What are STRIPS?

STRIPS stands for Separate Trading of Registered Interest and Principal of Securities. They are securities that represent the separate interest and principal components of Treasury securities.

The U.S. Treasury created the STRIPS program in February 1985.

How Do STRIPS Work?

Though STRIPS are considered Treasury instruments, they aren’t really Treasury securities at all. They are synthetic zero-coupon bonds.

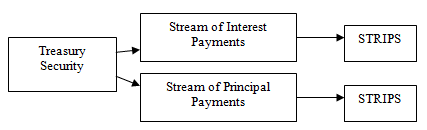

Essentially, STRIPS are created when a financial institution buys a T-Note or T-Bond and then turns each interest and principal payment into a separate security (i.e., it 'strips' the interest and principal payments). These new securities are sold as zero-coupon bonds with maturities that correspond to the timing of each particular interest payment.

Consider a seven-year Treasury note. The note consists of 14 interest payments and one principal payment due at maturity. A financial institution could take this security and create 15 STRIPS: one for each of the 14 interest payments and one for the principal repayment. Each STRIPS has its own CUSIP number and is sold at a deep discount; the securities then increase in value every year until they reach their face values. For example, a financial institution might sell a STRIPS representing one of the seven-year Treasury's $500 interest payments to an investor for $200. As the note's interest payment draws near, value of the corresponding STRIPS increases, ultimately reaching $500.

The U.S. Treasury does not issue zero-coupon securities with maturities beyond 26 weeks, so STRIPS fill the void. Investors cannot purchase STRIPS directly from the U.S. Treasury; rather, financial institutions create and sell them. (The U.S. Treasury does make the STRIPS program viable, however, by making the physical mechanics of detaching the interest and principal payments possible.)

Institutional investors make up most of the market for STRIPS, but individual investors can easily purchase and trade STRIPS as well by contacting a broker/dealer. Many investors hold STRIPS through mutual funds.

Why Do STRIPS Matter?

STRIPS can be excellent investments for investors who are especially wary of risk, concerned with preserving a consistent stream of income, or need specific payments on specific future dates. They are also good for tax-deferred accounts such as IRAs. But there are several factors the investor should consider before investing.

First, even though STRIPS carry little call risk or default risk, they do carry interest-rate risk, meaning that when interest rates rise, STRIPS prices fall, and vice versa. Fortunately, in periods of rising interest rates, STRIPS prices tend to fall less than other bonds do. Thus, with their virtually guaranteed income stream, STRIPS make excellent defensive plays in an uncertain market.

Second, inflation takes a bigger bite out of STRIPS returns than from riskier but higher-yielding fixed-income securities. Thus, changes in inflation expectations or the degree of uncertainty about inflation can really affect STRIPS prices.

Third, interest earned on STRIPS is taxable, and it must be reported even though it is not received until the STRIPS mature or are sold. (Keep in mind that Treasury income may be subject to Alternative Minimum Tax (AMT), so investors should seek tax advice before investing.)