savings bonds over the years, but only I Bonds and EE Bonds are available for purchase today.

How Does a U.S. Savings Bond Work?

U.S. savings bonds come in electronic form and can be purchased from most financial institutions or via the U.S. Treasury's TreasuryDirect website. U.S. citizens, official U.S. residents, and U.S. government employees (regardless of their citizenship status) can buy and own savings bonds. Minors can also own savings bonds.

Paper EE bonds (no longer sold, but still in circulation) were sold at 50% of face value, meaning that the investor pays $50 for a $100 bond and the bond is not worth its face value until it matures. Electronic EE Bonds are sold at face value, meaning the investor pays $50 for a $50 bond. Electronic EE Bonds can be purchased in any amount over $25. I Bonds are sold at face value (i.e., a $100 bond costs $100). Like EE Bonds, the minimum investment is $25, and investors who purchase I Bonds electronically can buy in any amount above $25.

Investors can only purchase paper savings bonds in $50, $75, $100, $200, $500, $1,000, $5,000 and $10,000 increments, and they may purchase up to $30,000 worth of savings bonds in one year.

When a savings bond matures, the investor receives the face value of the bond plus accrued interest. Savings bonds are not redeemable for the first 12 months they’re outstanding, and investors who redeem within the first five years forfeit the last three months of interest as a penalty.

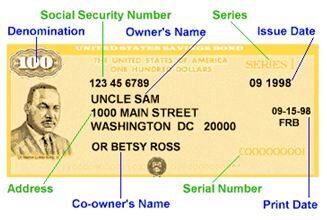

Below are the basic components of a paper savings bond.

Interest Payments

Savings bonds are zero-coupon bonds in that they earn interest monthly but do not pay that interest until they mature or are redeemed. The interest compounds semiannually.

EE Bonds issued after May 2005 carry a fixed interest rate equal to 90% of the average market yield on five-year Treasuries during the six months before the EE Bond’s issue.

I Bonds pay a fixed rate plus an inflation rate based on the CPI for Urban Consumers (CPI-U). The rate changes twice a year and offers some protection against lost purchasing power. This structure is what primarily distinguishes I Bonds from EE Bonds. The Bureau of Public Debt announces the bond rates in May and November.

Taxation

Interest from savings bonds is exempt from state and local taxes. It is subject to federal tax, however, but only in the year in which the bond matures or is redeemed. The holder may choose to pay taxes each year on the interest earned in that year, but the disadvantage to this is that the taxpayer must then pay taxes on accrued interest from any other investments as well.

Savings bond interest can be exempt from federal taxes if the investor redeems savings bonds and pays tuition for himself or a dependent in the same year. This exemption is called the Education Savings Bond Program, and there are eligibility requirements, so be sure to consult a qualified tax professional before investing.

Why Does a U.S. Savings Bond Matter?

Savings bonds are simple, low-risk investments. The state and local tax exemption, as well as the federal exemption for tuition payment, make savings bonds especially advantageous for investors in high tax brackets or those with children heading to college. Savings bonds are very liquid in that they can be redeemed online or at nearly any financial institution (but note that they have no secondary market, meaning that they cannot be traded among individual investors).

However, savings bonds offer a very low rate of return and lack protection from inflation due to their fixed interest rate (note that I Bonds do offer some inflation protection, however). There is also no capital gains opportunity with savings bonds, nor do they provide current income unless the investor redeems the bond. Because savings bonds already offer a tax deferral, it is rarely advantageous to hold them in tax-deferred accounts.