When determining if leasing is the right option for you be sure you understand how leasing works. It's also important to take a good look at your lease agreement and ask questions if there is something you don't understand.

Your cost will be determined by the car's sale price, residual value after the lease ends, and the money factor (aka, the APR) on the lease.

Is It Better to Buy or Lease a Car?

Leasing is very different from owning. Leasing is basically renting the car instead of buying it.

When you lease you typically have lower payments vs buying that same vehicle. Of course at the end of the lease term you can decide to turn in the car or purchase it.

When you buy a car your monthly payments may be higher, but you can keep the car for as long as you like and sell it when you are ready for an upgrade.

Generally, over the long term, buying a car will be less costly since you can potentially drive the car for years after you've paid it off and then sell it when you are done. You also benefit from decreased depreciation, which is most significant the first few years of a car’s lifespan.

Pros and Cons of Leasing

Before you go leasing a vehicle it’s important to weigh the pros and cons.

Pros of leasing a car:

You can likely lease a car for a lower monthly payment than buying

You have flexibility to change cars every few years

If you’re a business owner you may be able to deduct expenses

Cons of leasing:

You'll likely always have a car payment

You will be charged extra if you drive over the allotted miles on the lease

You’ll likely pay more for car insurance on a leased vehicle

If you’ve weighed the pros and cons and are ready to lease, follow these five essential tips before you do so:

Tip #1: Negotiate the Purchase Price

Whether buying or leasing a car, the initial purchase price is vitally important and should be negotiated downward as far as you can go. Many dealers try to shift emphasis away from the purchase price by telling you there is no need to haggle over price because the monthly payment is the only consideration when leasing a car.

However, the purchase price is a key determinant of the monthly payment, so spend time to get the best deal out there.

Tip #2: Get an Estimate of Residual Value

The value of the car when the lease is up is referred to as its residual value. A car that ends up with a higher residual value is better because the lease amount depends on the value of the car at the beginning of the term and at the end of the term. A car that loses more value over the term of the lease will be more expensive.

Leasing companies and others in the industry try to estimate this future residual value as accurately as possible, but the reality is it's difficult to predict with any certainty. Like the initial purchase price, residual value can definitely be used as a negotiation point between the auto dealer and car buyer, so it helps to have a reasonable estimate for what the residual value should be during the term of lease.

Look at prices of used cars (the same make and model you're looking to lease) to get an idea of what that new kind of car may sell for after it's a few years old and your lease term is up.

Tip #3: Understand How Lease APR Works

The amount you're financing will be the difference between the sale price and the residual value. For example, if you leased a $25,000 car that will be worth $19,000 at the end of the lease term you'll need to pay $6,000 for the lease (plus any other costs, such as interest and sales tax in some states).

In the leasing world, interest is called the 'money factor'. It can also be called the 'lease factor' or 'lease fee.'

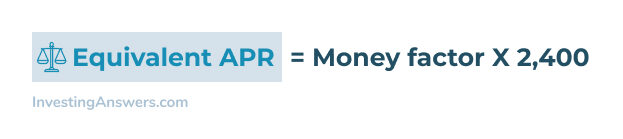

To calculate the equivalent APR on a lease take the money factor and multiply it by 2,400.

A lower money factor means a lower financing rate which can significantly lower the monthly payment. The money factor will fluctuate along with interest rates. Take a moment to look up current interest rates for cars before you head to the dealership.

Tip #4: Compare Car Lease Terms and APR Over Multiple Periods

Typical car leases are between 24 and 60 months. A longer lease term allows you to spread out the cost of a vehicle and can lower the monthly lease payments, but it also means that you are financing a higher percentage of the vehicle's useful life.

This consideration is somewhat offset by the fact that deprecation rates slow down after three or four years, which means that much of the cost of a car is paid up front or during the term of the lease.

Overall, see what options are offered by the dealer and ask for all price options by lease term to see which best fits your budget.

Tip #5: Figure out How Many Miles You Drive

Car mileage also affects lease payment amounts. Typical mileage agreements are for 10,000, 12,000, or 15,000 miles, though there are also options for those driving above-average miles for work. Logically lower mileage helps minimize monthly payments as it reduces depreciation, leaving you with a higher residual value.

Before you go in to negotiate a lease based on lower mileage, make sure you know you won't go over. Going over the agreed-upon mileage can become very expensive -- you're usually charged somewhere around $.15-.25c per mile over the mileage stated in the lease.

Again, have the dealer price out all available options to find which is best for you, and don't fool yourself into thinking you will drive less than you actually do.

Calculate Your Monthly Lease Payments

If you really love the idea of a new car (and that new car smell!) and are happy to pay for the right to switch into a new one every few years, then leasing may be a good option for you.

Before you do so though, make sure you can afford to lease! Run the numbers to know what kind of lease payments you can afford. Once you’ve got an idea see what your monthly payments would be for your next car with our Car Loan Calculator. And if you are going to have to pay sales taxes, don't forget to factor that in!

If you’re looking for the cheapest way to drive a car, however, look to buy an affordable used car and drive it until it’s no longer functioning. If you plan to buy a used vehicle and you need to know what your monthly payments will be after trading in your existing vehicle, then check out our Used Car Loan Calculator.

Considerations Specific to Electric Vehicles

If you’re considering leasing a car, you may want to consider looking into electric vehicles as some states offer tax credits and you may be eligible for federal tax credit as well.

However, if you are not eligible for these by leasing then it may be worth looking into purchasing an electric vehicle to take advantage of any available tax credits.